1/x

@capeparty

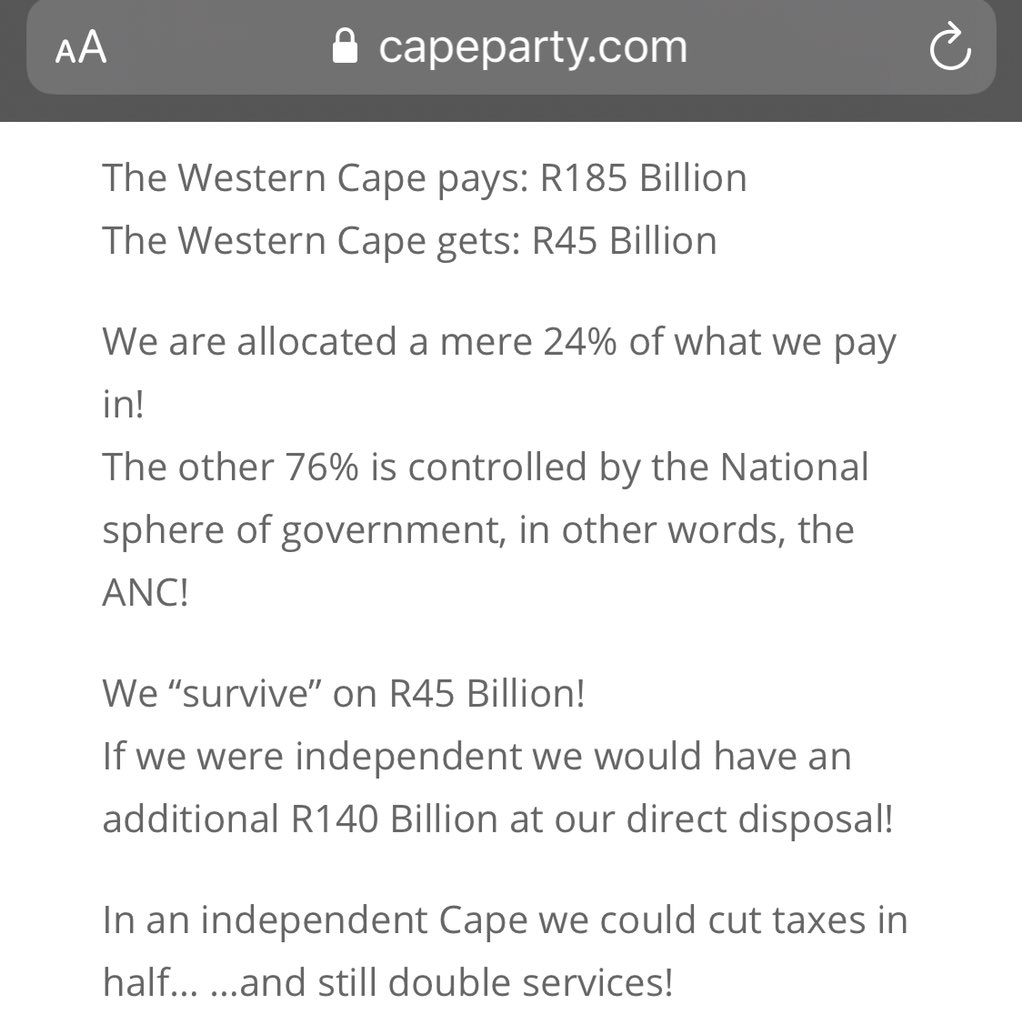

Care to defend your assertion below?

WC gets only 45 billion?

WC pays 185 billion?

I’m going to debunk it for you.

@capeparty

Care to defend your assertion below?

WC gets only 45 billion?

WC pays 185 billion?

I’m going to debunk it for you.

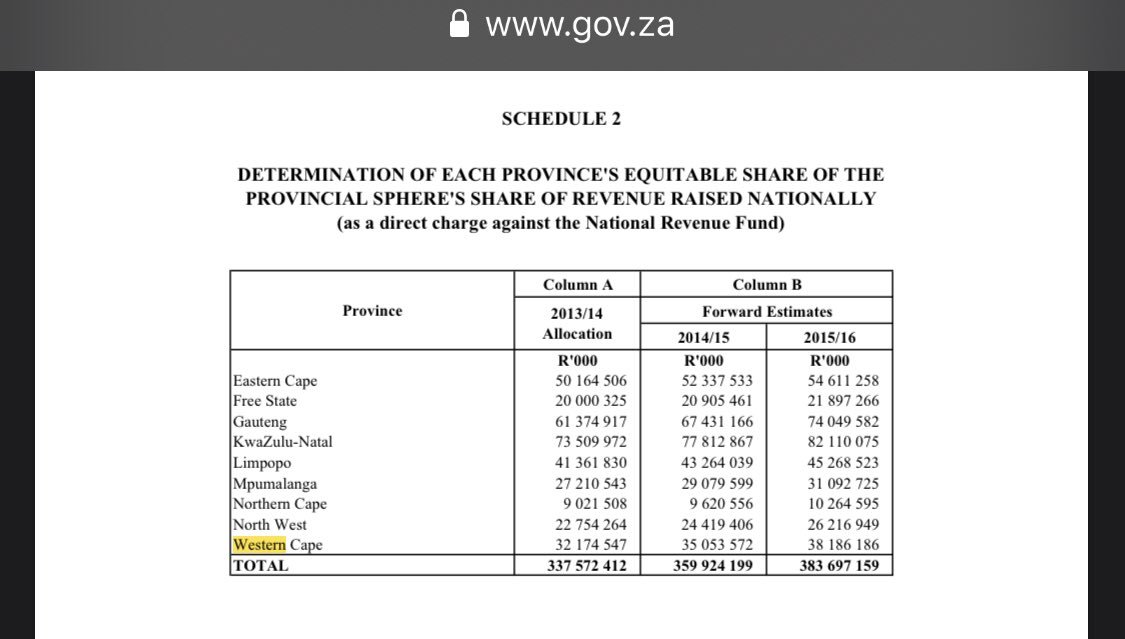

2/x

Through Treasury’s equitable share, WC got 38 billion.

Through Treasury’s municipal equitable share, WC got 3 billion.

We’re at 41 of the 45.

Through Treasury’s equitable share, WC got 38 billion.

Through Treasury’s municipal equitable share, WC got 3 billion.

We’re at 41 of the 45.

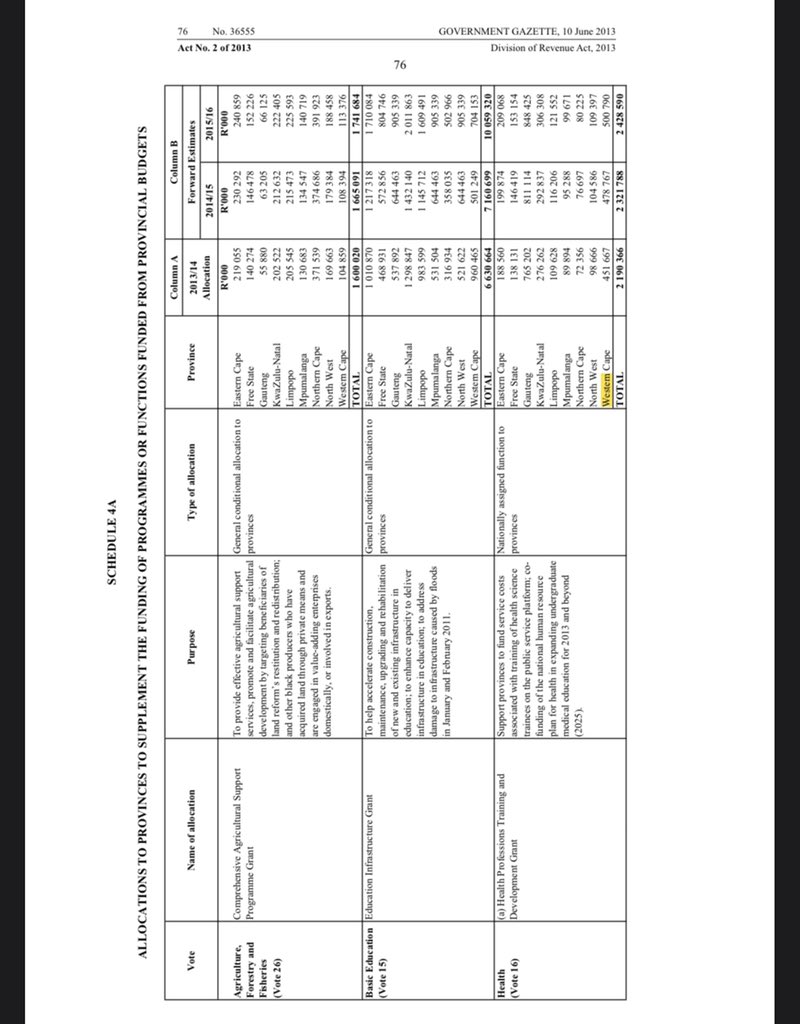

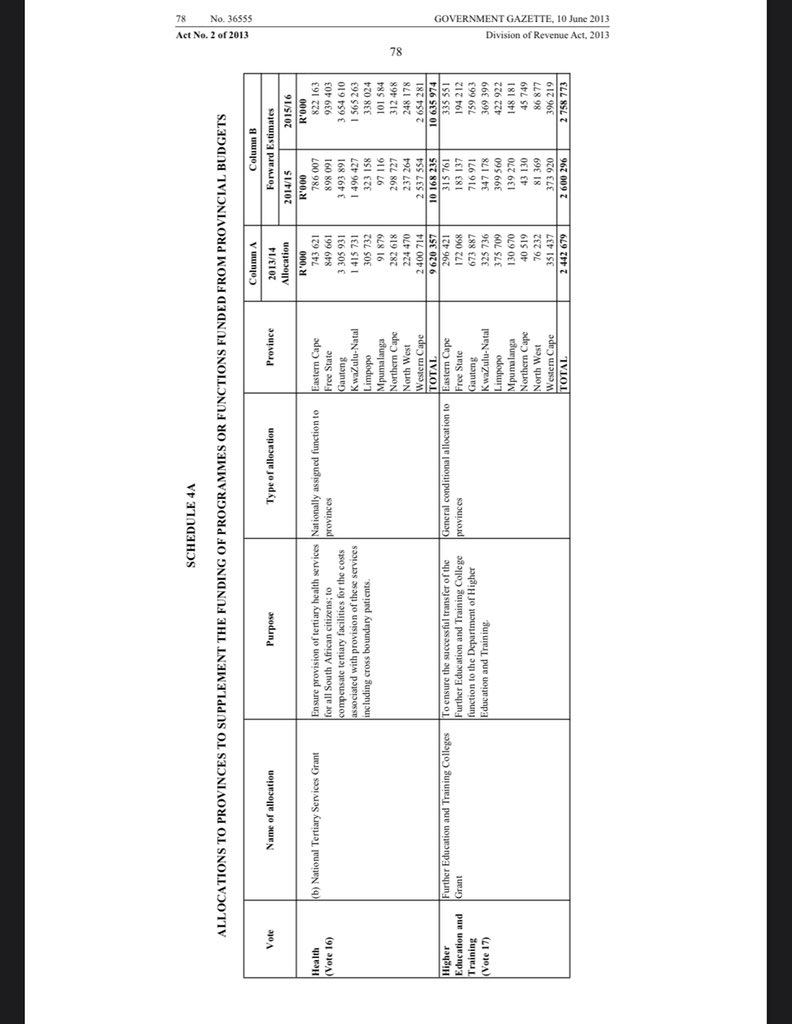

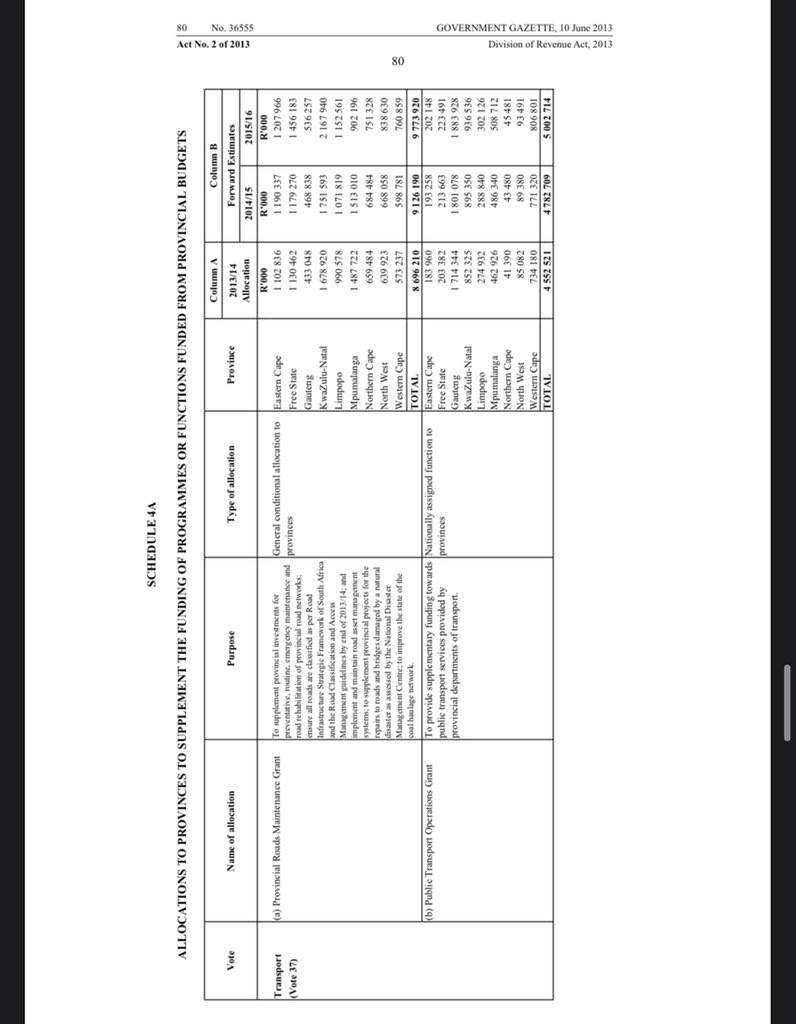

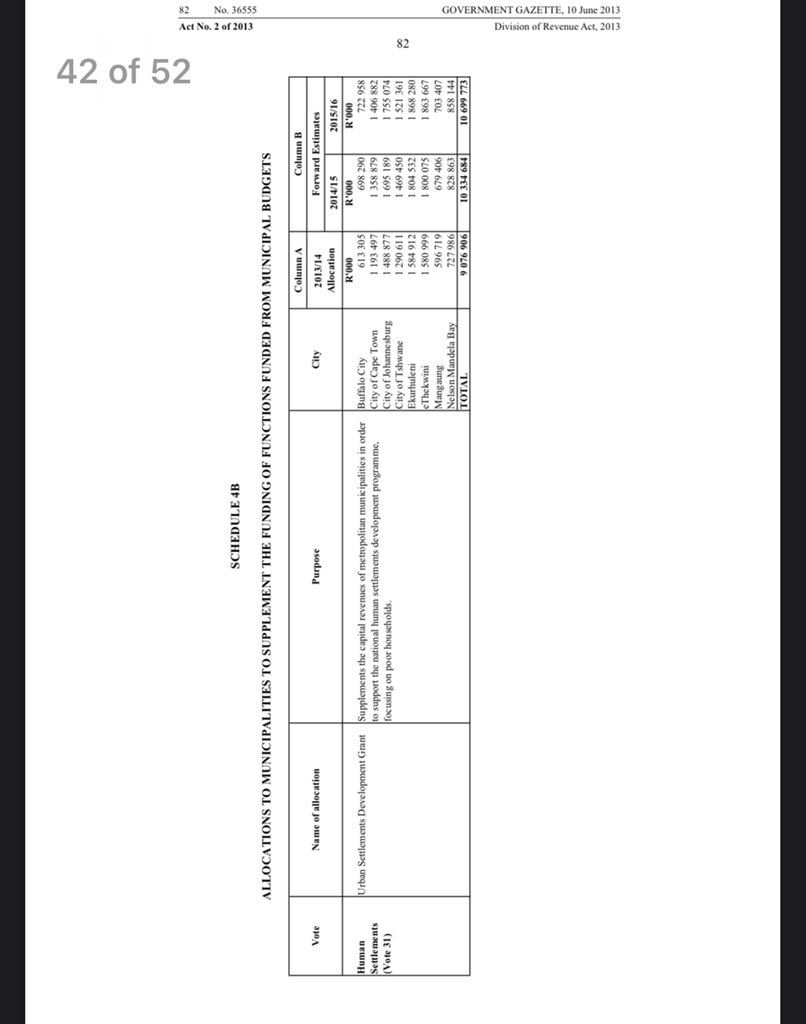

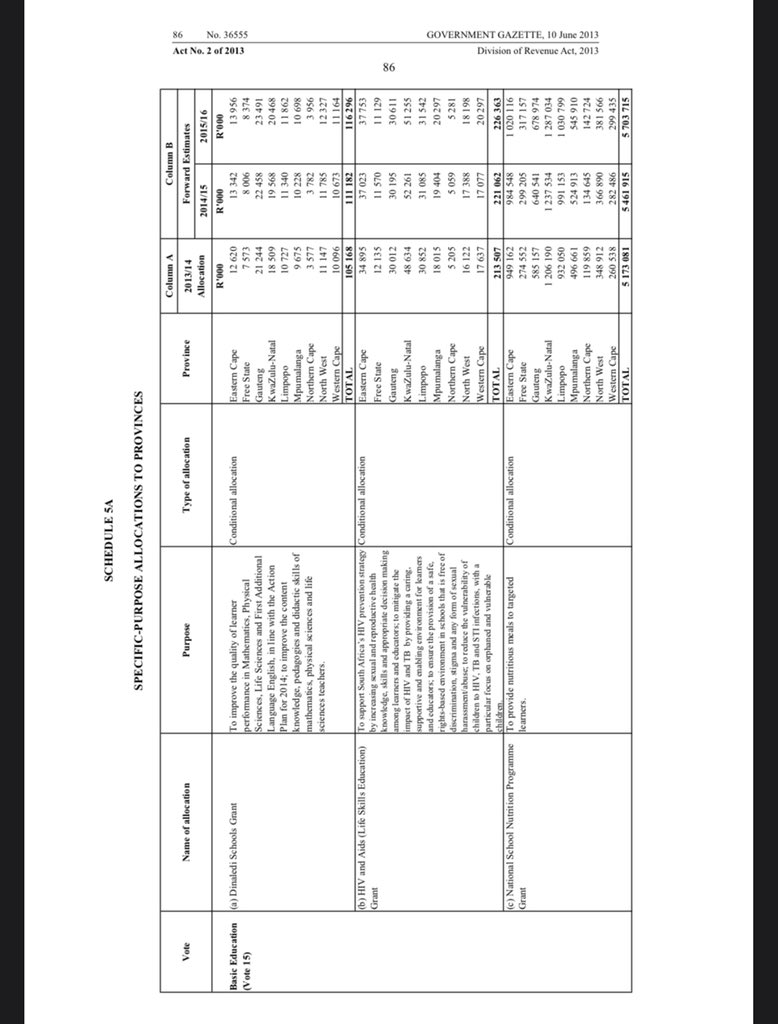

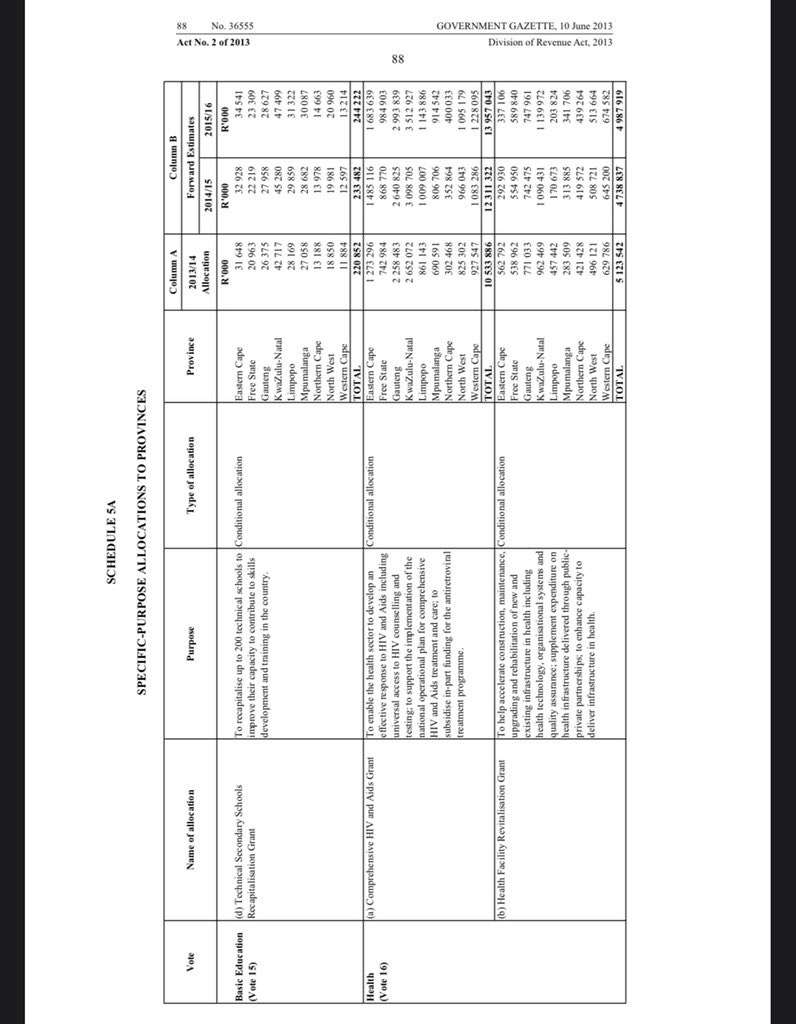

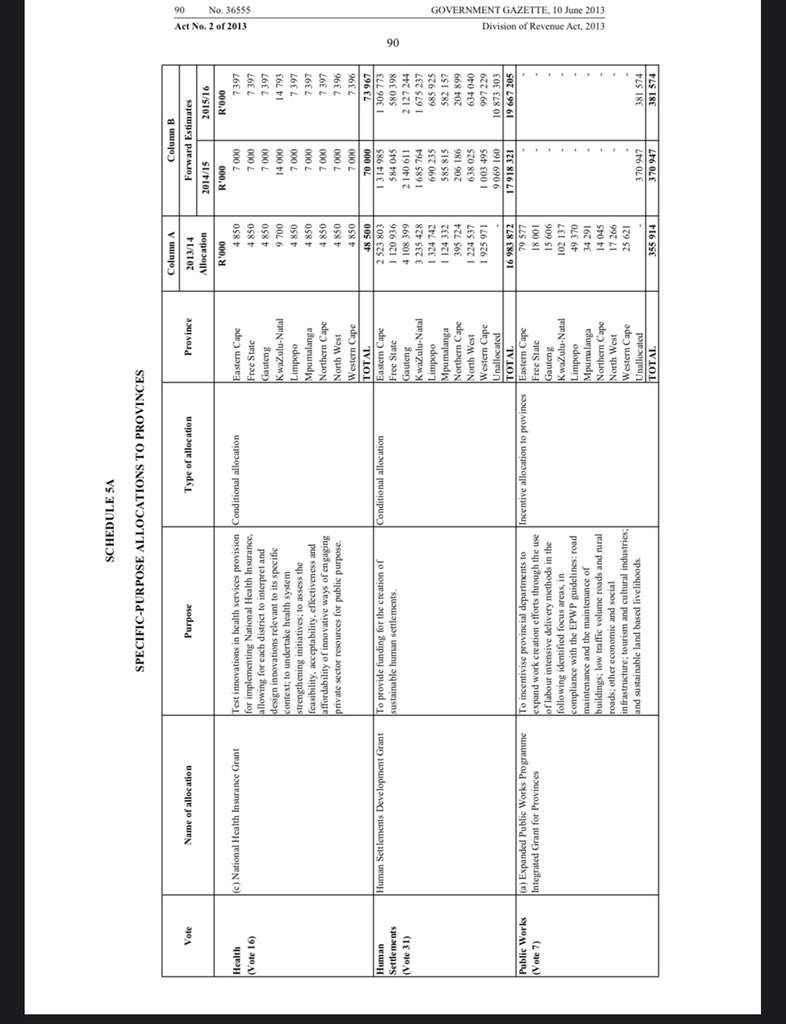

3/x Then you have plenty of ad box allocations from Treasury.

To simplify, I only took the large ones and round down.

Pic 1: 1.5

Pic 2: 2.7

Pic 3: 1.3

Pic 4: 1.1

We’re not at 41 + 6.6= 47.7 rounded down and excluding small allocations) and we’re already exceeding your 45.

To simplify, I only took the large ones and round down.

Pic 1: 1.5

Pic 2: 2.7

Pic 3: 1.3

Pic 4: 1.1

We’re not at 41 + 6.6= 47.7 rounded down and excluding small allocations) and we’re already exceeding your 45.

4/x Now let’s get to more ad hoc allocations:

Pic 1: 0.2

Pic 2: 1.57

Pic 3: 1.95

We’re now at 51.42 (10%+ in excess of your assertion) and rounding down and scrapping tiny ones to not make a 100 tweet thread.

But that’s not all.

Pic 1: 0.2

Pic 2: 1.57

Pic 3: 1.95

We’re now at 51.42 (10%+ in excess of your assertion) and rounding down and scrapping tiny ones to not make a 100 tweet thread.

But that’s not all.

5/x That’s only the equitable share.

It doesn’t include many many many things needed to have a functional town or province.

You still need highways (SANRAL), airports (ACSA), social grants (SASSA), electricity transmission (Eskom), police (SAPS), army (SANDF)

It doesn’t include many many many things needed to have a functional town or province.

You still need highways (SANRAL), airports (ACSA), social grants (SASSA), electricity transmission (Eskom), police (SAPS), army (SANDF)

6/x let’s continue, you also need pipelines (Transnet), courts (DOJ), harbors (Transnet), railways (Transnet), unemployment grants (UIF) and i skip hundreds and hundreds of others.

Just the current SAPS allocation for Western Cape is 7.3 billion.

Just the current SAPS allocation for Western Cape is 7.3 billion.

7/x You’ll probably run in excess of 100 billion once you’ve added absolutely everything.

Your revenue assumption was fantasyland.

Now let’s go to expenditure.

Your revenue assumption was fantasyland.

Now let’s go to expenditure.

8/x

Western cape pays 185 billion.

What’s the source?

What does it include? Does it include all taxes, levies, does it include municipal rates? Does it includes levies?

We don’t know since you don’t source your assertions.

Western cape pays 185 billion.

What’s the source?

What does it include? Does it include all taxes, levies, does it include municipal rates? Does it includes levies?

We don’t know since you don’t source your assertions.

9/x

I won’t nitpick on the numbers on this one but on a larger principle.

As example 1: Let’s take Capitec, Stellenbosch headquartered company.

13 million customers nationwide.

I won’t nitpick on the numbers on this one but on a larger principle.

As example 1: Let’s take Capitec, Stellenbosch headquartered company.

13 million customers nationwide.

10/x

If WesternCapeLandia becomes a country, Capitec will need a local office in South Africa (let’s say in Potch), and will be taxed on its South African activities by... SARS.

Capitec WesternCapeLandia will be taxed on its WesternCapeLandia activities in your capital.

If WesternCapeLandia becomes a country, Capitec will need a local office in South Africa (let’s say in Potch), and will be taxed on its South African activities by... SARS.

Capitec WesternCapeLandia will be taxed on its WesternCapeLandia activities in your capital.

11/x

Right now, what Capitec pays in VAT, PAYE, UIF, CIT and other taxes is all paid from Western Cape despite accounting for activities all over the country.

Your revenue collection will therefore heavily degrade to account for that.

Right now, what Capitec pays in VAT, PAYE, UIF, CIT and other taxes is all paid from Western Cape despite accounting for activities all over the country.

Your revenue collection will therefore heavily degrade to account for that.

12/x And it’s not an isolated case, the same goes for Pnp, Shoprite, Checkers, Woolworths.

The oil imported through Saldanha also goes to other provinces, it won’t come through Saldanha anymore.

Same for Mossel’s gas.

The oil imported through Saldanha also goes to other provinces, it won’t come through Saldanha anymore.

Same for Mossel’s gas.

13/x

Your tax collection will be a fraction of 185 billion because the 185 accounts for national activities taxes at the place of the headquarter.

When my company does a transaction in Limpopo, we still pay VAT and employees in Gauteng for that transaction.

Your tax collection will be a fraction of 185 billion because the 185 accounts for national activities taxes at the place of the headquarter.

When my company does a transaction in Limpopo, we still pay VAT and employees in Gauteng for that transaction.

14/x

What will likely occur is that these companies will relocate their large headquarter in Joburg (in Catalonia).

Imports for SA will come through Durban, PE, RCB instead of CPT.

The Cape’s support activity will shrink and so will benefits from it. https://www.businessinsider.com/firms-quit-catalonia-amid-its-political-upheaval-2017-12?amp">https://www.businessinsider.com/firms-qui...

What will likely occur is that these companies will relocate their large headquarter in Joburg (in Catalonia).

Imports for SA will come through Durban, PE, RCB instead of CPT.

The Cape’s support activity will shrink and so will benefits from it. https://www.businessinsider.com/firms-quit-catalonia-amid-its-political-upheaval-2017-12?amp">https://www.businessinsider.com/firms-qui...

15/x

If you want to be considered a credible alternative, you should start by presenting a credible plan with actual numbers which take into account all such mechanical factors.

Economic agents do not vote for your pretty eyes but for their pockets Jack.

If you want to be considered a credible alternative, you should start by presenting a credible plan with actual numbers which take into account all such mechanical factors.

Economic agents do not vote for your pretty eyes but for their pockets Jack.

Read on Twitter

Read on Twitter