This thread is for those of you who don’t find the time to read my #PetersbergSpeech in full. Link to English translation (including slides): https://www.ecb.europa.eu/press/key/date/2020/html/ecb.sp200627~6009be389f.en.html.">https://www.ecb.europa.eu/press/key... Link to original German version: https://www.ecb.europa.eu/press/key/date/2020/html/ecb.sp200627~6009be389f.de.html.">https://www.ecb.europa.eu/press/key... Op-ed @welt (in German): https://www.welt.de/wirtschaft/article210510613/Isabell-Schnabel-Warum-die-EZB-Politik-in-Corona-Zeiten-richtig-ist.html.">https://www.welt.de/wirtschaf... 1/11

Main message: Without the #PEPP and our other measures, we would now presumably be in the midst of a severe financial crisis. The measures taken by the ECB are (1) necessary, (2) suitable and (3) proportionate to ensure price stability in the euro area. 2/11

Important clarification: This speech is not about #PSPP, subject to a court case @BVerfG. It is about the measures taken in response to the pandemic, designed specifically for the pandemic & containing own safeguards to protect fundamental principles of the currency union. 3/11

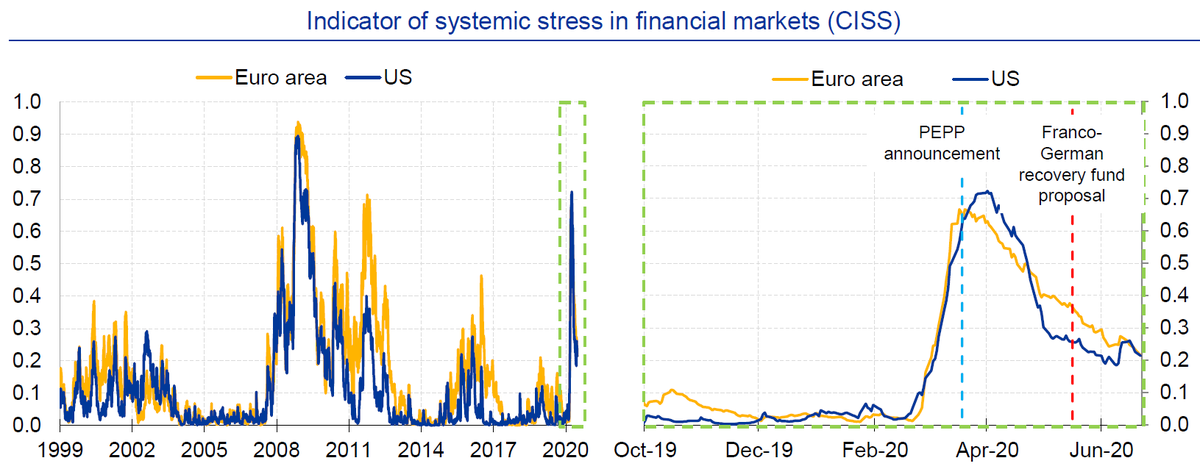

(1) Necessary: In the 1st crisis phase our measures likely prevented a full-blown financial crisis that would have posed a risk to achieving our price stability mandate. In March, indicators of systemic stress rose to levels seen in the global financial and euro area crises. 4/11

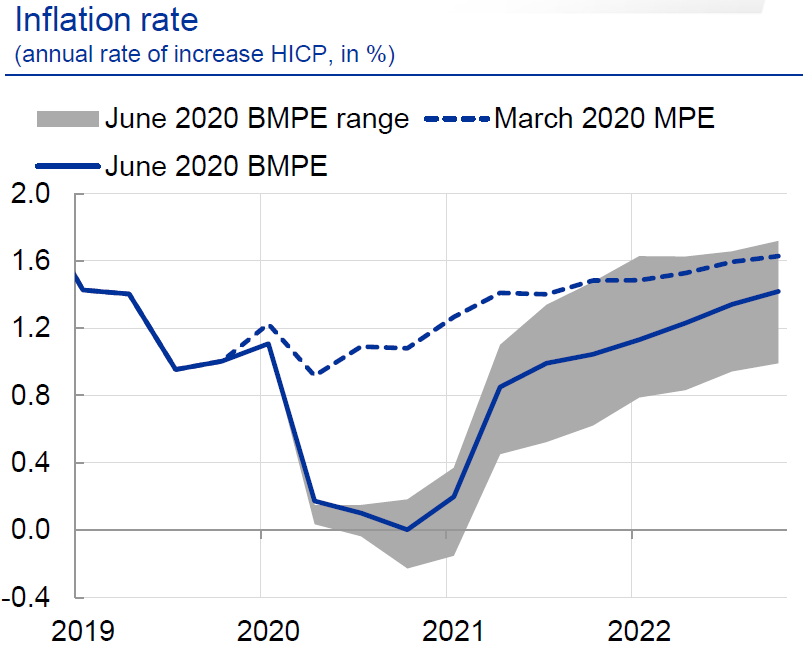

In the 2nd phase, the @ecb has to prevent that low inflation takes hold in the economy, which could lead to lower wages, growth & investment. According to current Eurosystem staff projections, inflation could remain at close to 0% well into the next year. 5/11

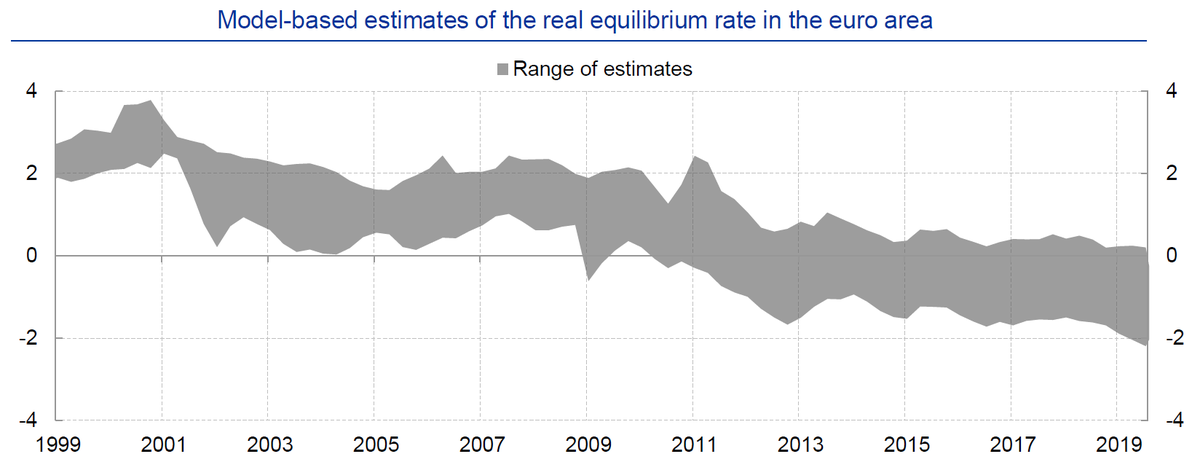

(2) Suitable: Room for manoeuvre for conventional monetary policy is limited due to a fall in the real equilibrium rate, caused by structural factors. Asset purchases are particularly effective in periods of high uncertainty & help to prevent self-reinforcing price spirals. 6/11

Flexibility is needed to counter risks of fragmentation in the euro area but ECB capital key remains an important compass guiding us over the medium term. Conditional on market conditions, deviations from capital key can eventually be reduced, e.g. in the reinvestment phase. 7/11

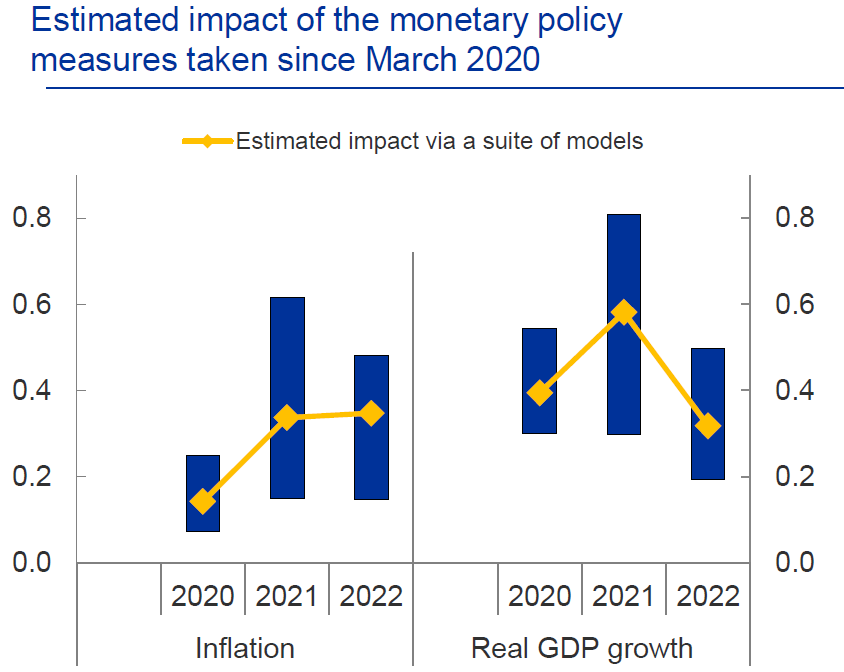

The crisis measures, including #PEPP and liquidity-providing operations for banks #TLTROs, have been effective in improving the financing conditions for governments, firms and banks. This, in turn, is expected to have a stabilising effect on inflation and economic growth. 8/11

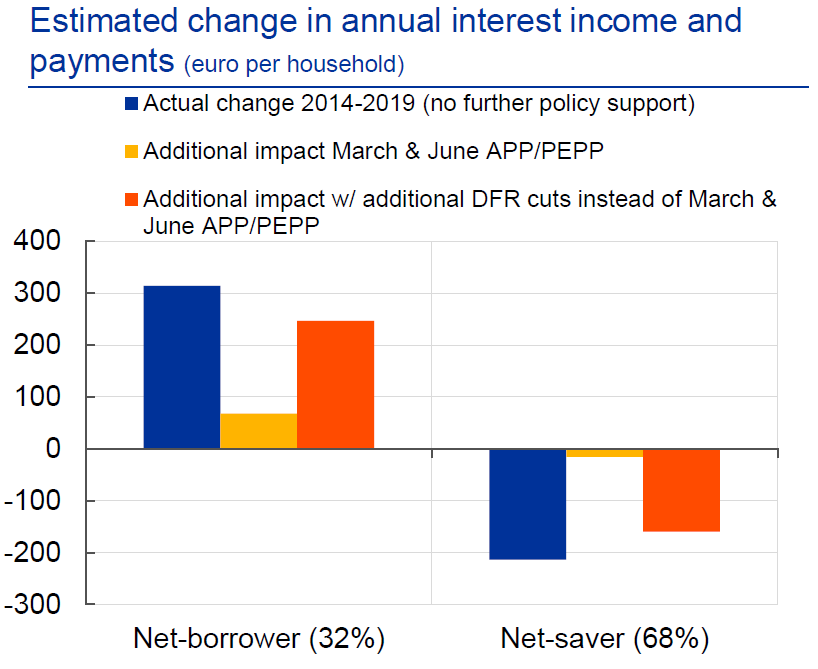

(3) Proportionality: (a) Distributional effects: The weakest in society will benefit most from our measures due to their effects on employment. Effects on net savers would have been much larger if @ecb had lowered key interest rates instead of increasing asset purchases. 9/11

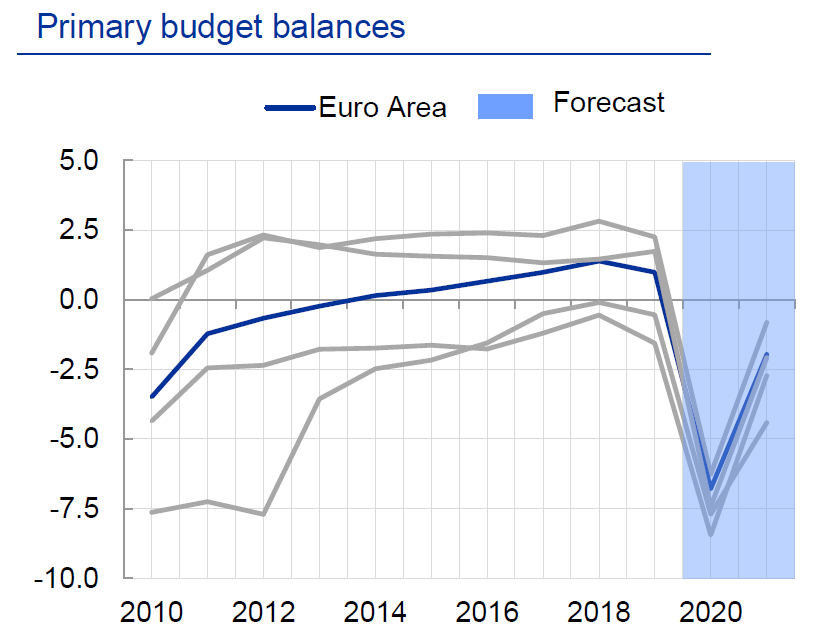

(b) Incentives for fiscal discipline: Rising primary balances in previous years do not suggest significant incentive effects. There are no signs of excessive government borrowing on the back of low yields. The temporary nature of #PEPP limits potential incentive effects. 10/11

For those interested in a broader discussion of potential side effects of monetary policy, please see my #KarlsruheSpeech in February (available in German and English): https://www.ecb.europa.eu/press/key/date/2020/html/ecb.sp200211_1~b439a2f4a0.en.html.">https://www.ecb.europa.eu/press/key... 11/11

Read on Twitter

Read on Twitter