#1 - A frame of reference

The “Motorcycle Diaries” was one of the most profound stories of the 20th century. The magic of Che spread thick and fast. It wasn’t quite the ending we expected, but it is what it is.

The “Motorcycle Diaries” was one of the most profound stories of the 20th century. The magic of Che spread thick and fast. It wasn’t quite the ending we expected, but it is what it is.

# 2 - The local frame

India has a motorcycle diary of her own. Not quite Che-ish, but critical to the thriving life-cycle of the microeconomic Hero’s, who are Pulsing and Thudding around us: the Doodhwala to the IT-wala to perhaps you reading this. You get the drift.

India has a motorcycle diary of her own. Not quite Che-ish, but critical to the thriving life-cycle of the microeconomic Hero’s, who are Pulsing and Thudding around us: the Doodhwala to the IT-wala to perhaps you reading this. You get the drift.

# 3 - Demography = secularity?

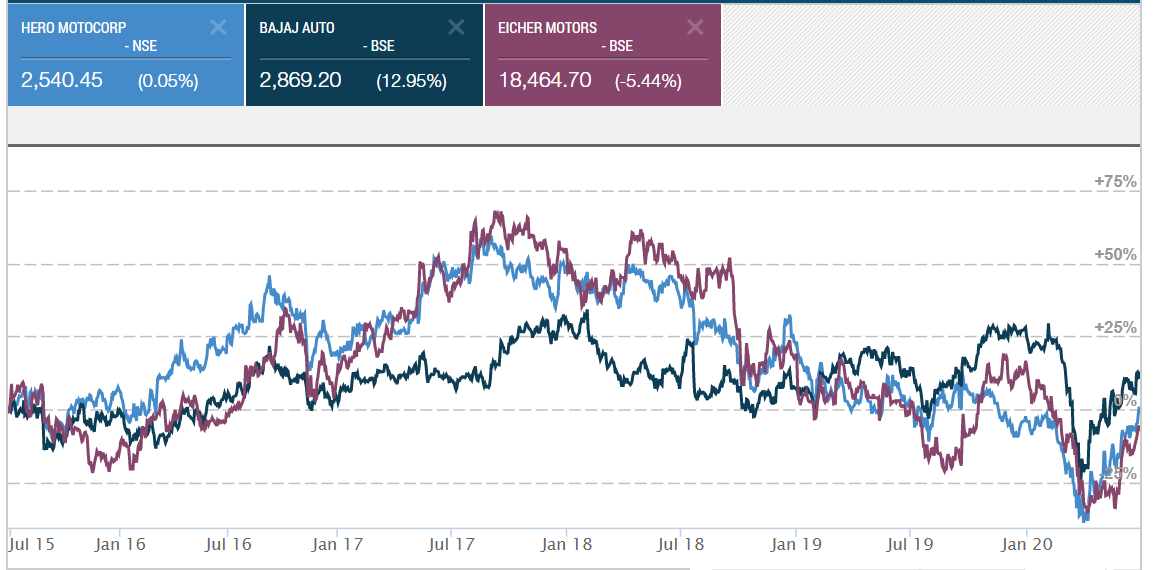

As investors where are we in the great 2-wheeler narrative? The multidecadal honeymoon has now had 5 years of mediocrity. The revv is out. Where are we in the cycle? Let’s examine.

As investors where are we in the great 2-wheeler narrative? The multidecadal honeymoon has now had 5 years of mediocrity. The revv is out. Where are we in the cycle? Let’s examine.

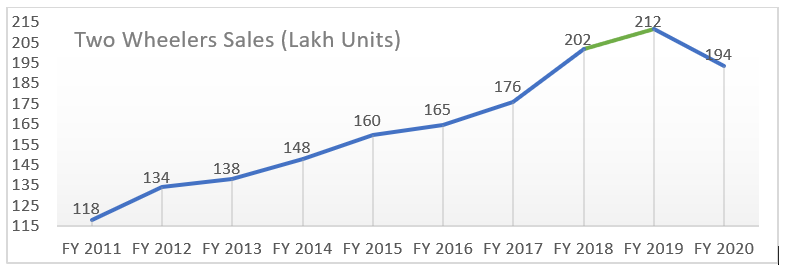

#4 - What growth?

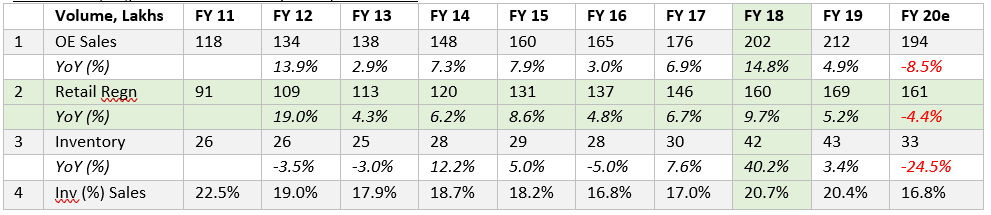

Optically, India’s 2-w sales over the decade looks strong. Optically. A closer look at trends reveals that weakness has long set in. Since FY-13, vol growth has ONLY averaged 6.5%. And in 4 years out of this 7-year period, growth is in the range of JUST 5%.

Optically, India’s 2-w sales over the decade looks strong. Optically. A closer look at trends reveals that weakness has long set in. Since FY-13, vol growth has ONLY averaged 6.5%. And in 4 years out of this 7-year period, growth is in the range of JUST 5%.

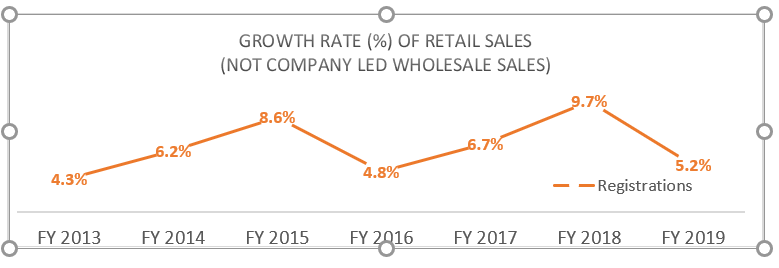

# 5 In all Modesty

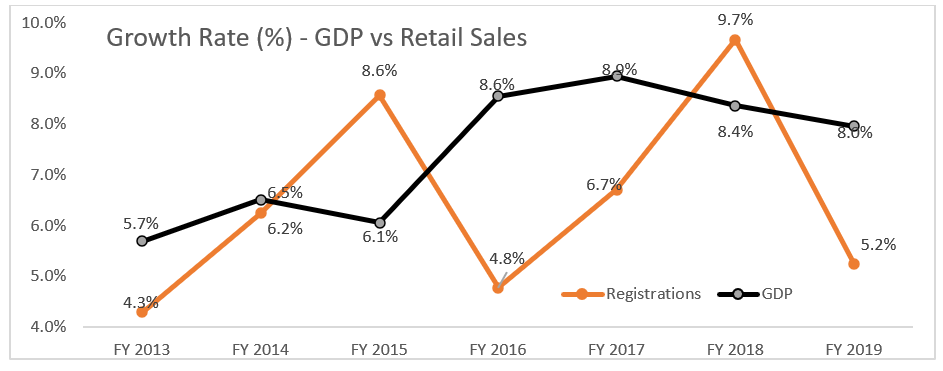

The spurt of 9.7% in ‘18 was led by the transition into the BS-4. Otherwise, the median rate for the past 7-yrs is just 5.7%. A reversal of mean to these numbers isn’t really an event to look forward to. Look at the chart carefully. What really impresses you?

The spurt of 9.7% in ‘18 was led by the transition into the BS-4. Otherwise, the median rate for the past 7-yrs is just 5.7%. A reversal of mean to these numbers isn’t really an event to look forward to. Look at the chart carefully. What really impresses you?

# 6 The bubble is a buildin..

Look at retail vs wholesale vs inventory CAGR. The inference is self-explanatory. But still:

A) Retail has for long avgd nos below wholesale nos.

b) The periods of high wholesale growth, is essentially a process of building inventory,

Look at retail vs wholesale vs inventory CAGR. The inference is self-explanatory. But still:

A) Retail has for long avgd nos below wholesale nos.

b) The periods of high wholesale growth, is essentially a process of building inventory,

# 7 .. contd from above

Retail Sales is the ultimate source of salience. Unless you disproportionately value an OE’s ability to build a channel. In the last 5 years, OEs have built bigger channels. Not better retail sales.

Retail Sales is the ultimate source of salience. Unless you disproportionately value an OE’s ability to build a channel. In the last 5 years, OEs have built bigger channels. Not better retail sales.

# 8 But demography? It& #39;s just the math

Across FY11-17, 8.47cr 2-W were sold

& a/c FY18-20e, 4.9cr were sold.

That& #39;s growth of 57% on a 5 yr base! 1.6cr 2-w are sold in India p.a. Kids, farmers & Ladakh trippers are still buying but as d the base builds, GP becomes AP

Across FY11-17, 8.47cr 2-W were sold

& a/c FY18-20e, 4.9cr were sold.

That& #39;s growth of 57% on a 5 yr base! 1.6cr 2-w are sold in India p.a. Kids, farmers & Ladakh trippers are still buying but as d the base builds, GP becomes AP

# 9 So, where is the case for equity risk in this industry? India& #39;s CAGR

a) 3-yr vol growth of 3.3%

b) 5-yr vol gr of 3.9%

c) 7-yr vol gr of 6.5%

None of these indicate an R of gr that is significant. While there& #39;s is P/L eco of scale, the R of G is consistent in its fall.

a) 3-yr vol growth of 3.3%

b) 5-yr vol gr of 3.9%

c) 7-yr vol gr of 6.5%

None of these indicate an R of gr that is significant. While there& #39;s is P/L eco of scale, the R of G is consistent in its fall.

#10 But our GDP was ok right?

2W sales have undershot GDP growth consistently since FY-16. Look at the wedge between GDP gr & 2W gr. It has been consistent. The big S Question: Is this then structural over cyclical? Yes. You& #39;ll see why.

2W sales have undershot GDP growth consistently since FY-16. Look at the wedge between GDP gr & 2W gr. It has been consistent. The big S Question: Is this then structural over cyclical? Yes. You& #39;ll see why.

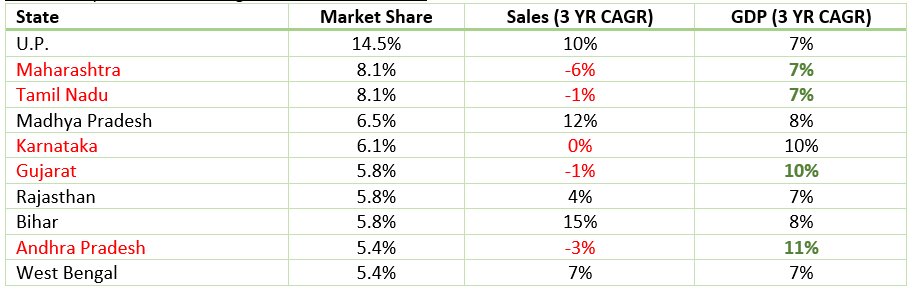

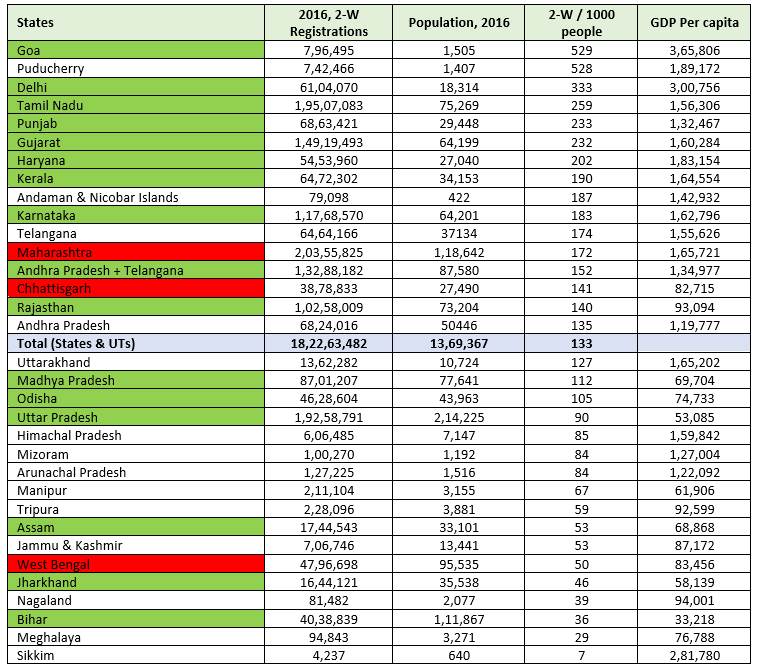

# 11 India is not one homogeneous market. National GDP clouds pockets of consumption. In order to appreciate the drivers of this slowdown, let us slice up data at a State level.

Between Nagaland and Tamil Nadu, GDP drivers are heterogeneous. Stay with the data here.

Between Nagaland and Tamil Nadu, GDP drivers are heterogeneous. Stay with the data here.

# 12 Big 3 slowin down

India’s heavy lifters, Maha, T.N, and Guj are showing massive divergence, with consumption actually turning negative. You will see above, their economies have done rather well

India’s heavy lifters, Maha, T.N, and Guj are showing massive divergence, with consumption actually turning negative. You will see above, their economies have done rather well

# 13 TN is a surprise: leader in social sec, employment, n generally. Under such circum 2W growth actually drives GDP. 2W trend here is -ve!

Karnataka: Bengaluru;s IT and comm realty is good and 2w trends are flat.

Base. Math. Reason.

Karnataka: Bengaluru;s IT and comm realty is good and 2w trends are flat.

Base. Math. Reason.

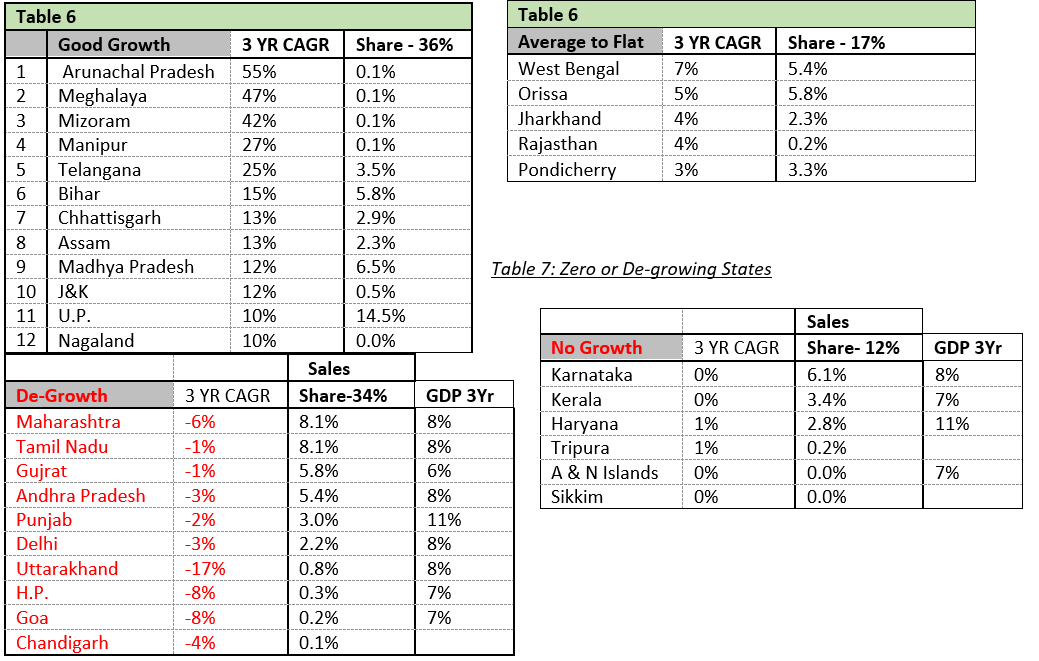

# 14 The weaker North & Eastern States are supporting growth. Go FC Sikkim! MP, Bihar and Bengal at 12%, 15% & 7% are rocking! UP at 10% remains solid.

Spend some time on the table below - trends State wise. You’ll get the picture. Jump to your fave conclusion after that

Spend some time on the table below - trends State wise. You’ll get the picture. Jump to your fave conclusion after that

# 15 Mapping Density

Taiwan is the gold standard on density of 2W per capita @ 300 2w/1000 ppl. As you will see, Goa, Dilli are well above that, and TN, Pnjab n Guj are close by. N-E with better per capita GDP is catching up.

So?

So, math, base, reason.

Taiwan is the gold standard on density of 2W per capita @ 300 2w/1000 ppl. As you will see, Goa, Dilli are well above that, and TN, Pnjab n Guj are close by. N-E with better per capita GDP is catching up.

So?

So, math, base, reason.

# 16 So when you see 2-W OE vols fall off a cliff, or puddle, don& #39;t act surprised.

Look at the context. A large part of the addressable 1.3bn pop who can afford a seat on 2 wheels already has one. And 1.6c folks will buy one every year.

Beyond a point, you cant fight the base

Look at the context. A large part of the addressable 1.3bn pop who can afford a seat on 2 wheels already has one. And 1.6c folks will buy one every year.

Beyond a point, you cant fight the base

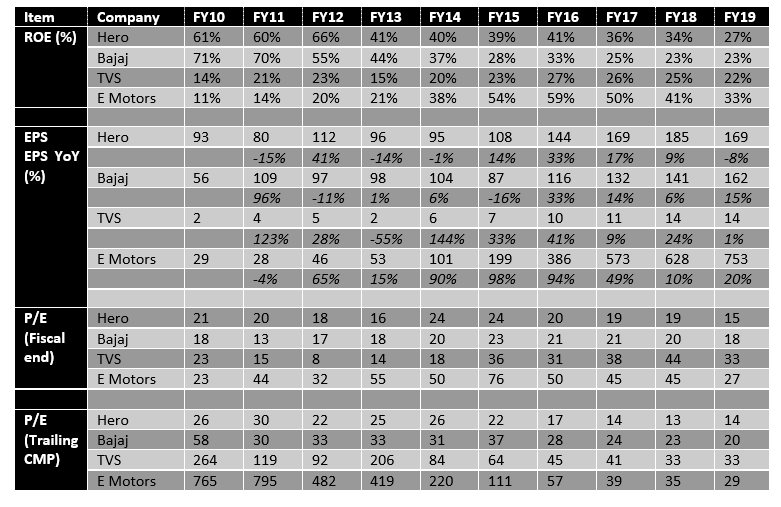

# 17 Which begs my fave Question.

How do you value equity in an industry that will have deteriorating vols?

Look at the RoE row blow. It& #39;s the proverbial frog in the boiling pan.

How do you value equity in an industry that will have deteriorating vols?

Look at the RoE row blow. It& #39;s the proverbial frog in the boiling pan.

I could go on with other angles of 2nd order that suggest the base in India is a risk; while abs nos will be good. Equity Vals track an industry& #39;s propensity to grow volumes and the rest follow.

Is the Margin of Safety today favourable for a secular buy n hold decision? Reflect

Is the Margin of Safety today favourable for a secular buy n hold decision? Reflect

Read on Twitter

Read on Twitter