RBI used to have this 7.75% bonds which was withdrawn recently. Now there& #39;s a new set: 7 year locked-in bonds by the government at 7.15% (floating).

Good long term fixed income investment for the retired. (Thread)

Good long term fixed income investment for the retired. (Thread)

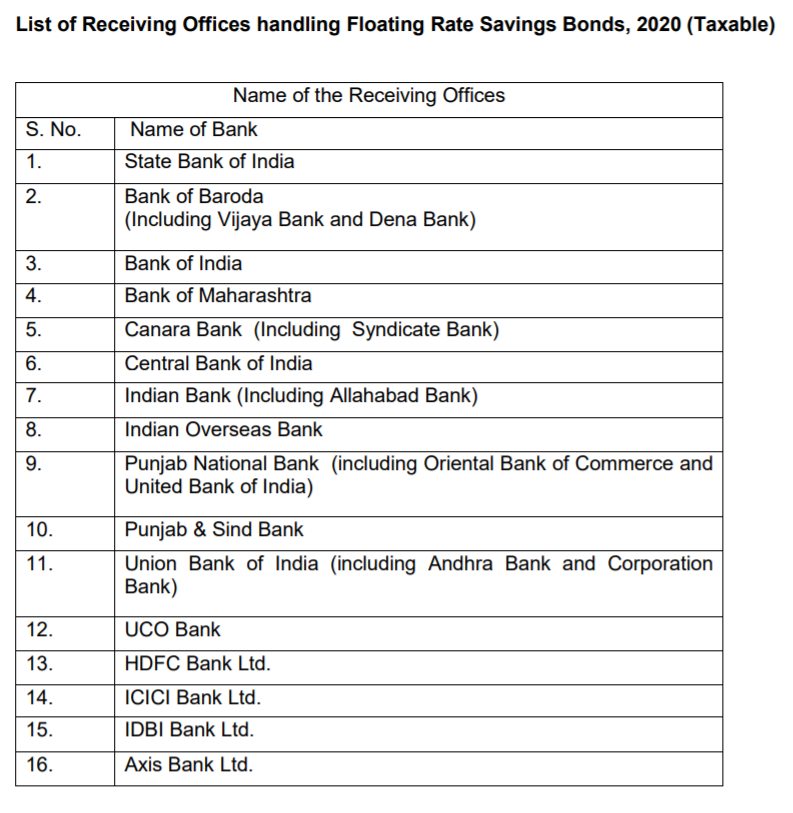

New RBI bonds can be bought from SBI and PSU banks. Needs a few forms filled, here& #39;s the branches: (Only Individual/HUF. No NRI, Companies, LLPs can apply)

Interest is 0.35% above the National Savings Certificate (NSC) rate, and will float up and down accordingly.

Paid Jan 1, and July 1. First one will be at 7.15% (divide by 2 for the half year payment)

Paid Jan 1, and July 1. First one will be at 7.15% (divide by 2 for the half year payment)

No upper limit, you can buy any amount.

Held in electronic form, but it& #39;s not in a demat account.

Income is fully taxable, TDS at 10% deducted. You can& #39;t self-declare like Form 15G/H: any tax deduction needs a full certification from the IT department in original.

Held in electronic form, but it& #39;s not in a demat account.

Income is fully taxable, TDS at 10% deducted. You can& #39;t self-declare like Form 15G/H: any tax deduction needs a full certification from the IT department in original.

The bonds are locked in for 7 years.

You can& #39;t trade them, you can& #39;t transfer them.

You can& #39;t take a loan against them.

If you die, your nominee will get them, but they also have to wait for maturity.

Lock in is reduced for age 80+ (4 years), 70-80 (5y) and 60-70 (6y)

You can& #39;t trade them, you can& #39;t transfer them.

You can& #39;t take a loan against them.

If you die, your nominee will get them, but they also have to wait for maturity.

Lock in is reduced for age 80+ (4 years), 70-80 (5y) and 60-70 (6y)

There& #39;s a 0.5% brokerage paid by the government so expect these to be sold well, and expect bankers not to tell you about the lock-in clauses.

Are there better alternatives? At the near-zero risk level like the government, possibly not. With a higher risk, some pvt banks (IDFC etc) offer higher rates, as do NBFCs like Bajaj, with more liquidity. There are bonds, but those have an even higher risk.

I believe this is a useful way for some senior citizens to lock in these rates for 7 years. The lack of liquidity is a bummer, for any emergency needs and you can& #39;t even take a loan against this. Floating rates mean you get a lower rate if NSC interest rate falls.

Links: https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=50009">https://www.rbi.org.in/Scripts/B... and

https://rbidocs.rbi.org.in/rdocs/content/pdfs/GOI26062020.pdf">https://rbidocs.rbi.org.in/rdocs/con...

https://rbidocs.rbi.org.in/rdocs/content/pdfs/GOI26062020.pdf">https://rbidocs.rbi.org.in/rdocs/con...

Sub points: The rates are not locked in so the floating rate bond may be less attractive.

More attractive is PMVVY from LIC - 7.4% annual floating (Max 15L, locked 7y)

Senior Citizen& #39;s Savings Scheme: 7.4% fixed (Max 15L, kinda locked 5y liquidity with penalty) ht @kallol68

More attractive is PMVVY from LIC - 7.4% annual floating (Max 15L, locked 7y)

Senior Citizen& #39;s Savings Scheme: 7.4% fixed (Max 15L, kinda locked 5y liquidity with penalty) ht @kallol68

Effectively a Senior Citizen willing to lock in money:

1) SCSS: 15 lakh at 7.4% fixed

2) PMVVY : 15 lakh at 7.4% floating (with scss)

3) RBI bonds: No upper limit, 7.1% floating with NSC+0.35%

4) NSCs themselves (5y, 6.75%)

5) Do not buy bank bonds please they are toxic.

1) SCSS: 15 lakh at 7.4% fixed

2) PMVVY : 15 lakh at 7.4% floating (with scss)

3) RBI bonds: No upper limit, 7.1% floating with NSC+0.35%

4) NSCs themselves (5y, 6.75%)

5) Do not buy bank bonds please they are toxic.

Read on Twitter

Read on Twitter