As your resident vol explainer guy, here& #39;s a long-form version of how one can be down 200% a la Malachite. They were doing capped vs. uncapped variance swaps, & #39;picking up $100 bills in front of a Soviet locomotive& #39;

Variance swaps are technically exotic derivatives and are nonlinear, but they can be hedged easily using vanilla options, so they aren& #39;t all that exotic. @EmanuelDerman wrote the holy grail on them https://www.researchgate.net/publication/332274779_Quantitative_Strategies_Research_Notes_More_Than_You_Ever_Wanted_To_Know_About_Volatility_Swaps_But_Less_Than_Can_Be_Said_QUANTITATIVE_STRATEGIES_RESEARCH_NOTES">https://www.researchgate.net/publicati...

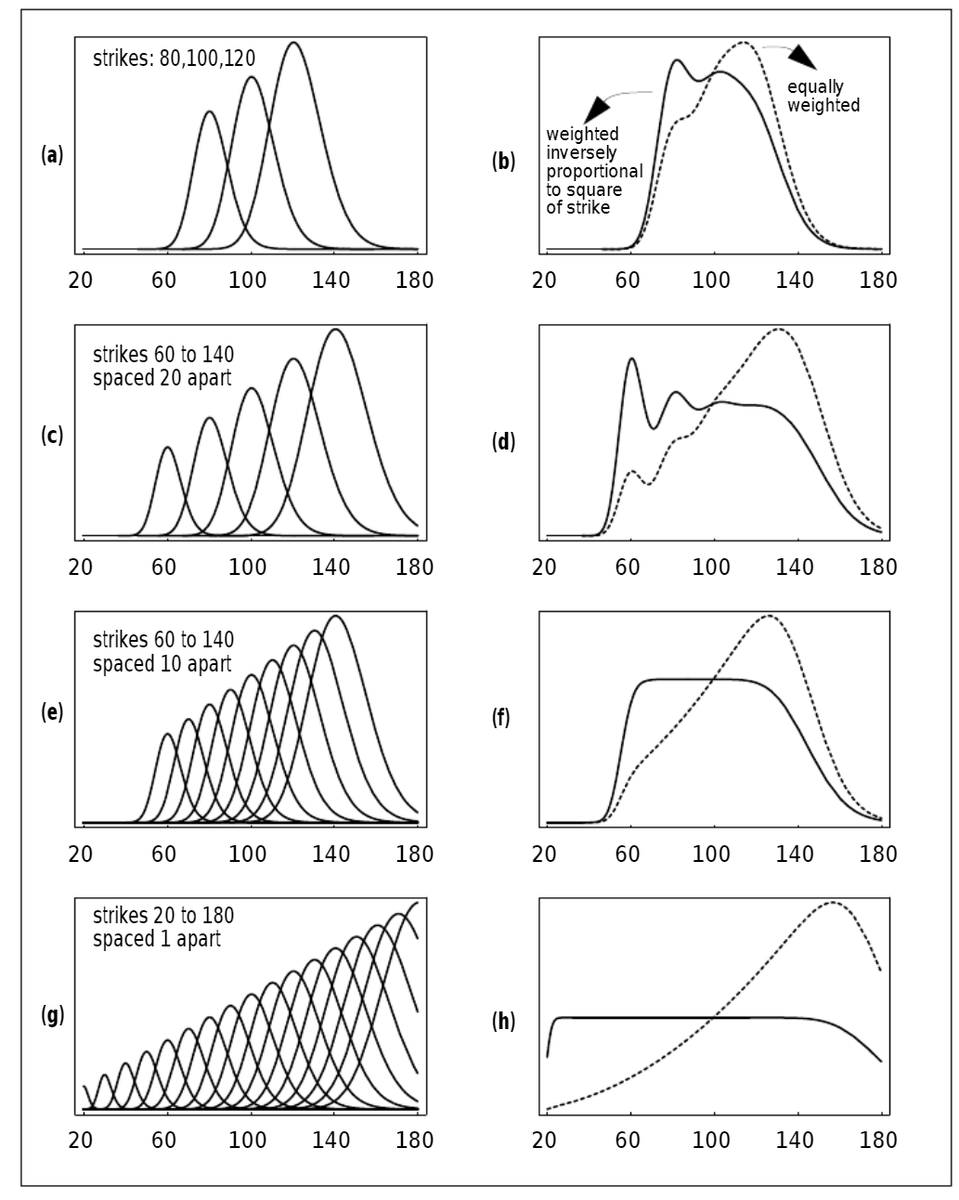

You can get a constant variance exposure by buying a strip of OTM puts and OTM calls with weighting by the inverse of the strike squared. Left are individual options in the hedging portfolio, right is what the variance exposure looks like when they are summed.

So: the vanilla variance swap has a & #39;fair variance& #39; at trade initiation, like the par fixed coupon on a vanilla interest rate swap. If the realized variance at expiry exactly equals the fair variance struck on initiation, your PnL is zero.

So because options are like insurance, the implied volatility of puts and calls are typically higher than the realized volatility. Casinos always win, insurance companies always win, and derivative dealers always charge a premium for implied volatility exposure.

So the boring trade that worked pretty consistently in the post-crisis period was to sell variance swaps and collect the difference between implied and realized volatility. Just like shorting VXX in your PA.

However, variance is standard deviation *squared* - the units of standard deviation are percent, the units of variance is percent *squared*. So when the trade goes against you, it goes against you BADLY.

The low in SPX 1yr realized vol in the last year was 7% or so, and the high is now 34%. If you& #39;d screwed up a vol swap trade you& #39;d lose some multiple of your original notional, which is kinda easy to comprehend in your brain.

In variance, it goes from 49 var to 1156 var, a 24x loss. It& #39;s huge. So typically dealers do & #39;capped variance& #39; where they say & #39;OK the highest variance you can realize is 500& #39; and you have a maximum loss on the trade rather than it being unbounded.

So what does Malachite do? They traded uncapped varswaps against capped varswaps. You buy capped variance swaps (i.e. long realized var with a cap), and you sell vanilla variance swaps (i.e. short realized var without a cap).

So say buy a 3mo capped SPX varswap at say 225var (15% vol) capped at 1600 var (40% vol), and sell a 3mo uncapped SPX varswap at 256var (16% vol). In ordinary times, the cap doesn& #39;t get hit, and you pocket the 256-225 difference. And you do it in SIZE, with LEVERAGE

But in March, 3mo realized variance went through the cap, to 64vol or 4096var. And your loss is 4096-1600 = 2496var, times whatever your original notional is. And you blow a hole in the ground the size of an asteroid.

Read on Twitter

Read on Twitter