1/n I was fortunate enough to speak to the Mitch Daniels Leadership Foundation class today @MDLF_IN. I spoke about Indiana& #39;s economy and what I think many state policymakers fail to see as an urgent call to action, that is far bigger than COVID-19. This is a summary of my talk.

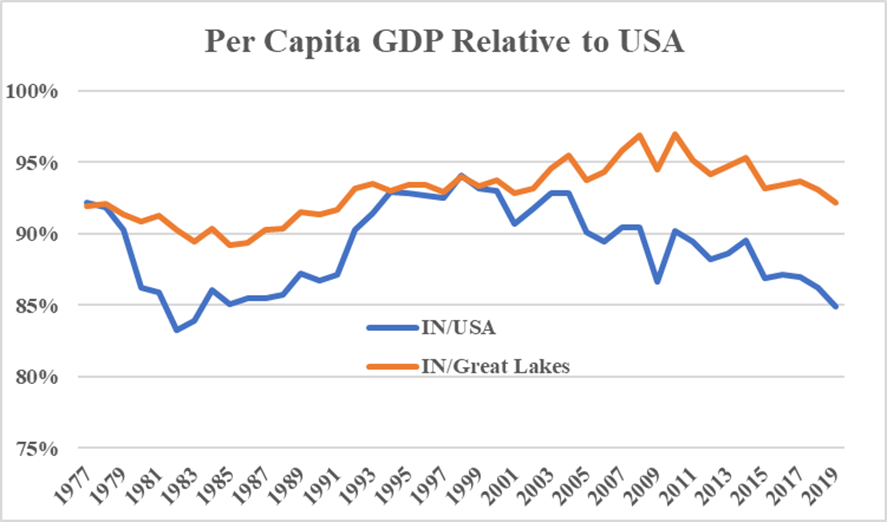

2/n Relative GDP per capita is diverging from both the nation and region. Hoosiers are only 85% as productive as the average American. This is surprising since we have the highest share of employment in manufacturing and logistics which enjoy high GDP per worker.

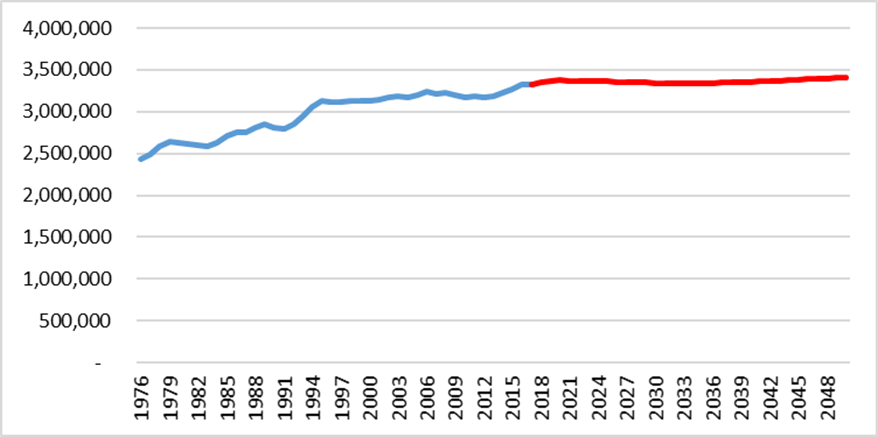

3/n Our population has stagnated, outside of Indy, and appears unlikely to grow for a long time. This is IU& #39;s demographic forecast, which is reflective of any demographic forecast of the state.

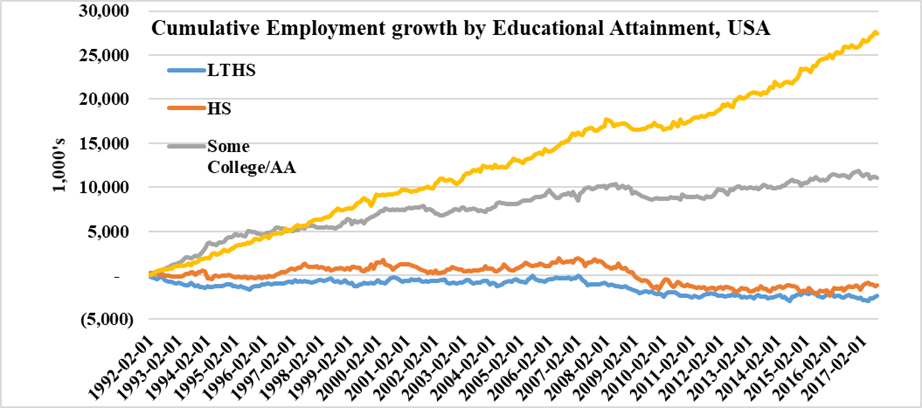

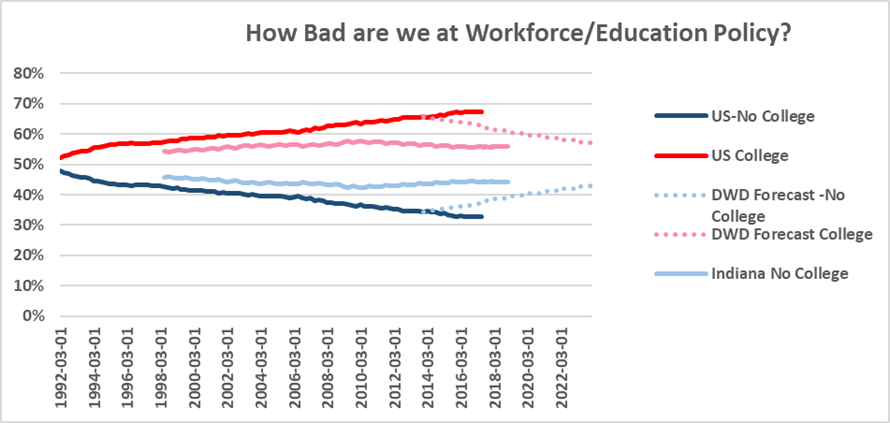

4/n Nationally, 100% of net job growth in the past 30 years went to those who& #39;d been to college, mostly to those who graduated.

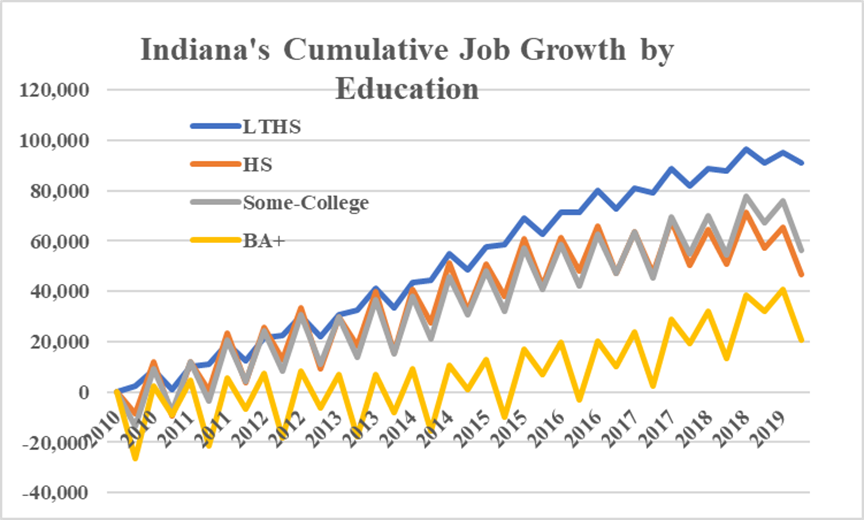

5/n Here in Indiana, for which I have shorter time series, it is the reverse. This is just since 2010, and surely reflects tight labor markets. But, it means we are not attracting college graduates. Indiana& #39;s share of college graduates in the labor force is now below Kentucky.

6/n Indiana& #39;s human capital policymakers rely on a forecast of plummeting share of college grads. This graph shows nation, and state trends, versus the prediction by DWD. It horrifies me that we use this for policy, but there we are.

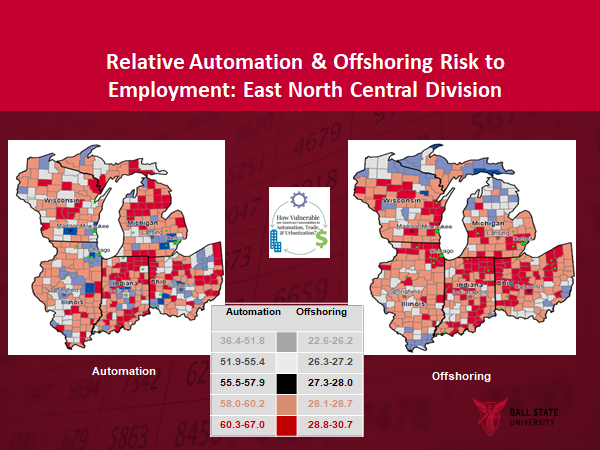

7/n Indiana is ground zero for automation and trade related job losses. This is from the county level study of the phenomenon, published by @BallStateCBER in 2017.

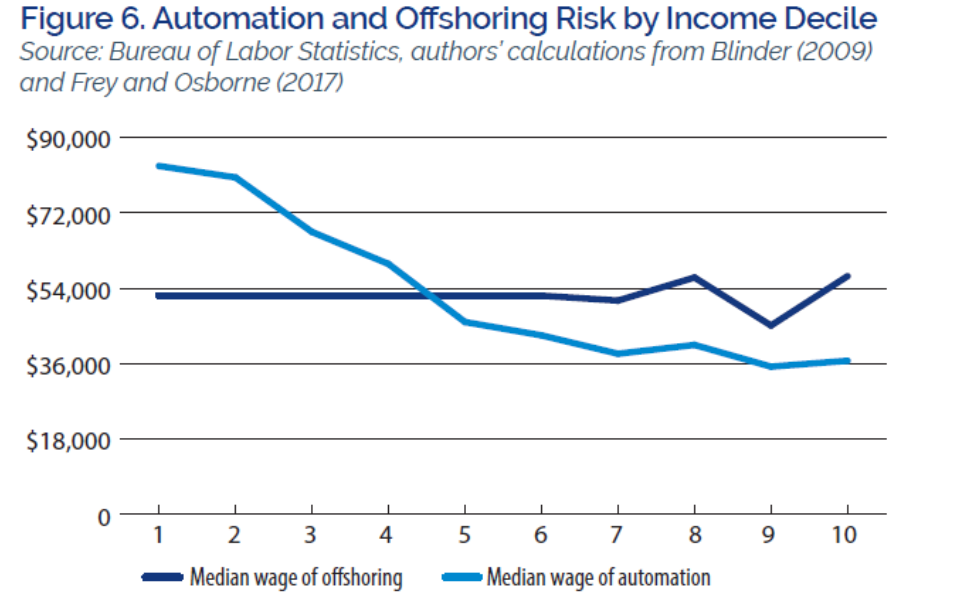

8/n And of course, automation, the higher risk falls very unequally upon workers. Again, this is from the same study.

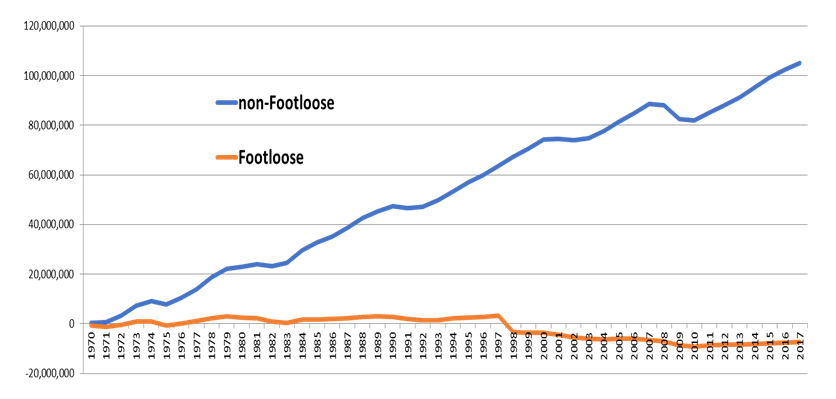

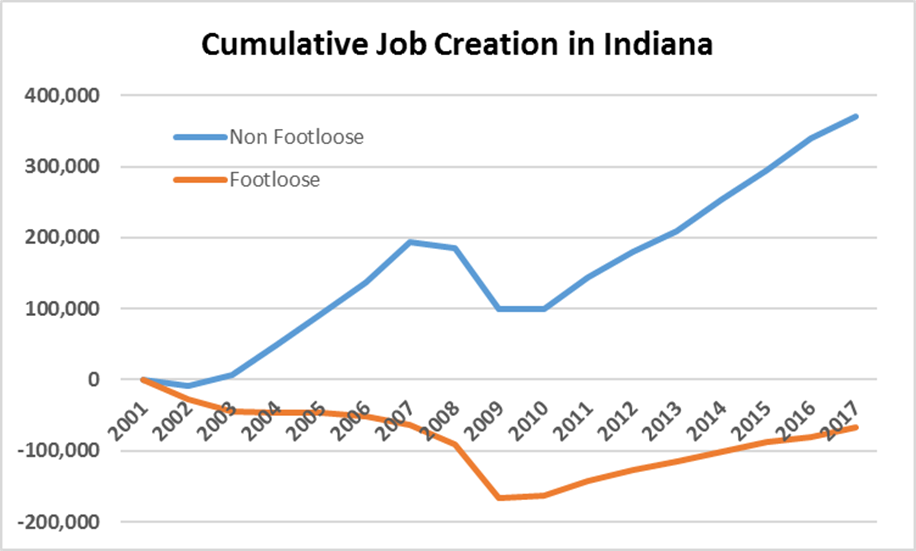

9/n All the net job growth in the US comes in & #39;non-footlose& #39; (non-exporting) jobs, which are those whose goods and services are consumed locally. Most economic development policy chases those footloose jobs, using tax dollars from those activities that build non-footloose jobs.

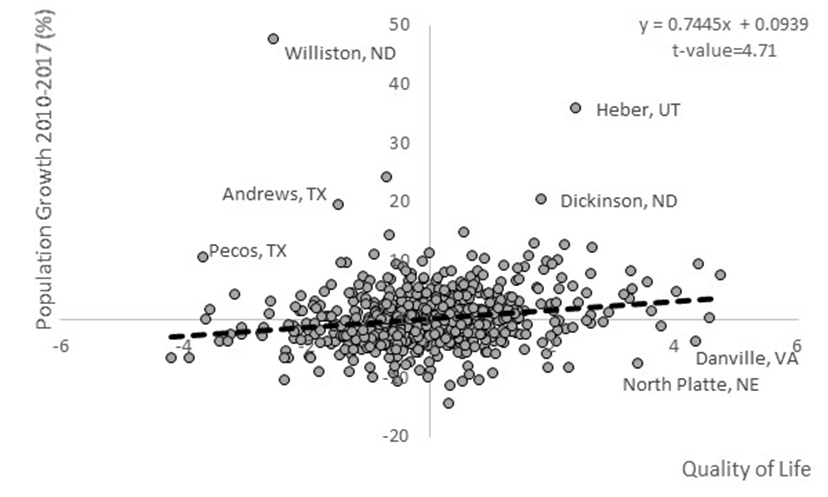

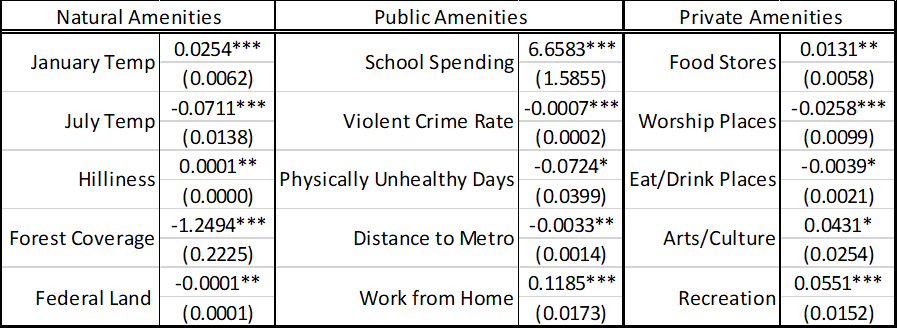

10/n They ignore that population growth occurs in high quality of life places (this is an extract from work by myself, @ProfWeinstein and @emilywornell), which uses the Rosen-Roback measure of amenities.

11/n So, when you spend money on attracting footloose jobs, you spend less money on things that boost amenities. That is of course, unless you live in the unicorn municipality without a budget constraint.

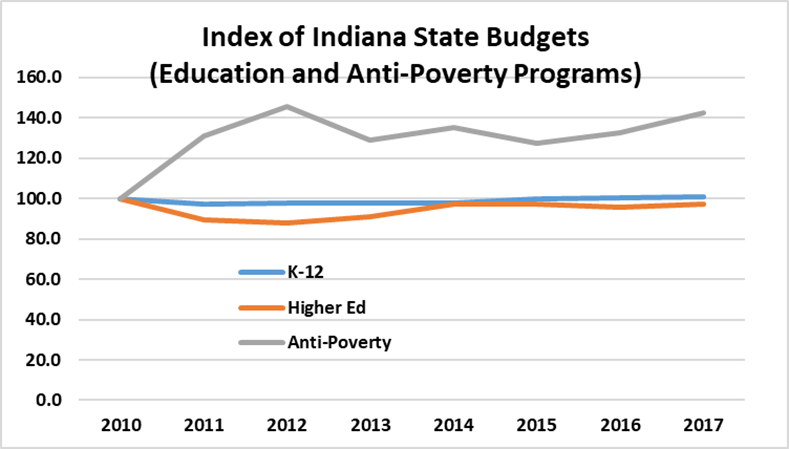

12/n The talk was longer, but now it is fine to shift to my critique of state policy. I begin by noting that in the longest recovery on US history, where did Indiana invest its money? Colleges, K-12 reading programs? Nope, anti poverty programs.

13/n We should& #39;ve spent more on some of these anti-poverty programs, they probably boost human capital in the long run. But, I heard no one in the general assembly ask whether, over the long run, maybe we could get better long term results by boosting education.

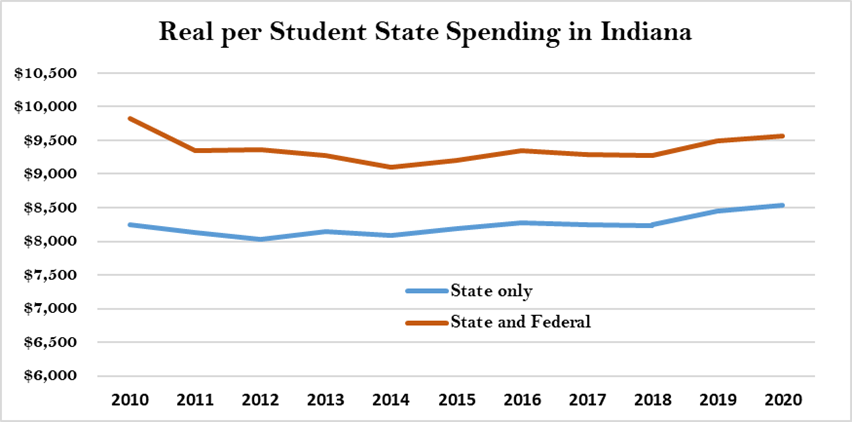

14/n Indiana isn& #39;t back to 2010 levels of per student spending (using a very poor CPI inflation measure). Moreover, the only reason it rose over the past two years is that we had an un-forecasted decline in K-12 enrollment. AGAIN, THIS IS THE LONGEST ECONOMIC RECOVERY IN HISTORY.

15/n We had plenty of money for tax incentives over the past three decades. This is from @UpjohnInstitute study on incentives.

16/n Oh, and how about the tax rate on exporting firms (those footloose jobs). Man, we are throwing money at those footloose jobs. Surely, that;s worked, right?

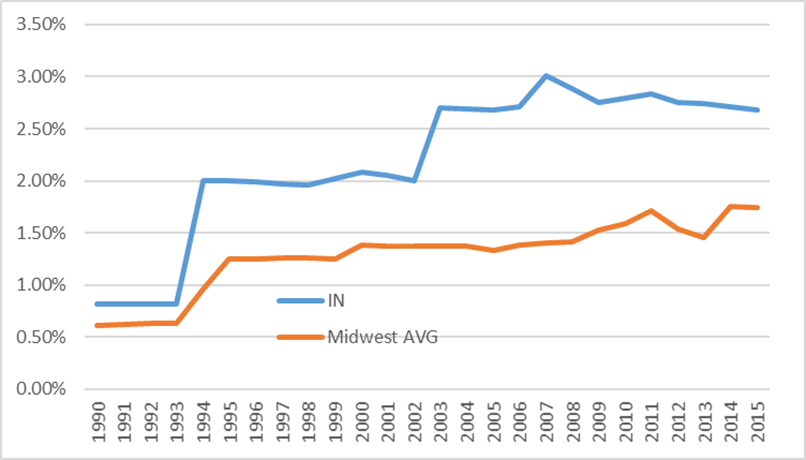

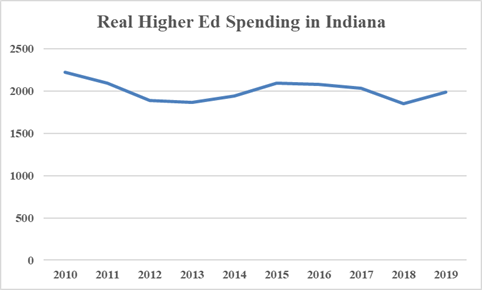

18/n Higher ed spending, how& #39;d that work? Look, maybe this is why our share of college educated workers is now lower than Kentucky& #39;s. Maybe there is some other mystical reason. But, I can say for sure, this affected college enrollment plans.

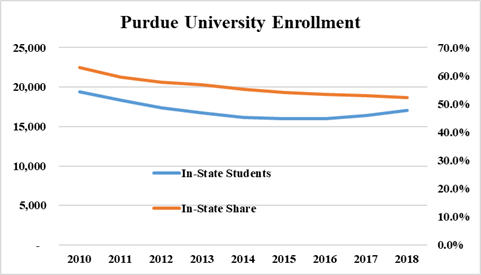

19/n This is what Purdue did when faced with less resources. They simply started replacing in-state with out-of-state students. Now, Mitch Daniels has begun to reverse that trend, but at this rate, it& #39;ll take several decades to get back to 2005 levels.

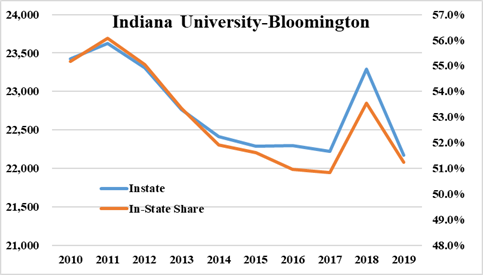

20/n Same at IU-Bloomington, and its the same at every public school that can attract students from outside the state. Of course, the grand reckoning comes this fall.

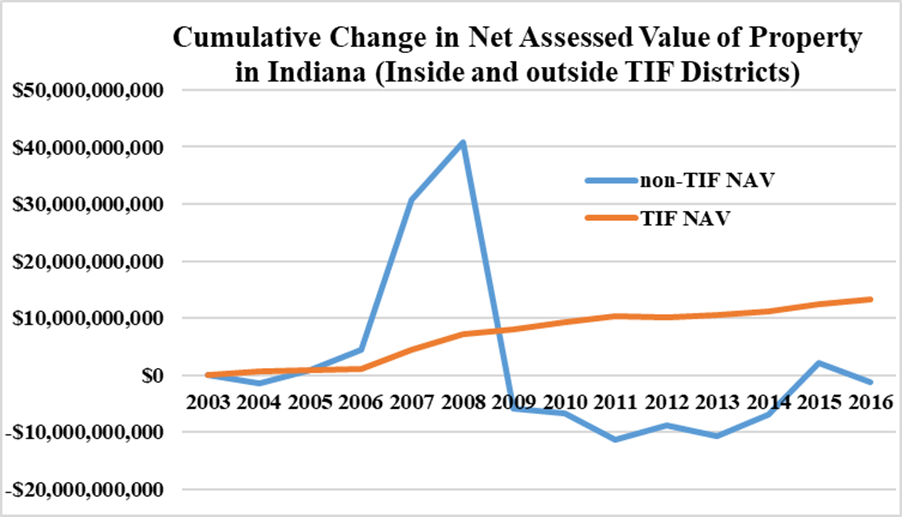

21/n Local gov& #39;ts have simply decided to capture all new assessed value into Tax Increment Financing Districts. This is what property tax caps gets you . . . shenanigans.

Now, some of this money is spent on quality of place, but most is just more business incentives.

Now, some of this money is spent on quality of place, but most is just more business incentives.

22/n Oh, and what amenities to people flock to? Well, school spending is the largest one.

Indiana typically ranks in the top 6 in terms of tax friendliness. We rank 38th in human capital, and we are in relative decline. Could that be a problem for us?

Answer follows.

Indiana typically ranks in the top 6 in terms of tax friendliness. We rank 38th in human capital, and we are in relative decline. Could that be a problem for us?

Answer follows.

23/n Yes. No one buys a home, car or suit based on price. We care about value. So, we also choose where we live, not on price, but value. If it were otherwise, San Francisco would be a vacant lot, and Blackford County, Indiana full of skyscrapers.

24/n Indiana, like many states, have spent too little improving their human capital, in a self-defeating quest to be a low tax state. In a world where mobile households care deeply about community and education, that is a self-defeating policy.

25/n All the school choice innovation, all the marketing and incentives, all the tax cuts to businesses have not yielded the results in economic development we wanted.

It is time to either change policies or re-calibrate expectations about economic growth.

It is time to either change policies or re-calibrate expectations about economic growth.

Read on Twitter

Read on Twitter