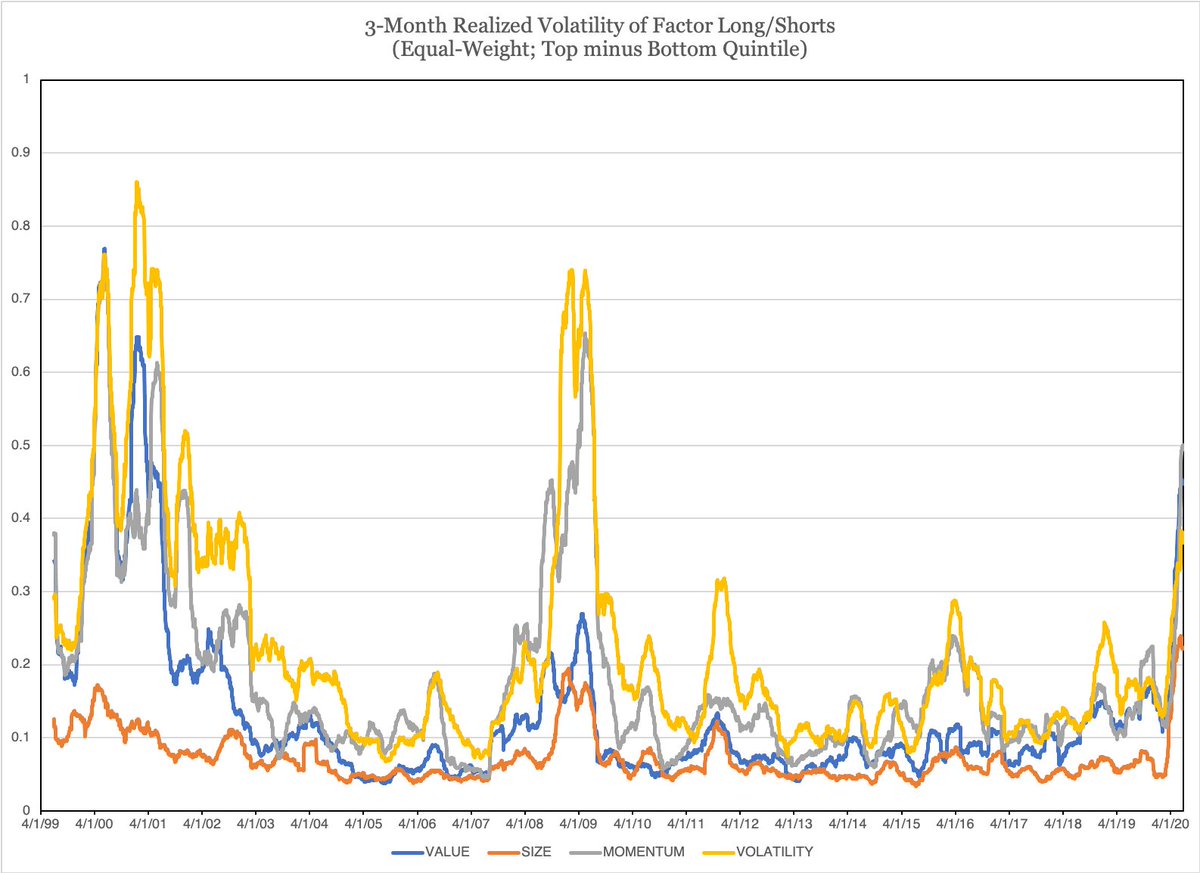

1/ I feel like factor volatility has shot through the roof in 2020 and nobody is really talking much about it.

(I get it, there are more important things going on.)

(I get it, there are more important things going on.)

2/ It isn’t unusual to see factor volatility jump in a crisis, but what is sort of weird about 2020 is that we’ve seen a bigger-than-usual jump in all the factors simultaneously.

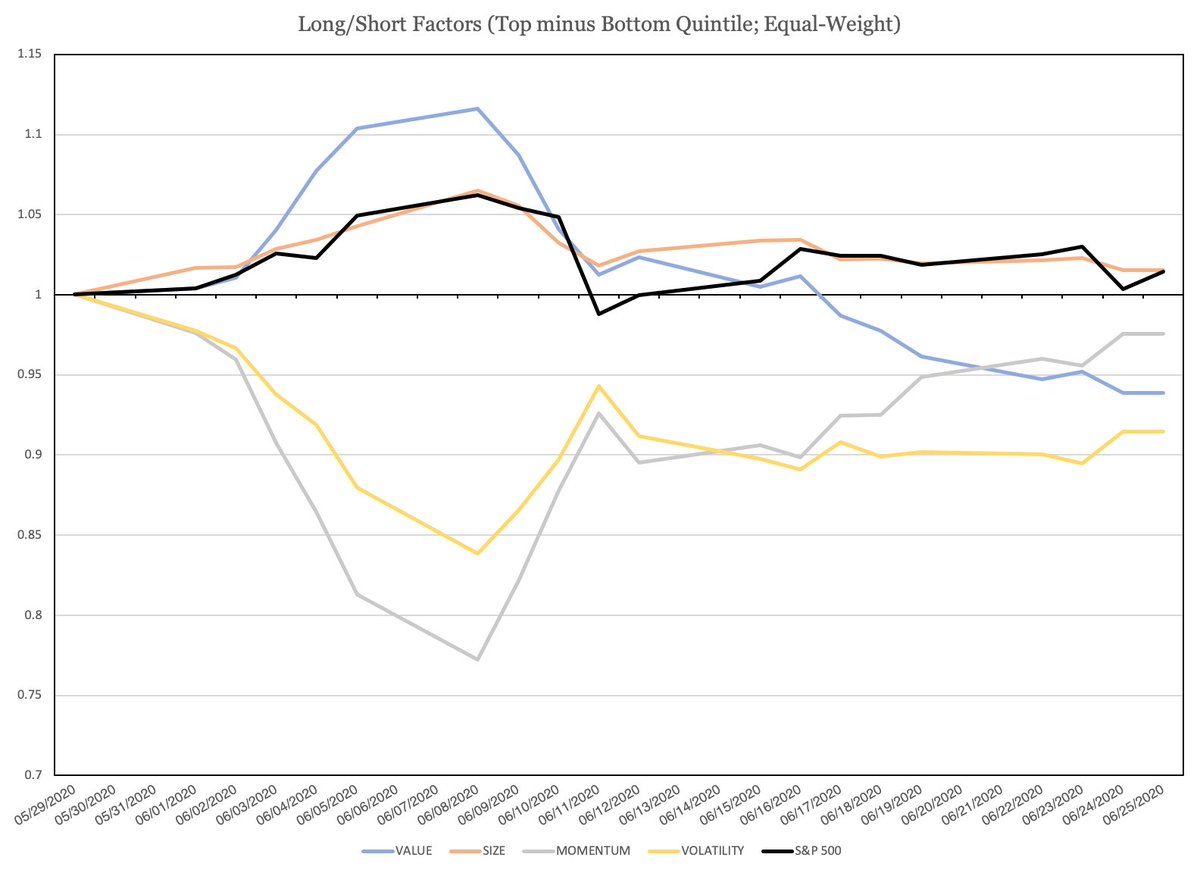

3/ Let’s talk about June for a second.

Within a week, value was up 10% and momentum was -20%. A WEEK.

And look how almost completely mirrored these factors have become.

Within a week, value was up 10% and momentum was -20%. A WEEK.

And look how almost completely mirrored these factors have become.

4/ Again, not totally unheard of from a return spread perspective. Anyone living through 1999 can tell you all about the rapid whiplashes between value and momentum.

5/ But June did hit <4th %-ile here for rolling 10-trading-day periods. That’s pretty gnarly.

But now consider this: what did the market do over this period?

But now consider this: what did the market do over this period?

6/ This is why a lot of people called June a junk rally. It was high volatility, negative momentum, cheap, small stuff that lead the way.

Is that healthy? No comment. I will say that it’s not unusual to see a momentum crash in a market recovery.

Is that healthy? No comment. I will say that it’s not unusual to see a momentum crash in a market recovery.

7/ But what thing I HAVE noticed is that the # of stocks falling into cheap, low momentum, high volatility quintiles spiked significantly as of late. https://twitter.com/choffstein/status/1275467660273254400">https://twitter.com/choffstei...

8/ This is a “problem” in so far as it can lead to unintentional crowding.

e.g. you trade value and your buddies trade momentum and low volatility. You get a margin call and need to de-lever. The more overlap in holdings you have, the more you impact their returns.

e.g. you trade value and your buddies trade momentum and low volatility. You get a margin call and need to de-lever. The more overlap in holdings you have, the more you impact their returns.

9/ What does it all mean? No idea.

I have zero explanation for the early June ramp other than an “unwind” of a factor convergence that occurred due to the overwhelming influence of a “COVID-19” factor that gripped markets in March.

I have zero explanation for the early June ramp other than an “unwind” of a factor convergence that occurred due to the overwhelming influence of a “COVID-19” factor that gripped markets in March.

10/ I’d certainly welcome any and all thoughts here.

FIN.

FIN.

Read on Twitter

Read on Twitter