1/ A thread showing 12 charts that illustrate #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> investor confidence and increased HODLing behavior.

https://abs.twimg.com/hashflags... draggable="false" alt=""> investor confidence and increased HODLing behavior.

Spoiler: This is long-term extremely bullish.

(data @glassnode)

Let& #39;s dig in https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

Spoiler: This is long-term extremely bullish.

(data @glassnode)

Let& #39;s dig in

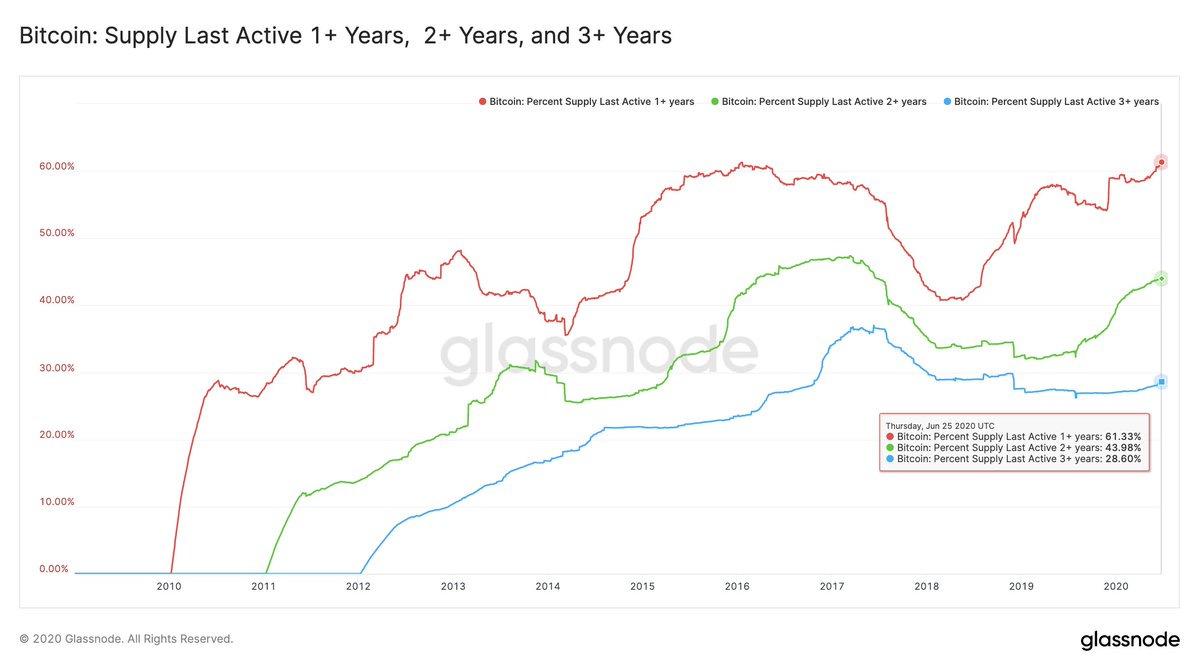

2/ First, the obvious one:

61% (!) of #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> supply that hasn& #39;t moved in over a year – that& #39;s an all-time high.

https://abs.twimg.com/hashflags... draggable="false" alt=""> supply that hasn& #39;t moved in over a year – that& #39;s an all-time high.

Moreover, 44% hasn& #39;t moved in 2+ years (approaching ATH), and almost 30% hasn& #39;t moved in 3+ years.

Loads of hodling here.

http://studio.glassnode.com/compare?a=BTC&a=BTC&a=BTC&m=supply.ActiveMore1YPercent&m=supply.ActiveMore2YPercent&m=supply.ActiveMore3YPercent&sameAxis=true">https://studio.glassnode.com/compare...

61% (!) of #Bitcoin

Moreover, 44% hasn& #39;t moved in 2+ years (approaching ATH), and almost 30% hasn& #39;t moved in 3+ years.

Loads of hodling here.

http://studio.glassnode.com/compare?a=BTC&a=BTC&a=BTC&m=supply.ActiveMore1YPercent&m=supply.ActiveMore2YPercent&m=supply.ActiveMore3YPercent&sameAxis=true">https://studio.glassnode.com/compare...

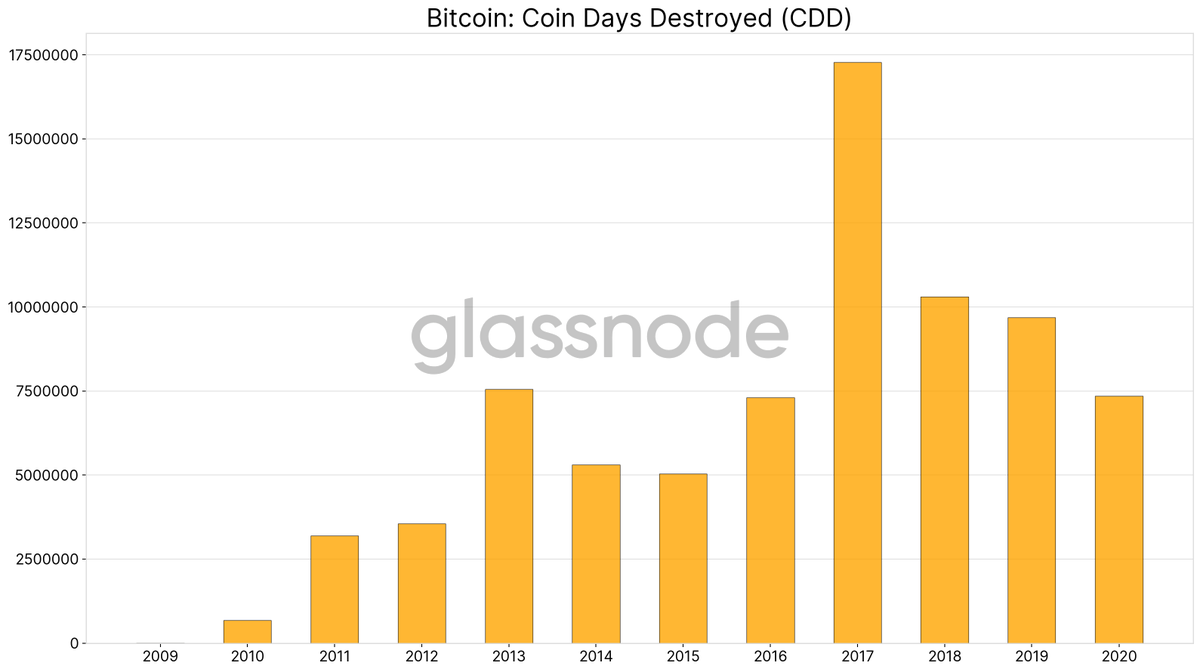

3/ The average Coin Days Destroyed (= transacted #bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> volume times number of days since coins were last moved) per year has been decreasing and is at its lowest level since 2016.

https://abs.twimg.com/hashflags... draggable="false" alt=""> volume times number of days since coins were last moved) per year has been decreasing and is at its lowest level since 2016.

Lower CDD = more long-term hodlers.

http://studio.glassnode.com/metrics?a=BTC&m=indicators.Cdd">https://studio.glassnode.com/metrics...

Lower CDD = more long-term hodlers.

http://studio.glassnode.com/metrics?a=BTC&m=indicators.Cdd">https://studio.glassnode.com/metrics...

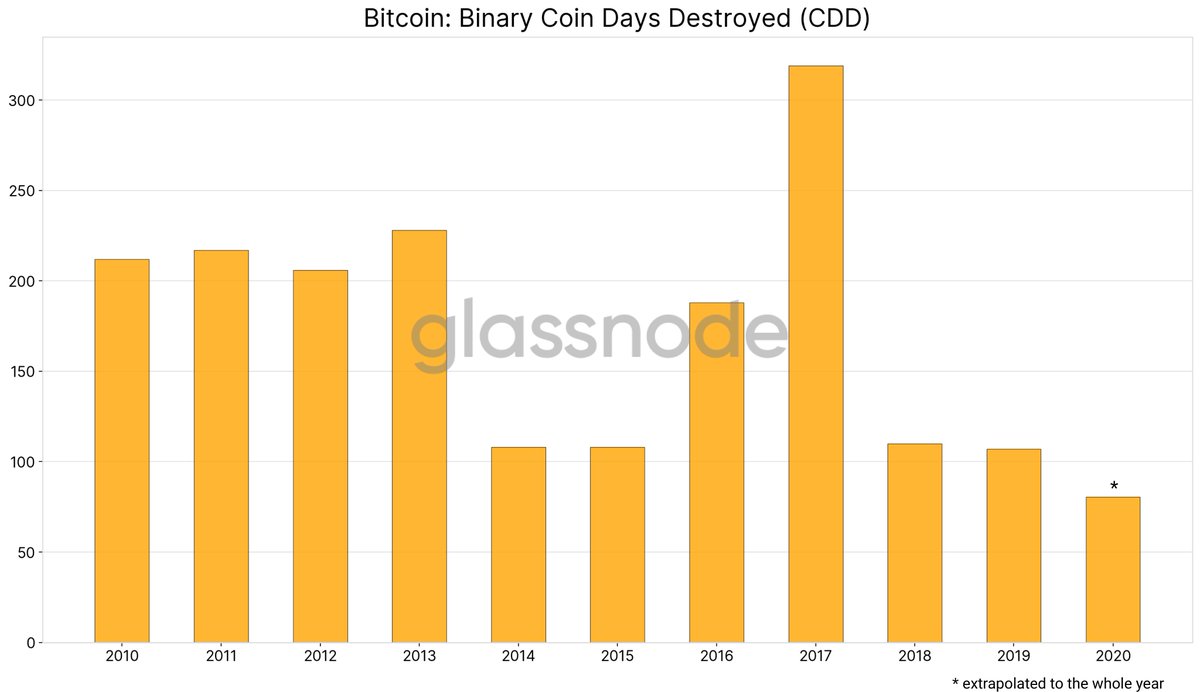

4/ Similarly, #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> Binary Coin Days Destroyed (= number of days per year in which more coins were destroyed compared to the historic average) has never been as low as in 2020.

https://abs.twimg.com/hashflags... draggable="false" alt=""> Binary Coin Days Destroyed (= number of days per year in which more coins were destroyed compared to the historic average) has never been as low as in 2020.

(h/t @hansthered for this metric)

http://studio.glassnode.com/metrics?a=BTC&m=indicators.CddSupplyAdjustedBinary">https://studio.glassnode.com/metrics...

(h/t @hansthered for this metric)

http://studio.glassnode.com/metrics?a=BTC&m=indicators.CddSupplyAdjustedBinary">https://studio.glassnode.com/metrics...

5/ Reserve Risk is extremely low, showing high confidence of long-term #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> investors.

https://abs.twimg.com/hashflags... draggable="false" alt=""> investors.

Reserve Risk at these levels indicates an attractive risk/reward ratio to invest.

Highly recommended read by @hansthered & @Ikigai_fund – http://www.kanaandkatana.com/valuation-depot-contents/2019/5/30/exploration-of-bitcoin-days-destroyed

https://www.kanaandkatana.com/valuation... href=" http://studio.glassnode.com/metrics?a=BTC&m=indicators.ReserveRisk">https://studio.glassnode.com/metrics...

Reserve Risk at these levels indicates an attractive risk/reward ratio to invest.

Highly recommended read by @hansthered & @Ikigai_fund – http://www.kanaandkatana.com/valuation-depot-contents/2019/5/30/exploration-of-bitcoin-days-destroyed

6/ Liveliness (=ratio of the coin days destroyed and the sum of all coin days ever created) has been on a downwards trend since 2019.

Liveliness increases as long-term holders liquidate positions, and decreases as long-term investors accumulate to HODL.

http://studio.glassnode.com/metrics?a=BTC&m=indicators.Liveliness">https://studio.glassnode.com/metrics...

Liveliness increases as long-term holders liquidate positions, and decreases as long-term investors accumulate to HODL.

http://studio.glassnode.com/metrics?a=BTC&m=indicators.Liveliness">https://studio.glassnode.com/metrics...

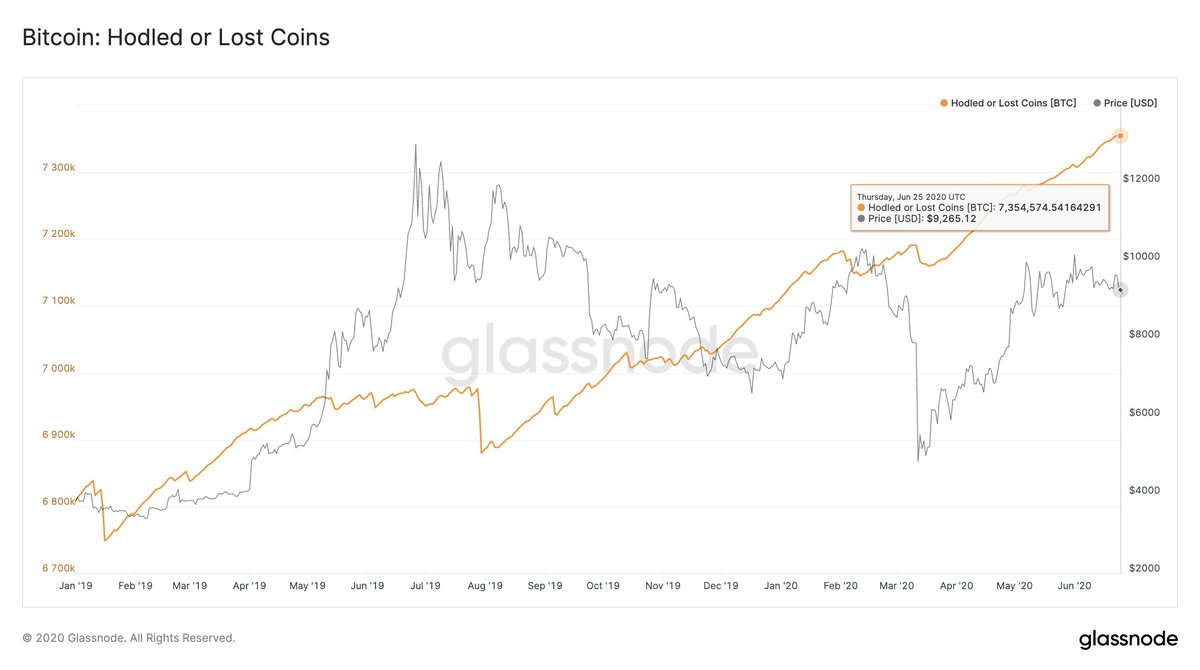

7/ The number of lost and HODLed #bitcoins has increased by 8% since the beginning of 2019.

It is currently sitting at more than 7.3 million $BTC – that is 40% of the circulating #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> supply.

https://abs.twimg.com/hashflags... draggable="false" alt=""> supply.

(h/t @TuurDemeester & @Adamant_Capital for this metric)

http://studio.glassnode.com/metrics?a=BTC&m=indicators.HodledLostCoins">https://studio.glassnode.com/metrics...

It is currently sitting at more than 7.3 million $BTC – that is 40% of the circulating #Bitcoin

(h/t @TuurDemeester & @Adamant_Capital for this metric)

http://studio.glassnode.com/metrics?a=BTC&m=indicators.HodledLostCoins">https://studio.glassnode.com/metrics...

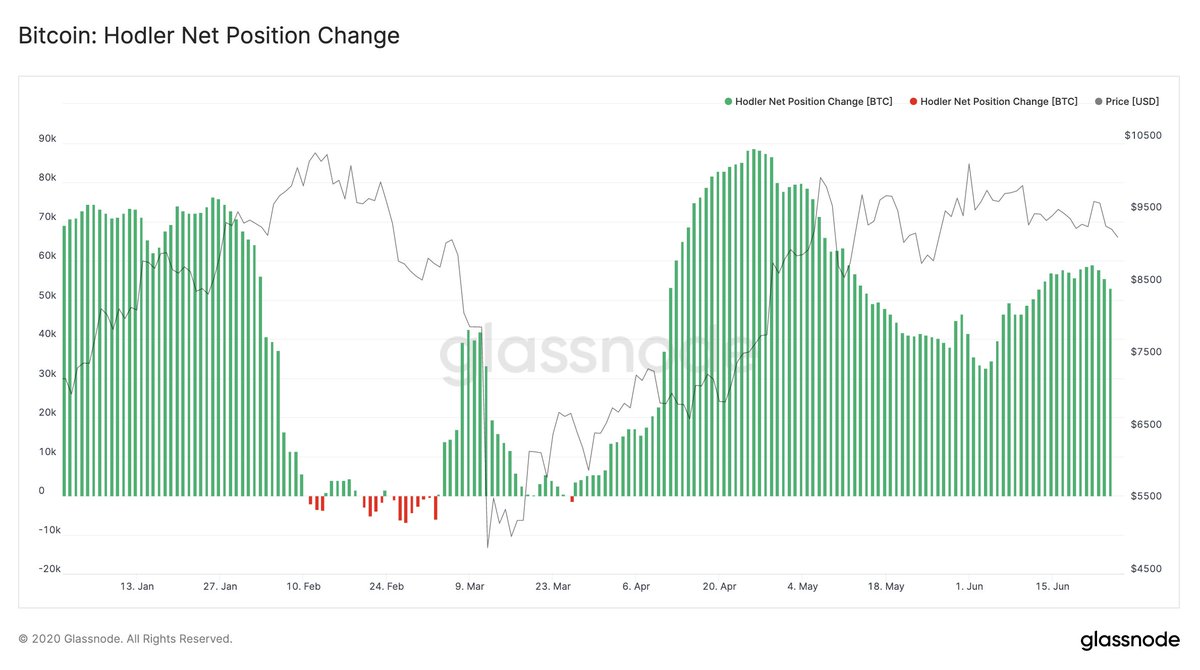

8/ In fact, HODLers are heavily accumulating in 2020: There have been only 16 days since the beginning of this year, in which the #BTC  https://abs.twimg.com/hashflags... draggable="false" alt=""> Hodler Net Position Change has been negative.

https://abs.twimg.com/hashflags... draggable="false" alt=""> Hodler Net Position Change has been negative.

HODLers doing what they do best.

(again h/t @TuurDemeester and @Adamant_Capital for the metric)

HODLers doing what they do best.

(again h/t @TuurDemeester and @Adamant_Capital for the metric)

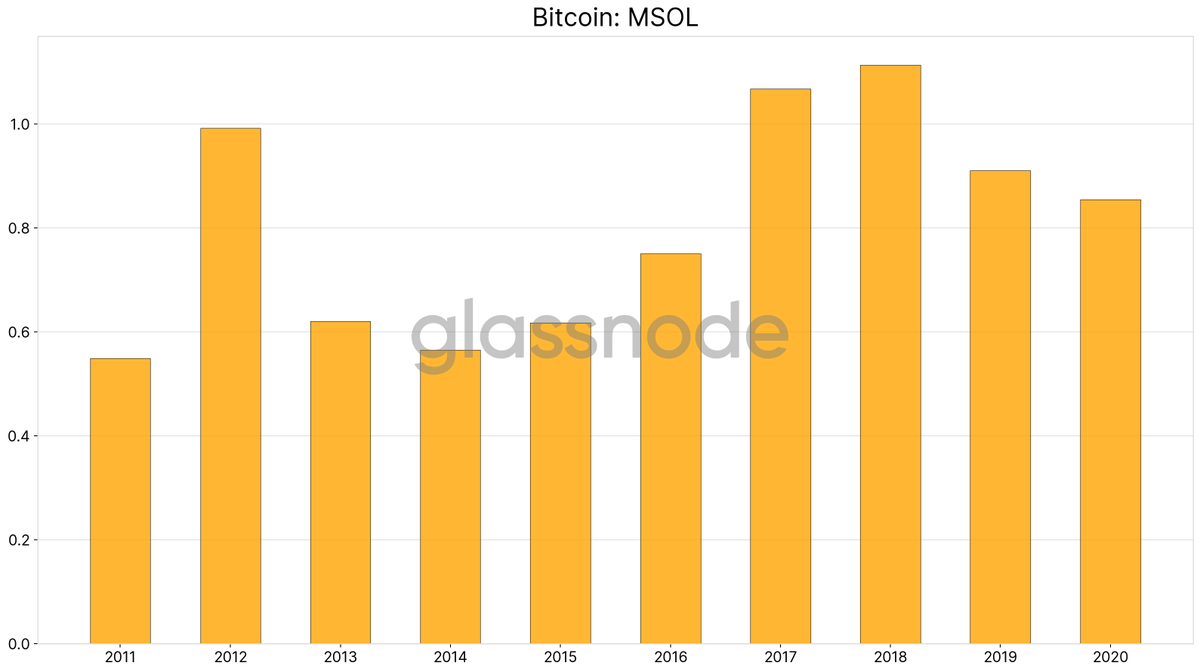

9/ The Median Spent Output Lifespan (MSOL) has been decreasing since 2018.

This shows that on average the age of #bitcoins being moved on-chain is constantly decreasing in the recent years.

(h/t @renato_shira for this metric)

http://studio.glassnode.com/metrics?a=BTC&m=indicators.Msol">https://studio.glassnode.com/metrics...

This shows that on average the age of #bitcoins being moved on-chain is constantly decreasing in the recent years.

(h/t @renato_shira for this metric)

http://studio.glassnode.com/metrics?a=BTC&m=indicators.Msol">https://studio.glassnode.com/metrics...

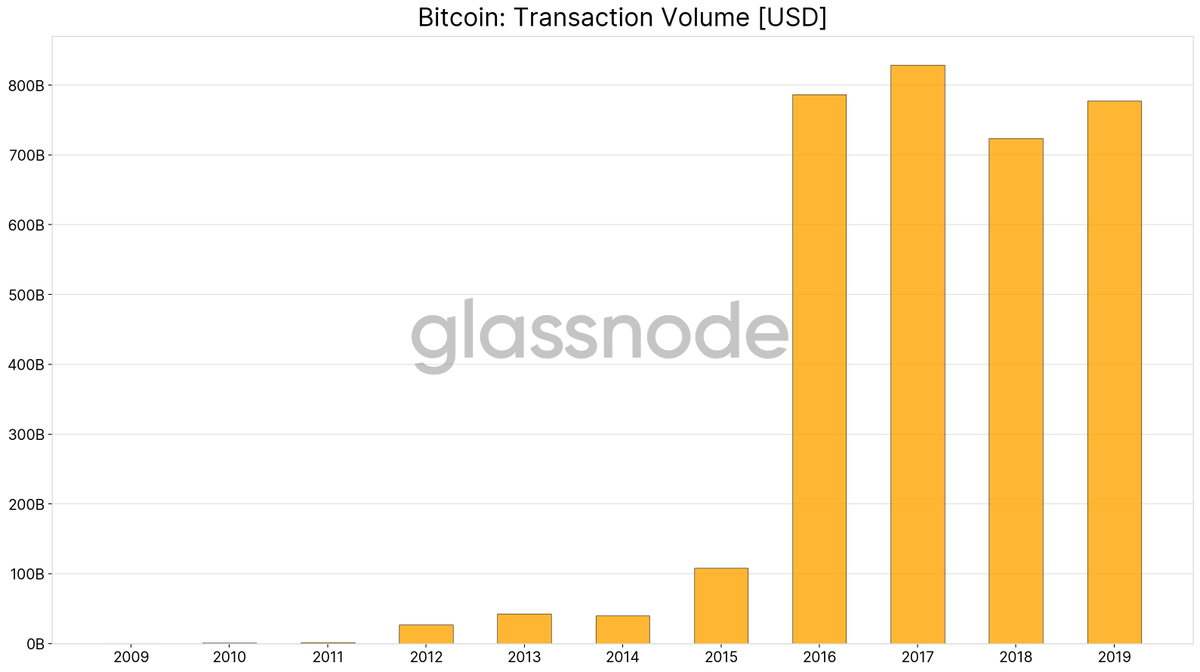

10/ Despite a continuous and immense growth of the #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> network, the amount of $BTC transferred on-chain has stagnated since 2016.

https://abs.twimg.com/hashflags... draggable="false" alt=""> network, the amount of $BTC transferred on-chain has stagnated since 2016.

This is a clear indication of Bitcoin& #39;s SoV narrative.

Investors are simply not willing to spend their bitcoins.

http://studio.glassnode.com/metrics?a=BTC&m=transactions.TransfersVolumeEntityAdjustedSum">https://studio.glassnode.com/metrics...

This is a clear indication of Bitcoin& #39;s SoV narrative.

Investors are simply not willing to spend their bitcoins.

http://studio.glassnode.com/metrics?a=BTC&m=transactions.TransfersVolumeEntityAdjustedSum">https://studio.glassnode.com/metrics...

11/ Long-Term Holder MVRV is looking strong.

LTH-MVRV usually only drops below 1 after prolonged #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> bear markets. Imo, current values indicate long-term investor confidence in higher $BTC prices from here.

https://abs.twimg.com/hashflags... draggable="false" alt=""> bear markets. Imo, current values indicate long-term investor confidence in higher $BTC prices from here.

http://studio.glassnode.com/metrics?a=BTC&m=market.MvrvMore155">https://studio.glassnode.com/metrics...

LTH-MVRV usually only drops below 1 after prolonged #Bitcoin

http://studio.glassnode.com/metrics?a=BTC&m=market.MvrvMore155">https://studio.glassnode.com/metrics...

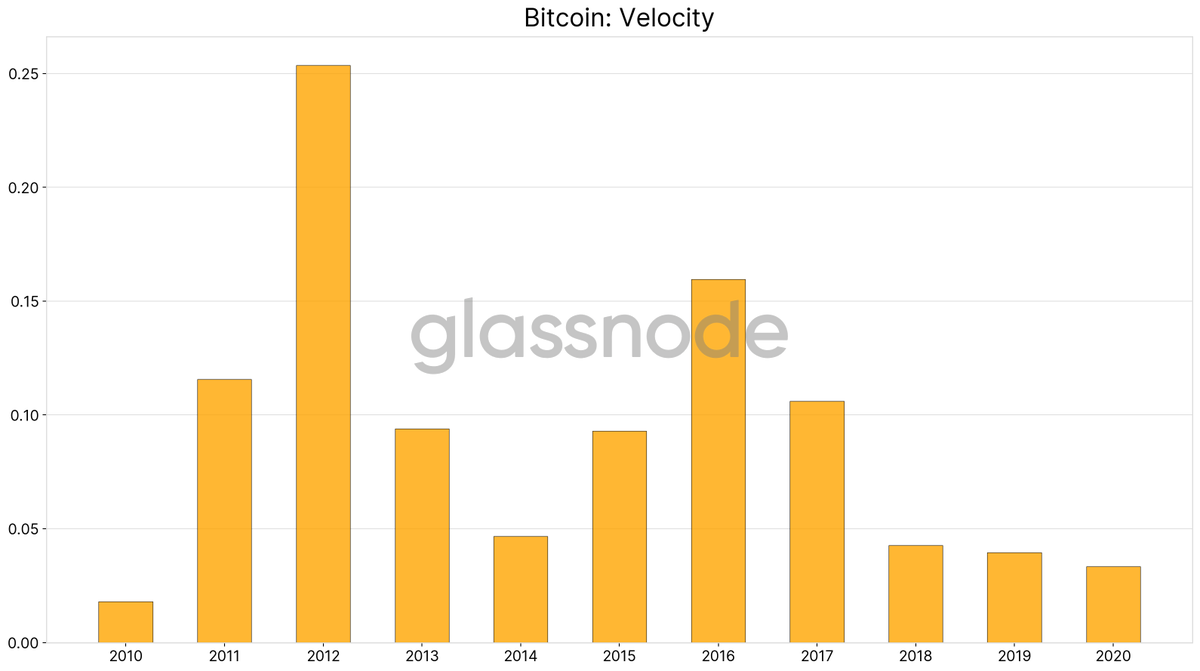

12/ #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> velocity, which measures how quickly units are circulating in the network, is the lowest it has been in 10 years.

https://abs.twimg.com/hashflags... draggable="false" alt=""> velocity, which measures how quickly units are circulating in the network, is the lowest it has been in 10 years.

Once again this is strong support for investors& #39; unwillingness to spent $BTC and the store-of-value narrative.

http://studio.glassnode.com/metrics?a=BTC&m=indicators.Velocity">https://studio.glassnode.com/metrics...

Once again this is strong support for investors& #39; unwillingness to spent $BTC and the store-of-value narrative.

http://studio.glassnode.com/metrics?a=BTC&m=indicators.Velocity">https://studio.glassnode.com/metrics...

13/ #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> balance on exchanges has significantly dropped since the beginning of the year.

https://abs.twimg.com/hashflags... draggable="false" alt=""> balance on exchanges has significantly dropped since the beginning of the year.

While there are a variety of factors that contribute to this decrease, a portion of this is potentially due to investors& #39; taking custody of their $BTC.

http://studio.glassnode.com/metrics?a=BTC&m=distribution.BalanceExchanges">https://studio.glassnode.com/metrics...

While there are a variety of factors that contribute to this decrease, a portion of this is potentially due to investors& #39; taking custody of their $BTC.

http://studio.glassnode.com/metrics?a=BTC&m=distribution.BalanceExchanges">https://studio.glassnode.com/metrics...

14/ Conclusion:

Much hodling going on. I& #39;m extremely long-term bullish on #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt="">. Don& #39;t let yourself get distracted by short-term price action – and always remember to zoom out and look at the bigger picture.

https://abs.twimg.com/hashflags... draggable="false" alt="">. Don& #39;t let yourself get distracted by short-term price action – and always remember to zoom out and look at the bigger picture.

(Obviously nothing here is investment advice.)

Much hodling going on. I& #39;m extremely long-term bullish on #Bitcoin

(Obviously nothing here is investment advice.)

Read on Twitter

Read on Twitter supply that hasn& #39;t moved in over a year – that& #39;s an all-time high.Moreover, 44% hasn& #39;t moved in 2+ years (approaching ATH), and almost 30% hasn& #39;t moved in 3+ years.Loads of hodling here. https://studio.glassnode.com/compare..." title="2/ First, the obvious one: 61% (!) of #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> supply that hasn& #39;t moved in over a year – that& #39;s an all-time high.Moreover, 44% hasn& #39;t moved in 2+ years (approaching ATH), and almost 30% hasn& #39;t moved in 3+ years.Loads of hodling here. https://studio.glassnode.com/compare..." class="img-responsive" style="max-width:100%;"/>

supply that hasn& #39;t moved in over a year – that& #39;s an all-time high.Moreover, 44% hasn& #39;t moved in 2+ years (approaching ATH), and almost 30% hasn& #39;t moved in 3+ years.Loads of hodling here. https://studio.glassnode.com/compare..." title="2/ First, the obvious one: 61% (!) of #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> supply that hasn& #39;t moved in over a year – that& #39;s an all-time high.Moreover, 44% hasn& #39;t moved in 2+ years (approaching ATH), and almost 30% hasn& #39;t moved in 3+ years.Loads of hodling here. https://studio.glassnode.com/compare..." class="img-responsive" style="max-width:100%;"/>

volume times number of days since coins were last moved) per year has been decreasing and is at its lowest level since 2016.Lower CDD = more long-term hodlers. https://studio.glassnode.com/metrics..." title="3/ The average Coin Days Destroyed (= transacted #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> volume times number of days since coins were last moved) per year has been decreasing and is at its lowest level since 2016.Lower CDD = more long-term hodlers. https://studio.glassnode.com/metrics..." class="img-responsive" style="max-width:100%;"/>

volume times number of days since coins were last moved) per year has been decreasing and is at its lowest level since 2016.Lower CDD = more long-term hodlers. https://studio.glassnode.com/metrics..." title="3/ The average Coin Days Destroyed (= transacted #bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> volume times number of days since coins were last moved) per year has been decreasing and is at its lowest level since 2016.Lower CDD = more long-term hodlers. https://studio.glassnode.com/metrics..." class="img-responsive" style="max-width:100%;"/>

Binary Coin Days Destroyed (= number of days per year in which more coins were destroyed compared to the historic average) has never been as low as in 2020.(h/t @hansthered for this metric) https://studio.glassnode.com/metrics..." title="4/ Similarly, #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> Binary Coin Days Destroyed (= number of days per year in which more coins were destroyed compared to the historic average) has never been as low as in 2020.(h/t @hansthered for this metric) https://studio.glassnode.com/metrics..." class="img-responsive" style="max-width:100%;"/>

Binary Coin Days Destroyed (= number of days per year in which more coins were destroyed compared to the historic average) has never been as low as in 2020.(h/t @hansthered for this metric) https://studio.glassnode.com/metrics..." title="4/ Similarly, #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> Binary Coin Days Destroyed (= number of days per year in which more coins were destroyed compared to the historic average) has never been as low as in 2020.(h/t @hansthered for this metric) https://studio.glassnode.com/metrics..." class="img-responsive" style="max-width:100%;"/>

investors.Reserve Risk at these levels indicates an attractive risk/reward ratio to invest.Highly recommended read by @hansthered & @Ikigai_fund – https://www.kanaandkatana.com/valuation... href=" http://studio.glassnode.com/metrics?a=BTC&m=indicators.ReserveRisk">https://studio.glassnode.com/metrics..." title="5/ Reserve Risk is extremely low, showing high confidence of long-term #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> investors.Reserve Risk at these levels indicates an attractive risk/reward ratio to invest.Highly recommended read by @hansthered & @Ikigai_fund – https://www.kanaandkatana.com/valuation... href=" http://studio.glassnode.com/metrics?a=BTC&m=indicators.ReserveRisk">https://studio.glassnode.com/metrics..." class="img-responsive" style="max-width:100%;"/>

investors.Reserve Risk at these levels indicates an attractive risk/reward ratio to invest.Highly recommended read by @hansthered & @Ikigai_fund – https://www.kanaandkatana.com/valuation... href=" http://studio.glassnode.com/metrics?a=BTC&m=indicators.ReserveRisk">https://studio.glassnode.com/metrics..." title="5/ Reserve Risk is extremely low, showing high confidence of long-term #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> investors.Reserve Risk at these levels indicates an attractive risk/reward ratio to invest.Highly recommended read by @hansthered & @Ikigai_fund – https://www.kanaandkatana.com/valuation... href=" http://studio.glassnode.com/metrics?a=BTC&m=indicators.ReserveRisk">https://studio.glassnode.com/metrics..." class="img-responsive" style="max-width:100%;"/>

supply.(h/t @TuurDemeester & @Adamant_Capital for this metric) https://studio.glassnode.com/metrics..." title="7/ The number of lost and HODLed #bitcoins has increased by 8% since the beginning of 2019.It is currently sitting at more than 7.3 million $BTC – that is 40% of the circulating #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> supply.(h/t @TuurDemeester & @Adamant_Capital for this metric) https://studio.glassnode.com/metrics..." class="img-responsive" style="max-width:100%;"/>

supply.(h/t @TuurDemeester & @Adamant_Capital for this metric) https://studio.glassnode.com/metrics..." title="7/ The number of lost and HODLed #bitcoins has increased by 8% since the beginning of 2019.It is currently sitting at more than 7.3 million $BTC – that is 40% of the circulating #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> supply.(h/t @TuurDemeester & @Adamant_Capital for this metric) https://studio.glassnode.com/metrics..." class="img-responsive" style="max-width:100%;"/>

Hodler Net Position Change has been negative.HODLers doing what they do best.(again h/t @TuurDemeester and @Adamant_Capital for the metric)" title="8/ In fact, HODLers are heavily accumulating in 2020: There have been only 16 days since the beginning of this year, in which the #BTC https://abs.twimg.com/hashflags... draggable="false" alt=""> Hodler Net Position Change has been negative.HODLers doing what they do best.(again h/t @TuurDemeester and @Adamant_Capital for the metric)" class="img-responsive" style="max-width:100%;"/>

Hodler Net Position Change has been negative.HODLers doing what they do best.(again h/t @TuurDemeester and @Adamant_Capital for the metric)" title="8/ In fact, HODLers are heavily accumulating in 2020: There have been only 16 days since the beginning of this year, in which the #BTC https://abs.twimg.com/hashflags... draggable="false" alt=""> Hodler Net Position Change has been negative.HODLers doing what they do best.(again h/t @TuurDemeester and @Adamant_Capital for the metric)" class="img-responsive" style="max-width:100%;"/>

network, the amount of $BTC transferred on-chain has stagnated since 2016.This is a clear indication of Bitcoin& #39;s SoV narrative.Investors are simply not willing to spend their bitcoins. https://studio.glassnode.com/metrics..." title="10/ Despite a continuous and immense growth of the #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> network, the amount of $BTC transferred on-chain has stagnated since 2016.This is a clear indication of Bitcoin& #39;s SoV narrative.Investors are simply not willing to spend their bitcoins. https://studio.glassnode.com/metrics..." class="img-responsive" style="max-width:100%;"/>

network, the amount of $BTC transferred on-chain has stagnated since 2016.This is a clear indication of Bitcoin& #39;s SoV narrative.Investors are simply not willing to spend their bitcoins. https://studio.glassnode.com/metrics..." title="10/ Despite a continuous and immense growth of the #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> network, the amount of $BTC transferred on-chain has stagnated since 2016.This is a clear indication of Bitcoin& #39;s SoV narrative.Investors are simply not willing to spend their bitcoins. https://studio.glassnode.com/metrics..." class="img-responsive" style="max-width:100%;"/>

bear markets. Imo, current values indicate long-term investor confidence in higher $BTC prices from here. https://studio.glassnode.com/metrics..." title="11/ Long-Term Holder MVRV is looking strong. LTH-MVRV usually only drops below 1 after prolonged #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> bear markets. Imo, current values indicate long-term investor confidence in higher $BTC prices from here. https://studio.glassnode.com/metrics..." class="img-responsive" style="max-width:100%;"/>

bear markets. Imo, current values indicate long-term investor confidence in higher $BTC prices from here. https://studio.glassnode.com/metrics..." title="11/ Long-Term Holder MVRV is looking strong. LTH-MVRV usually only drops below 1 after prolonged #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> bear markets. Imo, current values indicate long-term investor confidence in higher $BTC prices from here. https://studio.glassnode.com/metrics..." class="img-responsive" style="max-width:100%;"/>

velocity, which measures how quickly units are circulating in the network, is the lowest it has been in 10 years.Once again this is strong support for investors& #39; unwillingness to spent $BTC and the store-of-value narrative. https://studio.glassnode.com/metrics..." title="12/ #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> velocity, which measures how quickly units are circulating in the network, is the lowest it has been in 10 years.Once again this is strong support for investors& #39; unwillingness to spent $BTC and the store-of-value narrative. https://studio.glassnode.com/metrics..." class="img-responsive" style="max-width:100%;"/>

velocity, which measures how quickly units are circulating in the network, is the lowest it has been in 10 years.Once again this is strong support for investors& #39; unwillingness to spent $BTC and the store-of-value narrative. https://studio.glassnode.com/metrics..." title="12/ #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> velocity, which measures how quickly units are circulating in the network, is the lowest it has been in 10 years.Once again this is strong support for investors& #39; unwillingness to spent $BTC and the store-of-value narrative. https://studio.glassnode.com/metrics..." class="img-responsive" style="max-width:100%;"/>

balance on exchanges has significantly dropped since the beginning of the year. While there are a variety of factors that contribute to this decrease, a portion of this is potentially due to investors& #39; taking custody of their $BTC. https://studio.glassnode.com/metrics..." title="13/ #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> balance on exchanges has significantly dropped since the beginning of the year. While there are a variety of factors that contribute to this decrease, a portion of this is potentially due to investors& #39; taking custody of their $BTC. https://studio.glassnode.com/metrics..." class="img-responsive" style="max-width:100%;"/>

balance on exchanges has significantly dropped since the beginning of the year. While there are a variety of factors that contribute to this decrease, a portion of this is potentially due to investors& #39; taking custody of their $BTC. https://studio.glassnode.com/metrics..." title="13/ #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> balance on exchanges has significantly dropped since the beginning of the year. While there are a variety of factors that contribute to this decrease, a portion of this is potentially due to investors& #39; taking custody of their $BTC. https://studio.glassnode.com/metrics..." class="img-responsive" style="max-width:100%;"/>