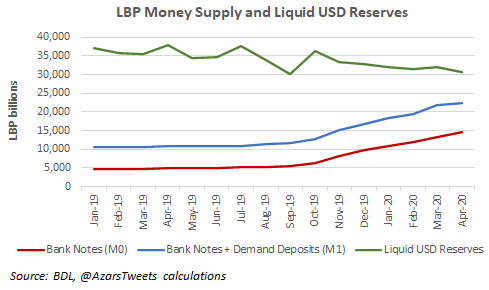

1/ Prices are rising rapidly & the LBP is depreciating daily because USD reserves are falling and LBP money supply is increasing. I& #39;ll explain why this is happening below. The consequences of delaying reforms/restructuring and delaying/impeding an IMF program can be catastrophic.

Normal price inflation is an economic phenomenon, but hyperinflation (where prices increase by insane amounts) is a psychological one and, from other countries& #39; experience, incredibly difficult to end. It hurts the poor the most.

We& #39;ve been put in an impossible situation where the two choices we face are:

1/ Stay the course and let prices & LBP exchange rate get out of control

2/ Limit inflation by reducing LBP withdrawal limits, deepening the economic contraction & pushing people further into poverty

1/ Stay the course and let prices & LBP exchange rate get out of control

2/ Limit inflation by reducing LBP withdrawal limits, deepening the economic contraction & pushing people further into poverty

There is huge demand for LBP bank notes because businesses are reluctant to accept payment via bank checks or credit cards. Why? Because they need LBP cash in order to buy USD from the sarraf so that they can import products.

We& #39;ve become a cash-based economy. To meet demand for LBP and give people relief from rising prices, BDL is allowing higher withdrawal of LBP bank notes & lollars in the form of LBP notes at a higher exchange rate than the official one. This is why the money supply is increasing.

People are also not rolling over their time deposits (mjammad accounts) so more money is going into demand deposits (7seb jeri). This is more spendable money entering the economy.

Both of the factors above is leading to more LBP in the economy chasing the same or fewer goods, and chasing fewer USD bank notes. It& #39;s resulting in USD disappearing from the market, a rising price for USD, and rising prices for goods... all while our USD reserves are falling.

If this phenomenon & the resulting price inflation continues, people will start expecting it to continue & will preemptively raise their prices in anticipation of future price increases. This creates a feedback loops wherein prices get out of control very quickly - hyperinflation

The only way to slow it right now is to tighten monetary policy (curtail the LBP money supply/withdrawal limits) to reduce spending by people (spending on goods, imported goods - which reduces USD demand, and USD bank notes). This means people will consume less and be poorer.

Ending the exchange rate subsidy for the goods it still applies to is another tool to achieve the same (reduced consumption of imported goods and reduced demand for USD). It also has very negative consequences so it needs to be considered and done very carefully.

This is happening in the context of only a fraction of the money supply being accessible to people because of capital controls. Imagine what would happen if we lifted capital controls? They need to be tightened further, which is a politically impossible but necessary decision...

... because if prices get out of control, everyone will be hurt much more. This is one of the consequences of refusing to recognize unfunded debts/losses in the system and the too-large money supply. We need to restructure the liabilities/deposits right now or it will get worse.

To give people relief, we need to increase the supply of USD. This is why the IMF program and reforms are so urgent. They& #39;re being delayed and undermined by political inaction and a ridiculous debate over size of debts in the system. The consequences of delays will be disastrous.

Read on Twitter

Read on Twitter