Did not realize the AckSPAC would be filing its S-1 yesterday: https://twitter.com/ShortSightedCap/status/1275063963831721984?s=20">https://twitter.com/ShortSigh...

It turns out the one thing I thought was known (the $1b size) was wrong.

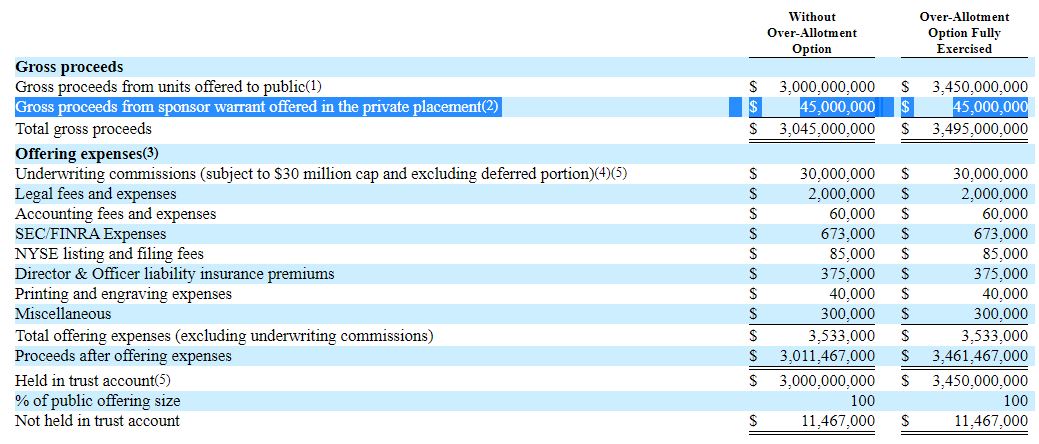

It& #39;s a $3b SPAC, up to $3.45b with the over-allotment... and comes with a forward purchase agreement for another $1 - $3b.

We& #39;re not hunting elephants anymore - we& #39;re going whaling, and Bill is Ahab.

We& #39;re not hunting elephants anymore - we& #39;re going whaling, and Bill is Ahab.

Some thoughts on the S-1.

1) $20 is adorable. It& #39;s twice as good as $10! (cc Retail Investors)

2) Tontine warrants? Somebody is a fan of financial history! (and / or recalls Buffett& #39;s early fascination with Tontines) (for background on Tontines: https://twitter.com/cablecarcapital/status/1275131702117937154?s=20">https://twitter.com/cablecarc... )

And it& #39;s a pretty decent description: with every unit, you get 1/9th of a detachable warrant. These warrants become tradeable 52 days after the offering.

But holders who do not redeem their shares at the time of the combination get another 2/9ths of a warrant (the Tontine Redeemable Warrant). Plus the pro-rata shares of anyone who redeems.

3) The promote seems limited to the founder warrants (capped at 5.95% dilution, purchased by the sponsor for an estimated $45m).

And, of course, the forward purchasers (Pershing Square entities) don& #39;t have their money tied up in a cash equivalent while waiting for a deal.

. @YellowLabLife makes some great points here: https://twitter.com/YellowLabLife/status/1275465675448954882">https://twitter.com/YellowLab...

There is no natural holder for this investment. The tontine structure means that this is less appealing to traditional SPAC buyers.

And I& #39;m not sure large LOs are willing to give Bill a cheap loan for up to 2 years to execute a transaction...

And I& #39;m not sure large LOs are willing to give Bill a cheap loan for up to 2 years to execute a transaction...

As @YellowLabLife notes, SPACkman might need some retail interest.

The size also significantly narrows the universe of targets.

The size also significantly narrows the universe of targets.

The S-1 mentions "private, large capitalization, high-quality, growth companies" and "mature unicorns"

So I& #39;m adjusting my totally speculative target list.

JAB& #39;s Coffee business makes the list, as does their Pret-Panera company. Endeavor, Caliber Collision, and Nets too.

JAB& #39;s Coffee business makes the list, as does their Pret-Panera company. Endeavor, Caliber Collision, and Nets too.

Again, maybe Ackman buys some PE-backed software co (Ultimate Software? Informatica? trying to think of the other large PE acqs)... but I& #39;d be surprised. It& #39;s not the space he& #39;s most comfortable in.

Stripe? I don& #39;t think they& #39;d do it... but I could be surprised. Doesn& #39;t sound like they are in a rush to go public. And, if they were really *that* opposed to a traditional IPO, maybe they& #39;d consider a direct listing. Or even Chamath& #39;s SPAC.

AirBnB? The timing could be better, even for a negotiated transaction.

And I assume they have adequate liquidity after their recent raise: https://www.cnbc.com/2020/04/14/airbnb-raises-another-1-billion-in-debt.html">https://www.cnbc.com/2020/04/1...

And I assume they have adequate liquidity after their recent raise: https://www.cnbc.com/2020/04/14/airbnb-raises-another-1-billion-in-debt.html">https://www.cnbc.com/2020/04/1...

Palantir would just be... weird, based on what little I know about the company. Probably not DoorDash (industry structure)... maybe Instacart? Although grocery delivery isn& #39;t easy either...

I don& #39;t think he& #39;s going to India / China...

I don& #39;t think he& #39;s going to India / China...

But if you really want retail hype... if you really want CNBC buzz... do I dare say it?

SpaceX

SpaceX

Just to throw more fuel on this totally unfounded (and honestly unlikely) theory - Ackman has been rather complimentary towards Musk: https://markets.businessinsider.com/news/stocks/billionaire-investor-bill-ackman-enormous-respect-tesla-ceo-elon-musk-2020-4-1029143572">https://markets.businessinsider.com/news/stoc...

And then there was this: https://twitter.com/billackman/status/1263528252502609922?lang=en">https://twitter.com/billackma...

I have no idea how Bill Ackman would square SpaceX with his new business principles... but it would be fun.

And, critically, it& #39;s fun to speculate about this. People tweeting about his SPAC and generating buzz is a nice bonus for Bill.

And, critically, it& #39;s fun to speculate about this. People tweeting about his SPAC and generating buzz is a nice bonus for Bill.

Read on Twitter

Read on Twitter