METAL vs DIGITAL 1/5: #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> often labeled digital #gold, though many disagree with the comparison. Over the past few months, global economic events and the halving have breathed new life into this discussion. Let’s take a look at a few stats on the topic.

https://abs.twimg.com/hashflags... draggable="false" alt=""> often labeled digital #gold, though many disagree with the comparison. Over the past few months, global economic events and the halving have breathed new life into this discussion. Let’s take a look at a few stats on the topic.

METAL vs DIGITAL 2/5: In terms of supply and demand, the cryptocurrency and the precious metal behave quite differently. Gold supply has outpaced demand over the last decade. #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">, on the other hand…

https://abs.twimg.com/hashflags... draggable="false" alt="">, on the other hand…

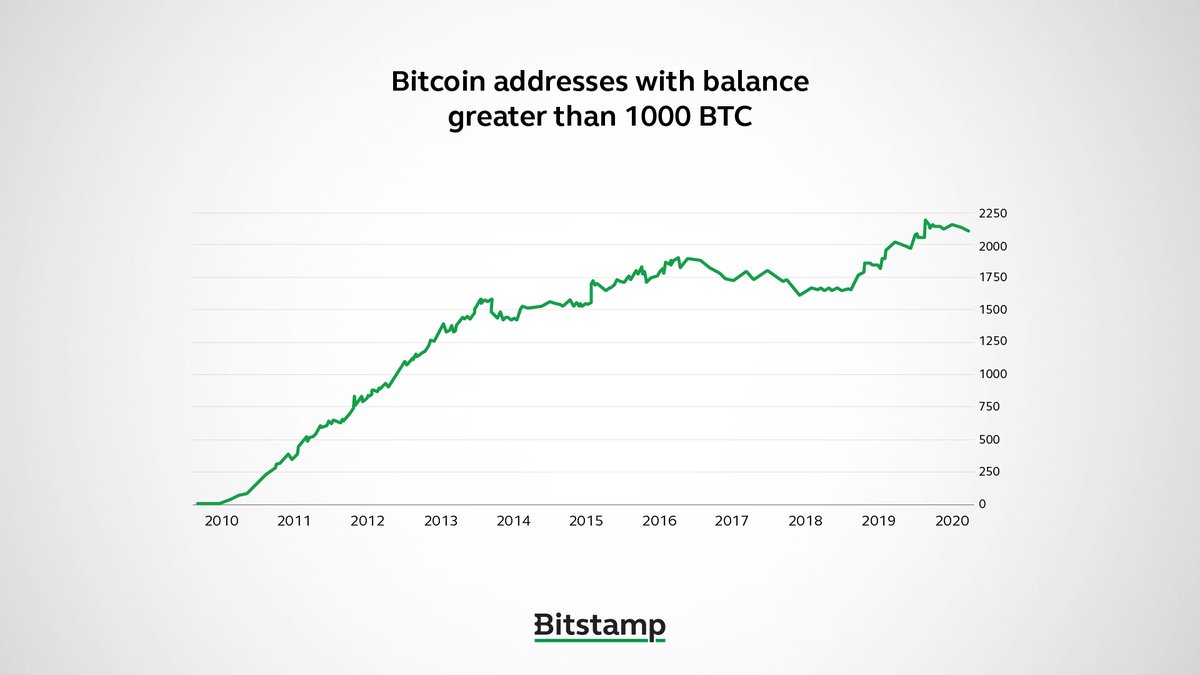

METAL vs DIGITAL 3/5: The number of #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> addresses holding more than 1000 BTC has been steadily rising over time, which implies more whales in the ocean, but also shows growing trust in BTC as a store of value appropriate for holding large amounts.

https://abs.twimg.com/hashflags... draggable="false" alt=""> addresses holding more than 1000 BTC has been steadily rising over time, which implies more whales in the ocean, but also shows growing trust in BTC as a store of value appropriate for holding large amounts.

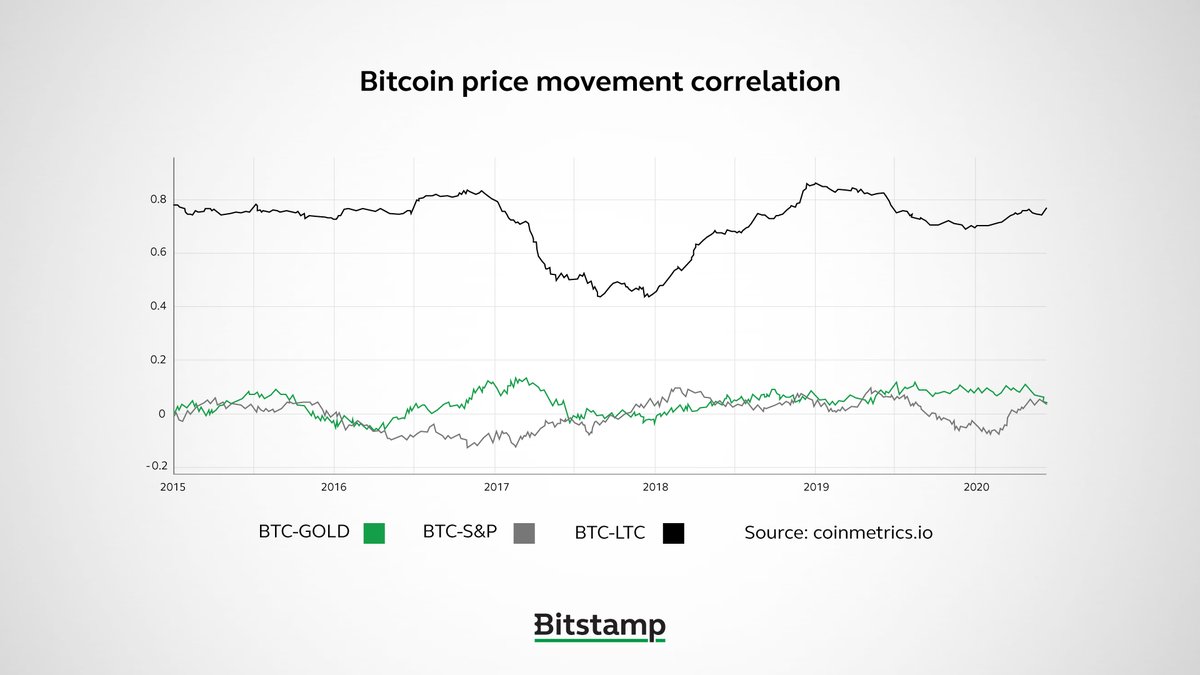

METAL vs DIGITAL 4/5: #Gold is touted as a safe haven due to its lack of correlation with other assets, especially stocks. #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">’s safe haven status is still under debate, but data shows its price is only correlated with other cryptocurrencies, not gold or S&P.

https://abs.twimg.com/hashflags... draggable="false" alt="">’s safe haven status is still under debate, but data shows its price is only correlated with other cryptocurrencies, not gold or S&P.

METAL vs DIGITAL 5/5: While #gold has been used as a store of value for thousands of years and successfully served as a safe haven, #bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> still has a lot to prove. But the fact that this is a legitimate discussion already shows how far #crypto has come over the past decade!

https://abs.twimg.com/hashflags... draggable="false" alt=""> still has a lot to prove. But the fact that this is a legitimate discussion already shows how far #crypto has come over the past decade!

Read on Twitter

Read on Twitter , on the other hand…" title="METAL vs DIGITAL 2/5: In terms of supply and demand, the cryptocurrency and the precious metal behave quite differently. Gold supply has outpaced demand over the last decade. #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt="">, on the other hand…" class="img-responsive" style="max-width:100%;"/>

, on the other hand…" title="METAL vs DIGITAL 2/5: In terms of supply and demand, the cryptocurrency and the precious metal behave quite differently. Gold supply has outpaced demand over the last decade. #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt="">, on the other hand…" class="img-responsive" style="max-width:100%;"/>

addresses holding more than 1000 BTC has been steadily rising over time, which implies more whales in the ocean, but also shows growing trust in BTC as a store of value appropriate for holding large amounts." title="METAL vs DIGITAL 3/5: The number of #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> addresses holding more than 1000 BTC has been steadily rising over time, which implies more whales in the ocean, but also shows growing trust in BTC as a store of value appropriate for holding large amounts." class="img-responsive" style="max-width:100%;"/>

addresses holding more than 1000 BTC has been steadily rising over time, which implies more whales in the ocean, but also shows growing trust in BTC as a store of value appropriate for holding large amounts." title="METAL vs DIGITAL 3/5: The number of #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> addresses holding more than 1000 BTC has been steadily rising over time, which implies more whales in the ocean, but also shows growing trust in BTC as a store of value appropriate for holding large amounts." class="img-responsive" style="max-width:100%;"/>

’s safe haven status is still under debate, but data shows its price is only correlated with other cryptocurrencies, not gold or S&P." title="METAL vs DIGITAL 4/5: #Gold is touted as a safe haven due to its lack of correlation with other assets, especially stocks. #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt="">’s safe haven status is still under debate, but data shows its price is only correlated with other cryptocurrencies, not gold or S&P." class="img-responsive" style="max-width:100%;"/>

’s safe haven status is still under debate, but data shows its price is only correlated with other cryptocurrencies, not gold or S&P." title="METAL vs DIGITAL 4/5: #Gold is touted as a safe haven due to its lack of correlation with other assets, especially stocks. #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt="">’s safe haven status is still under debate, but data shows its price is only correlated with other cryptocurrencies, not gold or S&P." class="img-responsive" style="max-width:100%;"/>