1/ I& #39;ve been investing for 22 years, and I& #39;ve never seen irrational exuberance and false hope around equities like we& #39;re experiencing right now. Over the past few weeks, many people who I& #39;ve followed my entire investing life have gone bonkers, jumping on the bandwagon.

2/ It& #39;s ironic that this is all coming at the point in time when the US economy is the worst it& #39;s been in my lifetime. Reality is being ignored, and seemingly just about everyone is investing based on faith and hope. Faith and hope are for religion, not business.

3/ So many people believe in "Don& #39;t fight the Fed" at a time where the Fed has zero ability to fix any of the issues that plague the economy and dampen the outlook for risk assets. It& #39;s also a time where we have the least qualified and least competent Fed Chair in history.

4/ So, just so I can sleep well tonight knowing I tried my best, here is a list of all of the issues facing us right now of which the Fed has zero control:

5/ Insolvency - personal, corporate, and sovereign - on a scale the world has never seen.

Demographics - an aging Boomer population who owns most of the country& #39;s assets leaving the workforce in droves.

Political and civil unrest leading to protesting and riots in the streets

Demographics - an aging Boomer population who owns most of the country& #39;s assets leaving the workforce in droves.

Political and civil unrest leading to protesting and riots in the streets

6/ Trade conflict with the US& #39; largest trading partner, China

Global supply chain disruption

Collapsing emerging markets all over the world

Corporate profits cratering to levels lower than during the GFC

Global supply chain disruption

Collapsing emerging markets all over the world

Corporate profits cratering to levels lower than during the GFC

7/ An upcoming election that will likely result in the most left-leaning government the US has seen since the 1940& #39;s. Higher corporate taxes, more corporate and environmental regulations are a guarantee.

8/ Unemployment at the highest level in modern American history.

Real estate - both commercial and residential - ready to absolutely implode as 106 million loans across the country are delinquent.

Real estate - both commercial and residential - ready to absolutely implode as 106 million loans across the country are delinquent.

9/ Global unrest with conflicts pitting two nuclear powers (China & India), a resurgent North Korea, and unending wars in the Middle East.

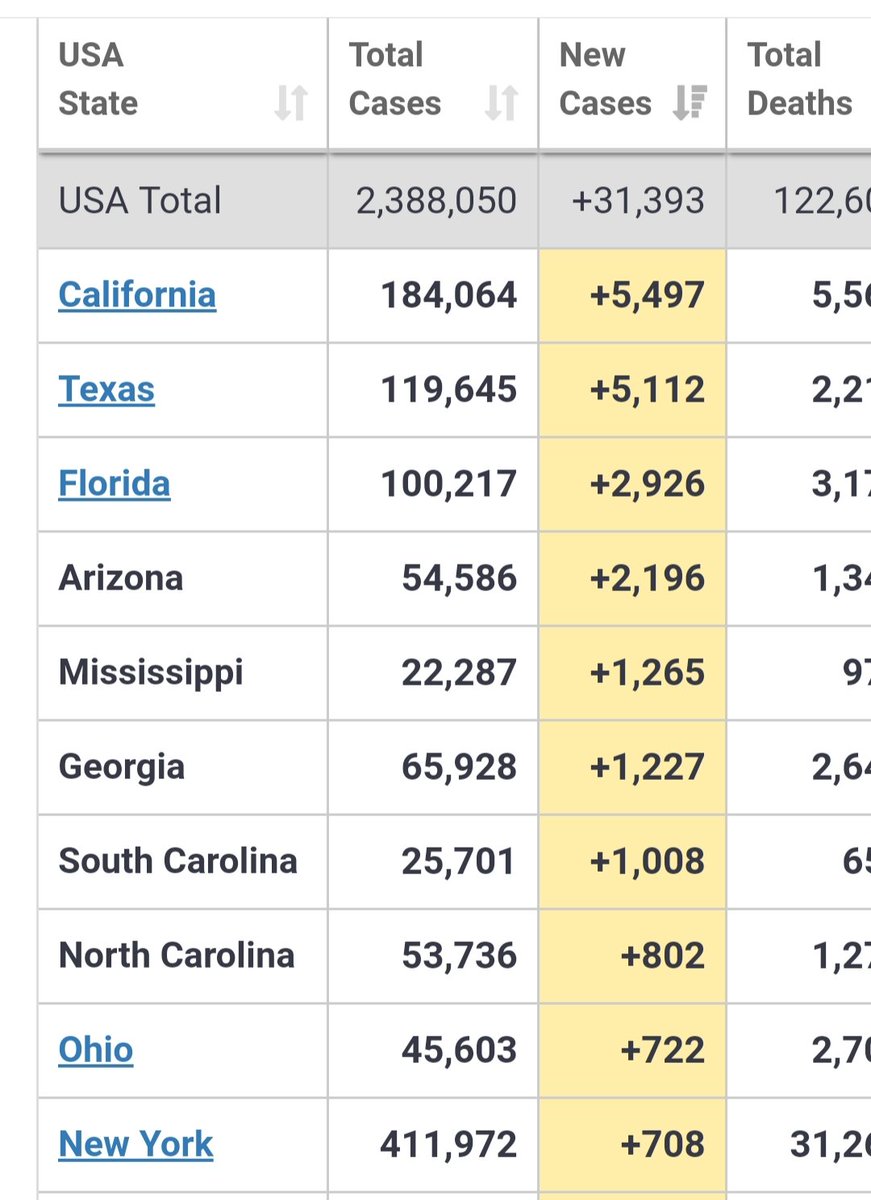

10/ And finally, COVID-19. Unless the Fed can find a way to cure this disease, consumer confidence and uncertainty for businesses will continue to pound the global economy.

Read on Twitter

Read on Twitter