Real Estate Investing: Before-Tax Cash Flow

A short thread on calculating BTCF

Is your investment property producing cash?

Let us investigate

A short thread on calculating BTCF

Is your investment property producing cash?

Let us investigate

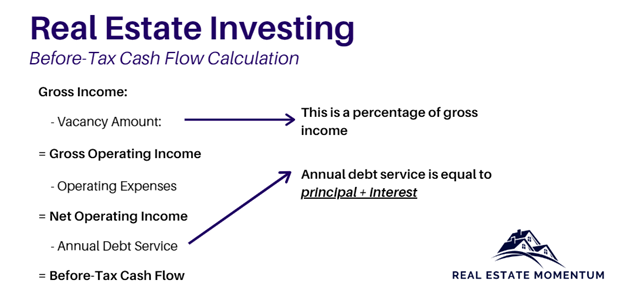

Calculating cash flow before taxes is a matter of determining the net operating income and deducting the debt service.

Once the before-tax cash flow estimation is calculated, you will insight on the property before allocating capital to the investment.

Once the before-tax cash flow estimation is calculated, you will insight on the property before allocating capital to the investment.

Step 1) Gross Income

•Rental Income

•Other Income

•Add these together to get total gross income

•Rental Income

•Other Income

•Add these together to get total gross income

Step 2) Vacancy Amount

•Percentage of gross income (ex. 4% of GI)

•Subtract this from gross income

•Move this amount on a monthly basis to your cash reserves account (future protection)

•Percentage of gross income (ex. 4% of GI)

•Subtract this from gross income

•Move this amount on a monthly basis to your cash reserves account (future protection)

Step 3) Gross Operating Income

•Gross income – vacancy amount

•This is the amount of income you generate after considering the vacancy rate

•Gross income – vacancy amount

•This is the amount of income you generate after considering the vacancy rate

Step 4) Operating Expenses

•These are the monthly costs to run your property

•Property insurance, property taxes, repairs and maintenance, utilities that tenant does not pay, etc.

•Subtract these from gross operating income

•These are the monthly costs to run your property

•Property insurance, property taxes, repairs and maintenance, utilities that tenant does not pay, etc.

•Subtract these from gross operating income

Step 5) Net Operating Income

•Take gross operating income and subtract operating expenses

•Often used in real estate to measure a property’s profit potential and financial health by calculating the income after operating expenses are deducted.

•Take gross operating income and subtract operating expenses

•Often used in real estate to measure a property’s profit potential and financial health by calculating the income after operating expenses are deducted.

Step 6) Debt Service

•Take net operating income and subtract your principal and interest payments

•The debt service is the debt the investor is obligated to repay in connection with the investment property; this includes principal repayments and interest

•Take net operating income and subtract your principal and interest payments

•The debt service is the debt the investor is obligated to repay in connection with the investment property; this includes principal repayments and interest

There are the steps to calculate before-tax cash flow.

Note: capital expenditures, which can occur at any time (for example, replacing HVAC), is a cash outflow – this will reduce your before-tax cash flow.

Note: capital expenditures, which can occur at any time (for example, replacing HVAC), is a cash outflow – this will reduce your before-tax cash flow.

Part two of my series will break this down in-depth and how it relates to the debt/return profile.

It will be released soon so stay tuned!

It will be released soon so stay tuned!

Read on Twitter

Read on Twitter