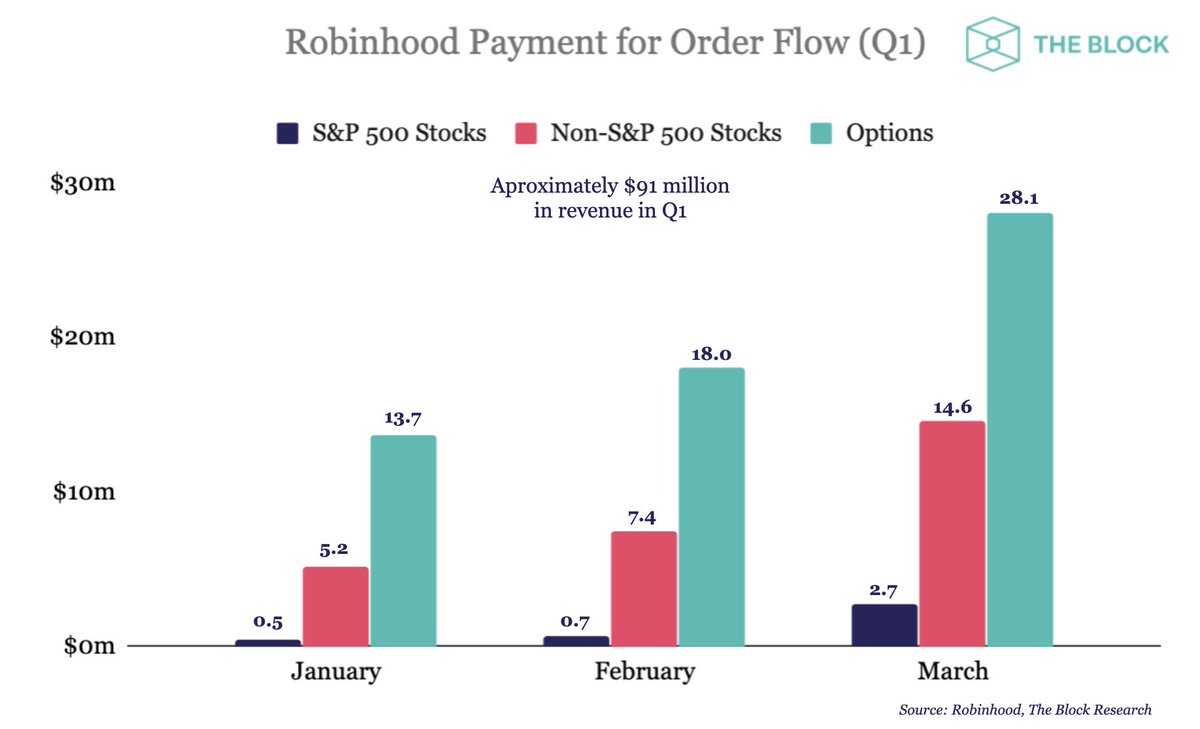

Last week, I examined Robinhood& #39;s most recent 606 report to get a sense of its routing activity. As most in the industry know, they& #39;re not the only firm making $ from payment for order flow. TD, Schwab, and ETrade appear to have brought in more than $300m from PFOF in Q1. Thread.

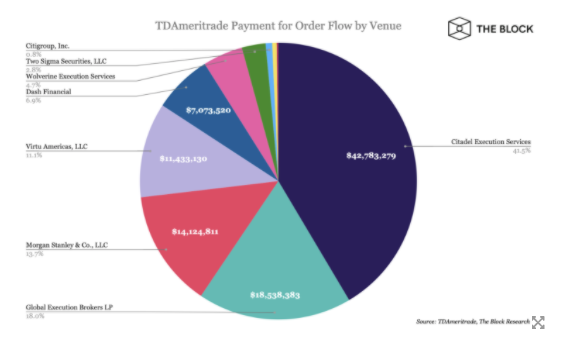

In total, trading firms paid TDAmeritrade over $200 million through its brokerage and clearing divisions.

Payments for TDAmeritrade, specifically, totaled ~$103.2 million.

Payments for TDAmeritrade, specifically, totaled ~$103.2 million.

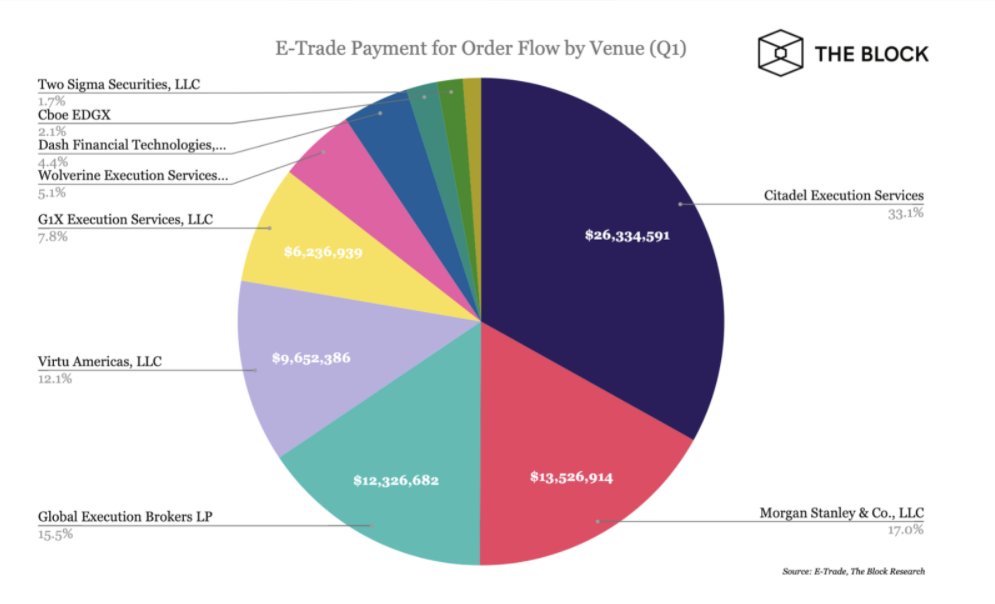

Meanwhile, E*Trade brought in $79.5 million from PFOF during the first quarter.

Interestingly, Morgan Stanley accounted for 17% of its payments. At the beginning of the year, MS agreed to purchase E*Trade in a $13bn deal

Interestingly, Morgan Stanley accounted for 17% of its payments. At the beginning of the year, MS agreed to purchase E*Trade in a $13bn deal

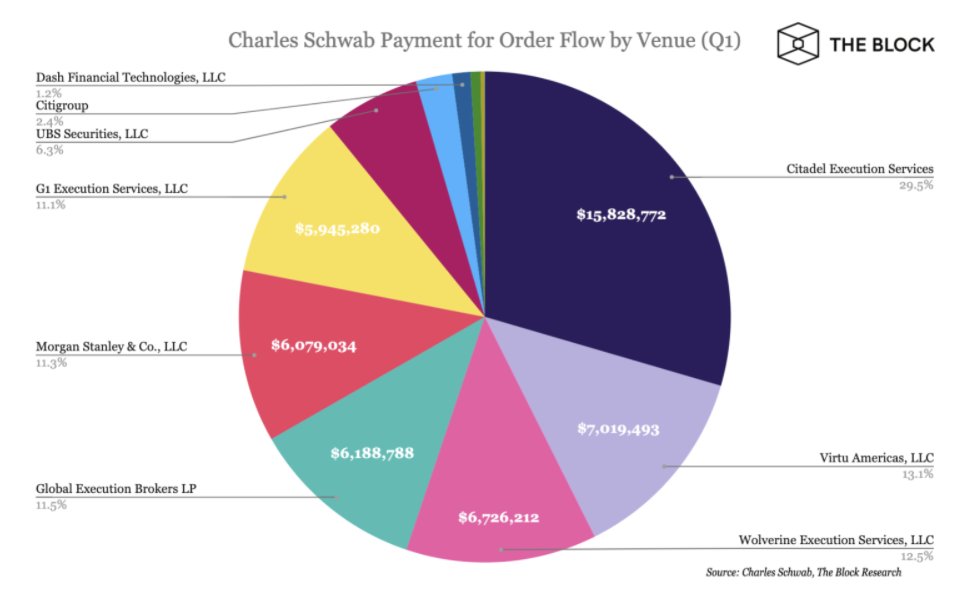

Charles Schwab — which has its own deal to acquire TDAmeritrade in the works — raked in $53 million from PFOF in Q1.

Not just Robinhood: These three brokers combined made more than $300 million from big trading firms in Q1 https://www.theblockcrypto.com/post/68875/not-just-robinhood-brokers-combined-big-traders">https://www.theblockcrypto.com/post/6887...

Read on Twitter

Read on Twitter