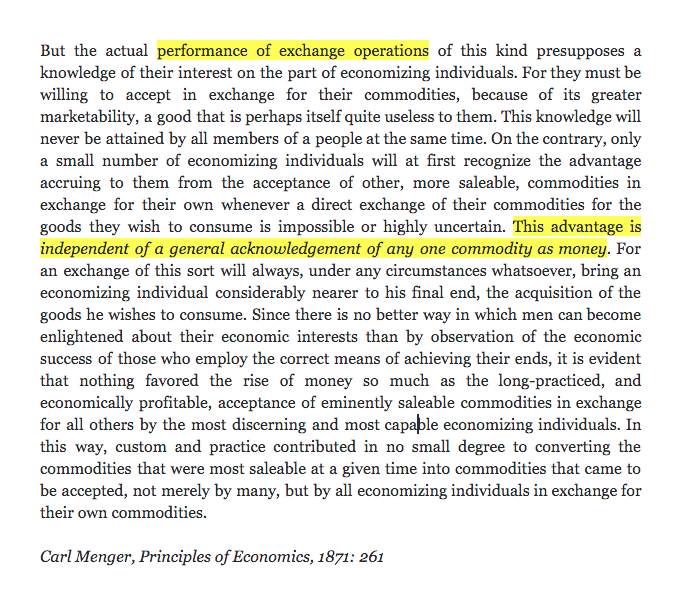

1/ It is very common to hear that "network effects" are crucial stopping other assets from replacing current money. But Menger already explained in 1871 that causality mainly goes in the opposite direction. The most saleable assets sooner or later become money in the free market.

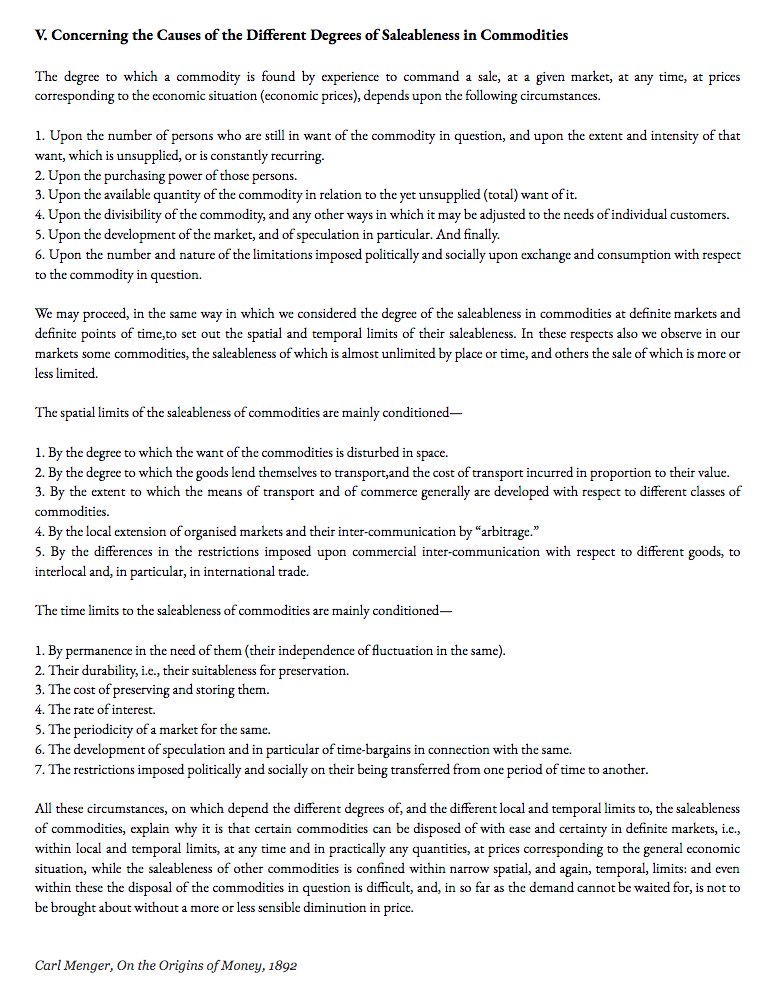

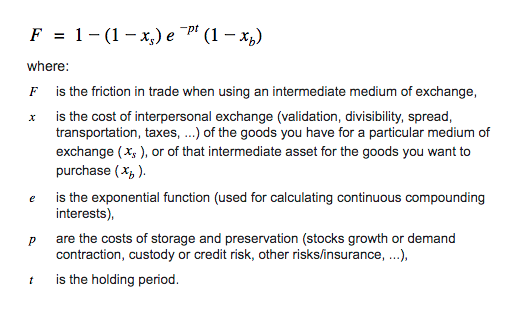

2/ He divided the limits of saleableness in spatial and time limits. The lack of general demand/acceptance may create some spatial friction, limiting saleableness. But this will always be capped by the cost of using money to make an additional intermediate exchange.

3/ Using *two intermediate MoE instead of one* will be economically rational whenever the cost of exchange between them (negligible when not censored) is lower than the cost of holding money (t>0) with relatively poor SoV capabilities.

Saleableness creates network effects!

Saleableness creates network effects!

4/ The more expensive holding money becomes relative to bitcoin, due to the temporal erosion of its value, the more people will demand/accept bitcoin, even for shorter holding periods. And the weaker becomes the advantage provided by local currency network effects.

Read on Twitter

Read on Twitter