Can we talk about the price of risk? Does risk even mean anything, anymore? Perhaps the lack of risk, is the risk itself. Complacency used to be what was the "lack of fear" but I don& #39;t think it& #39;s that anymore, is it?

We know things can fall but we also know CBs won& #39;t let it.

We know things can fall but we also know CBs won& #39;t let it.

So how do you allocate capital based on risk now, when a pervasive thought seems to be "just buy the & #39;risky& #39; stuff because the market won& #39;t be allowed to fail.

We somehow went from "too big to fail" to "too shitty to fail".

We somehow went from "too big to fail" to "too shitty to fail".

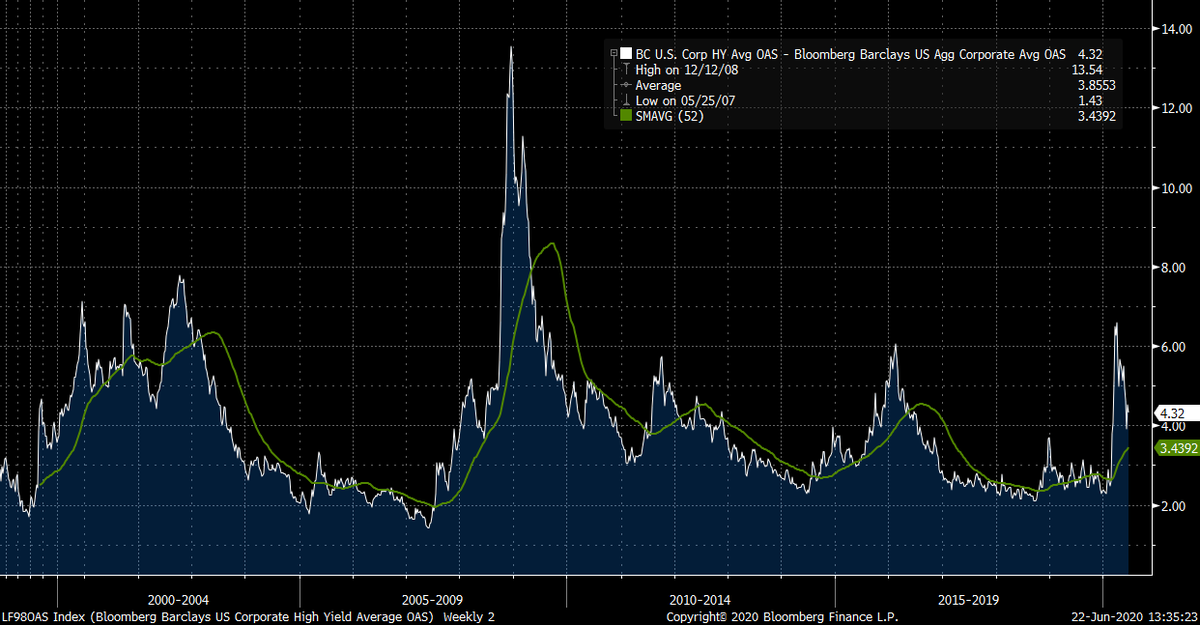

Despite being the fastest selloff in history and despite smashing into a recession in a matter of months, HY spreads got to 50% of the 2008 peak.

On a normalized basis IG actually performed WORSE on spread.

Look at the spread between IG and HY. We didn& #39;t even get to halfway.

On a normalized basis IG actually performed WORSE on spread.

Look at the spread between IG and HY. We didn& #39;t even get to halfway.

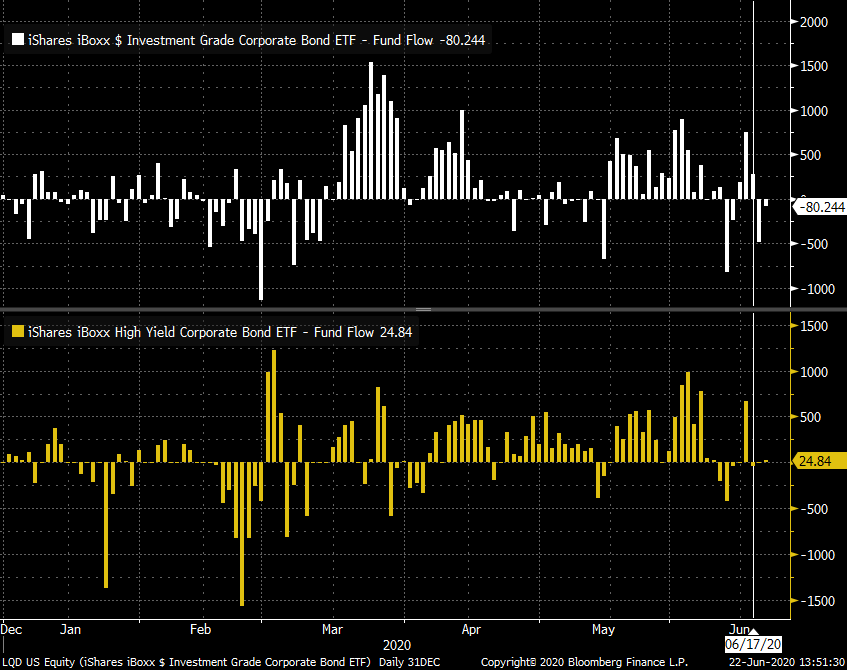

So we& #39;re buying risk because it won& #39;t be allowed to go down. "We& #39;re buying because the Fed is buying."

So in other words, has the Fed absorbed all the fundamental risk of the market? Is the risk no longer a fundamental risk but a regulatory and policy risk, wholeheartedly?

So in other words, has the Fed absorbed all the fundamental risk of the market? Is the risk no longer a fundamental risk but a regulatory and policy risk, wholeheartedly?

What happens when the market follows the Fed and suddenly the Fed stops buying? Quantitative Tightening wasn& #39;t enough of an example?

*Powell Says Fed Will Move Away From ETF Buys Over Time

*Powell Says Fed Will Move Away From ETF Buys Over Time

These are honest questions that I face from a money management perspective and I welcome any thoughtful response to this question of allocating capital.

Is there a point in a mandate? Are risk-adjusted returns pointless? Is there such a thing as fair value?

Is there a point in a mandate? Are risk-adjusted returns pointless? Is there such a thing as fair value?

The counterargument could be this: by encouraging the flow of assets toward the lower quality sectors, the concomitant underperformance in benchmarks will help to reset the base higher as economy grows.

Past a certain level, cost of cap is too high and market reprices risk.

Past a certain level, cost of cap is too high and market reprices risk.

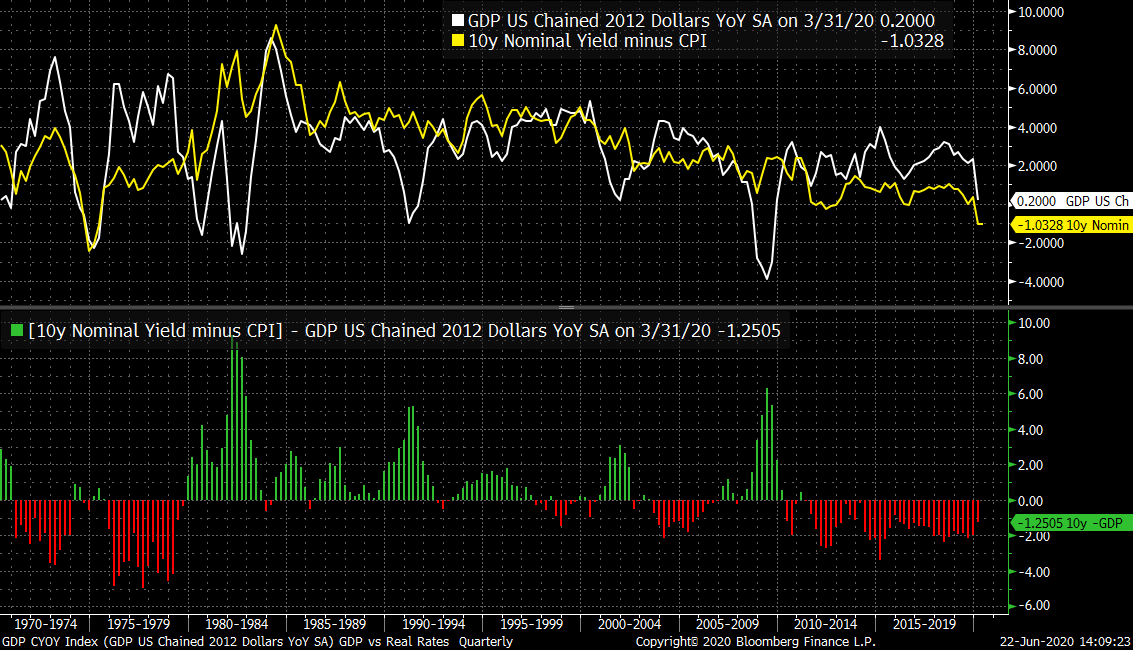

Can we reasonably expect an uptick in growth? And if we do, should we expect a meaningful increase in consumer price inflation? Real rates have been skeptical of significant growth for the last 30 years.

Read on Twitter

Read on Twitter