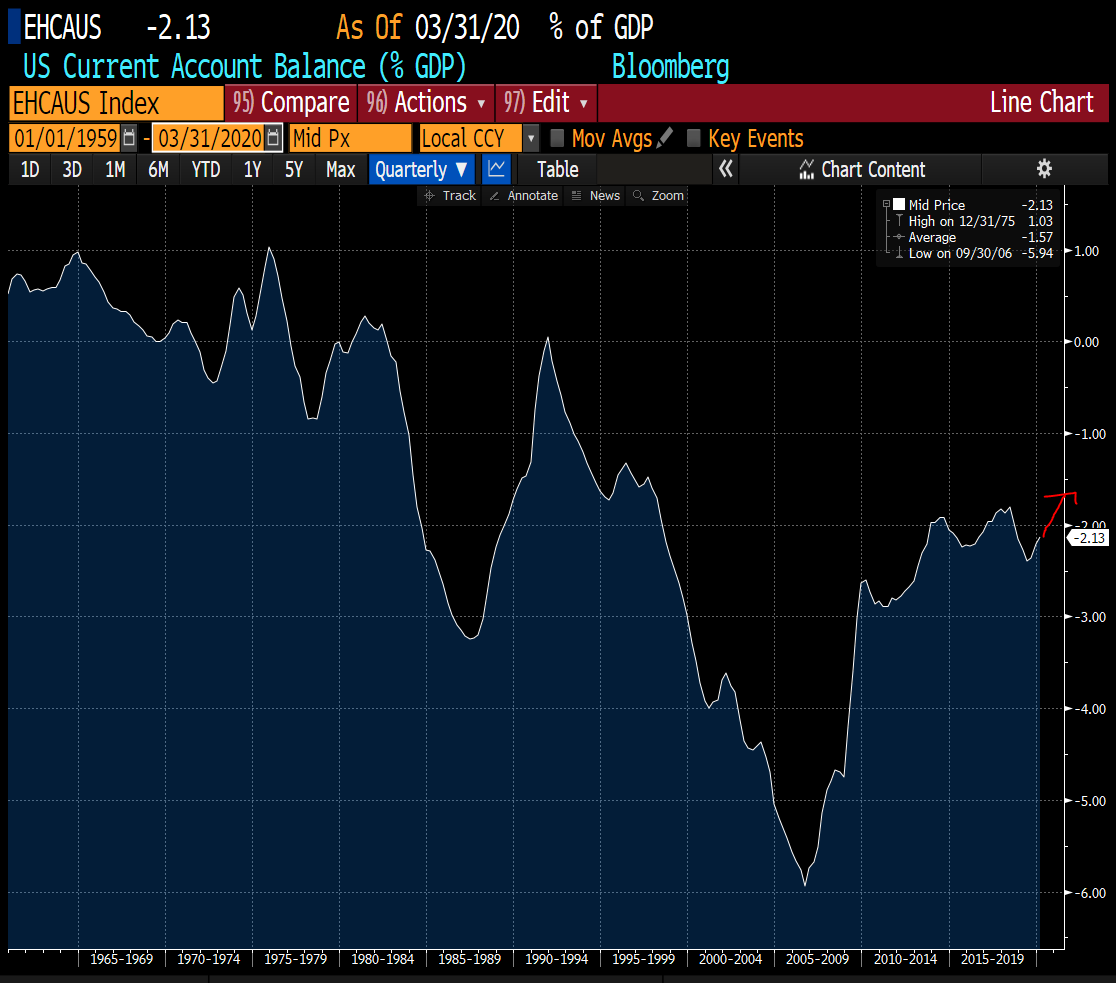

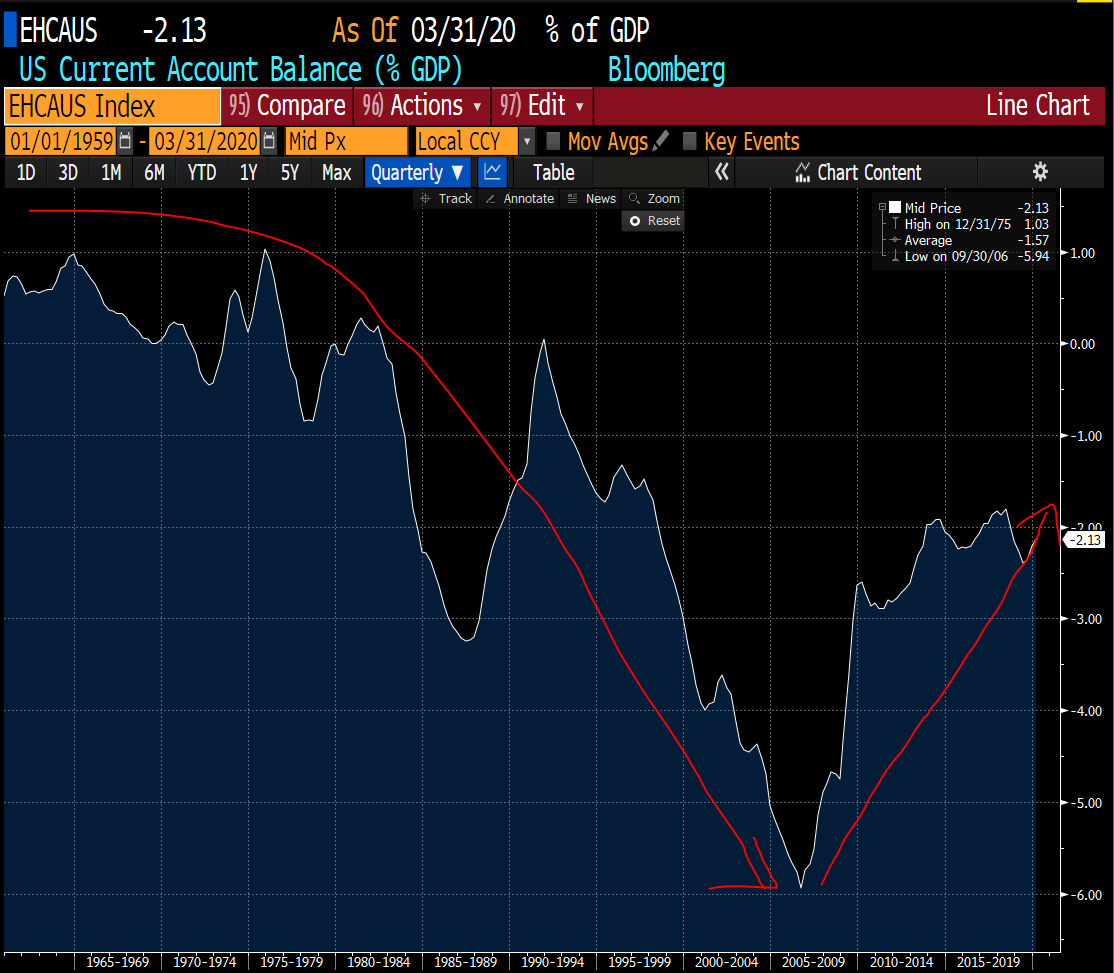

Something to pay attention to: US current account deficits are narrowing. Right before the Great Financial Crisis (GFC), US spending was way above its means w/ it peaking at -6% of GDP in 2006. A cheaper USD helped rebalance it.

Recent collapse of demand helps w/ income deficit

Recent collapse of demand helps w/ income deficit

Current account = net income flows from abroad & the fact that net income flows are -1.9% from peak of -6% means that we& #39;re getting a rebalancing in the US but bad for traders that want to get the US to import global deflationary impulses

Imports https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Tabelle mit Abwärtstrend" aria-label="Emoji: Tabelle mit Abwärtstrend">& repatriation

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📉" title="Tabelle mit Abwärtstrend" aria-label="Emoji: Tabelle mit Abwärtstrend">& repatriation https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> = less deficit

https://abs.twimg.com/emoji/v2/... draggable="false" alt="📈" title="Tabelle mit Aufwärtstrend" aria-label="Emoji: Tabelle mit Aufwärtstrend"> = less deficit

Imports

For those new to macro economics (hello my new Millennial followers  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👋🏻" title="Waving hand (heller Hautton)" aria-label="Emoji: Waving hand (heller Hautton)">), here is the math for US income flows. We have a deficit of trade (import more than we export) but we have a surplus of capital inflows into the US.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👋🏻" title="Waving hand (heller Hautton)" aria-label="Emoji: Waving hand (heller Hautton)">), here is the math for US income flows. We have a deficit of trade (import more than we export) but we have a surplus of capital inflows into the US.

Math & thread here https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)"> https://twitter.com/Trinhnomics/status/1136186536498569224?s=20">https://twitter.com/Trinhnomi...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)"> https://twitter.com/Trinhnomics/status/1136186536498569224?s=20">https://twitter.com/Trinhnomi...

Math & thread here

US current account (in plain term it means what Americans as a whole receive in USD from net trade income (merchandise & services) & net income (individuals + firms sending $).

Deficit (income shortage in terms of national spending) peaked in 2006 & narrowing in Q1 2020 to -1.9%

Deficit (income shortage in terms of national spending) peaked in 2006 & narrowing in Q1 2020 to -1.9%

The US had net income surpluses in the 1960s, 1970s and started to go into negative in the 1980s.

Btw, the oldest Millennials are born in the 1980s when the structural shift occurred.

Btw, the oldest Millennials are born in the 1980s when the structural shift occurred.

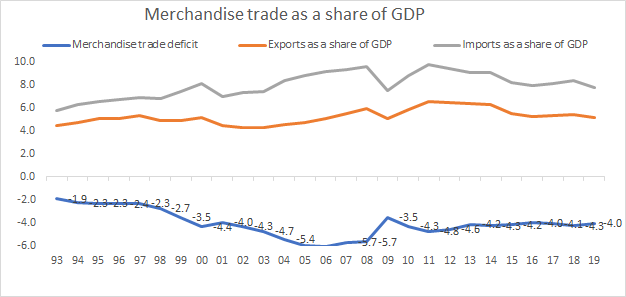

US merchandise trade as a share of national GDP. Graphed exports & imports and the trade balance. Note that this is only physical goods income & not services

In the 1999s, deficit was about -2% of GDP but that blew up to -6% of GDP by the mid 2000s. Improving but still high https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">

In the 1999s, deficit was about -2% of GDP but that blew up to -6% of GDP by the mid 2000s. Improving but still high

Read on Twitter

Read on Twitter

" title="US merchandise trade as a share of national GDP. Graphed exports & imports and the trade balance. Note that this is only physical goods income & not servicesIn the 1999s, deficit was about -2% of GDP but that blew up to -6% of GDP by the mid 2000s. Improving but still highhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">" class="img-responsive" style="max-width:100%;"/>

" title="US merchandise trade as a share of national GDP. Graphed exports & imports and the trade balance. Note that this is only physical goods income & not servicesIn the 1999s, deficit was about -2% of GDP but that blew up to -6% of GDP by the mid 2000s. Improving but still highhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">" class="img-responsive" style="max-width:100%;"/>