So, because you haven’t endured a long thread from me for a while, I thought I’d provide some thoughts on a number of the recommendations and the Government’s response to the Fair Deal Panel.

#ableg #abpoli

1/

#ableg #abpoli

1/

First, I would like to exhort all government-appointed panels to set their word processors to Canadian English and to proofread their documents. TBF, there weren’t many spelling errors, but the goal is zero errors. Perfectionism drives you to ensuring your points are clear.

2/

2/

Second, is please cite law correctly. The panel got this inexcusably wrong.

The British North America Act, 1867 is not *also* known as the Constitution Act, 1867. Rather, the Constitution Act, 1867 *used* to be known as the BNA Act. It hasn’t been the BNA Act since 1982.

3/

The British North America Act, 1867 is not *also* known as the Constitution Act, 1867. Rather, the Constitution Act, 1867 *used* to be known as the BNA Act. It hasn’t been the BNA Act since 1982.

3/

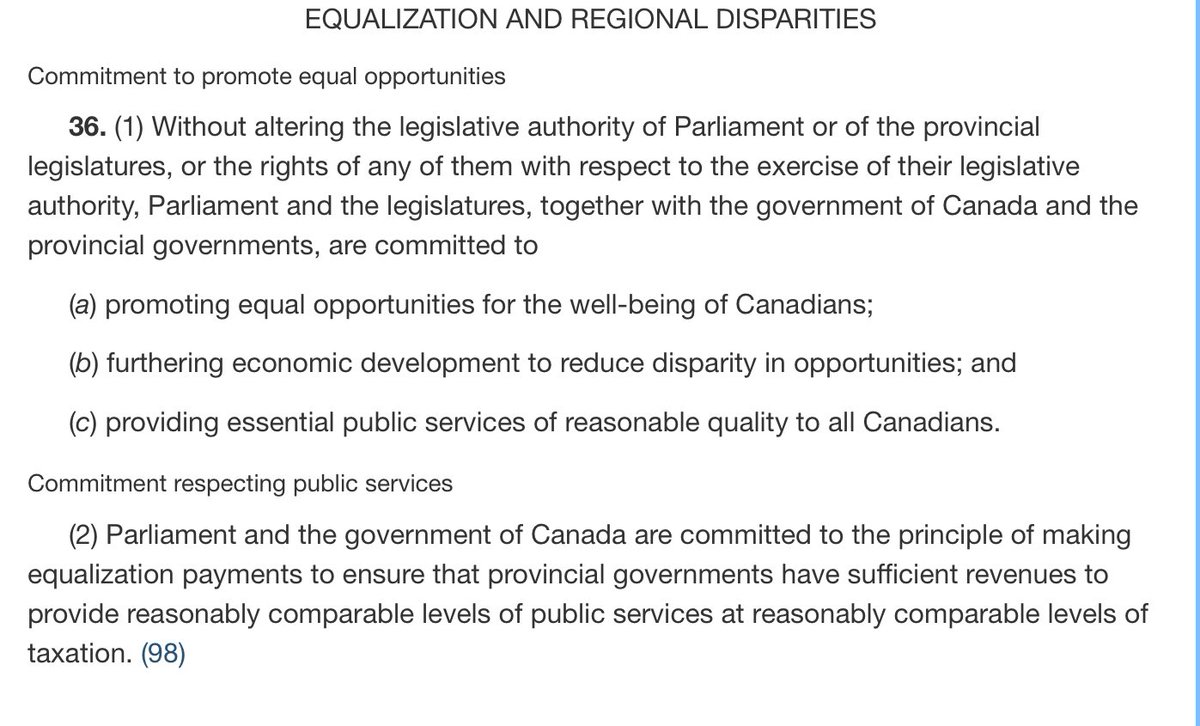

On Recommendation 1, Equalization, the panel correctly points out why a referendum would do nothing, which makes one wonder why one is recommended.

As noted by the panel, s. 36 of the Constitution Act, 1982, reads as follows:

4/

As noted by the panel, s. 36 of the Constitution Act, 1982, reads as follows:

4/

The panel notes that equalization predates s. 36. Equalization started in earnest in 1957. Section 36 was enacted in 1982. The panel also notes that Parliament alone establishes the formula, although it sometimes consults with provinces before doing so.

5/

5/

The panel also notes:

“in the event of clear approval of the question [to repeal s. 36] in a referendum, this would not guarantee the removal of equalization from the Constitution, or any reworking of the equalization formula.”

6/

“in the event of clear approval of the question [to repeal s. 36] in a referendum, this would not guarantee the removal of equalization from the Constitution, or any reworking of the equalization formula.”

6/

Instead, the panel argues that this would “morally obligate the federal government and the provinces to come to the table”. Not legally obligate, but morally. In other words, the panel acknowledges that, at most, a referendum *might* create political pressure.

7/

7/

In its response, the Government doesn’t commit to the panel’s proposed question, saying further analysis is required. But the reality is that equalization comes from federal government revenues and it is fundamentally up to the federal government how it spends its money.

8/

8/

On Recommendation 3, Reducing Trade Barriers, the panel points to s. 121 of the Constitution Act, 1867, and implies that the federal government hasn’t been enforcing that provision.

This is a fundamental misstatement of constitutional law.

9/

This is a fundamental misstatement of constitutional law.

9/

First, challenging a trade barrier for violating s. 121 isn’t restricted to the federal government. Any affected party can challenge a trade barrier for being contrary to the constitution.

Second, s. 121 does not, in fact, guarantee barrier-free trade in Canada.

10/

Second, s. 121 does not, in fact, guarantee barrier-free trade in Canada.

10/

Remember Gerard Comeau? He travelled from NB to QC and bought 14 cases of beer, 2 bottles of whiskey and a bottle of liqueur. But that exceeded what he could bring back to NB under provincial law. He challenged that law, saying it violated s. 121.

The SCC upheld the law.

11/

The SCC upheld the law.

11/

The way to bring down trade barriers in Canada is negotiation. There is a Canada Free Trade Agreement that works to do just that. It isn’t perfect, but it, not the constitution, is the only option that exists.

12/

12/

In Recommendation 6, Fairer Representation, the panel bemoans Alberta’s underrepresentation in Parliament. But it misstates the reason for this problem.

New seats are added to the House of Commons regularly based on the census. Alberta has gained from this over the years.

13/

New seats are added to the House of Commons regularly based on the census. Alberta has gained from this over the years.

13/

The problem is that, even if following a census, each riding had exactly the same number of voters, that balance is only good as of the date of the census. Alberta’s population has grown faster than the national average, so its ridings end up having more voters in them.

14/

14/

As long as there is a representation by population basis, the provinces that grow faster than the national average will see their ridings grow faster than ridings of other provinces. Adding sears brings provinces temporarily back into alignment, and then the cycle repeats.

15/

15/

As for Senate reform, the two ideas championed by the panel: a triple-E Senate or Senators selected by voters, require constitutional amendments to happen. We have yet to figure out a way to negotiate our way through a post-Charlottetown Accord world.

16/

16/

Recommendation 8: residency of Federal Courts Justices.

The Federal Court, the Federal Court of Appeal and the Tax Court of Canada are all based in Ottawa. They are itinerant courts, though, which means they travel to different parts of the country to hold hearings.

17/

The Federal Court, the Federal Court of Appeal and the Tax Court of Canada are all based in Ottawa. They are itinerant courts, though, which means they travel to different parts of the country to hold hearings.

17/

The panel, however, is of the view that these courts, because they are based in Ottawa and the Justices spend most of their time in Ottawa, do not attract sufficient competent people from Western Canada, either as Justices or as law clerks.

18/

18/

The panel proposes the US model be copied, where there are regionally based federal courts. Justices, etc., would then be permanently based in those regions instead of based in Ottawa.

This is a bonkers idea.

19/

This is a bonkers idea.

19/

The US is a much larger country (by population) and the jurisdiction of the federal courts there is very different from the more limited role of the Federal Court of Canada. There just isn’t that much work to be done in most of the regions.

20/

20/

Also, this would mean parties could largely pick which Justice will hear their case simply by picking which region they want to file. Don’t like Justice X? That’s okay, he’s based in Edmonton, file in Calgary instead.

21/

21/

There are currently 36 full-time Federal Court Justices. Only with an itinerant court can the ability of parties trying to game which Justice they get be avoided.

22/

22/

Law clerks are generally articling students, often representing some of the best-performing students in law schools across Canada. I don’t have statistics, but Western Canadian law students do apply for and get hired to be law clerks.

23/

23/

Want to encourage more Western Canadians to apply to be law clerks? Get law societies to improve their rules to facilitate this. In Alberta, a law clerk has to spend 15 months articling instead of 12 months for students in firms. The law clerk program is 12 months.

24/

24/

Why should Alberta force students to find a second articling job (very stressful in bad times) when they can instead just be called to the Ontario bar on the strength of their time as a law clerk? Why not make it easier for law clerks to work in Alberta post clerkship?

25/

25/

In Recommendation 10, Advance Market-based approaches to environmental protection, I injured my eyes rolling them.

The panel noted a “perceived unfairness” with Quebec entering into a carbon offset agreement with California. QC developed its own carbon price program.

26/

The panel noted a “perceived unfairness” with Quebec entering into a carbon offset agreement with California. QC developed its own carbon price program.

26/

QC’s program is a cap-and-trade that was designed to be compatible with California’s, so that the jurisdictions could trade carbon credits. This market-based measure is a price on carbon that the federal government determined is as stringent as its backstop carbon tax.

27/

27/

Alberta could have its own carbon price strategy, and it it were as stringent as the national one, it, too, wouldn’t be subject to the federal carbon levy.

In fact, Alberta *did* have a market-based carbon price. But the current government made its first Bill to repeal it.

28/

In fact, Alberta *did* have a market-based carbon price. But the current government made its first Bill to repeal it.

28/

In Recommendation 11, Challenge federal overreach, I fully support the principle that federal laws enacted outside of Parliament’s jurisdiction should be struck down.

It is bold, however, to just assert that the Impact Assessment Act and carbon levy are unconstitutional.

29/

It is bold, however, to just assert that the Impact Assessment Act and carbon levy are unconstitutional.

29/

In Recommendation 12, prohibit federal action in areas of provincial or joint jurisdiction without consent, I have to laugh.

The panel recognizes that Parliament wouldn’t support a constitutional amendment. Why, then, would it support an agreement?

30/

The panel recognizes that Parliament wouldn’t support a constitutional amendment. Why, then, would it support an agreement?

30/

Note that there either is federal jurisdiction or there isn’t. If there isn’t federal jurisdiction, the federal government can’t act constitutionally. No agreement is needed to change this.

31/

31/

Cooperative federalism, especially in areas of joint jurisdiction, is a great idea. But it is bonkers to imagine Parliament would accept a provincial veto. There will never be a federal carbon levy only if AB agrees. Instead, Alberta can have the choice of federal or AB tax.

32/

32/

On Recommendation 13, the Alberta Pension Plan, I have commented elsewhere. There is no constitutional bar to setting up the plan, and it can be done without federal consent.

The merits may be somewhat questionable.

33/

The merits may be somewhat questionable.

33/

On Recommendation 14, the Alberta Police Service, it is curious why the panel, after citing that Alberta pays $262.4 million for RCMP service and the federal government paying $112.4 million, feels that a provincial force would save provincial tax dollars.

34/

34/

Is the $112.4 million in federal dollars going to suddenly go towards a provincial police force? Or is the RCMP so bloated that a provincial force could cost 1/3 less? There may be another reason, but the panel doesn’t give it.

35/

35/

The panel complains that many RCMP detachments/areas are under serviced. It does not, however, make it clear if the problem is that the RCMP cannot find the constables to staff those positions or if this is because the budget isn’t high enough. Maybe AB has to spend more.

36/

36/

Recommendation 15, a Chief Firearms Officer, overstates any benefit. A CFO follows and enforces federal law. That person exercises limited discretion and not necessarily as the province would like.

Mind you, appointing a CFO isn’t a large cost—maybe no more than 2 Matts https://abs.twimg.com/emoji/v2/... draggable="false" alt="™️" title="Registered-Trade-Mark-Symbol" aria-label="Emoji: Registered-Trade-Mark-Symbol">.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="™️" title="Registered-Trade-Mark-Symbol" aria-label="Emoji: Registered-Trade-Mark-Symbol">.

37/

Mind you, appointing a CFO isn’t a large cost—maybe no more than 2 Matts

37/

Recommendation 16, participating in international agreements, is to demand what largely exists.

The federal government can enter into any international agreements. But it can’t always implement the entire agreement.

38/

The federal government can enter into any international agreements. But it can’t always implement the entire agreement.

38/

Agreements can only be implemented by enacting domestic law. But if the law falls into provincial jurisdiction, then only the provinces can implement that portion of the agreement.

Hence, the federal government involves provinces in trade negotiations.

39/

Hence, the federal government involves provinces in trade negotiations.

39/

The last thing the federal government wants to do is make a binding commitment to an international partner only to have the provinces say they won’t implement it. It’s embarrassing at best and can be very costly if Canada ends up being sued.

40/

40/

To prevent this disaster, the federal government has discussions with provincial counterparts to get their buy-in on matters within provincial jurisdiction *before* the federal government commits Canada to anything. Alberta’s interests, therefore, are already at the table.

41/

41/

In Recommendation 18, Opt out with compensation, the panel imagines that Alberta can just say no and still get a full share of cash from the federal government.

Anyone who ever paid or received an allowance knows this doesn’t happen.

42/

Anyone who ever paid or received an allowance knows this doesn’t happen.

42/

If I tell my kids that they get $10 a week if they keep their bedrooms clean, and one kid “opts out” of the cleaning, that kid cannot still expect the $10 will be paid.

It just doesn’t work that way in families or in confederation.

43/

It just doesn’t work that way in families or in confederation.

43/

Now, the kids could negotiate with me. They could haggle over what standard is acceptable for the room being clean. Or they could insist on $15 instead of $10. Or maybe they can propose a different goal altogether. Compromise is possible.

44/

44/

But the federal government, when handing over its money to provinces, can and will insist that the money has to go towards specific goals.

45/

45/

Read on Twitter

Read on Twitter