As COMP crosses the $3b mark and Compound reaches over $500m in Total Value Locked on the platform, if you are like me you may be wondering how sustainable this is and wondering what are the risks?

1/

1/

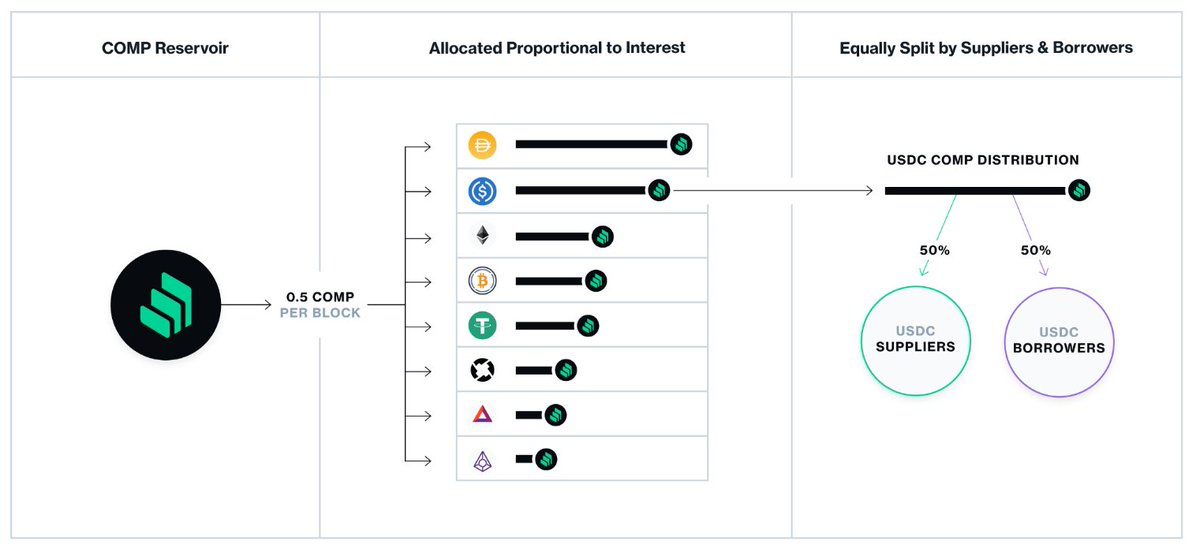

For those who don& #39;t know what COMP liquidity mining is, @compoundfinance recently announced the launch of their governance token, which they are distributing to borrowers and lender on the platform daily. You can find the details here https://medium.com/compound-finance/expanding-compound-governance-ce13fcd4fe36

2/">https://medium.com/compound-...

2/">https://medium.com/compound-...

These tokens will give the token holders governance rights to changes to the Compound platform and currently gives holders no financial claim to any of the revenues generated by Compound.

3/

3/

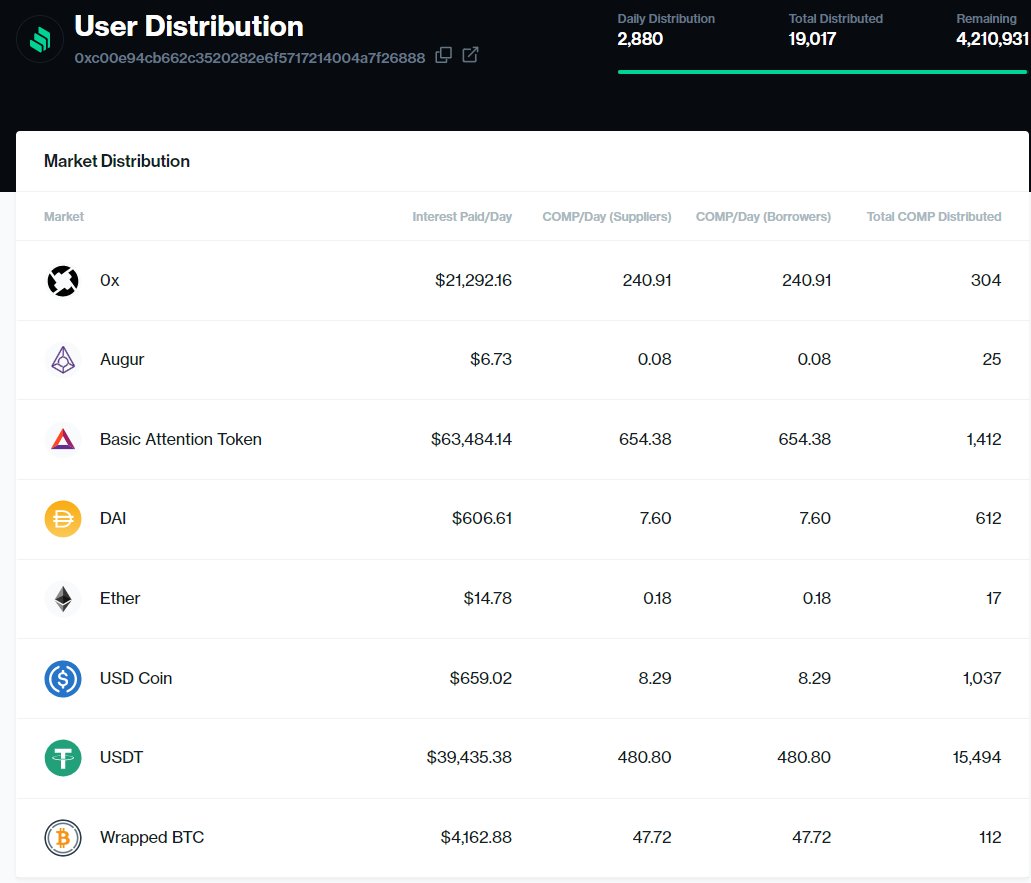

2880 COMP tokens are distributed daily split 50/50 between borrowers and lenders on the platform. These COMP distributions act as a subsidy to users of the platform with over $955,728 worth of COMP subsidies being given away daily at current prices.

/4

/4

As liquidity miners are compensated for both lending and borrowing, the optimal strategy is to lend the highest interest rate asset, borrow as much as you can against your cAsset tokens (a claim on-lent assets) and then add the remaining assets back into the lending pool.

/5

/5

While these users are incurring interest for borrowing, at current COMP prices the COMP subsidy more than compensates them for this risk, with users earning annualised returns of over 117.67%.

/6

/6

While these returns are certainly impressive, what& #39;s both interesting and concerning is that many users quickly worked out that by borrowing non-stablecoin assets, they could fairly easily move the interest rate higher, earning a higher portion of the COMP rewards.

/7

/7

This is causing the price of some of these assets to rise as people buy these assets to supply and then borrow against them, which given that price is rising suggests that many are not hedging out this exposure, which works great as long as the price keeps rising...

/8

/8

And let& #39;s not forget that these yields are predicated on the market cap of COMP being over $3.5 billion with only 25% of the supply circulating, no borrow market to short the spot COMP market and 2880 new COMP hitting the market every day for the next four years.

/9

/9

So while it is difficult to say what will happen to the price of COMP over the next few months, the spread between the spot price of COMP and @FTX_Official& #39;s COMP September Futures sure seems to indicate the market thinks it will be much lower.

/10

/10

So while all of these options contain risk, the safest way to play this may be to add liquidity to the @CurveFinance pool and provide liquidity for those liquidity mining

/11

/11

And lastly for the brave, if a COMP borrow market opens up, there may be an opportunity to short the COMP spot market / long the FTX Sep Futures or short the COMP spot market / long the FTX COMP Perp which is currently paying an annualised rate of around 1376.19% APY

/12

/12

So then the only question that remains is who will be the first to open a COMP borrow market? @FTX_Official @bitfinex @deversifi @binance @AaveAave @compoundfinance

cc those who may have a better understanding of these market dynamics than I do @AriDavidPaul @cburniske @zhusu @CryptoHayes @ceterispar1bus @kaiynne

Read on Twitter

Read on Twitter