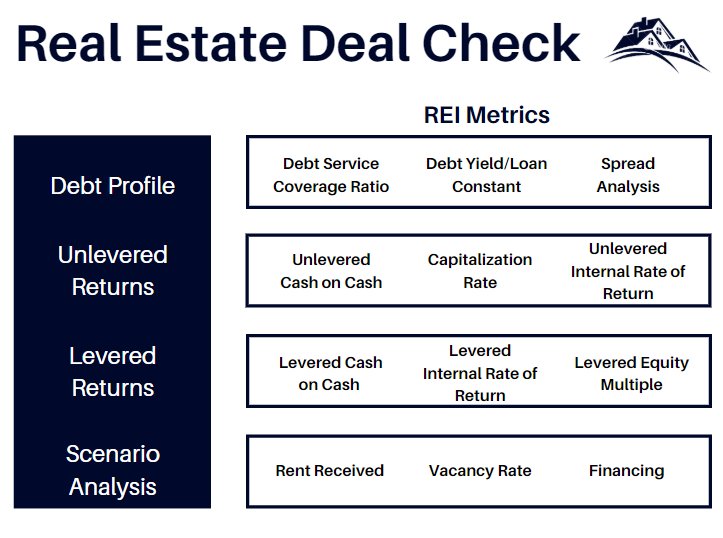

Real estate deal check:

A short threads on the steps I take to evaluate a deal.

This thread will specifically focus on risk and returns.

A short threads on the steps I take to evaluate a deal.

This thread will specifically focus on risk and returns.

The steps start after I have projected:

1) Rental income

2) Vacancy

3) Operating expenses

4) Debt Service

This thread will focus on the debt/return profile and how I evaluate them.

1) Rental income

2) Vacancy

3) Operating expenses

4) Debt Service

This thread will focus on the debt/return profile and how I evaluate them.

1) Debt profile:

This is where I spend a lot of my time - it& #39;s my risk management process.

I want to evaluate how leverage plays a role in my investment.

How can I maximize my returns with leverage but also protect downside risk?

Am I overleveraged? Can I withstand a hit?

This is where I spend a lot of my time - it& #39;s my risk management process.

I want to evaluate how leverage plays a role in my investment.

How can I maximize my returns with leverage but also protect downside risk?

Am I overleveraged? Can I withstand a hit?

2) Unlevered Returns:

This return profile takes into consideration how much you would yield on your investment if you owned the property outright (paid cash for the property with no debt financing).

This return profile takes into consideration how much you would yield on your investment if you owned the property outright (paid cash for the property with no debt financing).

I want to know, if I did not use debt, what return would the property generate?

Essentially, it is a risk management profile; I can evaluate a deal without the magnification of leverage.

This is property specific. Individual financing terms don& #39;t play a role in the decision

Essentially, it is a risk management profile; I can evaluate a deal without the magnification of leverage.

This is property specific. Individual financing terms don& #39;t play a role in the decision

3) Levered Returns:

For levered returns, we evaluate the string of cash flows received after taking into consideration financing.

The difference is you do not own the property outright, instead, you used a form of debt financing to purchase the deal.

For levered returns, we evaluate the string of cash flows received after taking into consideration financing.

The difference is you do not own the property outright, instead, you used a form of debt financing to purchase the deal.

This is where financing comes into play.

My financing terms will be different than yours even on the same property.

For this return profile, my main objective is to gauge how leverage has amplified my return relative to the unlevered return profile.

My financing terms will be different than yours even on the same property.

For this return profile, my main objective is to gauge how leverage has amplified my return relative to the unlevered return profile.

4) Scenario Analysis:

I run my deal through a scenario analysis.

I will check to see how returns will be altered if:

1) There is a change in rental income received (100% vs. 50%)

2) A difference in vacancy rates (4% vs. 8%)

3) How different financing terms can change returns

I run my deal through a scenario analysis.

I will check to see how returns will be altered if:

1) There is a change in rental income received (100% vs. 50%)

2) A difference in vacancy rates (4% vs. 8%)

3) How different financing terms can change returns

Read on Twitter

Read on Twitter