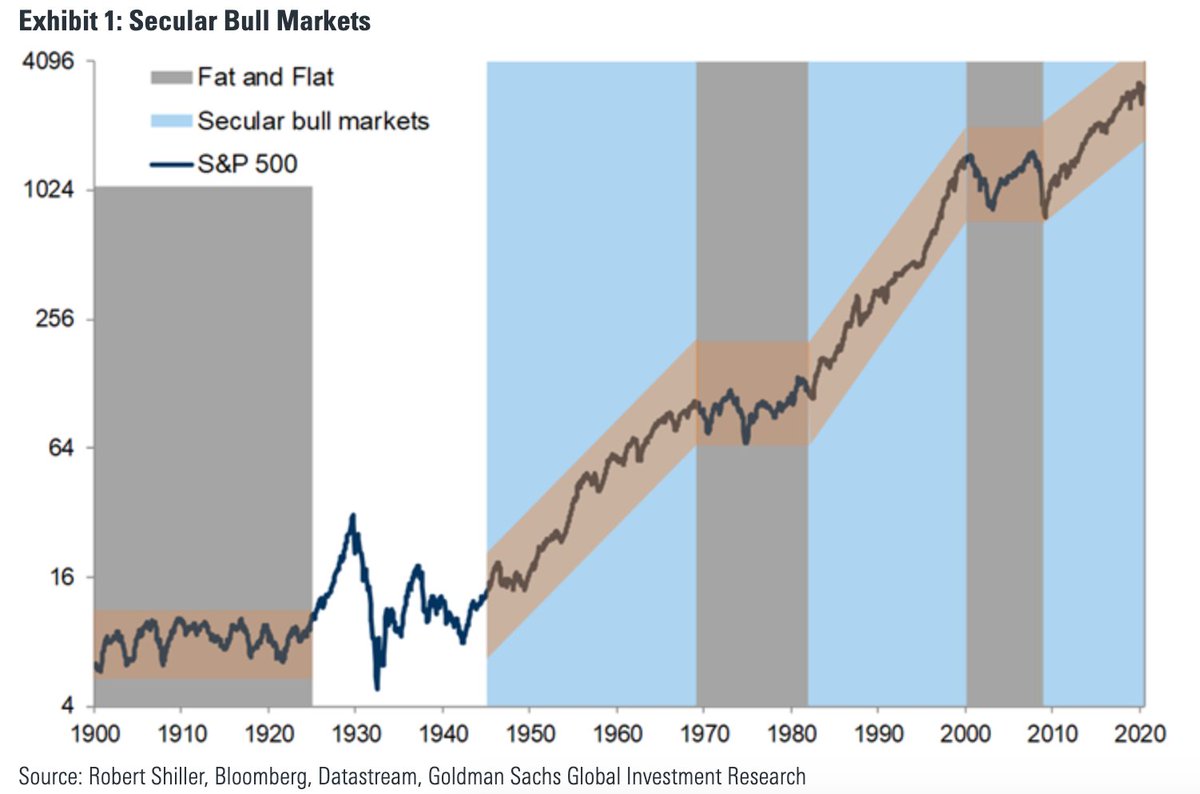

Going to tweet some of the eye-catching charts in the latest note from Goldman Sachs& #39;s chief global equity strategist Peter Oppenheimer, where he argues that the coming era will be "fat and flat".

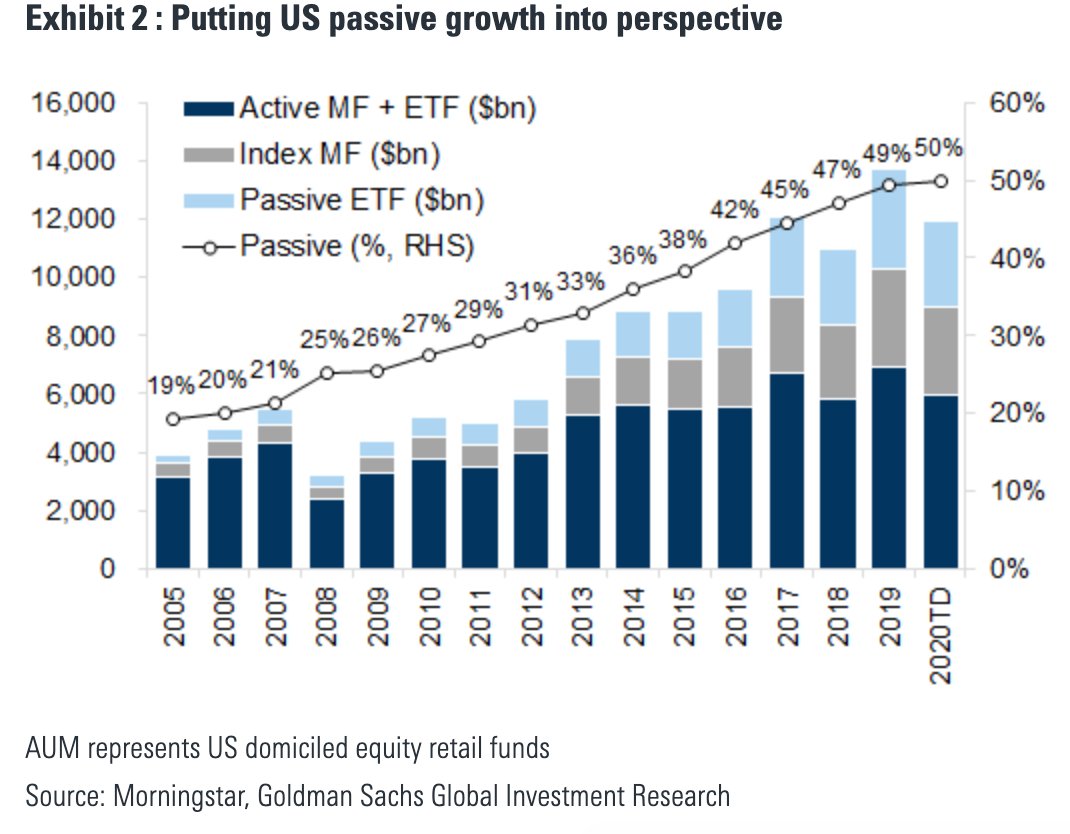

Passive funds have enjoyed enormous tailwinds lately, and now account for over half of all equity AUM in the US.

Falling bond yields have led to valuation expansion (you& #39;re willing to pay more for stocks when rates are low), which has been a huge contributor to equity returns since the GFC.

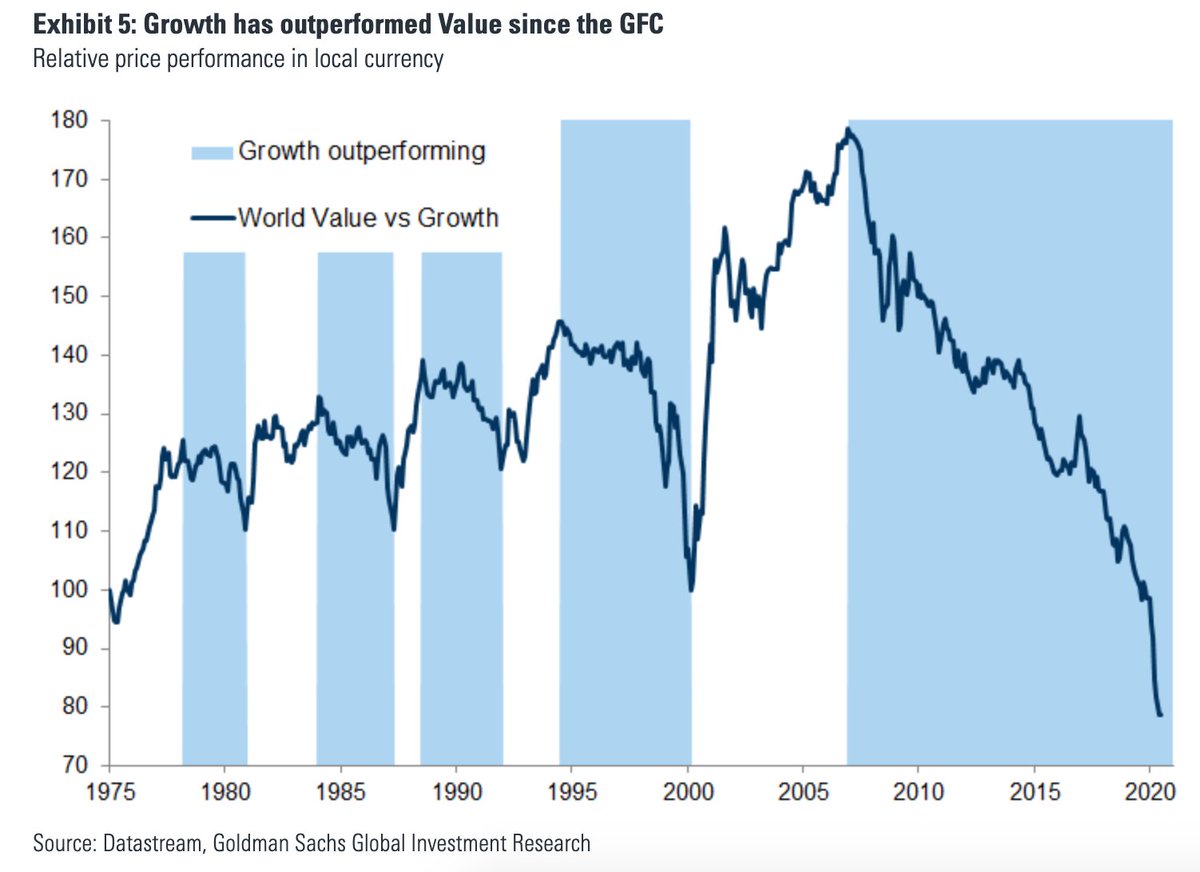

The value-versus-growth performance has been just BRUTAL lately. (i wrote a big piece about it here: https://www.ft.com/content/00c722d6-760f-4871-a927-2c564fe17276)">https://www.ft.com/content/0...

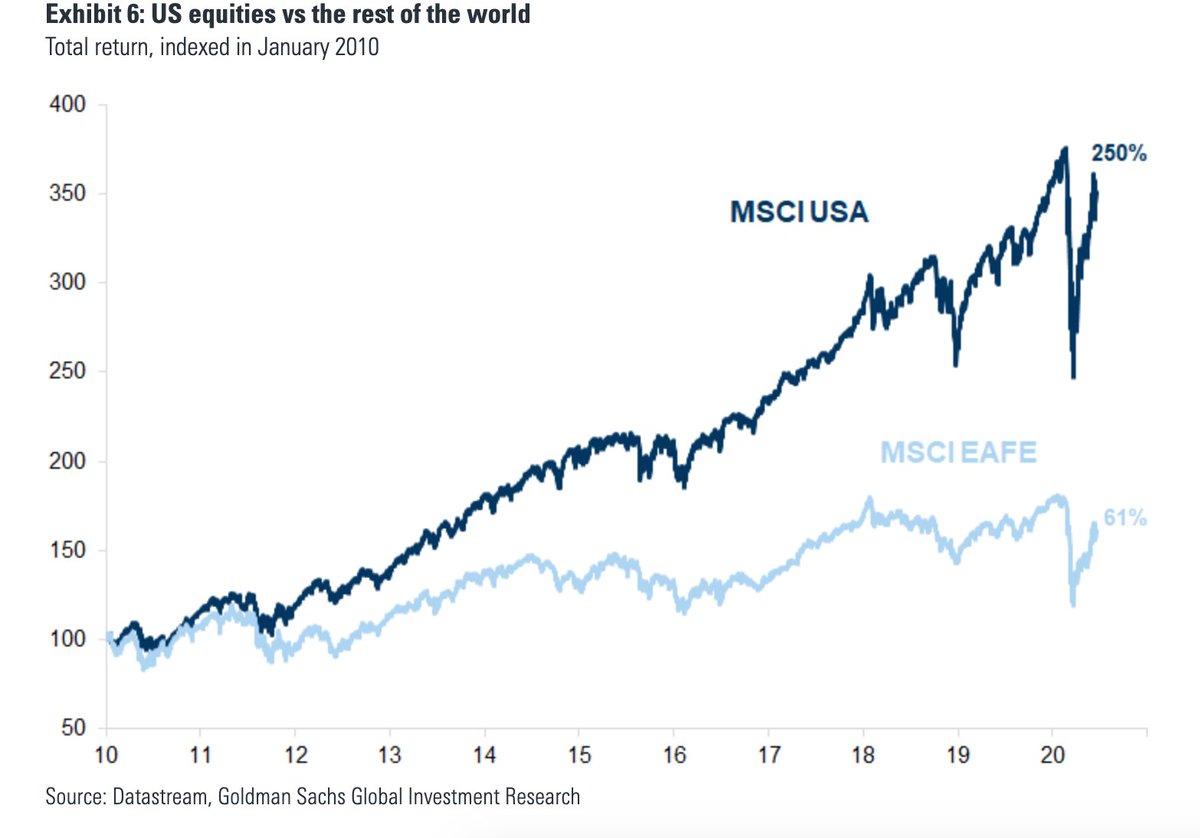

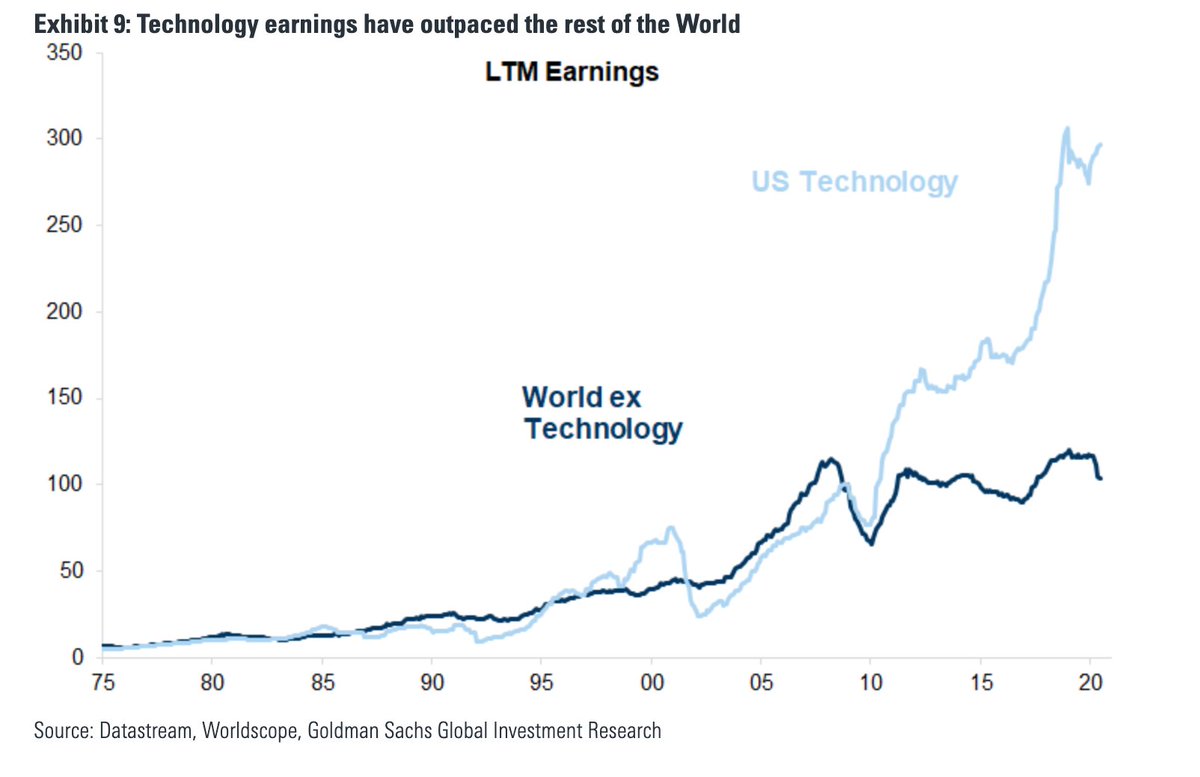

It has also been a particularly sparkling decade for US stocks (you& #39;ll see *why* in the next chart)

This is a KILLER chart, showing how technology companies are churning out money at a pace that every other industry combined cannot match.

Still, while US stock market breadth has been narrowing, if you measure it by top 10 members, the US stock market isnt quite as narrow as Asia& #39;s, and not enormously different from Europe and Japan.

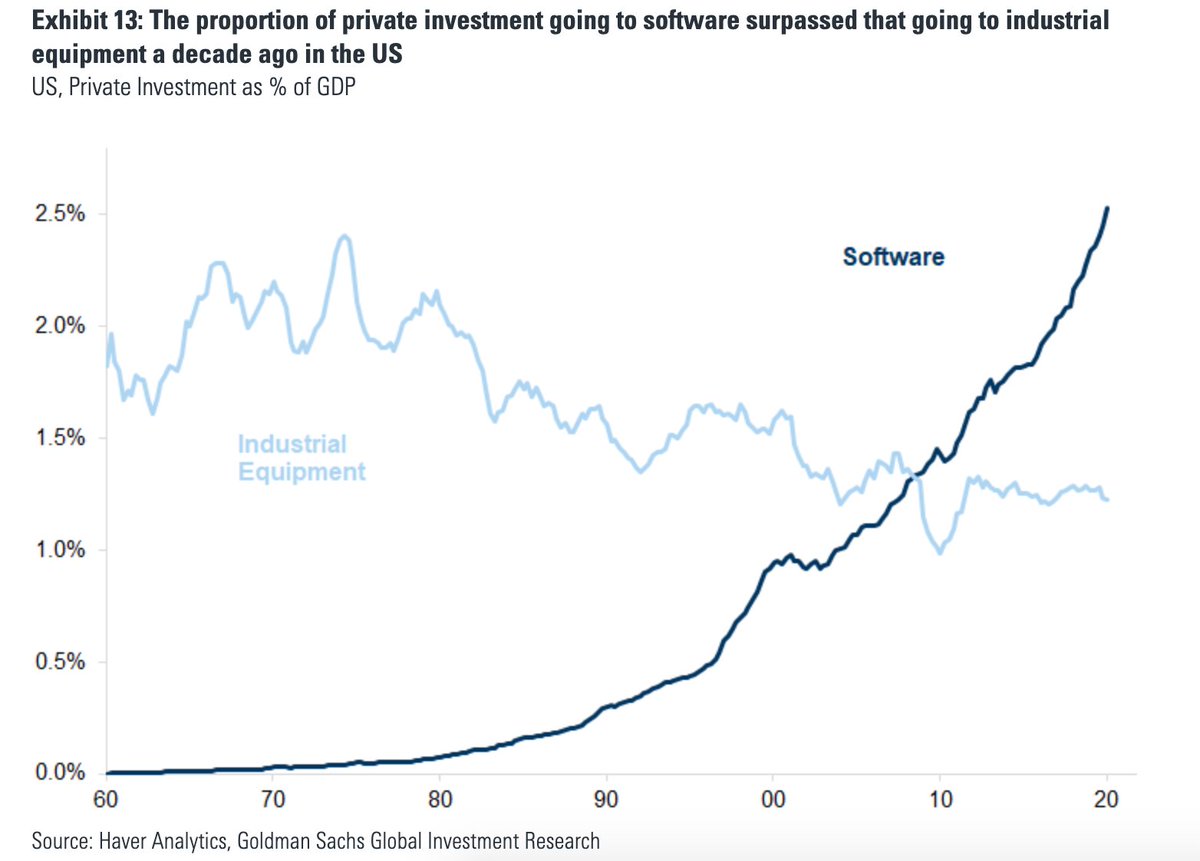

Capex is increasingly in "soft" stuff like software, rather than "hard" stuff like factories and mines.

Read on Twitter

Read on Twitter