Chapter 2 of the Lord& #39;s work: Economic characteristics of intangible assets

In this thread, I& #39;m going to contrast the economic characteristics of intangible vs tangible assets & present a case why businesses build on intangible assets are far superior in terms of value creation

In this thread, I& #39;m going to contrast the economic characteristics of intangible vs tangible assets & present a case why businesses build on intangible assets are far superior in terms of value creation

Where to start: Economics 101. Anyone who has been to an economics class have seen the Supply and Demand diagram below which depicts how the 3rd industrial economy worked. Two observations

1. The equilibrium, when demand = supply maximizes the value to both suppliers & consumers

1. The equilibrium, when demand = supply maximizes the value to both suppliers & consumers

2. The total cost of production increases as supply increases. In other words, the marginal cost to produce the 100th item is the same as that to produce the 15th item because each product requires a certain amount of materials and labour. Keep this point in mind

So lets bring it home: think about building a block of apartments. Within certain constrains, if 10 apartments cost $X to construction, then 20 apartments will cost $2X and 30 apartments will cost $3X (of course, there are some economies of scale with large projects)

So, with tangible assets, for every 10 extra apartments you want to sell, you have to spend $X in capex to build them. However, intangible assets don’t work like that and this is where things get interesting. Lets take Microsoft& #39;s Windows Operating software for example...

The company spend tons of money upfront, mainly in R&D to develop the software. But ones its done, additional units of the same software can be produced infinitely for virtually nothing. So Microsoft can sell 10 more copies of Windows to new customers with zero cost of production

So what& #39;s the key takeaway? Intangible assets are far more scalable than a physical assets. In other words "the total cost of production them DOES NOT increase as supply increases". Consequently, businesses build on intangible assets exhibit positive operating leverage

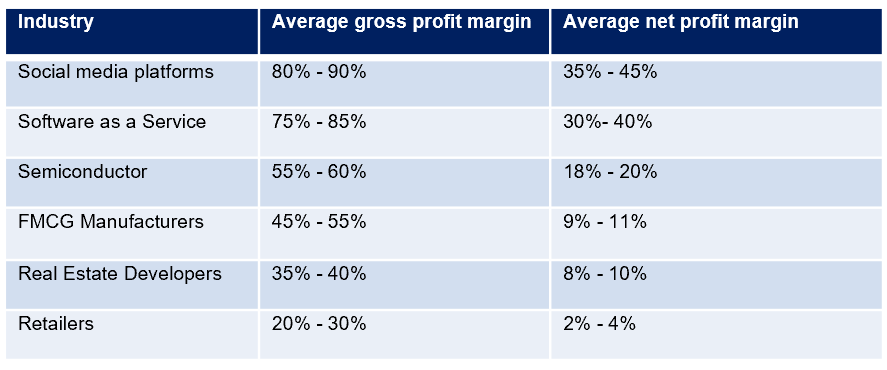

This means their revenue grows faster than their expenses which results in higher profit margins as they grow bigger. The diagram below shows the average gross and net profit margins for businesses build on intangible assets vs. those build on tangible assets

In addition to exponential growth, intangible assets also lend to themselves to a phenomenon called "network effects". This is the game changer and requires a thread on its on

So until next, remember to always do the Lord& #39;s work

So until next, remember to always do the Lord& #39;s work

Read on Twitter

Read on Twitter