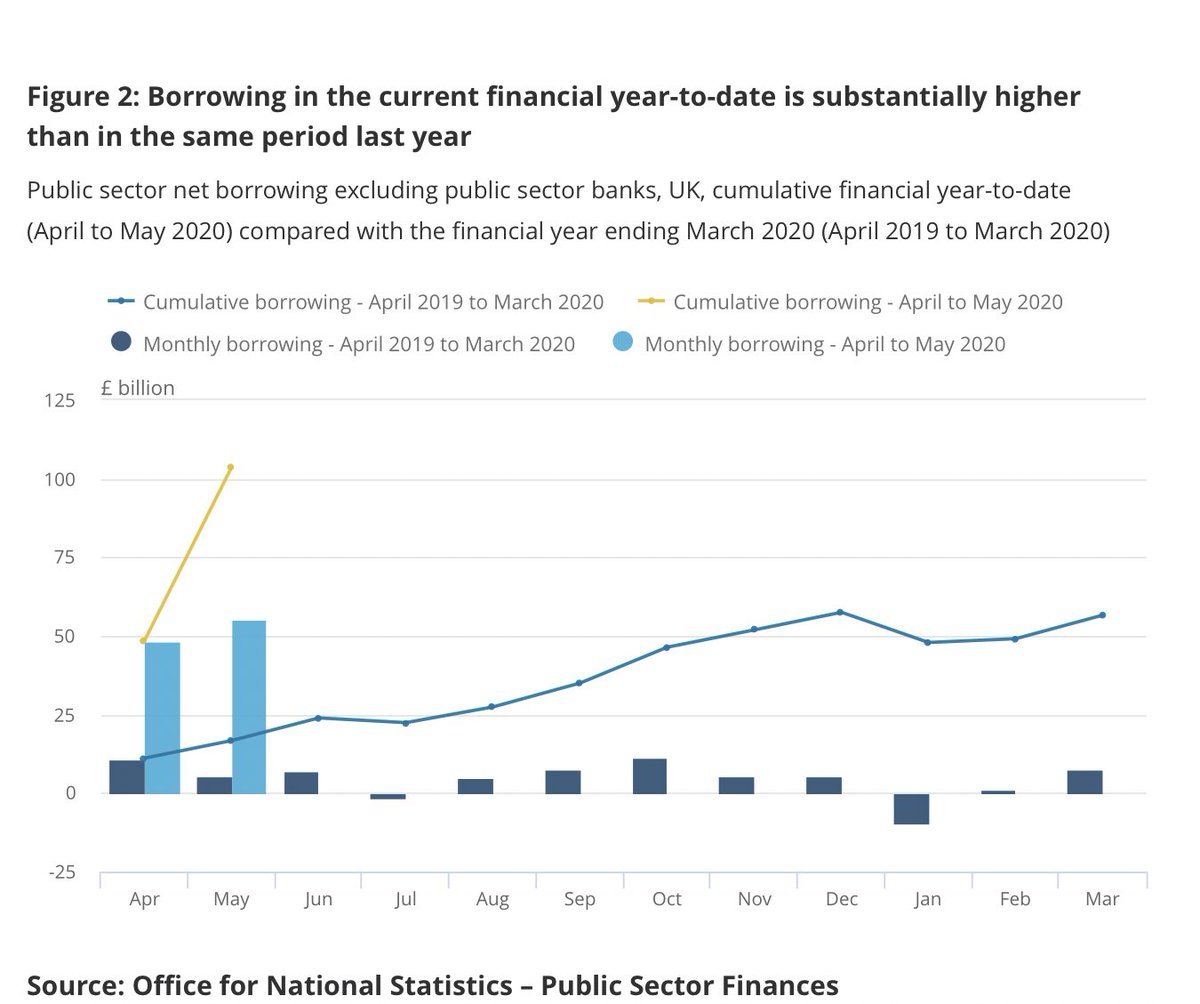

May UK public finances - £55.2 billion borrowed - 9x last year, highest monthly borrowing on record (since 1993)

Public Sector Net Debt is at 100.9% of GDP - first time since the early 1960s

April’s deficit revised down £14bn to £48.5bn

Public Sector Net Debt is at 100.9% of GDP - first time since the early 1960s

April’s deficit revised down £14bn to £48.5bn

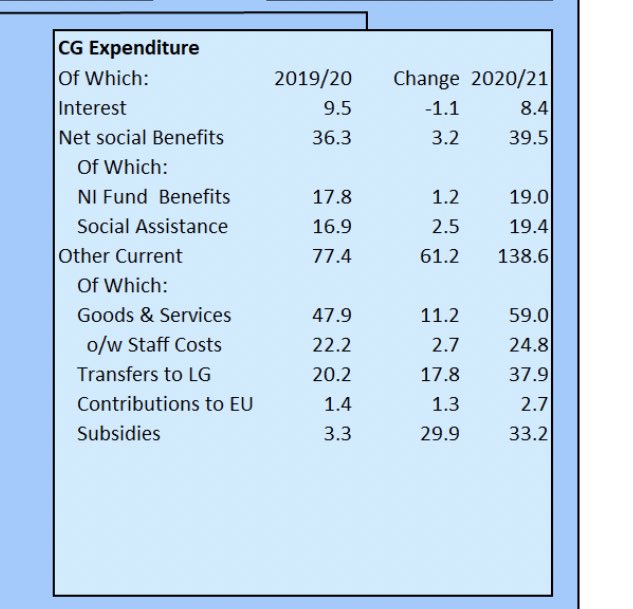

ONS have included a 7% adjustment ie reduction for possible non-payment of PAYE income tax in Covid crisis...

Public finances dont include possible/ likely losses on CLBILS and Bounce Back Loans - latter in particular being formally assessed for classification

May 2020 borrowing a record for a month at £55.2bn, which compares with £56.6bn for the entire fiscal year from April 2019 to March 2020

Adding April and May together - comparing to last year...

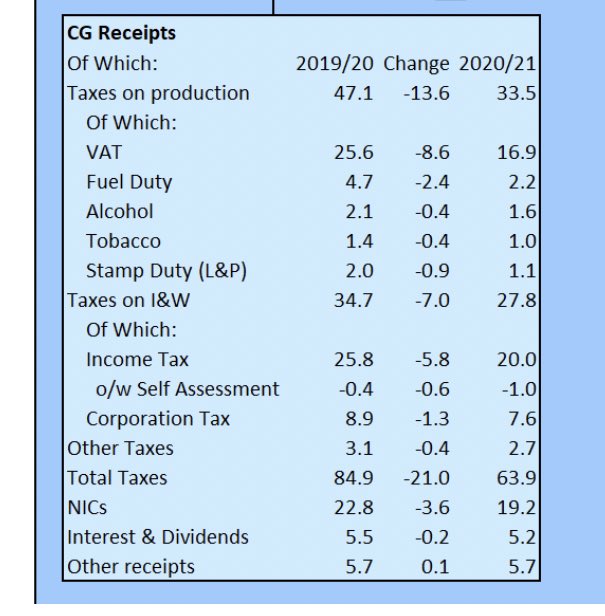

VAT receipts down £9bn to £17bn (this is policy decision to defer)

Fuel Duty more than halved down £2.4bn to £2.2bn

Income Tax down £6bn to £20bn

Corp Tax down £1bn to £8bn

Total tax take down £21bn to £64bn

VAT receipts down £9bn to £17bn (this is policy decision to defer)

Fuel Duty more than halved down £2.4bn to £2.2bn

Income Tax down £6bn to £20bn

Corp Tax down £1bn to £8bn

Total tax take down £21bn to £64bn

Read on Twitter

Read on Twitter