It& #39;s lunch time again & will dedicate lunch to u to talk more about this as 1.1M saw this on Twitter & 0.14M engaged w/ it.

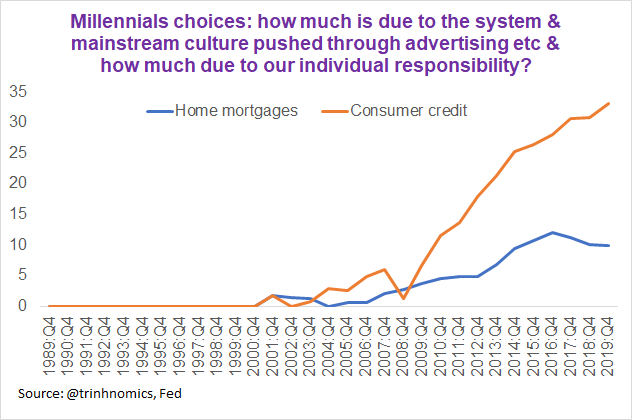

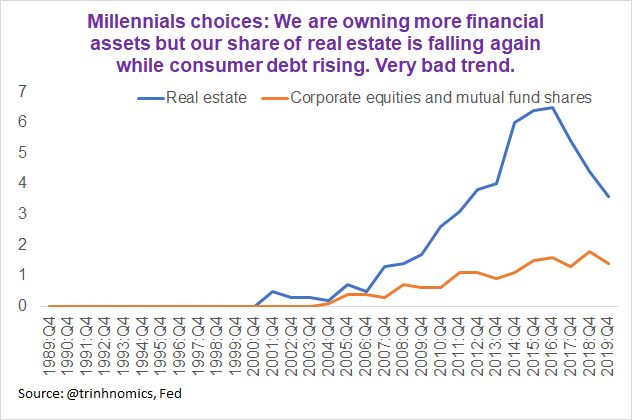

We all agree that we& #39;re concerned about our present & future. As we own:

1% financial assets

2% private biz

4% real estate

yet 33% of consumer debt https://abs.twimg.com/emoji/v2/... draggable="false" alt="👈🏻" title="Rückhand Zeigefinger nach links (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach links (heller Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👈🏻" title="Rückhand Zeigefinger nach links (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach links (heller Hautton)"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="😬" title="Grimasse schneidendes Gesicht" aria-label="Emoji: Grimasse schneidendes Gesicht">!

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😬" title="Grimasse schneidendes Gesicht" aria-label="Emoji: Grimasse schneidendes Gesicht">!

We all agree that we& #39;re concerned about our present & future. As we own:

1% financial assets

2% private biz

4% real estate

yet 33% of consumer debt

The answer to how we got here should start with the following reflection:

*Systemic reasons why we are behind

*Individual responsibility to how we can bring about change to reverse this trend.

The bulk of work will have to come from us through public & private engagement.

*Systemic reasons why we are behind

*Individual responsibility to how we can bring about change to reverse this trend.

The bulk of work will have to come from us through public & private engagement.

Let& #39;s talk about systemic reasons why we are behind. I speak as a millennial that graduated from grad school in 2010, which is right after the Great Financial Crisis & the greatest recession since the Great Depression. Will add both personal & macro statistics to this discussion.

Millennial or Gen Y is a group of people born between 1981 to 1996. Obviously there are older millennial (oldest 39) & young ones that are 24.

Irrespective, they are full fledged adults w/ 15 yrs b/n them. Some have been around much longer & others just starting out in career.

Irrespective, they are full fledged adults w/ 15 yrs b/n them. Some have been around much longer & others just starting out in career.

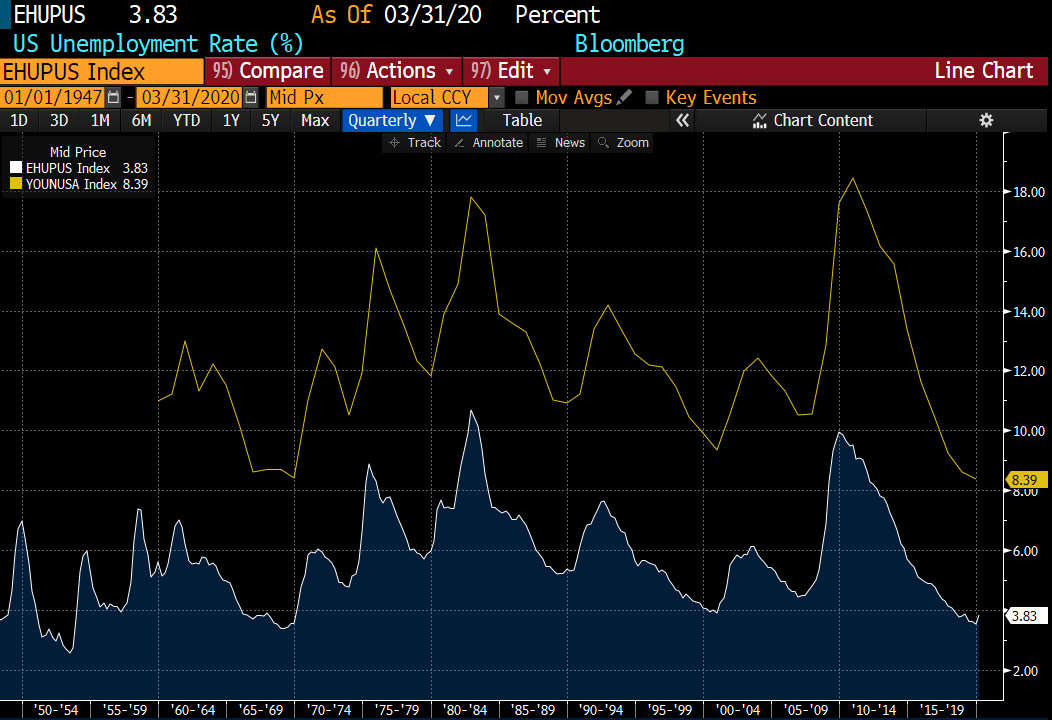

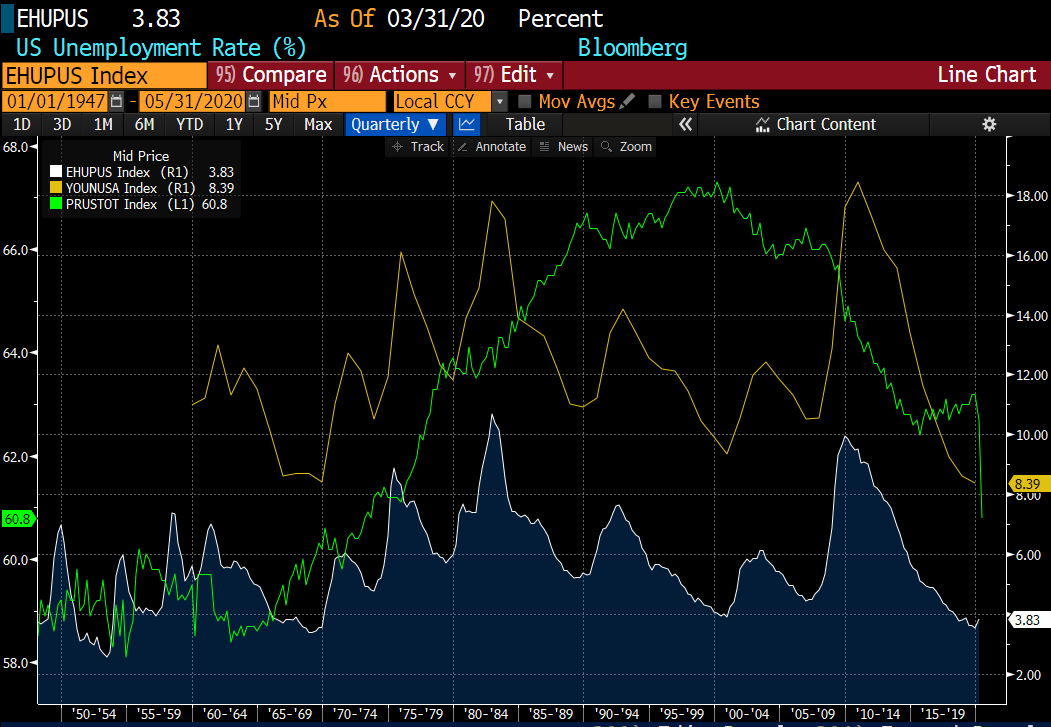

In 2009, the oldest millennial would be 28 years old. And those born in the mid 1980s would be 24 years old in 2009.

Let& #39;s talk about the 24-28 years old Americans. What do they find when they emerged from undergraduate/grad school?

The aftermath of the GFC. US unemployment https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">.

Let& #39;s talk about the 24-28 years old Americans. What do they find when they emerged from undergraduate/grad school?

The aftermath of the GFC. US unemployment

They would find the most unfavorable labor market since 1980s & the unemployment rate was persistently high from 2008 to 2014 that was above 6% & more importantly peaked at 10%. Youth unemployment of course was much higher. U should this: US labor participation rate FELL sharply

How do u calculate unemployment:

Take the total unemployed divided by the labor force.

But actually, it& #39;s misleading because they take out the people that have given up looking for a job BUT OF WORKING AGE.

Participation rate is the ratio of that and that declined after GFC!

Take the total unemployed divided by the labor force.

But actually, it& #39;s misleading because they take out the people that have given up looking for a job BUT OF WORKING AGE.

Participation rate is the ratio of that and that declined after GFC!

That& #39;s what I call systemic: u as an individual entering an environment that is unfavorable to your future income outcome.

What else is there about you before u earnestly started ur career in a bad market?

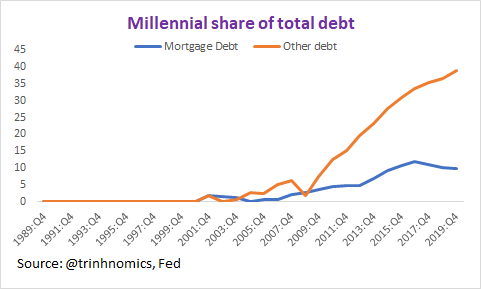

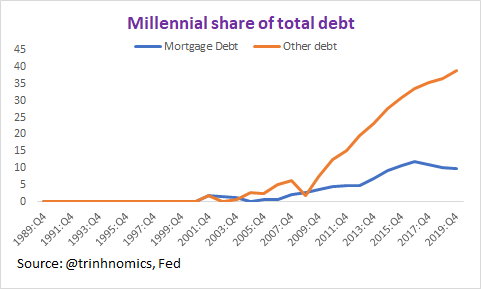

You have a lot of debt. And u started out w/ a lot of non-mortgage debt.

What else is there about you before u earnestly started ur career in a bad market?

You have a lot of debt. And u started out w/ a lot of non-mortgage debt.

Let& #39;s take the year I finished grad school in 2010 (went to Johns Hopkins University & UCLA for undergrad). Oldest millennial would be 29.

Your share of non-mortgage debt was already 12.6% of total in 2010 so u have a lot of debt relative to income just starting out.

So?

Your share of non-mortgage debt was already 12.6% of total in 2010 so u have a lot of debt relative to income just starting out.

So?

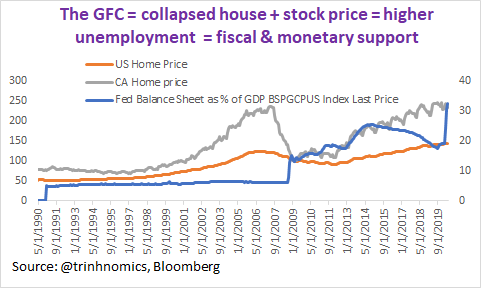

Let& #39;s talk about the system. As u know, it almost collapsed due to excessive risk taking. So to mitigate the fallout of the decline of financial & housing asset price, the gov& #39; (Obama) & Fed (Bernanke) did government spending & lowered interest rates to zero & bought gov bonds.

If u are the oldest millennial, this happened while u& #39;re working. And if u are younger, u& #39;re about the enter the workforce with:

Student loan + consumer debt + high unemployment + collapsed asset prices that about to be stimulated by low interest rates, fiscal programs & QE.

Student loan + consumer debt + high unemployment + collapsed asset prices that about to be stimulated by low interest rates, fiscal programs & QE.

As someone who just graduated & got debt & unfavorable labor market & limited financial literacy, UNLIKELY that u& #39;d have the cash to:

* Purchase a home at bottom (prices did crash so good for those w/ cash to buy cheaper)

* Purchase financial assets (stocks+bonds) at the bottom

* Purchase a home at bottom (prices did crash so good for those w/ cash to buy cheaper)

* Purchase financial assets (stocks+bonds) at the bottom

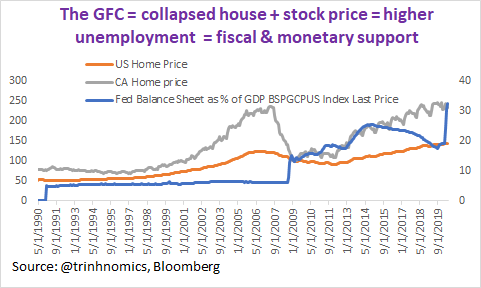

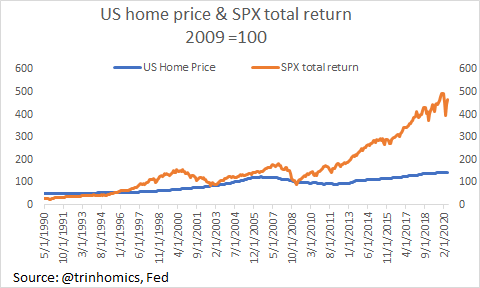

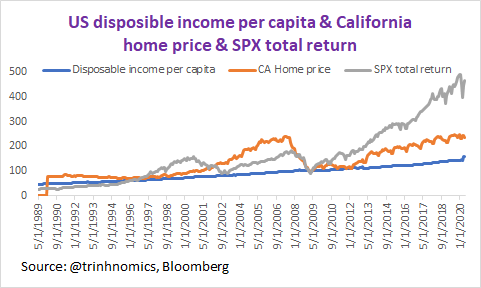

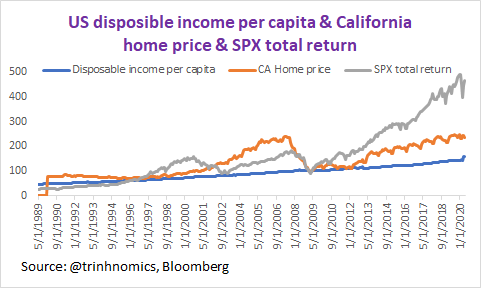

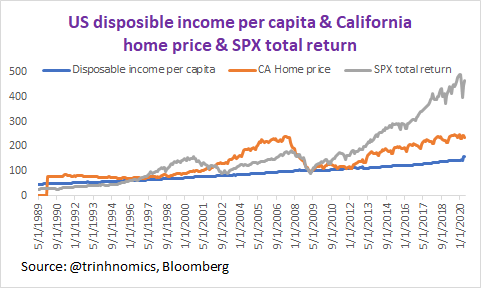

Evolution of HARD asset (home price) & financial asset (SPX total return).

If price in 2009 = 100, which is the bottom of the market & a very good entry level for those willing to take the risk & have cash, key caveats that Millennials do not qualify,

then

SPX = 468

Home =144

If price in 2009 = 100, which is the bottom of the market & a very good entry level for those willing to take the risk & have cash, key caveats that Millennials do not qualify,

then

SPX = 468

Home =144

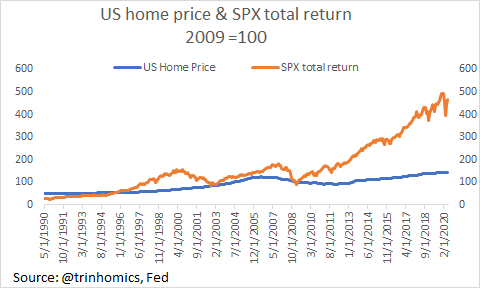

Change of wealth from 2007-2019: Share is more positive for all three generations but the gain for Millennial is much less for the fact that they did not own enough (& still don& #39;t):

Financial Asset

Real Estate Asset

Change of net worth & evolution of millennial asset share https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">

Financial Asset

Real Estate Asset

Change of net worth & evolution of millennial asset share

Okay, so we are here so far:

*Enter the job market when it& #39;s one of the worst in modern history

*Have non-mortgage debt (student loans)

*Don& #39;t have cash to buy assets that are about to rise SHARPLY.

Let& #39;s talk about assets & why u should care & improve ur financial literary!

*Enter the job market when it& #39;s one of the worst in modern history

*Have non-mortgage debt (student loans)

*Don& #39;t have cash to buy assets that are about to rise SHARPLY.

Let& #39;s talk about assets & why u should care & improve ur financial literary!

There are two types of assets you can own:

Physical asset (a home/car/watch)

Financial asset (stocks or bonds & they differ due to return & risks).

U can buy a home or rent. When u buy a home, u put down 10-20% & the bank lend u the rest at an interest rate (fixed or variable).

Physical asset (a home/car/watch)

Financial asset (stocks or bonds & they differ due to return & risks).

U can buy a home or rent. When u buy a home, u put down 10-20% & the bank lend u the rest at an interest rate (fixed or variable).

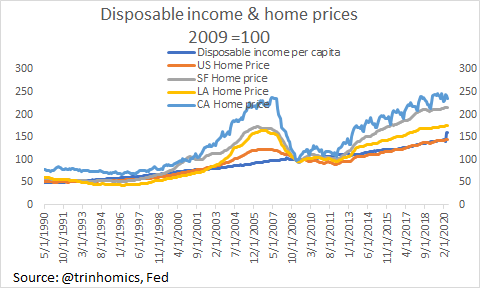

Before u can buy assets, u need money that u have saved up working & not SPENDING & not BORROWING to CONSUME to then invest in say a home. Key is disposable income net of essential expenses + debt payment. So let& #39;s look at disposable income per capital in the USA & home prices.

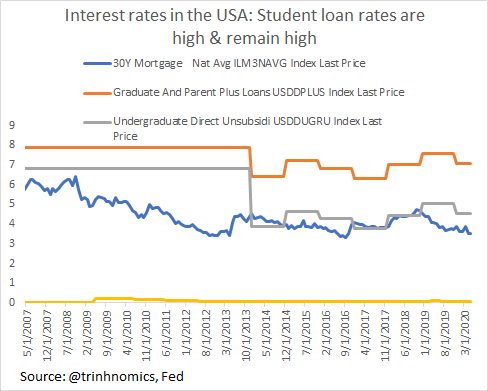

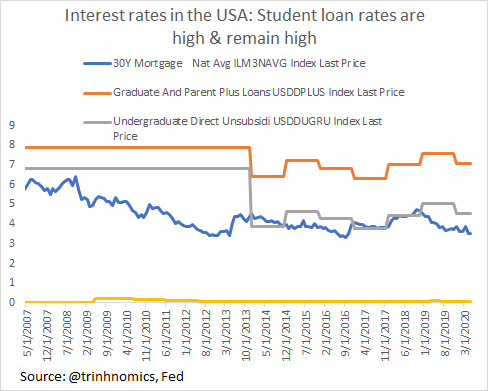

When u get out of grad/undergrad school w/ student loan debt, have to prioritize the following:

*Low fixed costs (lower quality of housing & reduce eating out/drinking/shopping/traveling)

*Pay off high interest student loans ASAP & preferably before 30.

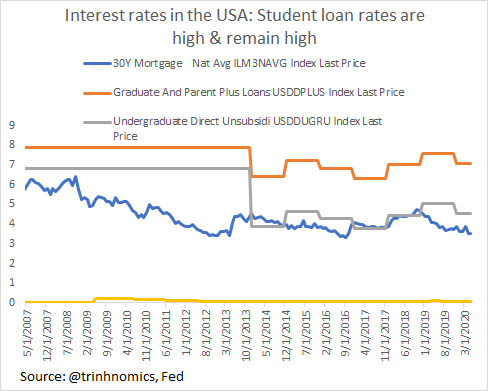

Why? Look at the rates.

*Low fixed costs (lower quality of housing & reduce eating out/drinking/shopping/traveling)

*Pay off high interest student loans ASAP & preferably before 30.

Why? Look at the rates.

As u know, the Fed Fund Rate is close to ZERO but that& #39;s not what u pay on your consumer credit card or ur student loans.

Why? B/c they are non-collateralized & u have very high risks & risks priced into rates.

If u want to get ahead, need to reduce high costs of debt.

Why? B/c they are non-collateralized & u have very high risks & risks priced into rates.

If u want to get ahead, need to reduce high costs of debt.

The fact that millennials have DECLINING share of mortage debts (that have lower interest rates so good to have debt when ur costs of debt getting lower) while HIGHER SHARE OF CONSUMER DEBT + STUDENT LOAN DEBT is worrying.

We need to reduce the orange line & raise the blue line.

We need to reduce the orange line & raise the blue line.

Back to interest rates & why millennials have so much non-mortgage debt. BOTH SYSTEMIC & INDIVIDUAL reasons:

*System gives debts without questions asked & without educating them about the need to repay as INTEREST RATES ARE HIGH, esp graduate school debt

*Need to pay back debt!!

*System gives debts without questions asked & without educating them about the need to repay as INTEREST RATES ARE HIGH, esp graduate school debt

*Need to pay back debt!!

If someone educated u that the unsubsidized undergraduate student loans u have are VERY EXPENSIVE & that u& #39;ll need to CAREFULLY CONSIDER THE RETURN OF YOUR EDUCATION, which means JOB & INCOME PROSPECT, then u& #39;d reconsider taking all of that on.

We weren& #39;t taught this & borrowed.

We weren& #39;t taught this & borrowed.

And most importantly, YOU CANNOT DECLARE BANKRUPTCY on your student loan debt.

And u did this when u were 18 & u had no idea what u were doing & did not take college decision as seriously as u should& #39;ve & racking up debt that the older adult u have to pay.

Systemic problem.

And u did this when u were 18 & u had no idea what u were doing & did not take college decision as seriously as u should& #39;ve & racking up debt that the older adult u have to pay.

Systemic problem.

We must change this culture of young people taking out debt such as consumer credit card, auto loan debt, & STUDENT LOAN DEBT without understanding compound interests & how that will eat into their future prospect.

Okay, let& #39;s talk about assets now that we talked about debt https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤗" title="Umarmendes Gesicht" aria-label="Emoji: Umarmendes Gesicht">.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤗" title="Umarmendes Gesicht" aria-label="Emoji: Umarmendes Gesicht">.

Okay, let& #39;s talk about assets now that we talked about debt

Actually, let me illustrate what compound interests are assuming this:

USD10,000

After 10 years on the following rates:

Deposit at bank = 0.06%

Mortgage =3.52%

Undergrad loan = 4.5%

Graduate loan =7.1%

Credit debt rate = 15% (random here & can be higher)

Your grd loan doubles!

USD10,000

After 10 years on the following rates:

Deposit at bank = 0.06%

Mortgage =3.52%

Undergrad loan = 4.5%

Graduate loan =7.1%

Credit debt rate = 15% (random here & can be higher)

Your grd loan doubles!

So you can see why u want to pay down you highest interest rates as fast as possible because it will eat into your future very very fast. Best is if u borrow at a rate that is LOWER THAN YOUR EXPECTED RETURN. Ok, we talk about assets b/c u want to own assets that give u return! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤗" title="Umarmendes Gesicht" aria-label="Emoji: Umarmendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤗" title="Umarmendes Gesicht" aria-label="Emoji: Umarmendes Gesicht">

Disposable income & US home prices & CA home prices. First, I normalized everything to make it easier for u to think. We assume that the value of the year of 2009 = 100.

Note ur disposable income per capita has risen but it doesn& #39;t take into ur consumption behavior & debt.

Note ur disposable income per capita has risen but it doesn& #39;t take into ur consumption behavior & debt.

Average disposable income per capita has risen as much as US house price. But US house price has some pretty laggard places & some very expensive places. Importantly, u didn& #39;t buy at the bottom as u had limited capital & debt.

Let& #39;s use disposable per capita vs some key assets

Let& #39;s use disposable per capita vs some key assets

The US is a rather unequal place & I don& #39;t just mean inter-generational/race etc but in interstate wealth & growth & opportunities.

So if u want to have higher income & get a good job, u need to move to where the jobs are. CA is my home state & it& #39;s a great economy.

So?

So if u want to have higher income & get a good job, u need to move to where the jobs are. CA is my home state & it& #39;s a great economy.

So?

If u worked hard, and assuming u made great decisions in paying off your student loan debt ASAP & do not have any consumer credit debt & put your disposable income into savings through just bank deposits then u are not compounding at all.

CA home price & SPX return skyrockets! https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">

CA home price & SPX return skyrockets!

If 2009, the bottom of the market, = 100, then by May 2020,

Disposable income per capita =160

California home price =235

SPX Total Return =468

Now, u see why u want to avoid racking up consumer credit debt & start putting some of that away into assets as return faster than wage

Disposable income per capita =160

California home price =235

SPX Total Return =468

Now, u see why u want to avoid racking up consumer credit debt & start putting some of that away into assets as return faster than wage

Question for u:

Do u know why California housing has OUTPACED THE REST OF THE USA? The answer is both high demand & low SUPPLY.

U should argue & lobby for more supply of housing in states that have the most opportunities so u can catch up!

Why is supply of housing low in CA?

Do u know why California housing has OUTPACED THE REST OF THE USA? The answer is both high demand & low SUPPLY.

U should argue & lobby for more supply of housing in states that have the most opportunities so u can catch up!

Why is supply of housing low in CA?

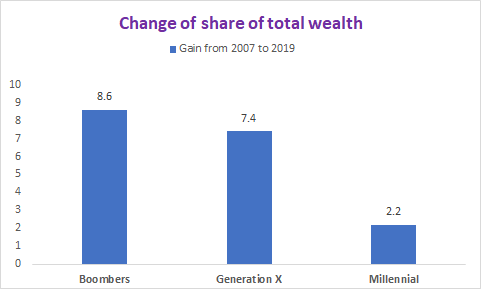

Juxtaposition of millennial ownership of financial assets & real estate asset, which is 1.4% for financial & only 3.6% for real estate, and, wait for it:

SPX total return & CA housing prices.

We have a lot of bad debt & not enough of the stuff that is skyrocketing in return. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👈🏻" title="Rückhand Zeigefinger nach links (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach links (heller Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👈🏻" title="Rückhand Zeigefinger nach links (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach links (heller Hautton)">

SPX total return & CA housing prices.

We have a lot of bad debt & not enough of the stuff that is skyrocketing in return.

Lunch-time pro-bono Millennial analysis over  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👋🏻" title="Waving hand (heller Hautton)" aria-label="Emoji: Waving hand (heller Hautton)">. Have a great day :-) Remember that we still have time & that the present does not dictate the future. Together, we can both improve our individual decisions & also system in which we will inherit one day.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👋🏻" title="Waving hand (heller Hautton)" aria-label="Emoji: Waving hand (heller Hautton)">. Have a great day :-) Remember that we still have time & that the present does not dictate the future. Together, we can both improve our individual decisions & also system in which we will inherit one day.

Sincerely,

@Trinhnomics

Sincerely,

@Trinhnomics

Read on Twitter

Read on Twitter https://abs.twimg.com/emoji/v2/... draggable="false" alt="😬" title="Grimasse schneidendes Gesicht" aria-label="Emoji: Grimasse schneidendes Gesicht">!" title="It& #39;s lunch time again & will dedicate lunch to u to talk more about this as 1.1M saw this on Twitter & 0.14M engaged w/ it.We all agree that we& #39;re concerned about our present & future. As we own:1% financial assets2% private biz4% real estateyet 33% of consumer debthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👈🏻" title="Rückhand Zeigefinger nach links (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach links (heller Hautton)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😬" title="Grimasse schneidendes Gesicht" aria-label="Emoji: Grimasse schneidendes Gesicht">!" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😬" title="Grimasse schneidendes Gesicht" aria-label="Emoji: Grimasse schneidendes Gesicht">!" title="It& #39;s lunch time again & will dedicate lunch to u to talk more about this as 1.1M saw this on Twitter & 0.14M engaged w/ it.We all agree that we& #39;re concerned about our present & future. As we own:1% financial assets2% private biz4% real estateyet 33% of consumer debthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👈🏻" title="Rückhand Zeigefinger nach links (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach links (heller Hautton)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="😬" title="Grimasse schneidendes Gesicht" aria-label="Emoji: Grimasse schneidendes Gesicht">!" class="img-responsive" style="max-width:100%;"/>

." title="In 2009, the oldest millennial would be 28 years old. And those born in the mid 1980s would be 24 years old in 2009.Let& #39;s talk about the 24-28 years old Americans. What do they find when they emerged from undergraduate/grad school? The aftermath of the GFC. US unemploymenthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">." class="img-responsive" style="max-width:100%;"/>

." title="In 2009, the oldest millennial would be 28 years old. And those born in the mid 1980s would be 24 years old in 2009.Let& #39;s talk about the 24-28 years old Americans. What do they find when they emerged from undergraduate/grad school? The aftermath of the GFC. US unemploymenthttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">." class="img-responsive" style="max-width:100%;"/>

" title="Change of wealth from 2007-2019: Share is more positive for all three generations but the gain for Millennial is much less for the fact that they did not own enough (& still don& #39;t):Financial AssetReal Estate Asset Change of net worth & evolution of millennial asset sharehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">">

" title="Change of wealth from 2007-2019: Share is more positive for all three generations but the gain for Millennial is much less for the fact that they did not own enough (& still don& #39;t):Financial AssetReal Estate Asset Change of net worth & evolution of millennial asset sharehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">">

" title="Change of wealth from 2007-2019: Share is more positive for all three generations but the gain for Millennial is much less for the fact that they did not own enough (& still don& #39;t):Financial AssetReal Estate Asset Change of net worth & evolution of millennial asset sharehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">">

" title="Change of wealth from 2007-2019: Share is more positive for all three generations but the gain for Millennial is much less for the fact that they did not own enough (& still don& #39;t):Financial AssetReal Estate Asset Change of net worth & evolution of millennial asset sharehttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">">

." title="We must change this culture of young people taking out debt such as consumer credit card, auto loan debt, & STUDENT LOAN DEBT without understanding compound interests & how that will eat into their future prospect. Okay, let& #39;s talk about assets now that we talked about debt https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤗" title="Umarmendes Gesicht" aria-label="Emoji: Umarmendes Gesicht">." class="img-responsive" style="max-width:100%;"/>

." title="We must change this culture of young people taking out debt such as consumer credit card, auto loan debt, & STUDENT LOAN DEBT without understanding compound interests & how that will eat into their future prospect. Okay, let& #39;s talk about assets now that we talked about debt https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤗" title="Umarmendes Gesicht" aria-label="Emoji: Umarmendes Gesicht">." class="img-responsive" style="max-width:100%;"/>

" title="If u worked hard, and assuming u made great decisions in paying off your student loan debt ASAP & do not have any consumer credit debt & put your disposable income into savings through just bank deposits then u are not compounding at all.CA home price & SPX return skyrockets!https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">" class="img-responsive" style="max-width:100%;"/>

" title="If u worked hard, and assuming u made great decisions in paying off your student loan debt ASAP & do not have any consumer credit debt & put your disposable income into savings through just bank deposits then u are not compounding at all.CA home price & SPX return skyrockets!https://abs.twimg.com/emoji/v2/... draggable="false" alt="🚀" title="Rakete" aria-label="Emoji: Rakete">" class="img-responsive" style="max-width:100%;"/>

" title="Juxtaposition of millennial ownership of financial assets & real estate asset, which is 1.4% for financial & only 3.6% for real estate, and, wait for it:SPX total return & CA housing prices. We have a lot of bad debt & not enough of the stuff that is skyrocketing in return.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👈🏻" title="Rückhand Zeigefinger nach links (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach links (heller Hautton)">" class="img-responsive" style="max-width:100%;"/>

" title="Juxtaposition of millennial ownership of financial assets & real estate asset, which is 1.4% for financial & only 3.6% for real estate, and, wait for it:SPX total return & CA housing prices. We have a lot of bad debt & not enough of the stuff that is skyrocketing in return.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👈🏻" title="Rückhand Zeigefinger nach links (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach links (heller Hautton)">" class="img-responsive" style="max-width:100%;"/>