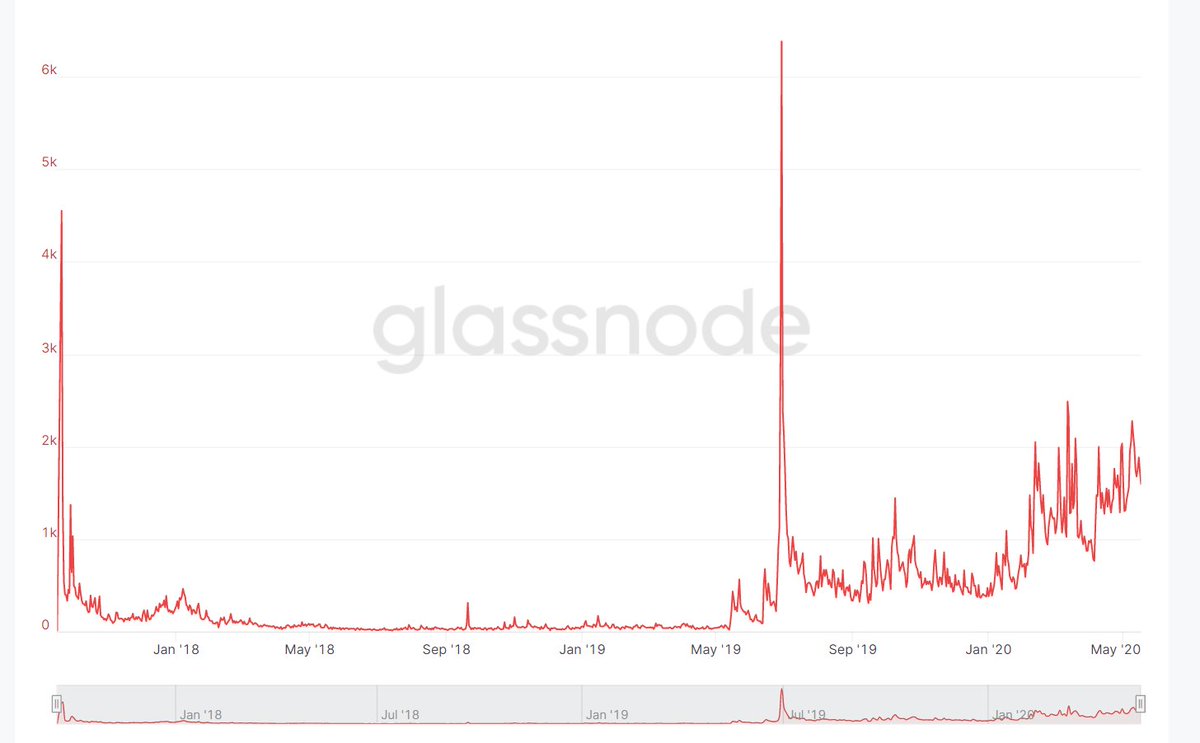

Number of non-zero $LINK addresses on the rise

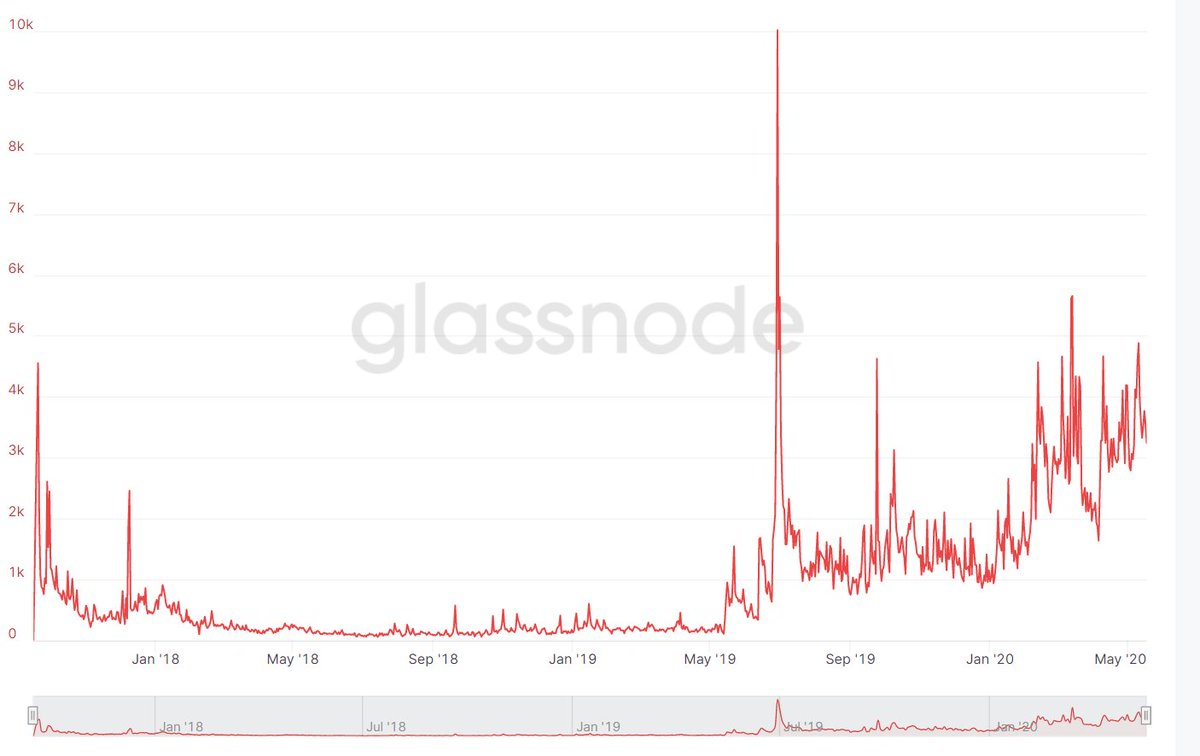

Number of NEW $LINK addresses on the increase

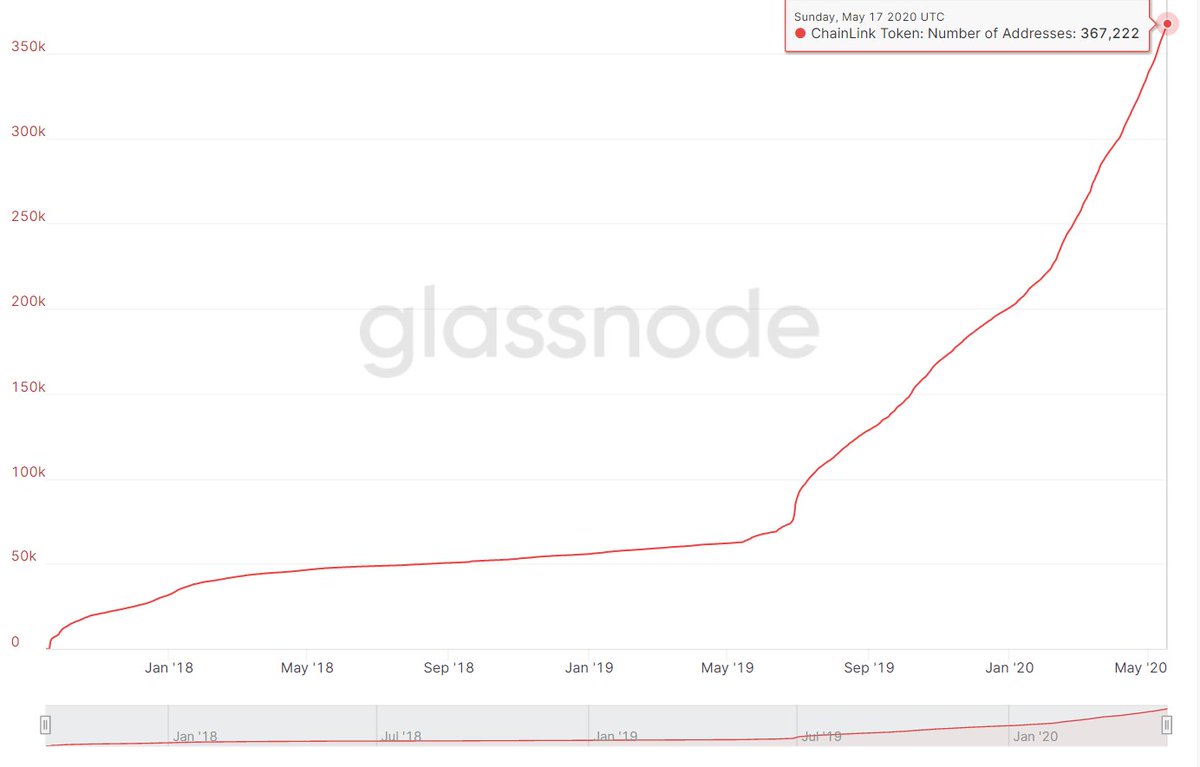

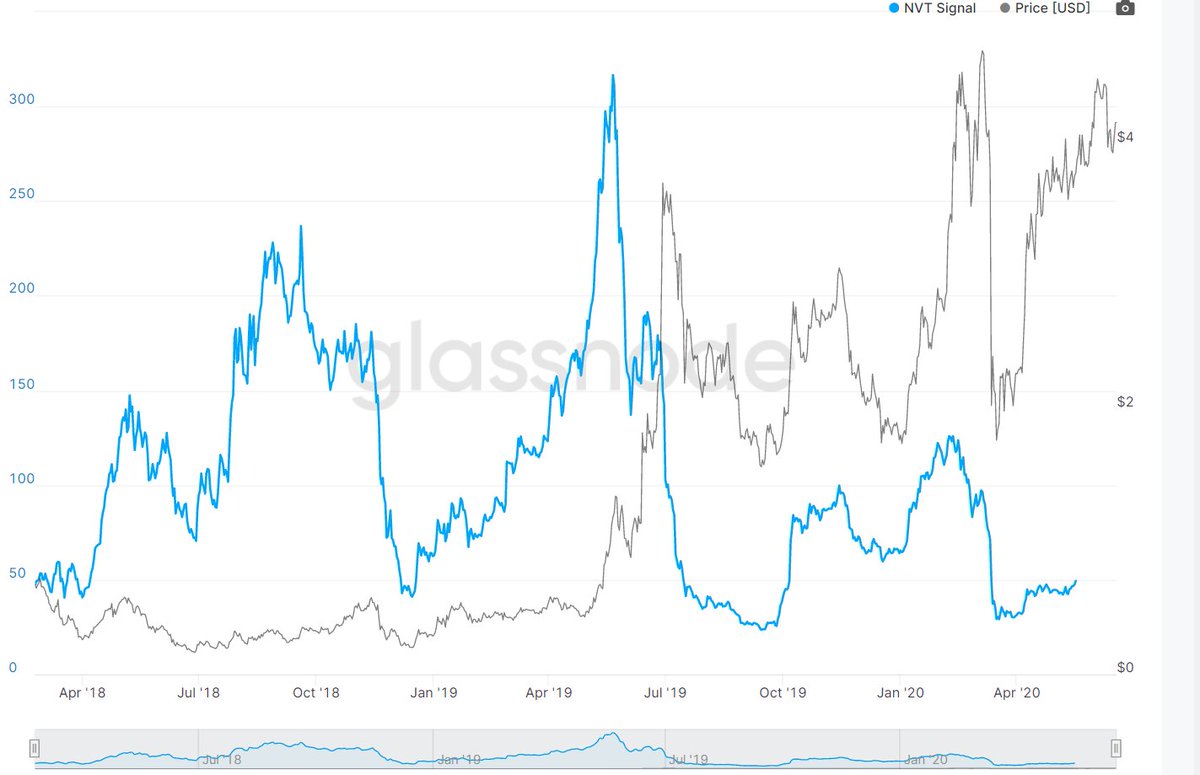

NVT ratio of $LINK (Network Value to Transactions)

(Market cap/ transferred on-chain volume in USD)

TL;DR: $LINK is undervalued

(further reading: https://www.norupp.com/nvt-ratio-and-nvt-signal-ratio-detect-bitcoin-bubbles/#:~:text=The%20NVT%20ratio%20is%20also,the%20stock%20price%20against%20earnings.)">https://www.norupp.com/nvt-ratio...

(Market cap/ transferred on-chain volume in USD)

TL;DR: $LINK is undervalued

(further reading: https://www.norupp.com/nvt-ratio-and-nvt-signal-ratio-detect-bitcoin-bubbles/#:~:text=The%20NVT%20ratio%20is%20also,the%20stock%20price%20against%20earnings.)">https://www.norupp.com/nvt-ratio...

$LINK NVT signal (NVT ratio except it uses 90 moving average of $ daily transaction volume)

When NVT signal (blue) Is below $USD (grey) it is a "Good time to buy"

Bear in mind mainnet went live end of May & #39;19 which is where transaction volume really began

b4 was speculation

When NVT signal (blue) Is below $USD (grey) it is a "Good time to buy"

Bear in mind mainnet went live end of May & #39;19 which is where transaction volume really began

b4 was speculation

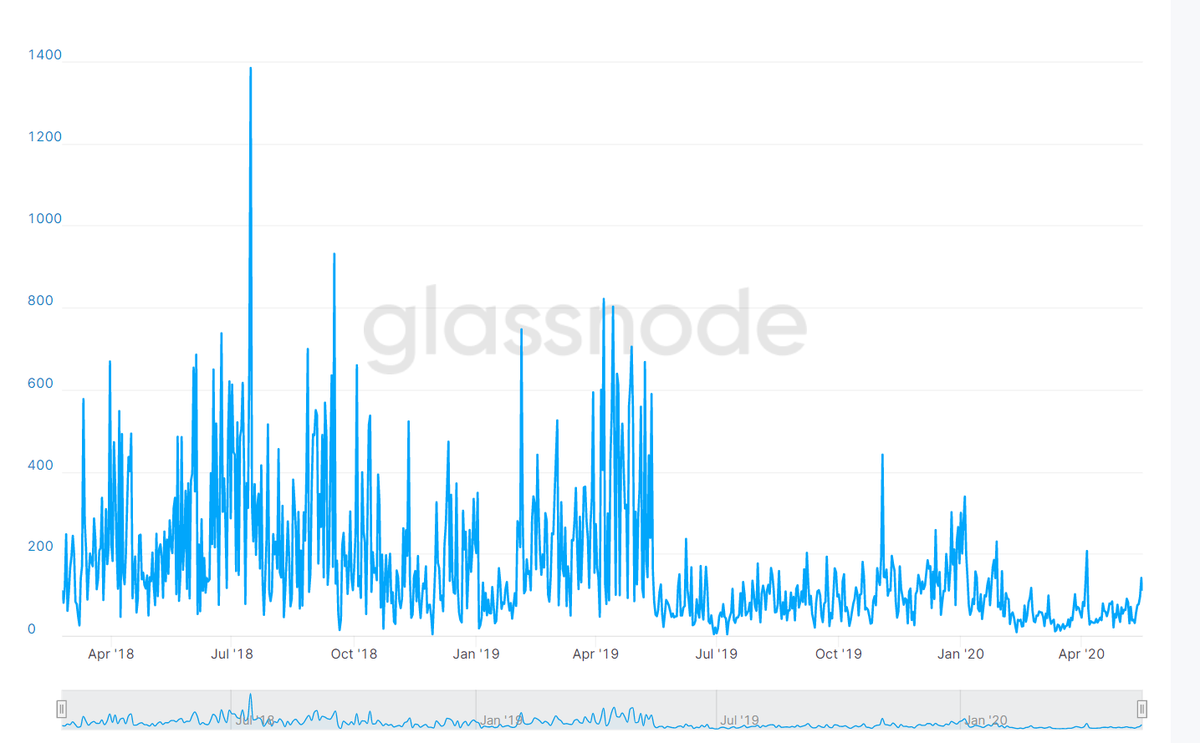

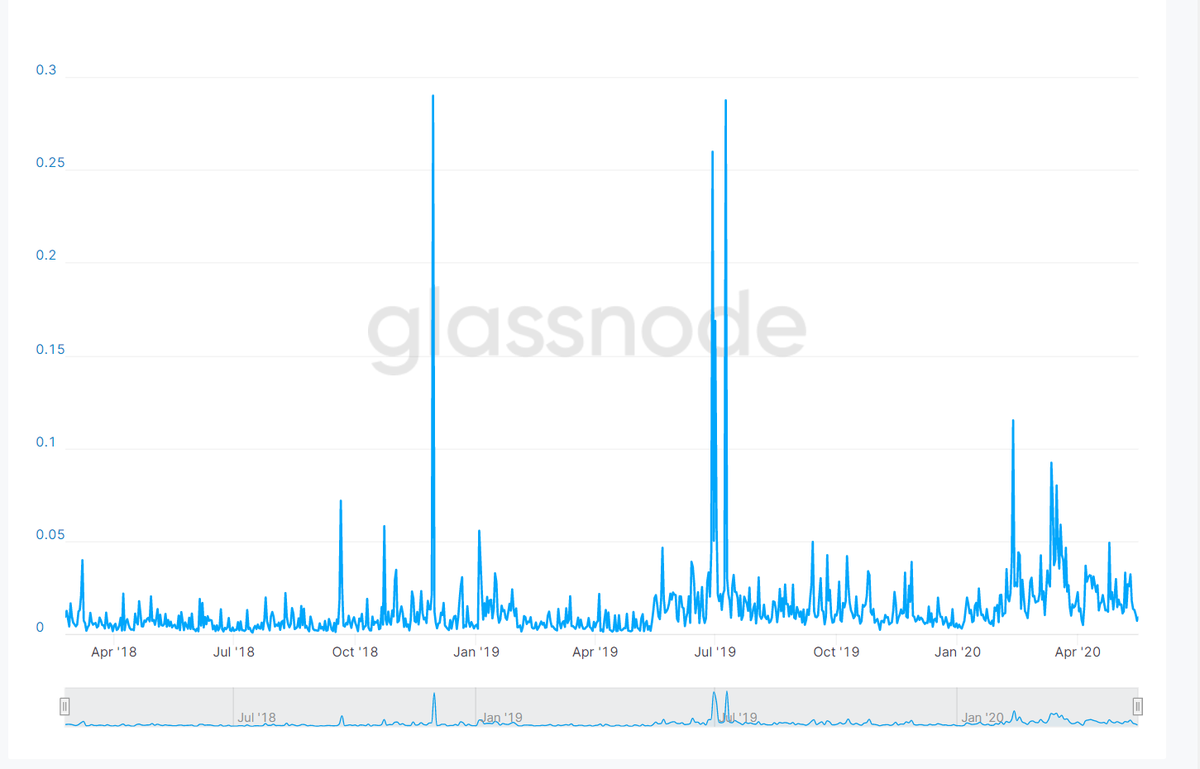

$LINK token velocity indicates people holding

Not much $LINK (in usd) is moving relative to market cap (in usd)

Most projects don& #39;t incentivise token holders to hold for more than a few minutes. High velocity tokens struggle to maintain long-term price appreciation

Not much $LINK (in usd) is moving relative to market cap (in usd)

Most projects don& #39;t incentivise token holders to hold for more than a few minutes. High velocity tokens struggle to maintain long-term price appreciation

$LINK balance on exchanges slowly decreasing, this metric is for the exchanges shown in fig 2

^They have publicly known wallet address& #39;s

^They have publicly known wallet address& #39;s

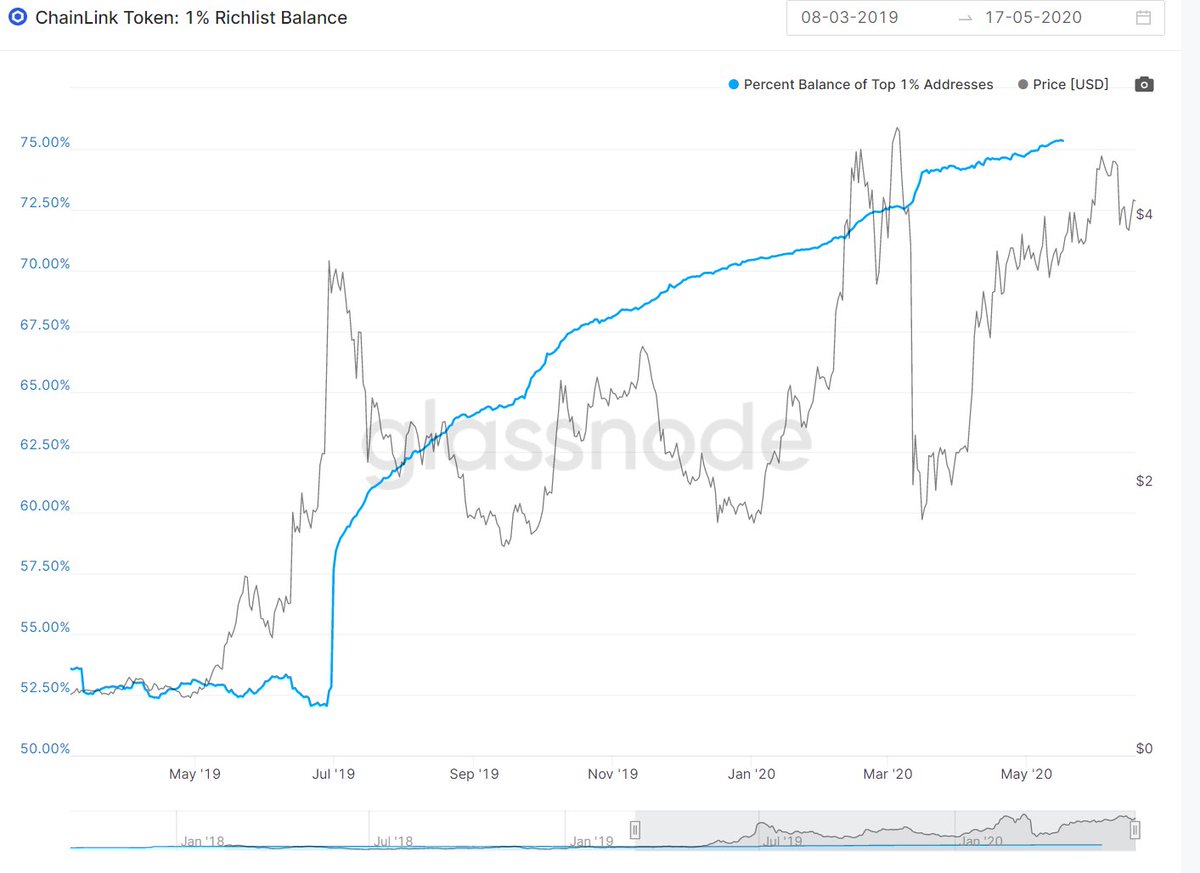

$LINK Richlist balance /$USD price

Whales are accumulating. Going from 52.1% in June 19 to 75.3% end of May (irrespective of price action)

(rich list is defined as the % of supply held by the top 1% addresses)

NOTE: this EXCLUDES the addresses of:

-Team funds

-Exchanges

Whales are accumulating. Going from 52.1% in June 19 to 75.3% end of May (irrespective of price action)

(rich list is defined as the % of supply held by the top 1% addresses)

NOTE: this EXCLUDES the addresses of:

-Team funds

-Exchanges

Read on Twitter

Read on Twitter