The COVID-19 outbreak will produce the worst economic downturn in a century. We expect that ‘the great lockdown’ will cause output to contract by about 7% this year. During the Great Depression, output fell by 6.1% and 6.2% in 1930 and 1931, respectively.

The SARB has responded flexibly, quickly and aggressively to this crisis. We have cut rates, provided liquidity to banks, provided R100 billion in funding for SMEs (with @TreasuryRSA) and purchased government bonds in the secondary market.

The cumulative reduction in the repo rate for 2020 now stands at 275 basis points. To compare, the emerging market median is 100 basis points. The repo rate is now at its lowest level on record, and below zero in real terms.

We have been buying government bonds in the secondary market, to improve market functioning. The total of new purchases now stands at around R25 billion, which is an increase of about 0.6% of GDP from pre-crisis levels. This is comparable to purchases by emerging market peers.

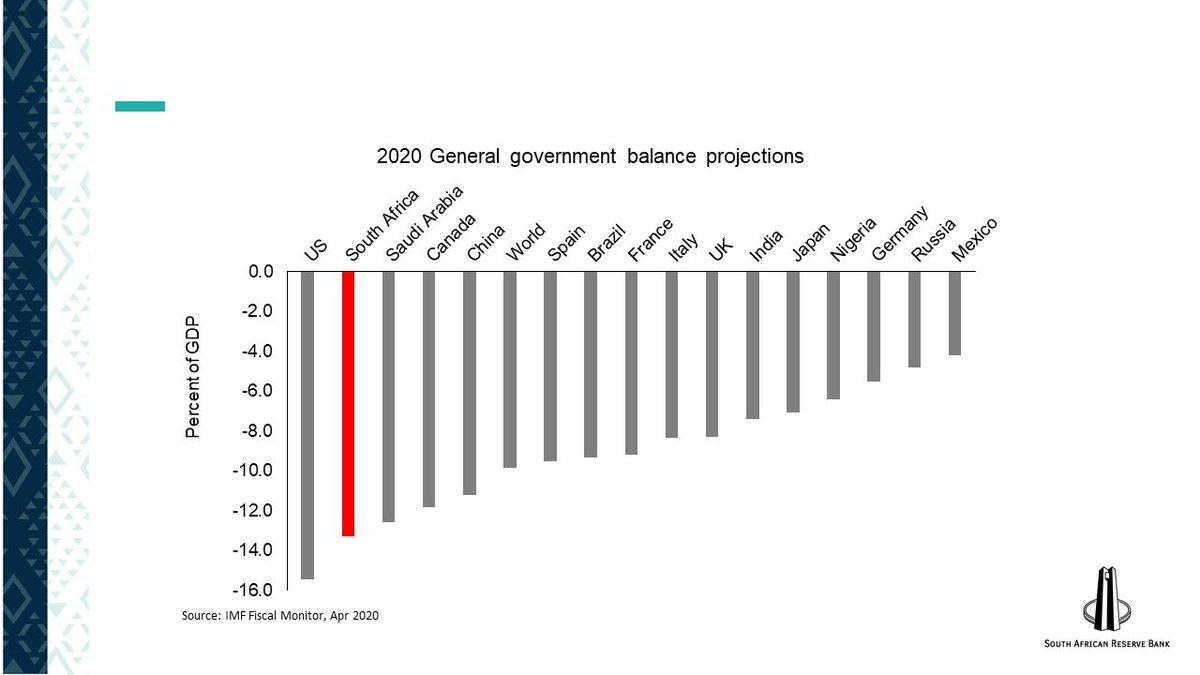

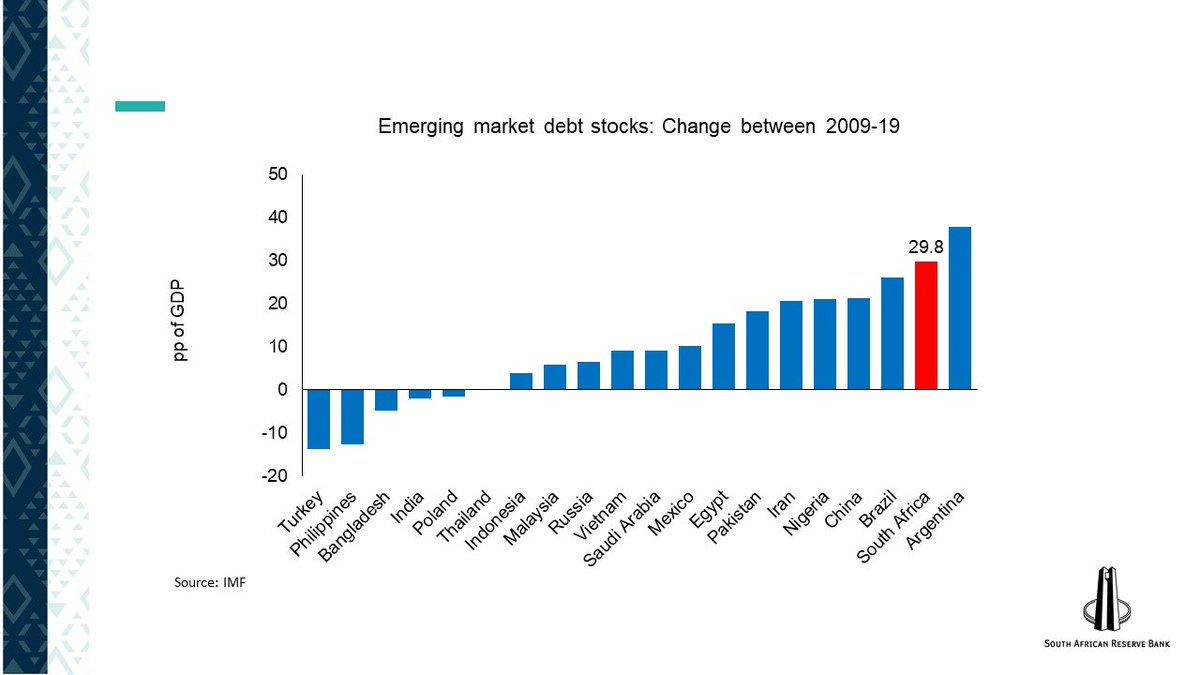

When the COVID-19 shock hit, South Africa was already running crisis-level deficits – over 6% of GDP in 2019. Our debt stock was on a rising trajectory. Unfortunately, the coronavirus is now forcing an additional fiscal deterioration.

Read on Twitter

Read on Twitter