With a great sense of timing CareTech, our biggest for-profit private provider of foster care and children& #39;s homes, has reported profits for the latest six months. No better way to demonstrate how taking children into care has become a hugely, profitable business. 1/

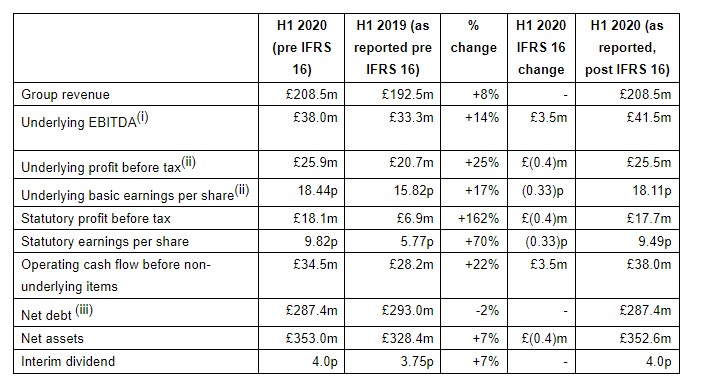

In just six months the company has increased profits by 25% to £25.9 million. Local authorities paid the company fees of £208.5 million, an increase of 8%. 2/

See also how shareholders are rewarded with a 7% increase in the dividend. This comes out of those fees paid by local authorities for care and support. Investors rewarded while vulnerable families go without. 3/

The company paid almost £8 million in interest charges, with borrowings now just under £300 million. Some would say that this is reckless use of public money. 4/

The dividend payments takes another £4 million out of children& #39;s services (in just six months). Last year the company paid a total of £10 million in dividends, with the chairman and chief executive getting much of the money. 5/

Further proof that pandemics and recession are good for the business of children and young people in care.

As CareTech elegantly puts it, a "growing and evolving marketplace." 6/

As CareTech elegantly puts it, a "growing and evolving marketplace." 6/

Another triumph of privatisation and @theNAFP , and their many supporters who populate my timeline. Give yourselves a pat on the back. 7/

You can read all about CareTech& #39;s financials here 8/ https://www.londonstockexchange.com/news-article/CTH/interim-results/14582024">https://www.londonstockexchange.com/news-arti...

You can read more about the & #39;market& #39; here (together with responses from some of its supporters) https://twitter.com/MartinBarrow/status/1273325378602491904?s=19">https://twitter.com/MartinBar...

Read on Twitter

Read on Twitter