The typical debate within South Africa about offshore vs. onshore investment is mostly misplaced. The arguments brought forward by either group are typically based on past performance, with either side going as far back as is convenient to support their argument

What is typically missing in these arguments is a thorough review of what drove value creation and consequently stock market performance over the past decade, century or however far back you want to go and most importantly, how those value drivers are evolving going forward

In this thread, I share my thoughts on how local investors should think about the offshore vs onshore debate. However, instead of looking backwards, I will argue that investors should rather frame the debate in the context of economic attributes of tangible vs. intangible assets

2010 was a historical year for SA as the country became the first African nation to host the FIFA Soccer World Cup competition which brought a great deal of optimism & introduced the world to the eardrum-popping sounds of the vuvuzela. However far away from the frenzy, a rather..

..quieter revolution was also taking place. For the first time ever, global businesses in developed economies invested more capital into intangible assets (software, patents, intellectual IP, brands etc.) than they did in tangible assets (PPE: plant, property and equipment)

This was the momentous, although less glamorous occasion that marked the end of the 3rd industrial revolution & ushered in a new era referred to as the 4th industrial revolution. Below, I will show why this is the reason the US market outperformed JSE in the decade that followed

Going forward, this outperformance will likely persist until we start to see similar levels of investments into intangible assets by South African businesses. Th reason is that intangible assets have economic characteristics that are far more superior than tangible assets

Investments into intangible assets changes how value is created & reported in financial statements. Businesses build on physical assets usually require significant capital to produce incremental value & therefore typically have lower ROIC (Return on Invested Capital)

Think of typical retailers like PnP, a mine or manufacturing company. To grow revenues, each have to spend quite a bit of cash to open up new stores, dig a new shaft or buy new machinery. Similarly for property developers, new apartments require significant capital spend

On the other hand, businesses build on intangible assets like Google/Facebook can expand globally without much capex per new customer. The end result is that they typically grow revenues exponentially

$FB revenue: 2009 - $777m, 2019 - $70bn

$PnP revenue: 2009 - $8bn, 2019 - $6bn

$FB revenue: 2009 - $777m, 2019 - $70bn

$PnP revenue: 2009 - $8bn, 2019 - $6bn

There are several pieces of literature on intangible assets but the best is the 1996 seminal economic paper by economist William Arthur titled: Increasing Returns & the Two Worlds of Business where he articulated hw intangible assets impact value creation http://tuvalu.santafe.edu/~wbarthur/Papers/HBR.pdf">https://tuvalu.santafe.edu/~wbarthur...

William argued that the transition in the global business landscape where bulk-material & industrial companies that shaped the industrial age are being replaced by new-age businesses built on intangible assets necessitates a shift in the way investors analyze & value companies

Unlike industrial companies that exhibit diminishing marginal returns as they grow bigger, companies build on intangible assets exhibit opposite, i.e. they generate higher returns as they grow bigger. This powerful attribute is tipping markets towards winner take all dynamics

In a later build-up of the same proposition, Jonathan Haskell & Stian Westlake in their book "Capitalism Without Capital" illuminated ways in which the scale of intangibility deforms the familiar mechanism of the global market economy and hence value creation

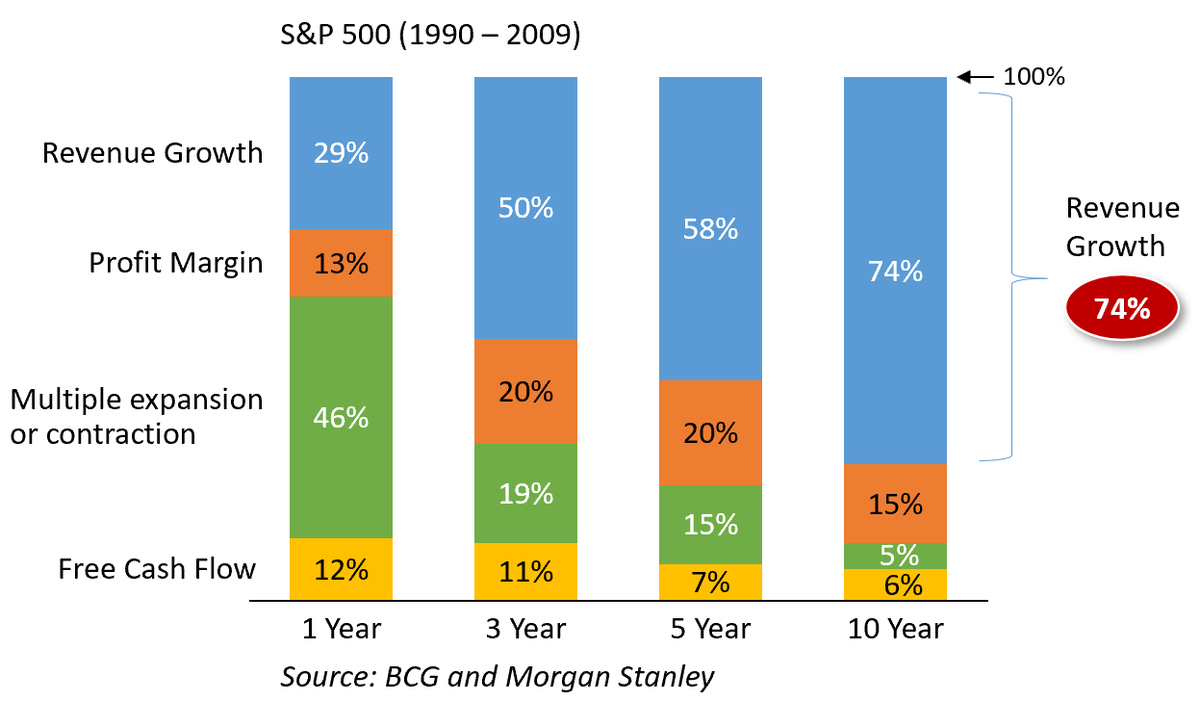

So why is revenue growth important to offshore stock market outperformance? The graph below explains. Revenue growth account for over 74% of stock price performance over a 10 year period. Because US companies grew revenue faster than SA companies, Wall Street outperformed the JSE

So the next time you thinking whether to invest onshore vs. offshore, just think about which markets are going to grow revenues faster over the next 10 years

Phew, enough gibberish for one day https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Lächelndes Gesicht mit offenem Mund und Angstschweiß" aria-label="Emoji: Lächelndes Gesicht mit offenem Mund und Angstschweiß">. Next time I will do a thread why intangible assets complicate financial analysis

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😅" title="Lächelndes Gesicht mit offenem Mund und Angstschweiß" aria-label="Emoji: Lächelndes Gesicht mit offenem Mund und Angstschweiß">. Next time I will do a thread why intangible assets complicate financial analysis

Phew, enough gibberish for one day

Read on Twitter

Read on Twitter