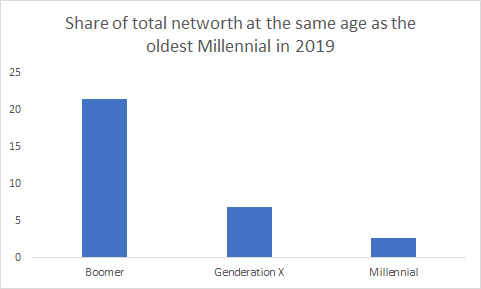

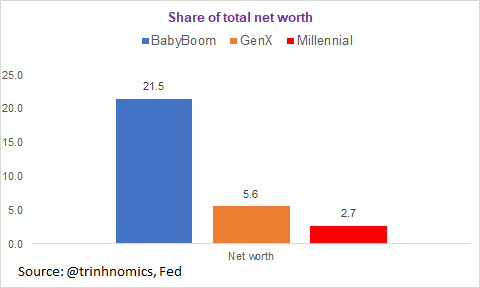

Are you ready? Here are the charts to visualize wealth distribution. The oldest millennial is 39 & if we compare generation for the same age period:

*In 1989, boomer had 21.5% of total wealth (we& #39;ll talk about distribution soon)

*In 2019, millennial of the same age has 2.7%

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">

*In 1989, boomer had 21.5% of total wealth (we& #39;ll talk about distribution soon)

*In 2019, millennial of the same age has 2.7%

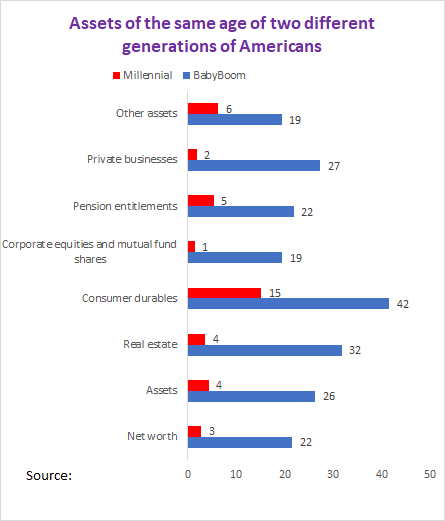

Ready? Here are the details of net worth & assets. Comparing Baby Boomer (BB) in 1989 versus Millennial (B) in 2019,

Baby Boomber in blue bars & Millennial in red bars. What do you see????

Details of assets also included below.

Baby Boomber in blue bars & Millennial in red bars. What do you see????

Details of assets also included below.

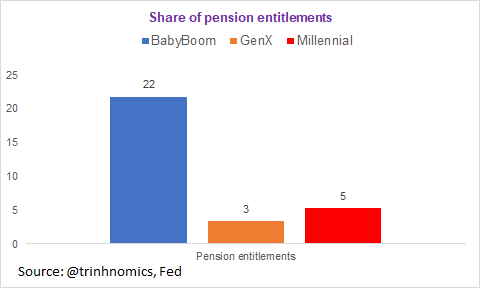

Let me show it differently by taking the difference between Baby Boomer versus the Millennial at the same age. The wealth gap by order of HIGHEST:

Real estate 28%

Durables 26

Private biz 26

Corporate equities & mutual fund shares 18

Pension entitlements 17

Assets 22

Networth 19

Real estate 28%

Durables 26

Private biz 26

Corporate equities & mutual fund shares 18

Pension entitlements 17

Assets 22

Networth 19

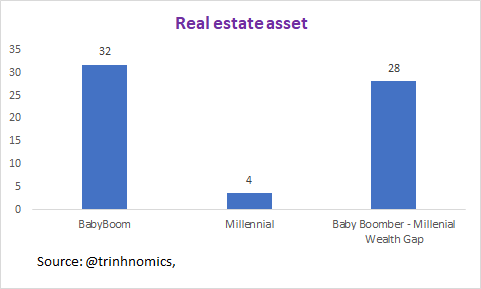

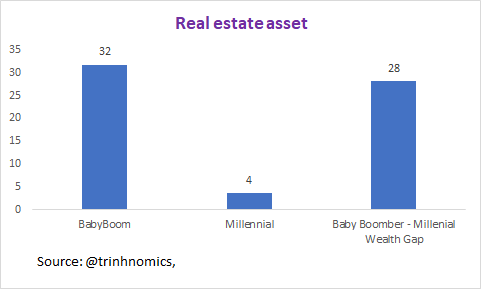

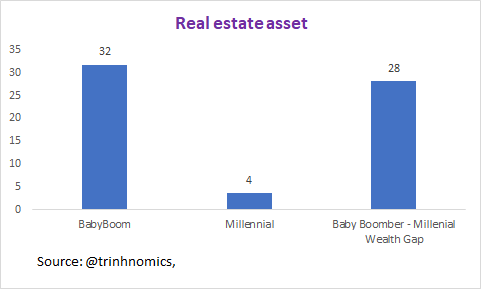

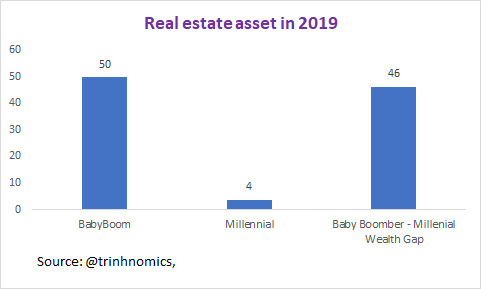

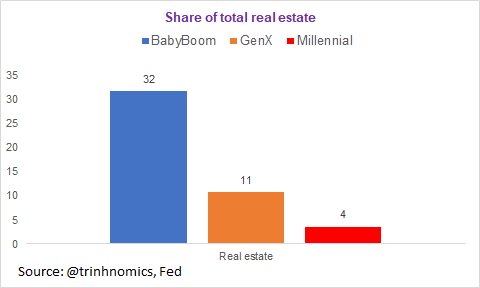

Basic human needs: SHELTER. Let& #39;s look at real asset share of ownership of Baby Boomer generation in 1989 vs Millennial in 2019 (same age):

Baby Boomer owned 32% of real estate https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏠" title="Haus" aria-label="Emoji: Haus"> assets in 1989

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏠" title="Haus" aria-label="Emoji: Haus"> assets in 1989

Millennial owned only 4% of real estate https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏠" title="Haus" aria-label="Emoji: Haus">assets in 2019

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏠" title="Haus" aria-label="Emoji: Haus">assets in 2019

The https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏠" title="Haus" aria-label="Emoji: Haus">gap is 28%

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏠" title="Haus" aria-label="Emoji: Haus">gap is 28%  https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">

Baby Boomer owned 32% of real estate

Millennial owned only 4% of real estate

The

Millennials, who are now approaching middle age, own only 4% of total housing assets in the USA, they are also not owning the following wealth: consumer durables.

When u think about what buying a house entails, can see a generation missing out.

House = leverage to build wealth.

When u think about what buying a house entails, can see a generation missing out.

House = leverage to build wealth.

When u put a down payment, whether 10 or 20% is a form of leverage with the bank who lends u the fund to pay off a house & if interest rates are LOW then u can accumulate wealth faster.

When u buy a house, u invest & commit & spend $ on things other than the self but community.

When u buy a house, u invest & commit & spend $ on things other than the self but community.

Property tax is a contribution to local community. Spending on gardening & landscaping not only enhances the soul (and even a food source) but also beautify the neigborhood. And then there are things to improve inside the house etc. Start thinking long-term vs short-term spending

We have a generation of Americans not part of this. Housing wealth is the best way to provide security when old (no more housing costs if paid off & what& #39;s left is property tax + insurance & maintenance) & also a source of security for the next generation.

This chart is scary https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">

This chart is scary

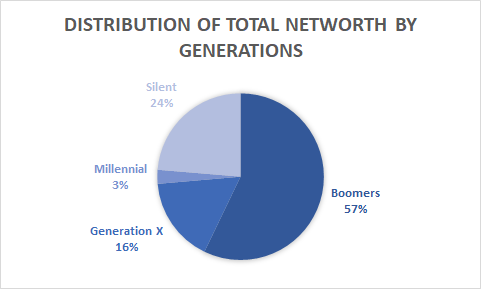

Why do I find it scary? Of the following consequence:

Boomer owns 57% of wealth in the USA & millennial only 4% & so when they die & they pass down the wealth, the divide WILL WIDEN b/n inherited wealth & NOT so less about merit & genetics.

Real estate is 50% vs 4% so same!

Boomer owns 57% of wealth in the USA & millennial only 4% & so when they die & they pass down the wealth, the divide WILL WIDEN b/n inherited wealth & NOT so less about merit & genetics.

Real estate is 50% vs 4% so same!

I gotta go to lunch but here are questions for you to ponder on the wealth gap:

a) What policy has led to this widening divide?

b) What can we do to rectify this worrying trend of deepening the divide & turn the US into more of a meritocracy so more people can be upwardly mobile?

a) What policy has led to this widening divide?

b) What can we do to rectify this worrying trend of deepening the divide & turn the US into more of a meritocracy so more people can be upwardly mobile?

Let& #39;s define a few things:

Boomers = Born 1946 to 1964

Generation X = 1965 to 1980

Millennial or Gen Y = 1981 to 1996

Let& #39;s look at the share of total net worth of the different generations at age 39:

Boomers = 21%

Gen X =7%

Millennial =3%

Boomers = Born 1946 to 1964

Generation X = 1965 to 1980

Millennial or Gen Y = 1981 to 1996

Let& #39;s look at the share of total net worth of the different generations at age 39:

Boomers = 21%

Gen X =7%

Millennial =3%

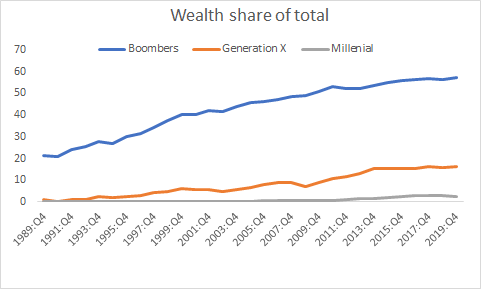

In 2020, age of the oldest of their respective generation:

Boomers = 74

Generation X = 55

Millennial = 39

And so they own by 2020 share of total wealth:

Boomers = 57%

Generation X = 17%

Millennial = 3%

Boomers = 74

Generation X = 55

Millennial = 39

And so they own by 2020 share of total wealth:

Boomers = 57%

Generation X = 17%

Millennial = 3%

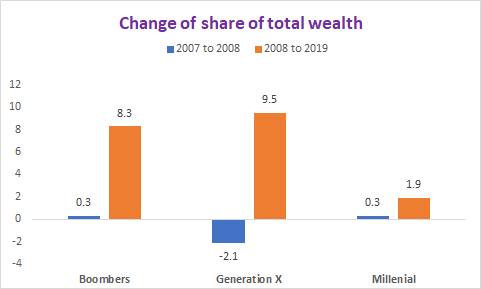

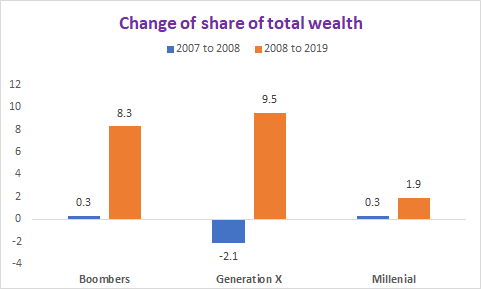

Okay you may like this - change of share of total wealth from:

2007 to 2008

and

2008 to 2019

Generation X lost a lot of wealth from 2008 to 2007. However, it gained the most from 2008 to 2019.

Millennial lagged both Boomers & Generation X people.

2007 to 2008

and

2008 to 2019

Generation X lost a lot of wealth from 2008 to 2007. However, it gained the most from 2008 to 2019.

Millennial lagged both Boomers & Generation X people.

In 2008, age of the oldest of the groups were:

Boomers: 62

Generation X: 43

Millennial: 27

Millennials didn& #39;t have much wealth to lose in 2007 (only 0.5% of total wealth) & from 2008 onward, lagged behind due to the job market & continued to fall behind in ownership of assets.

Boomers: 62

Generation X: 43

Millennial: 27

Millennials didn& #39;t have much wealth to lose in 2007 (only 0.5% of total wealth) & from 2008 onward, lagged behind due to the job market & continued to fall behind in ownership of assets.

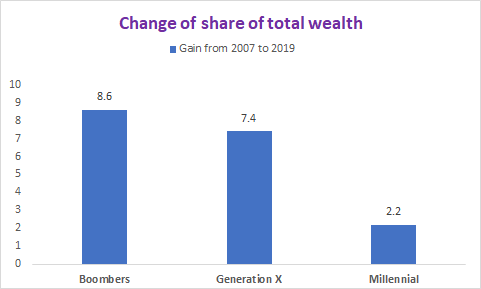

Change of share of total net worth from 2007 to 2019 by groups:

Boomers +8.6% of the wealth pie

Generation X +7.4% of total wealth pie

Millennial +2.2% to total wealth to reach to total wealth by 2019 of 2.7% of the total net worth pie.

We are in the slow train to adulthood. https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">

Boomers +8.6% of the wealth pie

Generation X +7.4% of total wealth pie

Millennial +2.2% to total wealth to reach to total wealth by 2019 of 2.7% of the total net worth pie.

We are in the slow train to adulthood.

Current distribution of net worth by age groups:

Silent 24%

Boomers 57%

Generation X 17%

Millennial 2.7%

Silent = Born between 1928 and 1945.

Silent 24%

Boomers 57%

Generation X 17%

Millennial 2.7%

Silent = Born between 1928 and 1945.

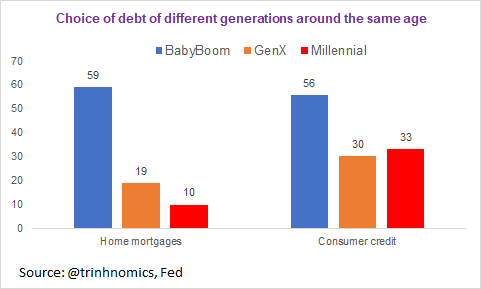

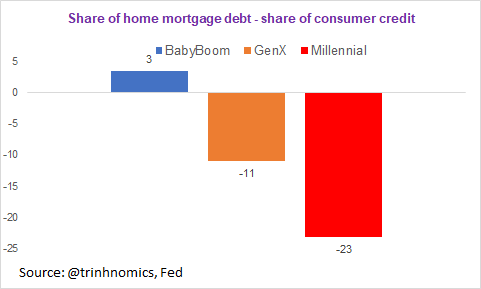

Urghhh, this is bad news. Let& #39;s look at our choice of private debt:

a) We have 33.1% of total consumer credit, and that is higher from 1.2% in 2008 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤢" title="Angewidertes Gesicht" aria-label="Emoji: Angewidertes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤢" title="Angewidertes Gesicht" aria-label="Emoji: Angewidertes Gesicht"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤢" title="Angewidertes Gesicht" aria-label="Emoji: Angewidertes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤢" title="Angewidertes Gesicht" aria-label="Emoji: Angewidertes Gesicht"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤢" title="Angewidertes Gesicht" aria-label="Emoji: Angewidertes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤢" title="Angewidertes Gesicht" aria-label="Emoji: Angewidertes Gesicht">

and the bad news is

b) We have even less home mortgages. Now only 9.9% of total & that& #39;s a decline from 12.1% in 2015.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😬" title="Grimasse schneidendes Gesicht" aria-label="Emoji: Grimasse schneidendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😬" title="Grimasse schneidendes Gesicht" aria-label="Emoji: Grimasse schneidendes Gesicht">

a) We have 33.1% of total consumer credit, and that is higher from 1.2% in 2008

and the bad news is

b) We have even less home mortgages. Now only 9.9% of total & that& #39;s a decline from 12.1% in 2015.

Liabilities of different generation: mortgages & consumer credit.

Baby Boom in 1989 at 59% of total home mortgages

Gen X in 2001 at 19% of total home mortgages

Millennial in 2019 10% of total home mortgages.

The gap between mortgages and consumer credit is scary for millennial

Baby Boom in 1989 at 59% of total home mortgages

Gen X in 2001 at 19% of total home mortgages

Millennial in 2019 10% of total home mortgages.

The gap between mortgages and consumer credit is scary for millennial

Let& #39;s talk about how we are so different at the same age as our elders (Boomers & Generation X):

Here I show the gap between share of total home mortgages and consumer credit.

Millennial leverage more consume vs investing in homes. The question is why we made these choices.

Here I show the gap between share of total home mortgages and consumer credit.

Millennial leverage more consume vs investing in homes. The question is why we made these choices.

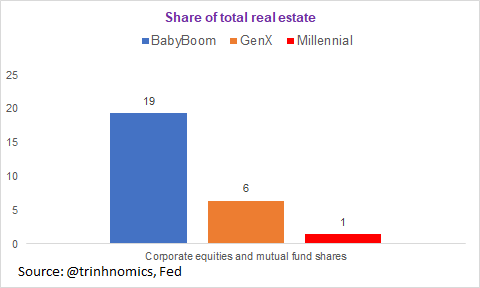

And finally, the charts to compare wealth between oldest Boomer, Gen X & Millennial at the same age. These 3 groups are the same age for the following years:

Boomer = 1989 (actually in 1986 but we don& #39;t have that data so use 1989)

Gen X = 2001

Millennial = 2019

Boomer = 1989 (actually in 1986 but we don& #39;t have that data so use 1989)

Gen X = 2001

Millennial = 2019

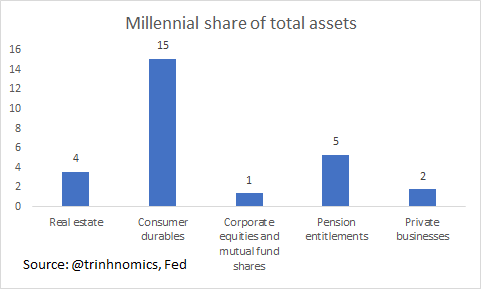

This is sad: millennial do not own FINANCIAL ASSETS. Our share of total is only 1% right now.

At our age, boomers at 19%.

How do we gain from low interest rates & free money from the Federal Reserve if we do not own much hard asset (housing) & very little financial asset.

At our age, boomers at 19%.

How do we gain from low interest rates & free money from the Federal Reserve if we do not own much hard asset (housing) & very little financial asset.

Some positive news: millennials are better than Generation X in terms of saving for retirement but behind the baby boomers by a long shot.

Millennials also don& #39;t own private businesses as our share of private business is only 2% vs Gen X at our age at 7% and Baby Boomer of 27%.

Here is a summary of what we OWN & sadly we don& #39;t own much hard assets & financial assets.

The question that& #39;ll be addressed at the next session will be:

*How did we get here?

*What can we do about it!

See you next time! https://abs.twimg.com/emoji/v2/... draggable="false" alt="👋🏻" title="Waving hand (heller Hautton)" aria-label="Emoji: Waving hand (heller Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👋🏻" title="Waving hand (heller Hautton)" aria-label="Emoji: Waving hand (heller Hautton)">

Sincerely,

@Trinhnomics (A millennial from CA in HK https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤗" title="Umarmendes Gesicht" aria-label="Emoji: Umarmendes Gesicht">)

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤗" title="Umarmendes Gesicht" aria-label="Emoji: Umarmendes Gesicht">)

The question that& #39;ll be addressed at the next session will be:

*How did we get here?

*What can we do about it!

See you next time!

Sincerely,

@Trinhnomics (A millennial from CA in HK

Read on Twitter

Read on Twitter " title="Are you ready? Here are the charts to visualize wealth distribution. The oldest millennial is 39 & if we compare generation for the same age period:*In 1989, boomer had 21.5% of total wealth (we& #39;ll talk about distribution soon)*In 2019, millennial of the same age has 2.7% https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">" class="img-responsive" style="max-width:100%;"/>

" title="Are you ready? Here are the charts to visualize wealth distribution. The oldest millennial is 39 & if we compare generation for the same age period:*In 1989, boomer had 21.5% of total wealth (we& #39;ll talk about distribution soon)*In 2019, millennial of the same age has 2.7% https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">" class="img-responsive" style="max-width:100%;"/>

assets in 1989Millennial owned only 4% of real estate https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏠" title="Haus" aria-label="Emoji: Haus">assets in 2019The https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏠" title="Haus" aria-label="Emoji: Haus">gap is 28% https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">" title="Basic human needs: SHELTER. Let& #39;s look at real asset share of ownership of Baby Boomer generation in 1989 vs Millennial in 2019 (same age):Baby Boomer owned 32% of real estate https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏠" title="Haus" aria-label="Emoji: Haus"> assets in 1989Millennial owned only 4% of real estate https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏠" title="Haus" aria-label="Emoji: Haus">assets in 2019The https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏠" title="Haus" aria-label="Emoji: Haus">gap is 28% https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">" class="img-responsive" style="max-width:100%;"/>

assets in 1989Millennial owned only 4% of real estate https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏠" title="Haus" aria-label="Emoji: Haus">assets in 2019The https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏠" title="Haus" aria-label="Emoji: Haus">gap is 28% https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">" title="Basic human needs: SHELTER. Let& #39;s look at real asset share of ownership of Baby Boomer generation in 1989 vs Millennial in 2019 (same age):Baby Boomer owned 32% of real estate https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏠" title="Haus" aria-label="Emoji: Haus"> assets in 1989Millennial owned only 4% of real estate https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏠" title="Haus" aria-label="Emoji: Haus">assets in 2019The https://abs.twimg.com/emoji/v2/... draggable="false" alt="🏠" title="Haus" aria-label="Emoji: Haus">gap is 28% https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">" class="img-responsive" style="max-width:100%;"/>

" title="We have a generation of Americans not part of this. Housing wealth is the best way to provide security when old (no more housing costs if paid off & what& #39;s left is property tax + insurance & maintenance) & also a source of security for the next generation.This chart is scaryhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">" class="img-responsive" style="max-width:100%;"/>

" title="We have a generation of Americans not part of this. Housing wealth is the best way to provide security when old (no more housing costs if paid off & what& #39;s left is property tax + insurance & maintenance) & also a source of security for the next generation.This chart is scaryhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">" class="img-responsive" style="max-width:100%;"/>

" title="Change of share of total net worth from 2007 to 2019 by groups:Boomers +8.6% of the wealth pieGeneration X +7.4% of total wealth pieMillennial +2.2% to total wealth to reach to total wealth by 2019 of 2.7% of the total net worth pie.We are in the slow train to adulthood.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">" class="img-responsive" style="max-width:100%;"/>

" title="Change of share of total net worth from 2007 to 2019 by groups:Boomers +8.6% of the wealth pieGeneration X +7.4% of total wealth pieMillennial +2.2% to total wealth to reach to total wealth by 2019 of 2.7% of the total net worth pie.We are in the slow train to adulthood.https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇🏻" title="Rückhand Zeigefinger nach unten (heller Hautton)" aria-label="Emoji: Rückhand Zeigefinger nach unten (heller Hautton)">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤢" title="Angewidertes Gesicht" aria-label="Emoji: Angewidertes Gesicht">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤢" title="Angewidertes Gesicht" aria-label="Emoji: Angewidertes Gesicht">and the bad news isb) We have even less home mortgages. Now only 9.9% of total & that& #39;s a decline from 12.1% in 2015.https://abs.twimg.com/emoji/v2/... draggable="false" alt="😬" title="Grimasse schneidendes Gesicht" aria-label="Emoji: Grimasse schneidendes Gesicht">" title="Urghhh, this is bad news. Let& #39;s look at our choice of private debt:a) We have 33.1% of total consumer credit, and that is higher from 1.2% in 2008 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤢" title="Angewidertes Gesicht" aria-label="Emoji: Angewidertes Gesicht">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤢" title="Angewidertes Gesicht" aria-label="Emoji: Angewidertes Gesicht">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤢" title="Angewidertes Gesicht" aria-label="Emoji: Angewidertes Gesicht">and the bad news isb) We have even less home mortgages. Now only 9.9% of total & that& #39;s a decline from 12.1% in 2015.https://abs.twimg.com/emoji/v2/... draggable="false" alt="😬" title="Grimasse schneidendes Gesicht" aria-label="Emoji: Grimasse schneidendes Gesicht">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤢" title="Angewidertes Gesicht" aria-label="Emoji: Angewidertes Gesicht">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤢" title="Angewidertes Gesicht" aria-label="Emoji: Angewidertes Gesicht">and the bad news isb) We have even less home mortgages. Now only 9.9% of total & that& #39;s a decline from 12.1% in 2015.https://abs.twimg.com/emoji/v2/... draggable="false" alt="😬" title="Grimasse schneidendes Gesicht" aria-label="Emoji: Grimasse schneidendes Gesicht">" title="Urghhh, this is bad news. Let& #39;s look at our choice of private debt:a) We have 33.1% of total consumer credit, and that is higher from 1.2% in 2008 https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤢" title="Angewidertes Gesicht" aria-label="Emoji: Angewidertes Gesicht">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤢" title="Angewidertes Gesicht" aria-label="Emoji: Angewidertes Gesicht">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤢" title="Angewidertes Gesicht" aria-label="Emoji: Angewidertes Gesicht">and the bad news isb) We have even less home mortgages. Now only 9.9% of total & that& #39;s a decline from 12.1% in 2015.https://abs.twimg.com/emoji/v2/... draggable="false" alt="😬" title="Grimasse schneidendes Gesicht" aria-label="Emoji: Grimasse schneidendes Gesicht">" class="img-responsive" style="max-width:100%;"/>

Sincerely, @Trinhnomics (A millennial from CA in HKhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🤗" title="Umarmendes Gesicht" aria-label="Emoji: Umarmendes Gesicht">)" title="Here is a summary of what we OWN & sadly we don& #39;t own much hard assets & financial assets.The question that& #39;ll be addressed at the next session will be:*How did we get here?*What can we do about it!See you next time!https://abs.twimg.com/emoji/v2/... draggable="false" alt="👋🏻" title="Waving hand (heller Hautton)" aria-label="Emoji: Waving hand (heller Hautton)">Sincerely, @Trinhnomics (A millennial from CA in HKhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🤗" title="Umarmendes Gesicht" aria-label="Emoji: Umarmendes Gesicht">)" class="img-responsive" style="max-width:100%;"/>

Sincerely, @Trinhnomics (A millennial from CA in HKhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🤗" title="Umarmendes Gesicht" aria-label="Emoji: Umarmendes Gesicht">)" title="Here is a summary of what we OWN & sadly we don& #39;t own much hard assets & financial assets.The question that& #39;ll be addressed at the next session will be:*How did we get here?*What can we do about it!See you next time!https://abs.twimg.com/emoji/v2/... draggable="false" alt="👋🏻" title="Waving hand (heller Hautton)" aria-label="Emoji: Waving hand (heller Hautton)">Sincerely, @Trinhnomics (A millennial from CA in HKhttps://abs.twimg.com/emoji/v2/... draggable="false" alt="🤗" title="Umarmendes Gesicht" aria-label="Emoji: Umarmendes Gesicht">)" class="img-responsive" style="max-width:100%;"/>