1 - $BTC #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">

https://abs.twimg.com/hashflags... draggable="false" alt="">

What is funding?

Perpetual swaps are a form of futures contract for Bitcoin.

A futures contract is an agreement between counter-parties to buy or sell an asset at an explicit price and date in the future.

What is funding?

Perpetual swaps are a form of futures contract for Bitcoin.

A futures contract is an agreement between counter-parties to buy or sell an asset at an explicit price and date in the future.

2 - $BTC #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">

https://abs.twimg.com/hashflags... draggable="false" alt="">

The buyer is obligated to buy the underlying asset a specific price once the contract expires,

and the seller is required to furnish the asset at the time of expiry.

1. Expiry date: There is no delivery date and expiry date in perpetual swap trading.

The buyer is obligated to buy the underlying asset a specific price once the contract expires,

and the seller is required to furnish the asset at the time of expiry.

1. Expiry date: There is no delivery date and expiry date in perpetual swap trading.

3 - $BTC #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">

https://abs.twimg.com/hashflags... draggable="false" alt="">

2. Funding: As there is no expiry date, a "funding" mechanism is used to anchor the perpetual swap price to spot market price. Funding occurs every 8 hours.

2. Funding: As there is no expiry date, a "funding" mechanism is used to anchor the perpetual swap price to spot market price. Funding occurs every 8 hours.

4 - $BTC #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">

https://abs.twimg.com/hashflags... draggable="false" alt="">

3. Mark Price provides a reasonable reference price based on spot index price and the moving average of basis. It helps to minimize negative impacts caused by abnormal volatility in the perpetual swap market.

3. Mark Price provides a reasonable reference price based on spot index price and the moving average of basis. It helps to minimize negative impacts caused by abnormal volatility in the perpetual swap market.

5 - $BTC #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">

https://abs.twimg.com/hashflags... draggable="false" alt="">

Funding = position value * funding rate (The funding rate is determined by the difference between contract price and spot index price).

* When the funding rate is positive, longs pay shorts.

* When it is negative shorts pay longs.

Funding = position value * funding rate (The funding rate is determined by the difference between contract price and spot index price).

* When the funding rate is positive, longs pay shorts.

* When it is negative shorts pay longs.

6 - $BTC #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">

https://abs.twimg.com/hashflags... draggable="false" alt="">

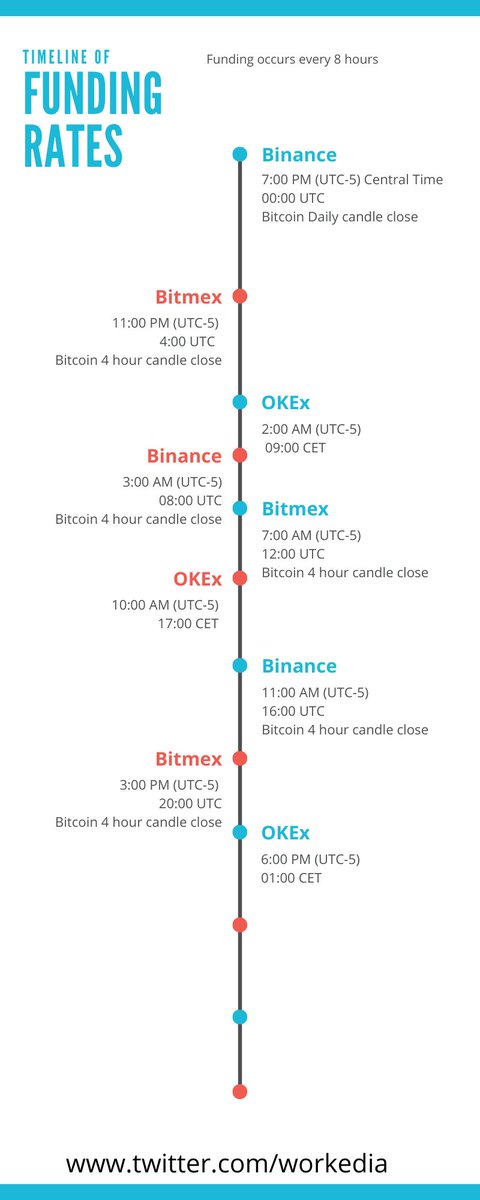

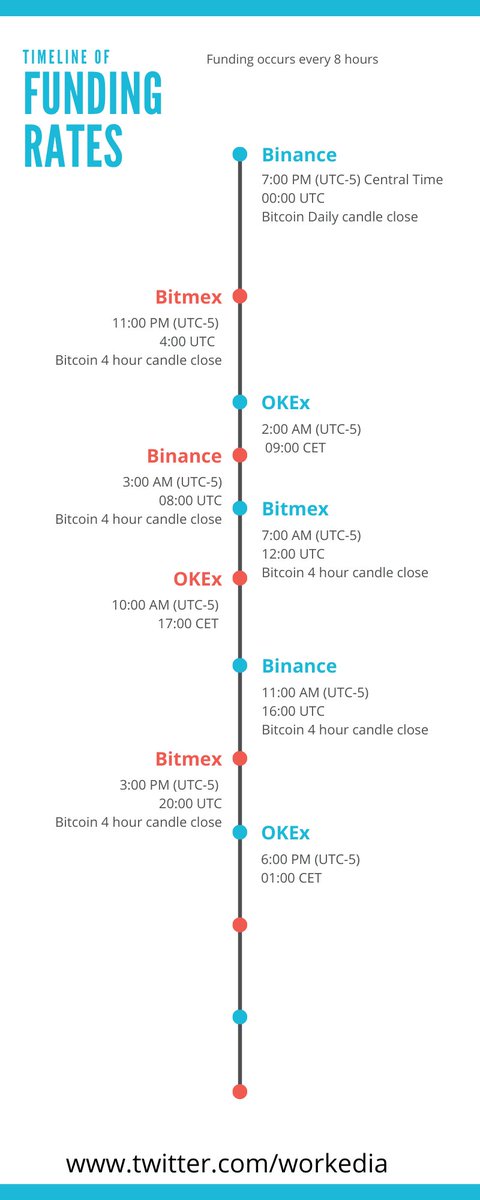

Perpetual Swap contracts don’t expire & charge funding rate at 3 predetermined times every day.

The funding payment, which is the size of your position plus the funding rate, is elicited every 8 hours at the below times:

Perpetual Swap contracts don’t expire & charge funding rate at 3 predetermined times every day.

The funding payment, which is the size of your position plus the funding rate, is elicited every 8 hours at the below times:

7 - $BTC #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">

https://abs.twimg.com/hashflags... draggable="false" alt="">

Funding rates based on Central timezone (UTC)

Bitmex:

Funding occurs every 8 hours at:

11:00 PM (UTC-5) 4:00 UTC - Bitcoin 4 hour candle close

7:00 AM (UTC-5) 12:00 UTC - Bitcoin 4 hour candle close

3:00 PM (UTC-5) 20:00 UTC - Bitcoin 4 hour candle close

Funding rates based on Central timezone (UTC)

Bitmex:

Funding occurs every 8 hours at:

11:00 PM (UTC-5) 4:00 UTC - Bitcoin 4 hour candle close

7:00 AM (UTC-5) 12:00 UTC - Bitcoin 4 hour candle close

3:00 PM (UTC-5) 20:00 UTC - Bitcoin 4 hour candle close

8 - $BTC #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">

https://abs.twimg.com/hashflags... draggable="false" alt="">

Binance Futures

Funding occurs every 8 hours at:

7:00 PM (UTC-5) 00:00 UTC - Bitcoin Daily candle close

3:00 AM (UTC-5) 08:00 UTC - Bitcoin 4 hour candle close

11:00 AM (UTC-5) 16:00 UTC - Bitcoin 4 hour candle close

Binance Futures

Funding occurs every 8 hours at:

7:00 PM (UTC-5) 00:00 UTC - Bitcoin Daily candle close

3:00 AM (UTC-5) 08:00 UTC - Bitcoin 4 hour candle close

11:00 AM (UTC-5) 16:00 UTC - Bitcoin 4 hour candle close

9 - $BTC #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">

https://abs.twimg.com/hashflags... draggable="false" alt="">

Okex Futures

Funding occurs every 8 hours at:

6:00 PM (UTC-5) 01:00 CET

2:00 AM (UTC-5) 09:00 CET

10:00 AM (UTC-5) 17:00 CET

Okex Futures

Funding occurs every 8 hours at:

6:00 PM (UTC-5) 01:00 CET

2:00 AM (UTC-5) 09:00 CET

10:00 AM (UTC-5) 17:00 CET

10 - $BTC #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">

https://abs.twimg.com/hashflags... draggable="false" alt="">

How to trade based on Funding?

Negative funding means that traders going against other traders (short vs. long) are rewarded for trading against the trend. If the funding rate is negative, shorts pay longs and vice versa for a positive funding rate.

How to trade based on Funding?

Negative funding means that traders going against other traders (short vs. long) are rewarded for trading against the trend. If the funding rate is negative, shorts pay longs and vice versa for a positive funding rate.

11 - $BTC #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">

https://abs.twimg.com/hashflags... draggable="false" alt="">

The funding is designed to keep the flow of perpetual contracts that do not expire. Since there’s no expiry with perpetual swaps, it is challenging for the price to converge on the index price.

The funding is designed to keep the flow of perpetual contracts that do not expire. Since there’s no expiry with perpetual swaps, it is challenging for the price to converge on the index price.

12 - $BTC #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">

https://abs.twimg.com/hashflags... draggable="false" alt="">

The result is that traders are incentivized to open or close certain positions, which focalize the contract price on the index price using interest payments transferred between the long and short traders.

The result is that traders are incentivized to open or close certain positions, which focalize the contract price on the index price using interest payments transferred between the long and short traders.

13 - $BTC #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">

https://abs.twimg.com/hashflags... draggable="false" alt="">

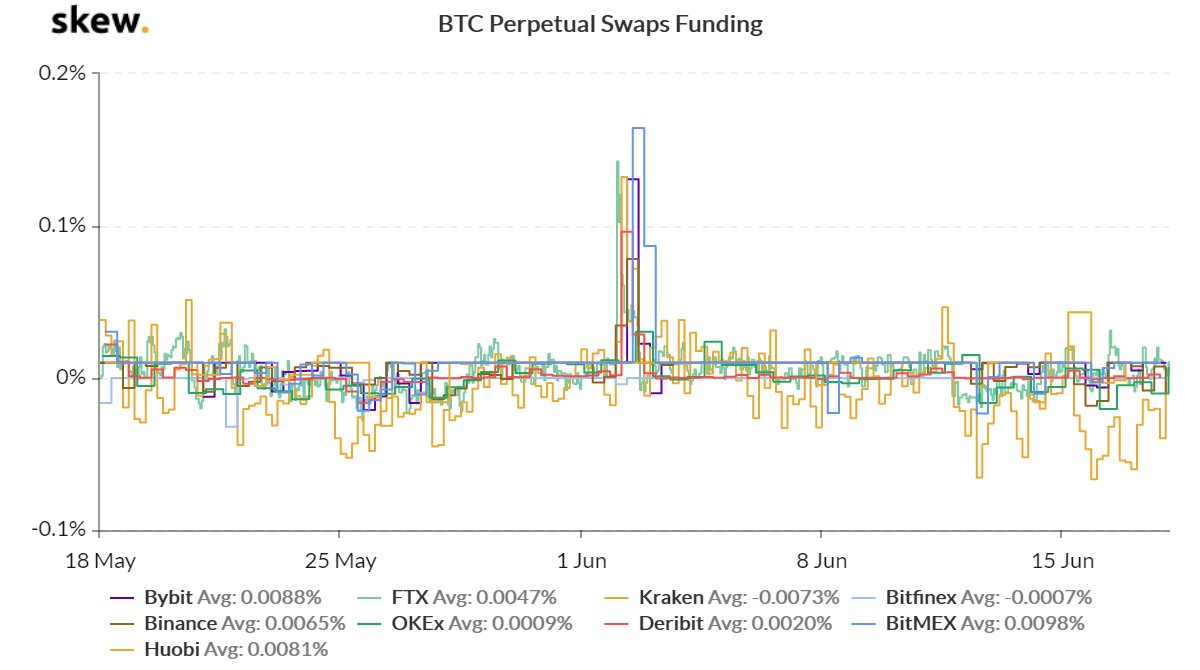

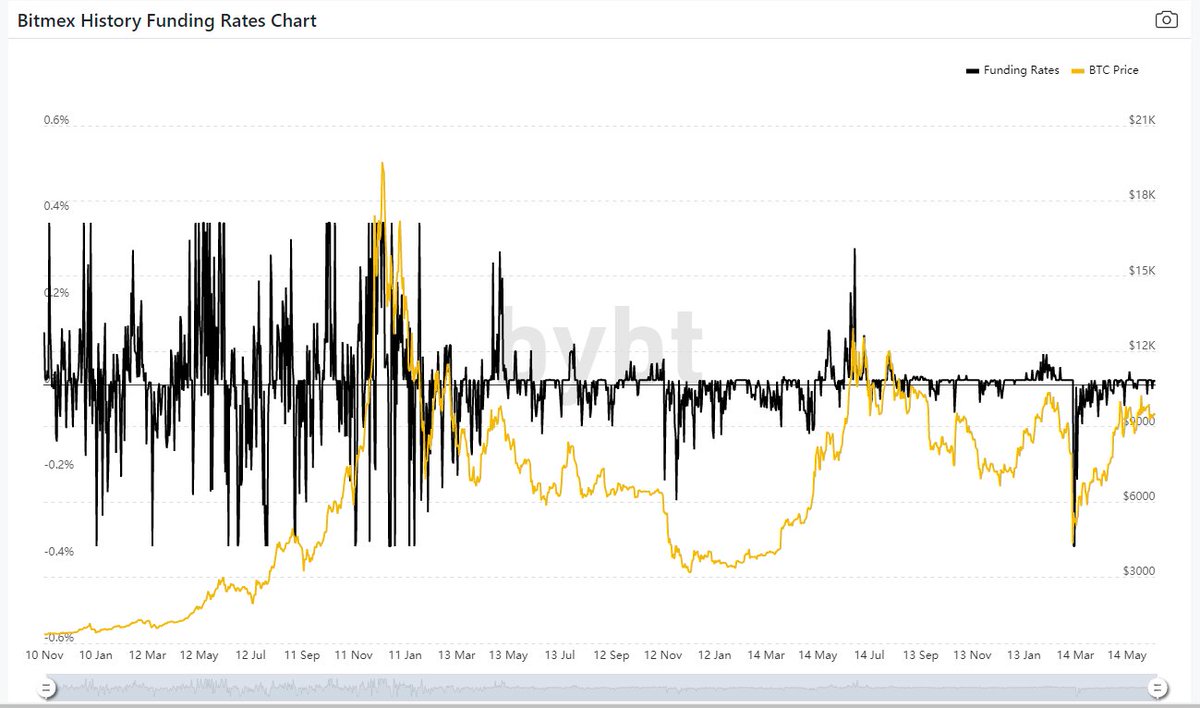

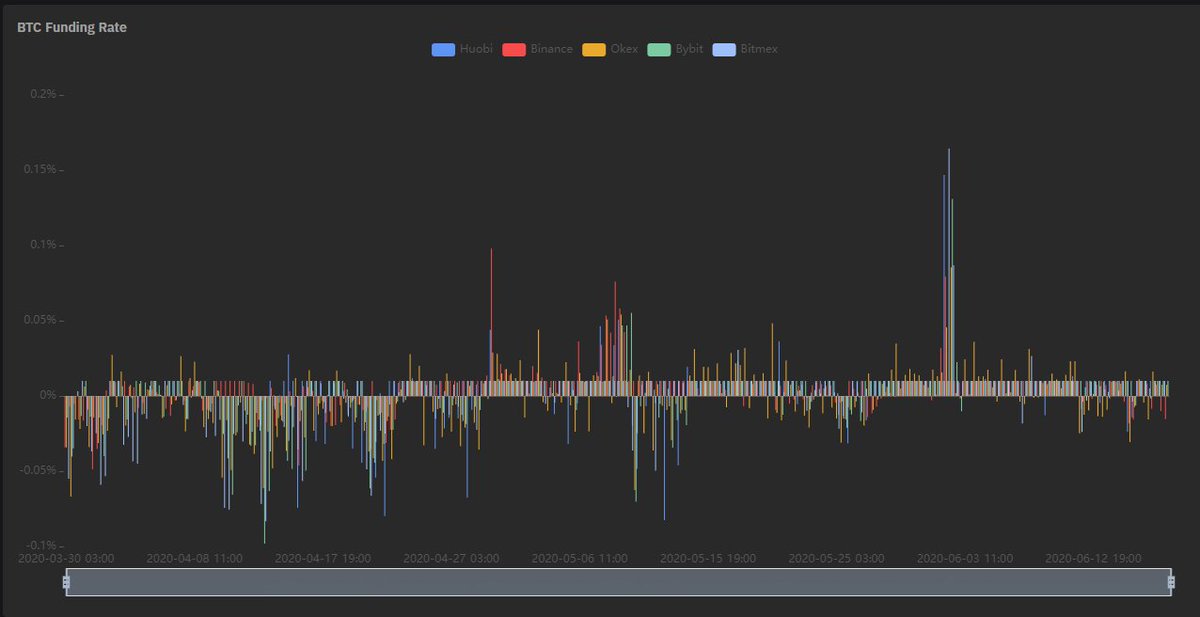

Funding rates history

Based on March-June, 2020

Neutral positive rates (0.01%)

Neutral negative rates (-0.01%

Positive rates (0.1%)

Negative rates (-0.1%)

Extreme positive (0.3%)

Extreme negative (-0.34%)

Funding rates history

Based on March-June, 2020

Neutral positive rates (0.01%)

Neutral negative rates (-0.01%

Positive rates (0.1%)

Negative rates (-0.1%)

Extreme positive (0.3%)

Extreme negative (-0.34%)

14 - $BTC #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">

https://abs.twimg.com/hashflags... draggable="false" alt="">

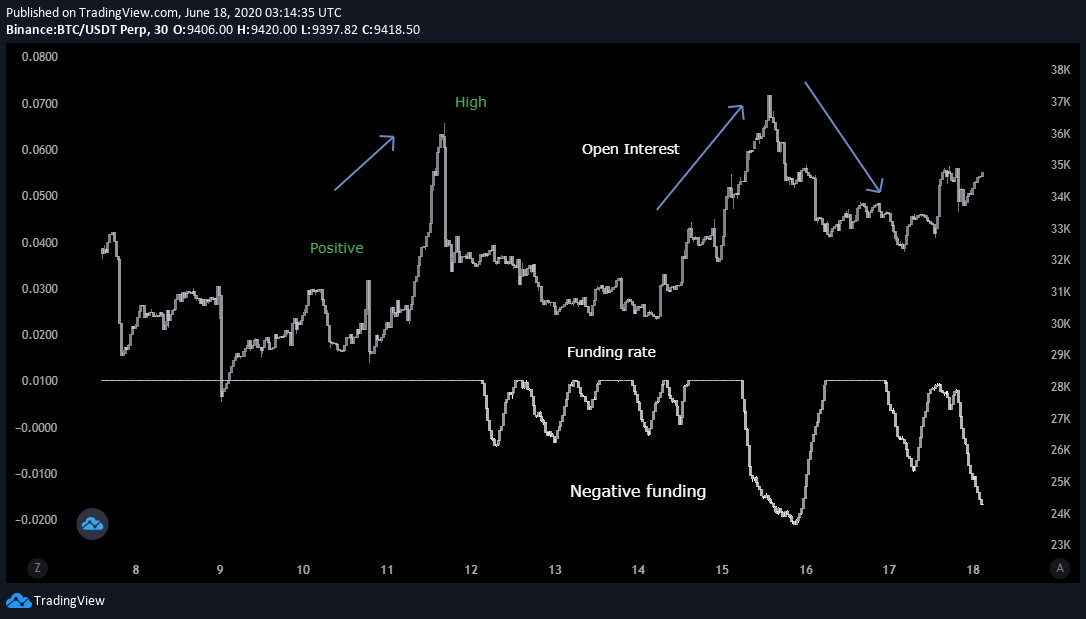

Funding rates strategy

1. Bullish

Price - rising

Open interest - rising

Funding - falling to Extreme negative

Liquidation - Longs get liquidated (big size)

Funding rates strategy

1. Bullish

Price - rising

Open interest - rising

Funding - falling to Extreme negative

Liquidation - Longs get liquidated (big size)

15 - $BTC #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">

https://abs.twimg.com/hashflags... draggable="false" alt="">

2. Moderately Bearish

Price - falling

Open interest - falling

Funding - Neutral

Liquidation - None

2. Moderately Bearish

Price - falling

Open interest - falling

Funding - Neutral

Liquidation - None

16 - $BTC #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">

https://abs.twimg.com/hashflags... draggable="false" alt="">

3. Bearish

Price - falling

Open interest - rising

Funding - rising to Extreme positive

Liquidation - Shorts get liquidated (big size)

3. Bearish

Price - falling

Open interest - rising

Funding - rising to Extreme positive

Liquidation - Shorts get liquidated (big size)

17 - $BTC #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">

https://abs.twimg.com/hashflags... draggable="false" alt="">

2. Moderately Bullish

Price - rising

Open interest - falling

Funding - Neutral

Liquidation - None

2. Moderately Bullish

Price - rising

Open interest - falling

Funding - Neutral

Liquidation - None

18 - $BTC #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">

https://abs.twimg.com/hashflags... draggable="false" alt="">

Notes: In strong trends, funding can be ignored. Buyers/sellers are paying high price to stay in trend. That can result in violent price swings, long or short squeezes.

Notes: In strong trends, funding can be ignored. Buyers/sellers are paying high price to stay in trend. That can result in violent price swings, long or short squeezes.

19 - $BTC #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">

https://abs.twimg.com/hashflags... draggable="false" alt="">

Tools used:

https://pro.bybt.com/futures/FundingRates">https://pro.bybt.com/futures/F... @bybt_com

https://www.binance.com/en/futures/funding-history/3

https://www.binance.com/en/future... href=" https://coinalyze.net/bitcoin/usdt/binance/btcusdt_perp/price-chart-live/">https://coinalyze.net/bitcoin/u... @coinalyzetool

https://www.okex.com/markets/futures-data/btc-usd-weekly

https://www.okex.com/markets/f... href=" https://www.coingecko.com/en/exchanges/derivatives

https://www.coingecko.com/en/exchan... href=" https://www.tradingview.com/script/exvN2QgD-BitMEX-Funding-and-Premium-Index-NeoButane/

https://www.tradingview.com/script/ex... href=" https://trdr.io/console ">https://trdr.io/console&q... @TRDR_io https://analytics.skew.com/dashboard/bitcoin-futures">https://analytics.skew.com/dashboard...

Tools used:

https://pro.bybt.com/futures/FundingRates">https://pro.bybt.com/futures/F... @bybt_com

https://www.binance.com/en/futures/funding-history/3

https://www.okex.com/markets/futures-data/btc-usd-weekly

Read on Twitter

Read on Twitter What is funding?Perpetual swaps are a form of futures contract for Bitcoin. A futures contract is an agreement between counter-parties to buy or sell an asset at an explicit price and date in the future." title="1 - $BTC #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> What is funding?Perpetual swaps are a form of futures contract for Bitcoin. A futures contract is an agreement between counter-parties to buy or sell an asset at an explicit price and date in the future.">

What is funding?Perpetual swaps are a form of futures contract for Bitcoin. A futures contract is an agreement between counter-parties to buy or sell an asset at an explicit price and date in the future." title="1 - $BTC #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> What is funding?Perpetual swaps are a form of futures contract for Bitcoin. A futures contract is an agreement between counter-parties to buy or sell an asset at an explicit price and date in the future.">

What is funding?Perpetual swaps are a form of futures contract for Bitcoin. A futures contract is an agreement between counter-parties to buy or sell an asset at an explicit price and date in the future." title="1 - $BTC #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> What is funding?Perpetual swaps are a form of futures contract for Bitcoin. A futures contract is an agreement between counter-parties to buy or sell an asset at an explicit price and date in the future.">

What is funding?Perpetual swaps are a form of futures contract for Bitcoin. A futures contract is an agreement between counter-parties to buy or sell an asset at an explicit price and date in the future." title="1 - $BTC #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> What is funding?Perpetual swaps are a form of futures contract for Bitcoin. A futures contract is an agreement between counter-parties to buy or sell an asset at an explicit price and date in the future.">

3. Mark Price provides a reasonable reference price based on spot index price and the moving average of basis. It helps to minimize negative impacts caused by abnormal volatility in the perpetual swap market." title="4 - $BTC #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> 3. Mark Price provides a reasonable reference price based on spot index price and the moving average of basis. It helps to minimize negative impacts caused by abnormal volatility in the perpetual swap market." class="img-responsive" style="max-width:100%;"/>

3. Mark Price provides a reasonable reference price based on spot index price and the moving average of basis. It helps to minimize negative impacts caused by abnormal volatility in the perpetual swap market." title="4 - $BTC #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> 3. Mark Price provides a reasonable reference price based on spot index price and the moving average of basis. It helps to minimize negative impacts caused by abnormal volatility in the perpetual swap market." class="img-responsive" style="max-width:100%;"/>

Funding rates based on Central timezone (UTC)Bitmex:Funding occurs every 8 hours at:11:00 PM (UTC-5) 4:00 UTC - Bitcoin 4 hour candle close7:00 AM (UTC-5) 12:00 UTC - Bitcoin 4 hour candle close3:00 PM (UTC-5) 20:00 UTC - Bitcoin 4 hour candle close" title="7 - $BTC #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> Funding rates based on Central timezone (UTC)Bitmex:Funding occurs every 8 hours at:11:00 PM (UTC-5) 4:00 UTC - Bitcoin 4 hour candle close7:00 AM (UTC-5) 12:00 UTC - Bitcoin 4 hour candle close3:00 PM (UTC-5) 20:00 UTC - Bitcoin 4 hour candle close" class="img-responsive" style="max-width:100%;"/>

Funding rates based on Central timezone (UTC)Bitmex:Funding occurs every 8 hours at:11:00 PM (UTC-5) 4:00 UTC - Bitcoin 4 hour candle close7:00 AM (UTC-5) 12:00 UTC - Bitcoin 4 hour candle close3:00 PM (UTC-5) 20:00 UTC - Bitcoin 4 hour candle close" title="7 - $BTC #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> Funding rates based on Central timezone (UTC)Bitmex:Funding occurs every 8 hours at:11:00 PM (UTC-5) 4:00 UTC - Bitcoin 4 hour candle close7:00 AM (UTC-5) 12:00 UTC - Bitcoin 4 hour candle close3:00 PM (UTC-5) 20:00 UTC - Bitcoin 4 hour candle close" class="img-responsive" style="max-width:100%;"/>

How to trade based on Funding?Negative funding means that traders going against other traders (short vs. long) are rewarded for trading against the trend. If the funding rate is negative, shorts pay longs and vice versa for a positive funding rate." title="10 - $BTC #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> How to trade based on Funding?Negative funding means that traders going against other traders (short vs. long) are rewarded for trading against the trend. If the funding rate is negative, shorts pay longs and vice versa for a positive funding rate." class="img-responsive" style="max-width:100%;"/>

How to trade based on Funding?Negative funding means that traders going against other traders (short vs. long) are rewarded for trading against the trend. If the funding rate is negative, shorts pay longs and vice versa for a positive funding rate." title="10 - $BTC #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> How to trade based on Funding?Negative funding means that traders going against other traders (short vs. long) are rewarded for trading against the trend. If the funding rate is negative, shorts pay longs and vice versa for a positive funding rate." class="img-responsive" style="max-width:100%;"/>

Funding rates historyBased on March-June, 2020Neutral positive rates (0.01%)Neutral negative rates (-0.01%Positive rates (0.1%)Negative rates (-0.1%)Extreme positive (0.3%)Extreme negative (-0.34%)" title="13 - $BTC #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> Funding rates historyBased on March-June, 2020Neutral positive rates (0.01%)Neutral negative rates (-0.01%Positive rates (0.1%)Negative rates (-0.1%)Extreme positive (0.3%)Extreme negative (-0.34%)" class="img-responsive" style="max-width:100%;"/>

Funding rates historyBased on March-June, 2020Neutral positive rates (0.01%)Neutral negative rates (-0.01%Positive rates (0.1%)Negative rates (-0.1%)Extreme positive (0.3%)Extreme negative (-0.34%)" title="13 - $BTC #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> Funding rates historyBased on March-June, 2020Neutral positive rates (0.01%)Neutral negative rates (-0.01%Positive rates (0.1%)Negative rates (-0.1%)Extreme positive (0.3%)Extreme negative (-0.34%)" class="img-responsive" style="max-width:100%;"/>

Funding rates strategy1. BullishPrice - risingOpen interest - risingFunding - falling to Extreme negativeLiquidation - Longs get liquidated (big size)" title="14 - $BTC #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt="">Funding rates strategy1. BullishPrice - risingOpen interest - risingFunding - falling to Extreme negativeLiquidation - Longs get liquidated (big size)" class="img-responsive" style="max-width:100%;"/>

Funding rates strategy1. BullishPrice - risingOpen interest - risingFunding - falling to Extreme negativeLiquidation - Longs get liquidated (big size)" title="14 - $BTC #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt="">Funding rates strategy1. BullishPrice - risingOpen interest - risingFunding - falling to Extreme negativeLiquidation - Longs get liquidated (big size)" class="img-responsive" style="max-width:100%;"/>

2. Moderately BearishPrice - fallingOpen interest - fallingFunding - NeutralLiquidation - None" title="15 - $BTC #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> 2. Moderately BearishPrice - fallingOpen interest - fallingFunding - NeutralLiquidation - None" class="img-responsive" style="max-width:100%;"/>

2. Moderately BearishPrice - fallingOpen interest - fallingFunding - NeutralLiquidation - None" title="15 - $BTC #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> 2. Moderately BearishPrice - fallingOpen interest - fallingFunding - NeutralLiquidation - None" class="img-responsive" style="max-width:100%;"/>

3. BearishPrice - fallingOpen interest - risingFunding - rising to Extreme positiveLiquidation - Shorts get liquidated (big size)" title="16 - $BTC #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> 3. BearishPrice - fallingOpen interest - risingFunding - rising to Extreme positiveLiquidation - Shorts get liquidated (big size)" class="img-responsive" style="max-width:100%;"/>

3. BearishPrice - fallingOpen interest - risingFunding - rising to Extreme positiveLiquidation - Shorts get liquidated (big size)" title="16 - $BTC #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> 3. BearishPrice - fallingOpen interest - risingFunding - rising to Extreme positiveLiquidation - Shorts get liquidated (big size)" class="img-responsive" style="max-width:100%;"/>

2. Moderately BullishPrice - risingOpen interest - fallingFunding - NeutralLiquidation - None" title="17 - $BTC #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> 2. Moderately BullishPrice - risingOpen interest - fallingFunding - NeutralLiquidation - None" class="img-responsive" style="max-width:100%;"/>

2. Moderately BullishPrice - risingOpen interest - fallingFunding - NeutralLiquidation - None" title="17 - $BTC #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> 2. Moderately BullishPrice - risingOpen interest - fallingFunding - NeutralLiquidation - None" class="img-responsive" style="max-width:100%;"/>

Notes: In strong trends, funding can be ignored. Buyers/sellers are paying high price to stay in trend. That can result in violent price swings, long or short squeezes." title="18 - $BTC #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> Notes: In strong trends, funding can be ignored. Buyers/sellers are paying high price to stay in trend. That can result in violent price swings, long or short squeezes." class="img-responsive" style="max-width:100%;"/>

Notes: In strong trends, funding can be ignored. Buyers/sellers are paying high price to stay in trend. That can result in violent price swings, long or short squeezes." title="18 - $BTC #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> Notes: In strong trends, funding can be ignored. Buyers/sellers are paying high price to stay in trend. That can result in violent price swings, long or short squeezes." class="img-responsive" style="max-width:100%;"/>