Hope my earlier thread on Supertrend indicator was informative.

If so, let us discuss an interesting concept based on Supertrend indicator. Before that let us deconstruct the popular moving average indicator. https://twitter.com/Prashantshah267/status/1271829551216091137">https://twitter.com/Prashants...

If so, let us discuss an interesting concept based on Supertrend indicator. Before that let us deconstruct the popular moving average indicator. https://twitter.com/Prashantshah267/status/1271829551216091137">https://twitter.com/Prashants...

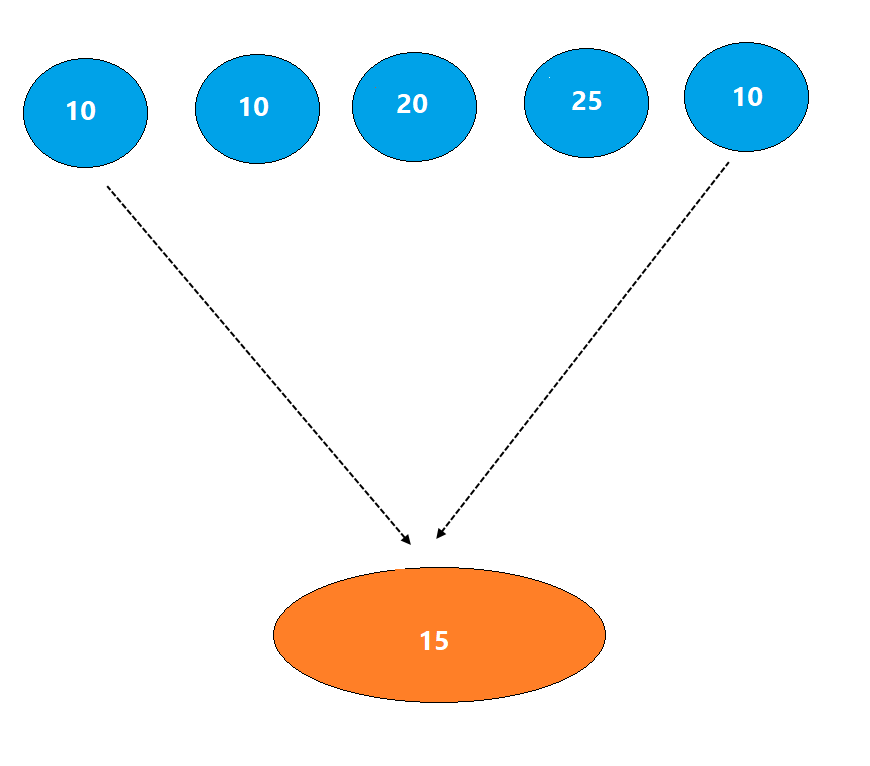

Moving average is a basic and popular indicator. Let us do a case study with a simple 5-period moving average. Have a look at the example below. This a simple average of 5 prices.

When the next price is printed, we drop the first price and the average is calculated for last 5 prices that includes the newly printed price. Hence, this is known as a moving average.

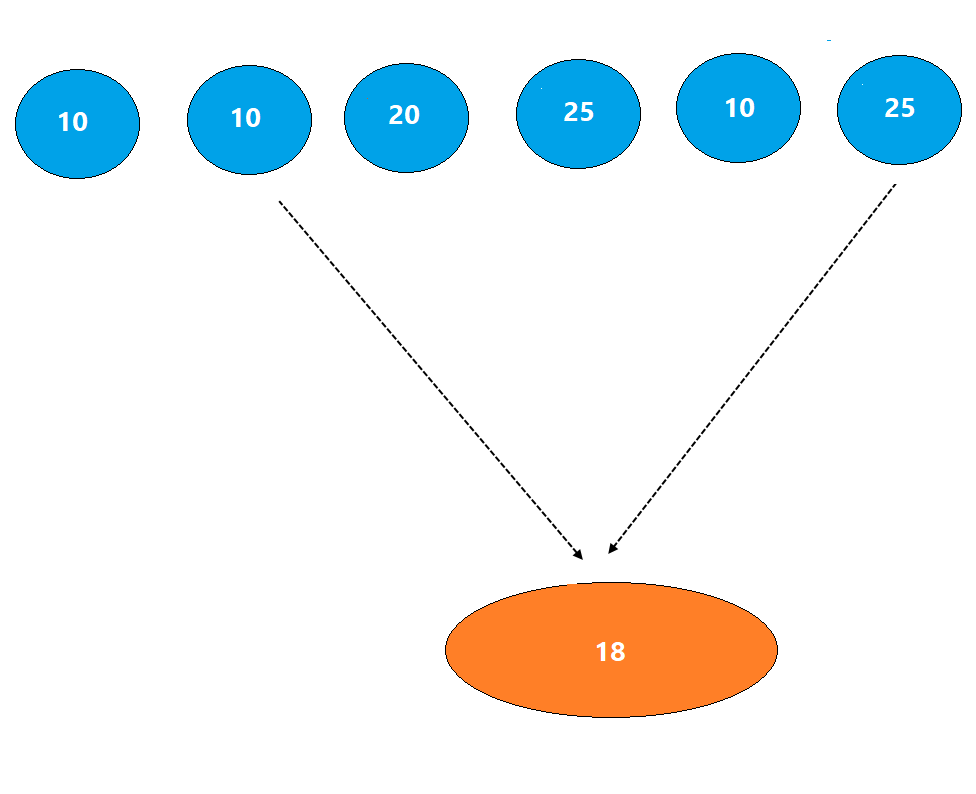

In the above example, a new price is printed at 25. We drop the first price that is 10 and calculate the average of last 5 prices. The average of the last five prices is at 18 now.

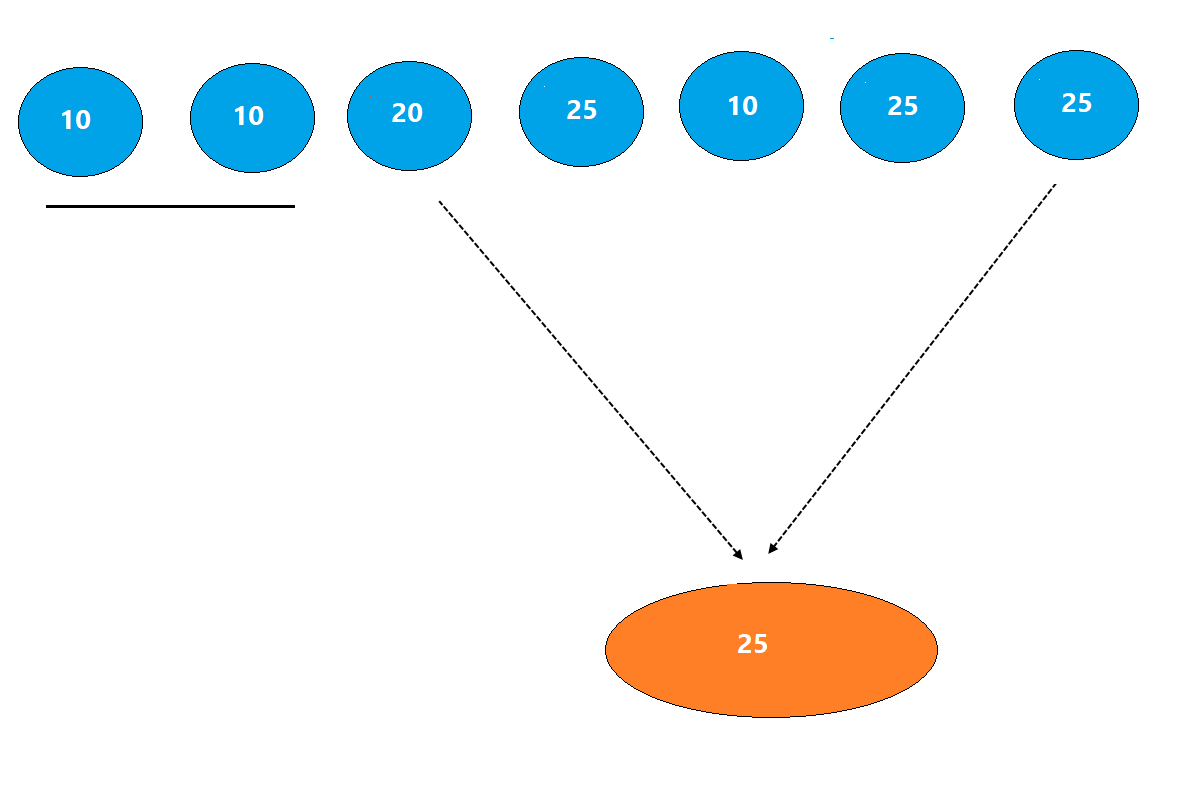

Because the first price was dropped from the calculation and the last five or the most recent 5 prices are taken for calculation. The second price which is 10 was dropped, and the last or new price of 25 added. This is known as a drop-off effect.

You may wonder how different is moving average from super trend.

Moving average plots average of price while the supertrend is a volatility based average line.

Moving average plots average of price while the supertrend is a volatility based average line.

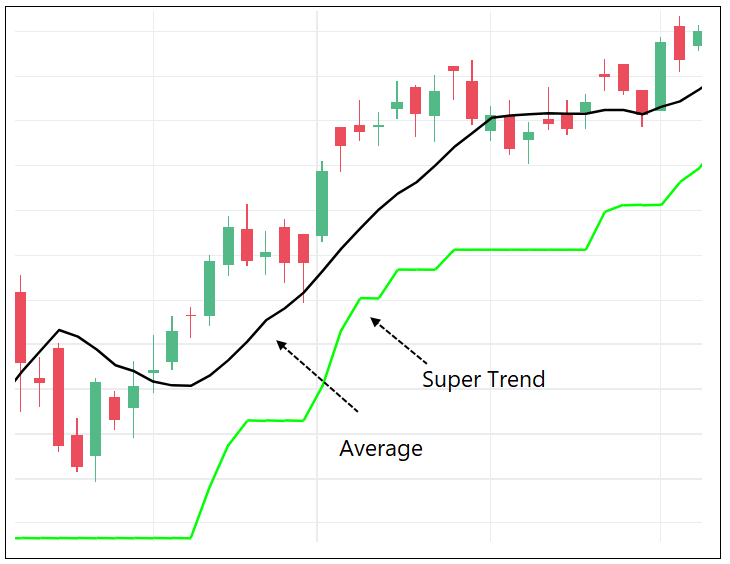

Did you ever wonder what would it show, if we plot both on the charts?

A 10-day moving average represents average price of last 10 bars. A 10,3 supertrend line would show value based on average volatility of last 10 bars.

A 10-day moving average represents average price of last 10 bars. A 10,3 supertrend line would show value based on average volatility of last 10 bars.

During strong trends, price tend to stay afloat above or below the super trend line.

When the price is trading below moving average, but above the super trend, it is highly likely that the super trend will be flat in that scenario.

Why?

When the price is trading below moving average, but above the super trend, it is highly likely that the super trend will be flat in that scenario.

Why?

Because there is a correction in the short-term as indicated by the price dropping below moving average and with rising volatility against the trend which is reflected by the flat trend in the Supertrend.

Let’s amalgamate the moving average indicator with supertrend to develop a new indicator called the MAST.

MA-for moving average and ST for Supertrend.

MA-for moving average and ST for Supertrend.

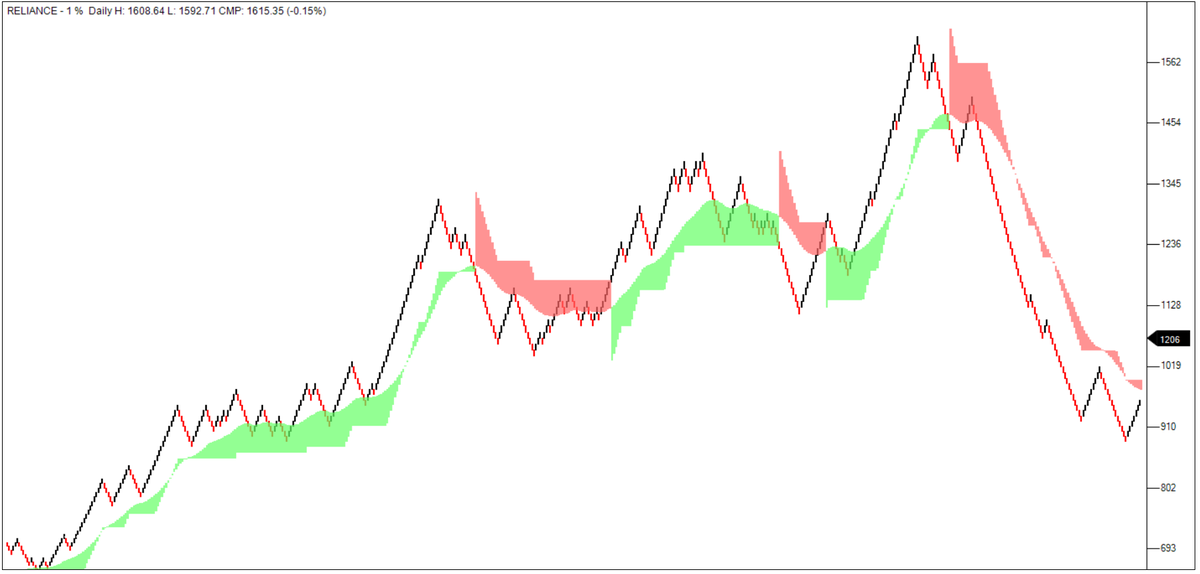

We combine both these indicators and plot them together on the chart. Both the indicators plotted together creates a band.

Band is coloured green when price is above super trend and turns red when price is below super trend.

Band is coloured green when price is above super trend and turns red when price is below super trend.

When the price is within the green band, it means price is below the moving average but above the super trend. When price is within the red band, it means it is trading above the moving average but below super trend. Default parameters are 10 for MA and 10, 3 for ST.

From a trading perspective, here is what you can do with the MAST indicator:

When the price is above the MAST band, look for bullish continuation price patterns

When the price is within the green band, look for bullish reversal patterns

When the price is above the MAST band, look for bullish continuation price patterns

When the price is within the green band, look for bullish reversal patterns

When the price is below the band, look for bearish continuation patterns

When the price is within the red band, then look for bearish reversal patterns

When the price is within the red band, then look for bearish reversal patterns

Study both the indicators and you will discover many possibilities from a trading perspective. Remember, objective price patterns can help you plan and execute the trades in conjunction with the MAST indicator.

Read on Twitter

Read on Twitter