The World’s Last Hope to Fight the Dollar

My most important thread so far!

Have a read and comment! Thank you

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🙏" title="Folded hands" aria-label="Emoji: Folded hands"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤛" title="Nach links zeigende Faust" aria-label="Emoji: Nach links zeigende Faust">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤛" title="Nach links zeigende Faust" aria-label="Emoji: Nach links zeigende Faust"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten">

My most important thread so far!

Have a read and comment! Thank you

1/This is a thread to all #Bitcoiners and #Ethereans. While tribal infighting is unabated, many parts around the globe are only just waking up to the fact that #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> and #Ether are the world’s best chance to ultimately fight the global dollar standard (by first promoting it).

https://abs.twimg.com/hashflags... draggable="false" alt=""> and #Ether are the world’s best chance to ultimately fight the global dollar standard (by first promoting it).

2/Our world is ailing under a crushing dollar yoke. After the world wars, the dollar has started its meteoric rise to dominance. Not only did the United States hold most of the world’s gold reserves but also most of its productive capital.

3/Postwar Europe would be importing goods from the US and paying for them in dollars. At the same time, the US would import oil in great quantities making payment in dollars. Until the end of Bretton Woods, the dollar would be the last currency to be pegged to gold directly.

4/All of this made the dollar into a reserve currency. Even the US’s default & going of gold would not lastingly hurt the US dollar. On the contrary: To this day, US treasuries providing the world’s deepest capital market serve as a safe haven in times of financial turmoil.

5/In his carefully researched book @EswarSPrasad highlights how the US dollar has tightened the grip on global finance. A dysfunctional international monetary system and US policies have paradoxically strengthened the dollar’s importance. https://www.amazon.com/Dollar-Trap-Tightened-Global-Finance/dp/0691168520">https://www.amazon.com/Dollar-Tr...

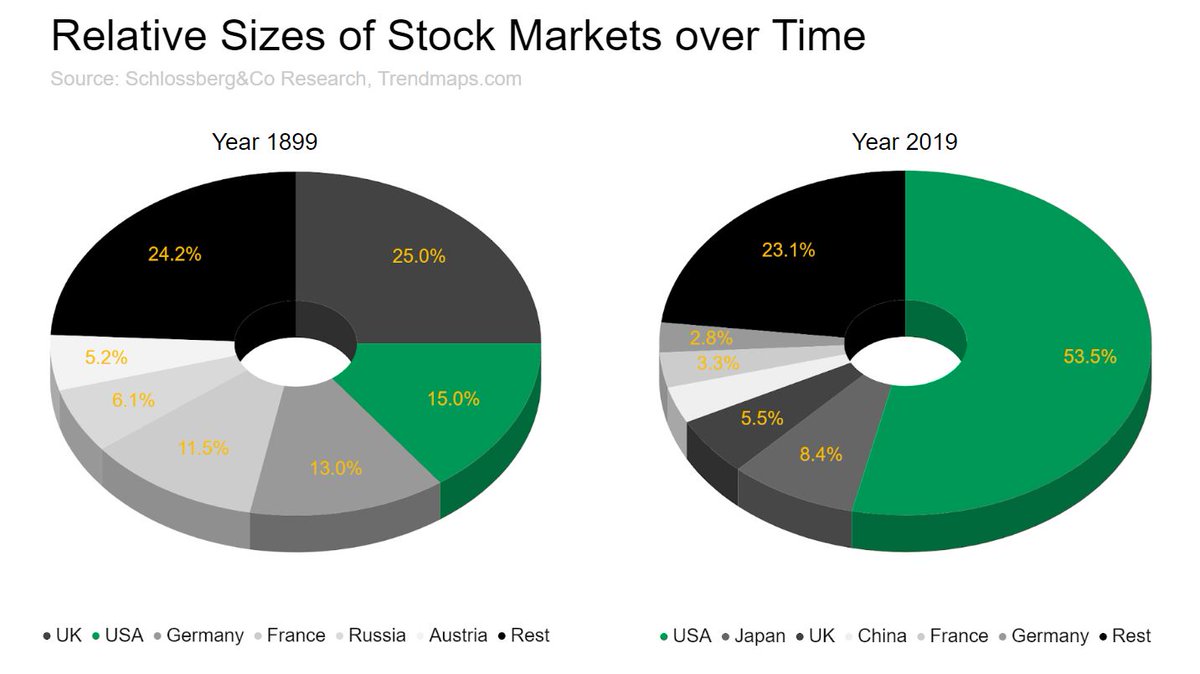

6/The shift in relative sizes of world stock markets over the last 100 hundred years is telling. With vast amounts of foreign financial capital locked up in dollar assets, including U.S. government securities, other countries now have a strong incentive to prevent a dollar crash.

7/The dollar trap the world has fallen into is actually a huge dollar shortage. As @max_bronstein has laid out in this excellent article, with nearly $60 trillion in dollar-denominated debt globally, there is immense demand to service dollar debt. https://unexpected-values.com/crypto-dollars/ ">https://unexpected-values.com/crypto-do...

8/Because the dollar has ascended to become the world’s number one currency with the deepest and most liquid capital market, people all around the globe have been going into dollar debt. It’s a reinforcing cycle.

9/But as we know: The jug goes to the well until it breaks and it broke 2007. The financial crisis of 2008 was a first sign of a possible breakdown. It was actually a crisis in the shadow banking sector, where liquidity suddenly vanished and players were scrambling for dollars.

10/Again this time with the #coronacrisis the same thing became obvious: Cooperations, banks, and other players all around the world are dependent on dealer markets providing enough funding liquidity to uphold market liquidity.

11/While central banks are moving in lockstep by providing liquidity to markets all over the world, they are all dependent on the Fed to provide enough dollars for the system, as all other national currencies are virtually dollar derivatives, as @kweiner01 would say.

12/Central banks, as well as the officials at the Fed, are finally waking up to this reality. This is why currency swap lines have been extended to other central banks by the Fed. Only this way, dollar liquidity can be distributed to where it is actually needed.

13/As a matter of fact though, we seem to be far away from any global agreement that everyone is fiercely dependent on the US central bank. And the Fed still has to come to terms with the fact that it will have to bail out the entire world.

14/As @nlw has discussed on his podcast already in debt, the Fed might really be perceived to be way more powerful than it actually is. So really trying to help the world by merely printing its own liabilities is too much of a task, even for the Fed. https://www.coindesk.com/the-mirage-of-the-money-printer-why-the-fed-is-more-pr-than-policy-feat-jeffrey-p-snider">https://www.coindesk.com/the-mirag...

15/As @PMehrling elaborates in his great book, private dealers are vital actors borrowing in the money market to finance their market-making operations in capital markets. They act as private lenders of last resort trying to provide a liquidity backstop. https://amzn.to/2US7A30 ">https://amzn.to/2US7A30&q...

16/This emergence of private dealers acting primarily through the shadow banking system is mainly due to one fact: Although central banks are routinely interested in fostering market liquidity for government debts, they don’t normally foster market liquidity for private debt.

17/Notwithstanding the fact that unstable private debt issuance is a problem of central banks’ own making by pushing interest rates ever lower, providing an indefinite backstop to corporate debt would really mark the total suffocation of what is left of market price discovery.

18/Although central banks have been doing exactly this with their emergency measures, they’d rather withdraw from acting as a dealer of last resort in money and capital markets. Hence their ramblings about quantitative tightening, which the markets don’t let them pull off.

19/By retreating as an ultimate dealer and tightening monetary policy, incentives for private liquidity provision are once again enhanced. So no matter what central banks do, private financial actors of any sort will always try to help themselves.

20/This has been the case for the last couple of decades. As a consequence, we got financial innovations such as the certificate of deposit, bank commercial paper, and most importantly Eurodollar borrowing.

21/As @JeffSnider_AIP says: The emergence of the Eurodollar system is a consequence of the Fed not being able to supply the world’s relentless need for extra dollars. Eurodollars are the private actors’ way to alleviate today’s global dollar shortage.

https://www.macrovoices.com/edu ">https://www.macrovoices.com/edu"...

https://www.macrovoices.com/edu ">https://www.macrovoices.com/edu"...

22/Today there are two “different” dollars. There’s the US dollar the Fed has oversight of. And they& #39;re offshore ‘dollars’ created and residing outside the purview of the US central bank. The increasing demand for offshore ‘dollars’ mirrors the increasing dollar demand.

23/According to Brent Johnson of @SantiagoAuFund this very dollar demand, aka the short squeeze of the century, is going to accelerate. Demand for dollars will be rising as more and more people will have to service their debt. https://www.youtube.com/watch?v=QPFl7X9R2VY">https://www.youtube.com/watch...

24/Repercussions of Covid19, supply-chain disruption, global trade deceleration, as well as economic deflation, will make it ever harder for debtors around the world to get dollars to service dollar debt.

25/ @RaoulGMI is pointing out: Going forward, cash flows might not be as sure as they once were. If cash flows disappear, people and corporations will be short of money to pay off debt. This will exacerbate the short squeeze. https://www.youtube.com/watch?v=YdfH3F4ZDhc">https://www.youtube.com/watch...

26/As more people will desperately try to get their hands on available dollars to service debt, local currencies around the world will consistently weaken against the greenback. Capital controls making it harder for debtors to obtain dollars will be inevitable.

27/But just as inevitable will be how #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> and #Ethereum will be used as a unified weapon to fight this global dollar shortage. In their struggle to get dollar exposure, the marginal debtor will discover the power of these public blockchains.

https://abs.twimg.com/hashflags... draggable="false" alt=""> and #Ethereum will be used as a unified weapon to fight this global dollar shortage. In their struggle to get dollar exposure, the marginal debtor will discover the power of these public blockchains.

28/As a matter of fact, US dollar stablecoins running on Bitcoin and Ethereum will be a way to get dollar exposure or dollar proxies. Being natively digital, they will help circumvent emerging capital controls. @Coindesk has already pointed this out: https://www.coindesk.com/tether-usdt-russia-china-importers">https://www.coindesk.com/tether-us...

29/The unfolding of the so-called dollar milkshake theory will inevitably foster what will become known as the digital thickshake theory firstly coined by @NuggetsNewsAU https://www.youtube.com/watch?v=yOitmaAxvqc&t=73s">https://www.youtube.com/watch...

30/In a sense it could also be called the digital smoothie theory since public blockchains make it smoother to transfer money around compared to the traditional dollar banking system, which could be labeled the real “thick” shake then.

31/This next evolutionary step in the future of global finance (which is at the same time a revolutionary one, but only further down in time) has already started and could be termed the dollarization of public blockchains, as @nic__carter would say.

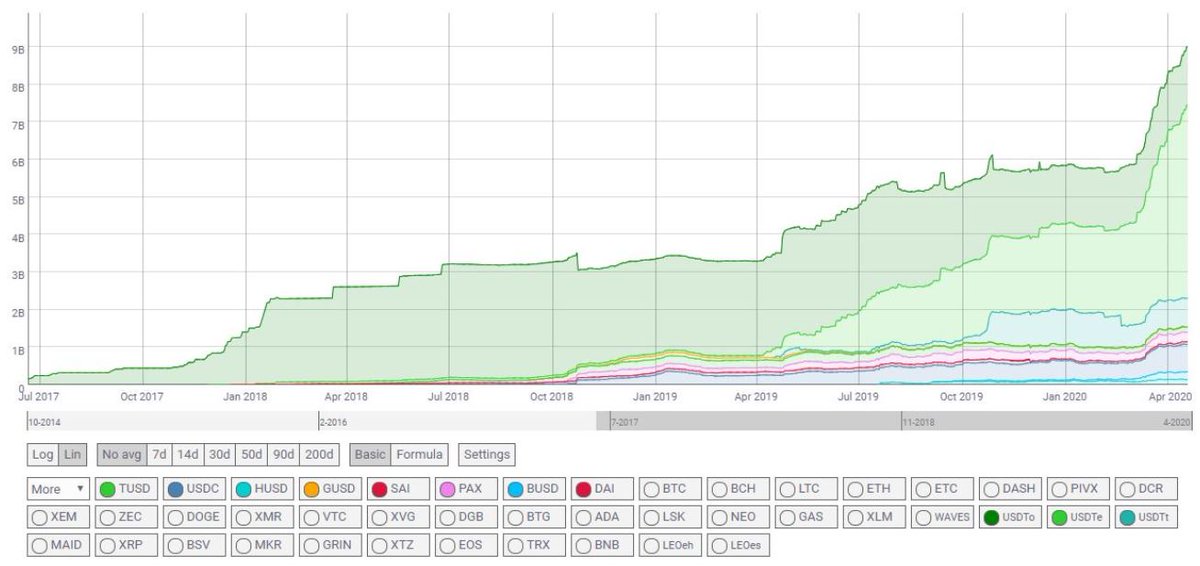

32/Over the last two years, the market capitalization of stablecoins has really exploded. As @AlexSaundersAU speculates, Tether could really surpass the market cap of Ethereum or even Bitcoin, because demand for synthetic dollars is going to be huge.

33/To use a term by @jp_koning, hyper-stablecoinization will be the upgrade for Eurodollar banking. It will once again be private individuals using the innovative tools at their hands to make sure they can get the dollar exposure they need.

34/Just as the shadow banking system is a way for private actors to pledge collateral in order to create synthetic dollar funds & approximations, the crypto world in conjunction with the programmability of public blockchains will take this one step further.

35/Already today #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> and #Ether serve as collateral to create dollar deposits and dollar credit instruments. More and more of these cryptoassets are also locked in DeFi, which might very well be one more push in the same direction of hyper crypto-dollarization.

https://abs.twimg.com/hashflags... draggable="false" alt=""> and #Ether serve as collateral to create dollar deposits and dollar credit instruments. More and more of these cryptoassets are also locked in DeFi, which might very well be one more push in the same direction of hyper crypto-dollarization.

Read on Twitter

Read on Twitter

and #Ether serve as collateral to create dollar deposits and dollar credit instruments. More and more of these cryptoassets are also locked in DeFi, which might very well be one more push in the same direction of hyper crypto-dollarization." title="35/Already today #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> and #Ether serve as collateral to create dollar deposits and dollar credit instruments. More and more of these cryptoassets are also locked in DeFi, which might very well be one more push in the same direction of hyper crypto-dollarization.">

and #Ether serve as collateral to create dollar deposits and dollar credit instruments. More and more of these cryptoassets are also locked in DeFi, which might very well be one more push in the same direction of hyper crypto-dollarization." title="35/Already today #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> and #Ether serve as collateral to create dollar deposits and dollar credit instruments. More and more of these cryptoassets are also locked in DeFi, which might very well be one more push in the same direction of hyper crypto-dollarization.">

and #Ether serve as collateral to create dollar deposits and dollar credit instruments. More and more of these cryptoassets are also locked in DeFi, which might very well be one more push in the same direction of hyper crypto-dollarization." title="35/Already today #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> and #Ether serve as collateral to create dollar deposits and dollar credit instruments. More and more of these cryptoassets are also locked in DeFi, which might very well be one more push in the same direction of hyper crypto-dollarization.">

and #Ether serve as collateral to create dollar deposits and dollar credit instruments. More and more of these cryptoassets are also locked in DeFi, which might very well be one more push in the same direction of hyper crypto-dollarization." title="35/Already today #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> and #Ether serve as collateral to create dollar deposits and dollar credit instruments. More and more of these cryptoassets are also locked in DeFi, which might very well be one more push in the same direction of hyper crypto-dollarization.">