After the crisis comes the clean-up. There are parallels btwn the postwar years, 1945-52, & today.

Now, it’s the CERB. Then, the hastily created mass income tax made a mess more complex than anything we face.

A tax history thread, to speak to some clean-up concerns. #cdnhist

Now, it’s the CERB. Then, the hastily created mass income tax made a mess more complex than anything we face.

A tax history thread, to speak to some clean-up concerns. #cdnhist

Imagine a 500% increase in business + a steady loss of your best staff, snaffled up by competing firms who double their salaries.

It’s 1944. You’re the federal income tax dept. 10s of 1,000s of unassessed returns pile up. By 1949, the backlog reaches 1.9 mill’n.

It’s 1944. You’re the federal income tax dept. 10s of 1,000s of unassessed returns pile up. By 1949, the backlog reaches 1.9 mill’n.

The CERB is today’s explosively expanded program. And there’ll be a clean-up. I’ll sketch 4 parallels and dive into some details about successes, failures, and lessons.

First. Both programs urgently were needed for a (mainly) unchallenged purpose. Then: Pay for the war. Now: Stem the spread of a life-threatening disease.

Two. a huge logistical challenge. Then: hire and train an army of (mainly women) clerks. Fight to keep accountants who can command double pay elsewhere. Now: design and launch software, take stock of changing needs, staff help lines.

Three. almost certainly the hardest: Manage the public. Communicate what the program offers and requires. Persuade them to supply information that’s complete and correct. And check up on how well they’ve done.

No one likes a careless government.

No one likes a careless government.

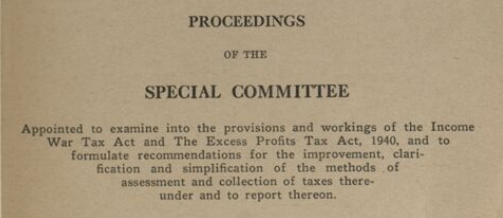

Four. Similar complaints: System is confusing? Check. Concerns about cheating? Check. Delays in confirming claim/return? Wait & #39;til 2021.

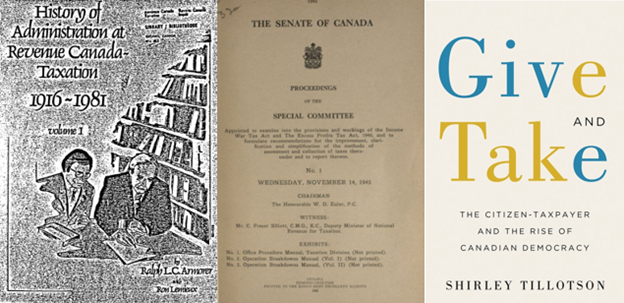

A Senate committee in ‘45/’46 heard ’em all. Ppl lying about how many children they had!

http://parl.canadiana.ca/view/oop.com_SOC_2001_1_1/7?r=0&s=1

https://parl.canadiana.ca/view/oop.... href=" http://parl.canadiana.ca/view/oop.com_SOC_2002_2_1/7?r=0&s=1">https://parl.canadiana.ca/view/oop....

A Senate committee in ‘45/’46 heard ’em all. Ppl lying about how many children they had!

http://parl.canadiana.ca/view/oop.com_SOC_2001_1_1/7?r=0&s=1

How did the tax authority and politicians (gov’t party and others) deal with these problems after the war? With mixed success.

Not surprising, I suppose. Perfection isn’t common.

Not surprising, I suppose. Perfection isn’t common.

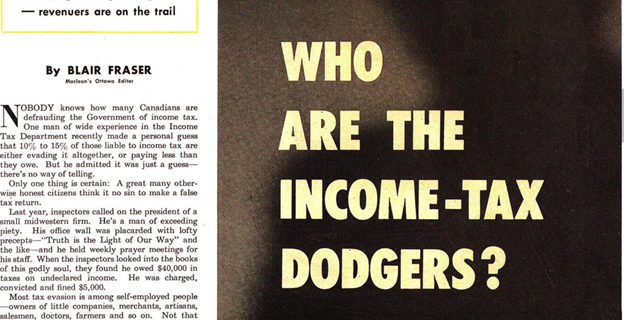

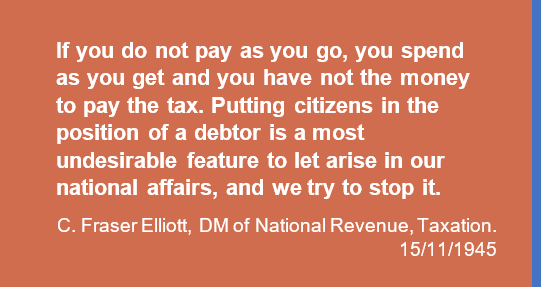

Educating the public meant doing a bit of frightening

In @macleans 03/15/1948, the pull quote on Blair Fraser’s article was “Perhaps 1 in 7 chisels on his income tax, but it’s becoming a dangerous game – revenuers are on the trail!

https://archive.macleans.ca/issue/19480315#!&pid=6">https://archive.macleans.ca/issue/194...

In @macleans 03/15/1948, the pull quote on Blair Fraser’s article was “Perhaps 1 in 7 chisels on his income tax, but it’s becoming a dangerous game – revenuers are on the trail!

https://archive.macleans.ca/issue/19480315#!&pid=6">https://archive.macleans.ca/issue/194...

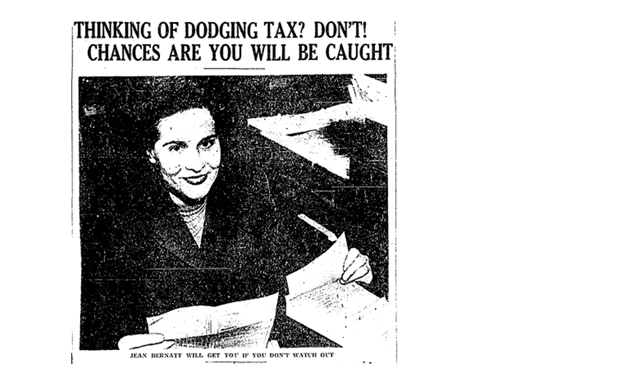

Stories of the tax men’s (or women’s) fearsome effectiveness circulated in the newspapers. And informers were trumpeted as a highly effective tool. (Toronto Daily Star, 11/03/1950) @TorontoStar

It’s not nasty to warn taxpayers of what’s prudent. And unpaid informants will volunteer, anyway. People vary in what motivates compliance. The issues are well-canvassed in this episode of the @cbccostofliving: https://www.cbc.ca/radio/costofliving/racism-in-corporate-canada-snitching-on-cerb-cheats-and-the-cash-consequences-of-international-students-1.5606083/think-your-neighbour-s-cheating-on-cerb-there-s-a-snitch-line-for-that-1.5606111">https://www.cbc.ca/radio/cos...

Along with the warnings to comply came an affordable means of appeal against the tax authority in 1949. Out of the post-war period came new legal foundations for taxpayer rights.

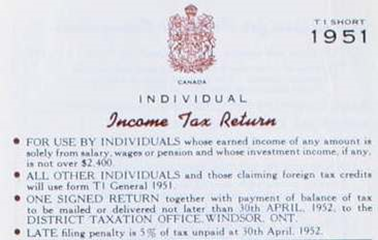

Support took some of the sting from warning. 1947 saw the new, easy to fill, pamphlet-sized T1 Short. And changes in the 1951 tax year meant that, for the first time, most employees got a refund rather than having to pay a bit of tax.

https://www.dal.ca/news/2018/04/12/the-conversation--the-pain--and-innovation--behind-personal-inco.html">https://www.dal.ca/news/2018...

https://www.dal.ca/news/2018/04/12/the-conversation--the-pain--and-innovation--behind-personal-inco.html">https://www.dal.ca/news/2018...

As @MoneyGal pointed out on April 8, most CERB claimants won’t end up with a tax debt. But she notes now that the risk of a tax debt in 2021 rises with the number of weeks your income is CERB without tax deductions. https://twitter.com/MoneyGal/status/1247915823831887875?s=20">https://twitter.com/MoneyGal/...

Even today, it’s possible, from calculations she’s done, that a single Ontarian w/ only standard deductions in 2020 who collected $8K in CERB and worked for min. wage for 8 months could owe $289 in 2021 ($1,585 due minus $1,296 withheld from pay cheques).

We should think twice about trying to collect very small tax debts from poor people in 2021. People who can be expected to save should plan ahead. But there will be some for whom saving for tax between now and next April will be an extraordinary hardship.

Sources: For practical tax skills, @MoneyGal (who is not responsible for the views I’ve expressed).

NB: The Revenue Canada history that’s one of the sources shown here is a bit scarce. I have and will share a pdf, and there’s a preservation copy at @LibraryArchives.

NB: The Revenue Canada history that’s one of the sources shown here is a bit scarce. I have and will share a pdf, and there’s a preservation copy at @LibraryArchives.

Read on Twitter

Read on Twitter

https://parl.canadiana.ca/view/oop...." title="Four. Similar complaints: System is confusing? Check. Concerns about cheating? Check. Delays in confirming claim/return? Wait & #39;til 2021. A Senate committee in ‘45/’46 heard ’em all. Ppl lying about how many children they had! https://parl.canadiana.ca/view/oop.... href=" http://parl.canadiana.ca/view/oop.com_SOC_2002_2_1/7?r=0&s=1">https://parl.canadiana.ca/view/oop...." class="img-responsive" style="max-width:100%;"/>

https://parl.canadiana.ca/view/oop...." title="Four. Similar complaints: System is confusing? Check. Concerns about cheating? Check. Delays in confirming claim/return? Wait & #39;til 2021. A Senate committee in ‘45/’46 heard ’em all. Ppl lying about how many children they had! https://parl.canadiana.ca/view/oop.... href=" http://parl.canadiana.ca/view/oop.com_SOC_2002_2_1/7?r=0&s=1">https://parl.canadiana.ca/view/oop...." class="img-responsive" style="max-width:100%;"/>