Nope, this is totally misleading and false.

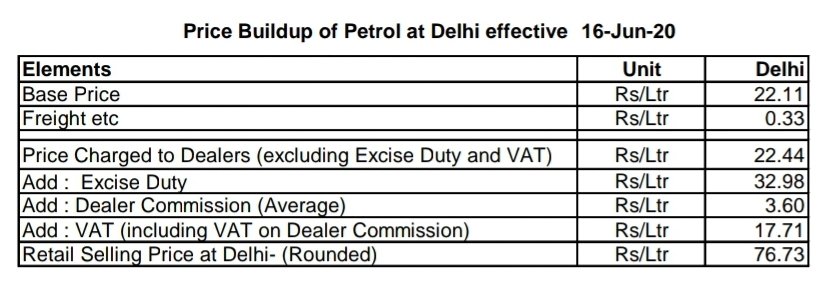

Petrol& #39;s base price is Rs. 22.44/-

Excise duty charged by Centre is Rs.32.98/-

Dealer Commission (Average) is Rs. 3.60

State VAT differs among States

In case of Kerala

30.08% Salea Tax + 1Rs. Additional tax + 1% flood cess = Rs.19.34 https://twitter.com/amal_jacob/status/1272943463915544577">https://twitter.com/amal_jaco...

Petrol& #39;s base price is Rs. 22.44/-

Excise duty charged by Centre is Rs.32.98/-

Dealer Commission (Average) is Rs. 3.60

State VAT differs among States

In case of Kerala

30.08% Salea Tax + 1Rs. Additional tax + 1% flood cess = Rs.19.34 https://twitter.com/amal_jacob/status/1272943463915544577">https://twitter.com/amal_jaco...

This is the break up of Petrol price by Indian Oil Corporation for DELHI from their website.

In case of Kerala, the freight charge & Dealer Commission may vary.

In case of Kerala, the freight charge & Dealer Commission may vary.

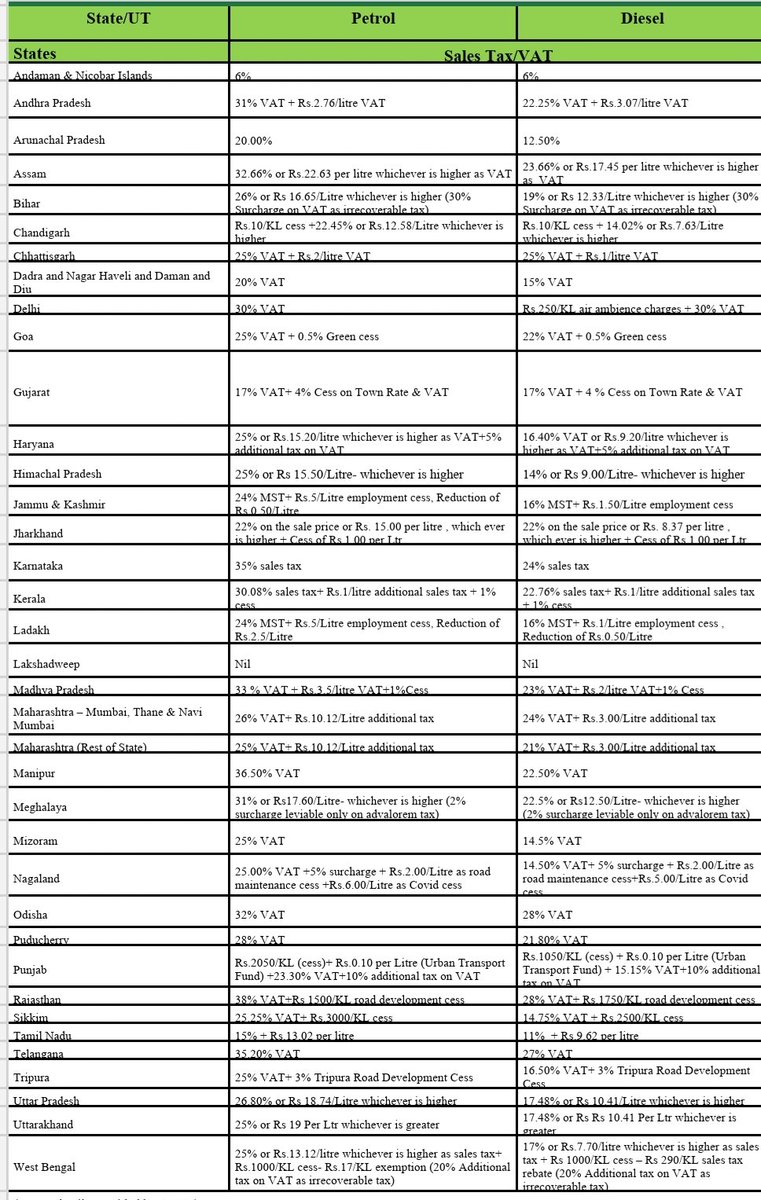

From this table, which is being published by PPAC under Union Petroleum Ministry you can compare different State& #39;s VAT on Petrol and Diesel.

Zoom and See or go to their website and download the Excel file.

Zoom and See or go to their website and download the Excel file.

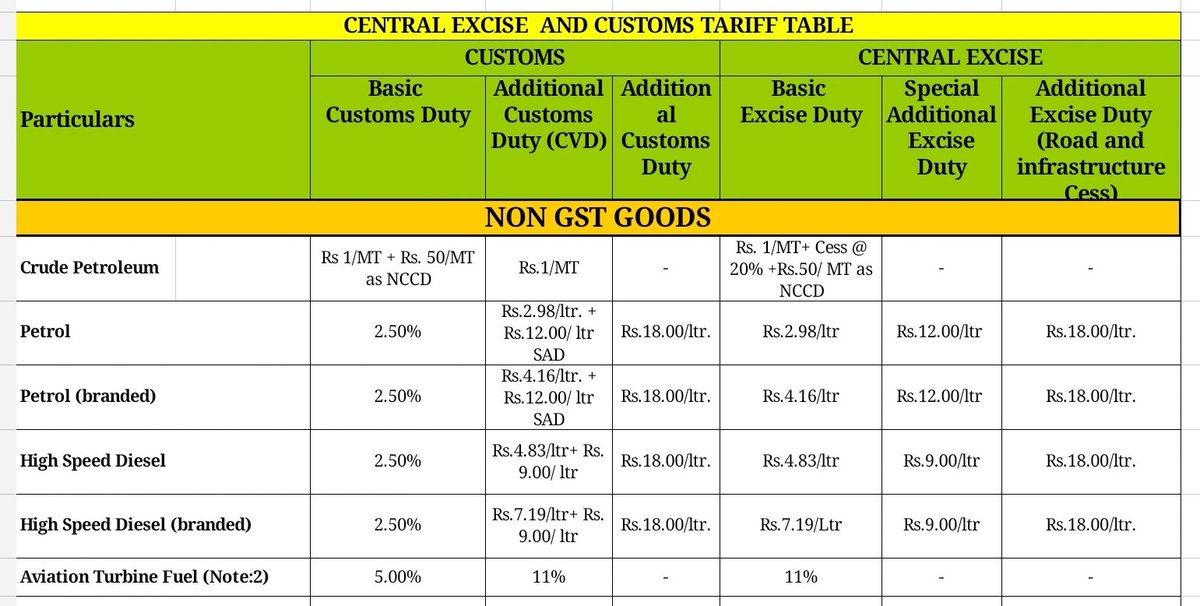

This table shows the Excise duty charged by the Union Government on Petrol and Diesel.

Understand that out of the 3 components of excise duty, the first one basic excise comes under divisible pool of 41%!

In case of Petrol, it is Rs. 2.98!

Rest 12+18 = Rs.30/- goes to Union

Understand that out of the 3 components of excise duty, the first one basic excise comes under divisible pool of 41%!

In case of Petrol, it is Rs. 2.98!

Rest 12+18 = Rs.30/- goes to Union

So the above table in Malayalam showing Petrol basic price as Rs.34 and State VAT as Rs. 30 are misleading!

Centre charges Rs.32.98/- per litre of Petrol & it shows instead Rs.13/-.

So naturally it is easy to understand who is behind this infographics! A mallu IT cell https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤣" title="Lachend auf dem Boden rollen" aria-label="Emoji: Lachend auf dem Boden rollen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤣" title="Lachend auf dem Boden rollen" aria-label="Emoji: Lachend auf dem Boden rollen">

Centre charges Rs.32.98/- per litre of Petrol & it shows instead Rs.13/-.

So naturally it is easy to understand who is behind this infographics! A mallu IT cell

If you are ready to search https://www.ppac.gov.in/ ">https://www.ppac.gov.in/">... all data include historical data is available there.

Or file an RTI with Rs.10/-, you will get the data!

Never get carried away with infographics peddled by the vested interests!

Or file an RTI with Rs.10/-, you will get the data!

Never get carried away with infographics peddled by the vested interests!

Government now conveniently removed the comparison with India& #39;s neighbours, which is being regularly published under the price tag, so that they themselves feel embarrassed with the loot of us in comparison!

One more important thing you should understand..

Union Excise Duty is a specific tax, ie, they charge a fixed amount per litre for fuel and it is not swing with international crude oil prices.

So excise duty is insulated from crude oil market variations...But...

Union Excise Duty is a specific tax, ie, they charge a fixed amount per litre for fuel and it is not swing with international crude oil prices.

So excise duty is insulated from crude oil market variations...But...

State VAT is a ad valorem tax or percentage tax

It is charged as per the philosophy of VAT, so it is a tax over (Basic Petrol Price + Freight charges+ Excise duty + Dealer Commission).

So States suffer when oil prices fall & benefits when it shoots up, but they didn& #39;t share!

It is charged as per the philosophy of VAT, so it is a tax over (Basic Petrol Price + Freight charges+ Excise duty + Dealer Commission).

So States suffer when oil prices fall & benefits when it shoots up, but they didn& #39;t share!

You must read the recommendations of the Rangarajan Committee Report which paved way for the Union Government to shift from ad valorem tax to specific tax.

I think before making a cry for GST on fuel, we should ask States also to shift to such a regime.

I think before making a cry for GST on fuel, we should ask States also to shift to such a regime.

That will insulate the States from the tremors of the crude oil prices and also pave way for a stable tax regime.

It will also check Union to increase excise heavily when crude prices falls in international markets.

It will also check Union to increase excise heavily when crude prices falls in international markets.

Logic is simple, then the varying component will be limited to 29-30% of the Petrol price charged to us, ie, the actual price of Petrol.

So centre will not take undue advantage of falling petrol price & increase excise as now varying component reduced from 57% to 29%!

So centre will not take undue advantage of falling petrol price & increase excise as now varying component reduced from 57% to 29%!

OCentre will take an undue advantage during falling crude oil price times while States suffer due to their reduction in VAT in actual price but benefit from excise hike as they charge VAT on these. So their protest will be tokenism. When prices increase Stares benefit immensely!

This one viscous cycle and we consumers are at the receiving end, paying more and more taxes!

Solace will be these fake news infographics to confuse us!

Ask questions, understand nuances, push for reforms, don& #39;t eat propaganda!

END

Solace will be these fake news infographics to confuse us!

Ask questions, understand nuances, push for reforms, don& #39;t eat propaganda!

END

PS: It is a wishful thinking that to assume GST on fuel will come soon!

When both Centre & States together tax us between 67-70% of Petrol prices & this is one major revenue, ask who will take bite the bullet?

Unless they find alternative tax avenues, don& #39;t wish for GST!

When both Centre & States together tax us between 67-70% of Petrol prices & this is one major revenue, ask who will take bite the bullet?

Unless they find alternative tax avenues, don& #39;t wish for GST!

Read on Twitter

Read on Twitter