There exists a token-based AMM design

That threatens to create a liquidity blackhole

Pulling in assets from everywhere

CEXs, DEXs, Cold Storage, etc.

I& #39;ll break it down

First, understand that liquidity can create feedback loops:

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck"> Trading Volume >

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck"> Trading Volume >  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck"> MM Profits >

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck"> MM Profits >  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck"> Capital Dedicated to MM >

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck"> Capital Dedicated to MM >  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck">Liquidity >

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck">Liquidity >  https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck"> Tighter spreads >

https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck"> Tighter spreads >  https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔁" title="Nach rechts und links zeigende Pfeile in offenem Kreis im Uhrzeigersinn" aria-label="Emoji: Nach rechts und links zeigende Pfeile in offenem Kreis im Uhrzeigersinn">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔁" title="Nach rechts und links zeigende Pfeile in offenem Kreis im Uhrzeigersinn" aria-label="Emoji: Nach rechts und links zeigende Pfeile in offenem Kreis im Uhrzeigersinn">

Liquidity begets Liquidity

This is true for any market, and for both CLOB exchanges & Pooled Liquidity models

Liquidity begets Liquidity

This is true for any market, and for both CLOB exchanges & Pooled Liquidity models

However, upstart exchanges face a chicken or the egg problem where they begin with both low liquidity & trading volumes

Many face a hard time kicking off the feedback loop

Liquidity mining presents a novel mechanism to bootstrap network effects

Read https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://insights.deribit.com/market-research/supercharging-network-effects-in-crypto/?utm_source=Twitter&utm_medium=Andrew&utm_campaign=InsightTweets">https://insights.deribit.com/market-re...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Rückhand Zeigefinger nach unten" aria-label="Emoji: Rückhand Zeigefinger nach unten"> https://insights.deribit.com/market-research/supercharging-network-effects-in-crypto/?utm_source=Twitter&utm_medium=Andrew&utm_campaign=InsightTweets">https://insights.deribit.com/market-re...

Many face a hard time kicking off the feedback loop

Liquidity mining presents a novel mechanism to bootstrap network effects

Read

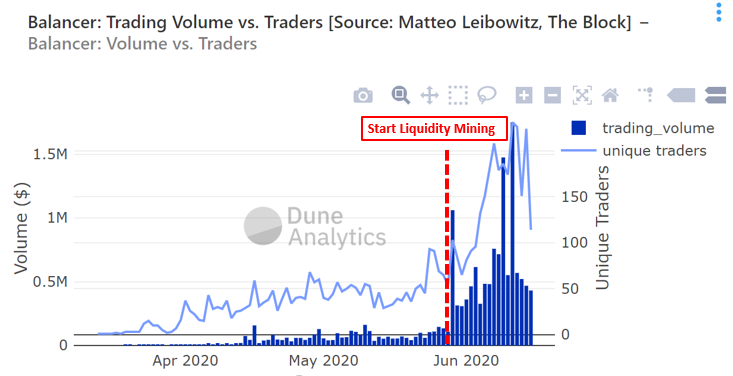

In short, liquidity mining incentivizes liquidity provisioning through token rewards

This allows liquidity to flourish and attract greater trading volumes.

After Liquidity Mining:

- @synthetix_io sETH Pool = 1/3 Total Uniswap Liquidity

- @BalancerLabs = $30M TVL in 1 week

This allows liquidity to flourish and attract greater trading volumes.

After Liquidity Mining:

- @synthetix_io sETH Pool = 1/3 Total Uniswap Liquidity

- @BalancerLabs = $30M TVL in 1 week

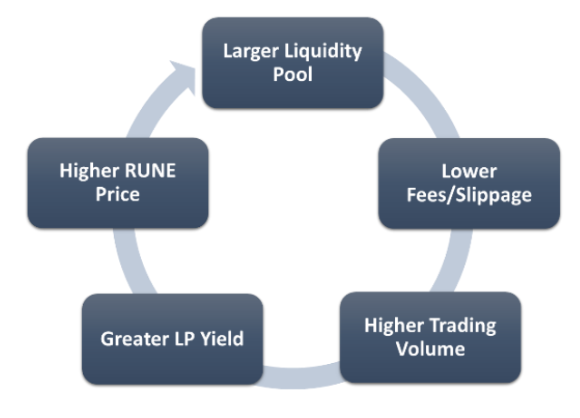

Now consider an AMM where the central asset in liquidity pools is a native network token

E.g., ETH is the central asset for all Uniswap markets. Imagine if Uniswap launched its own network token and this replaced ETH.

This is the model used by @Bancor and @thorchain_org

E.g., ETH is the central asset for all Uniswap markets. Imagine if Uniswap launched its own network token and this replaced ETH.

This is the model used by @Bancor and @thorchain_org

Now things get really crazy when you throw in liquidity mining (LM)

But in order to LM these pools, LPs need to own/stake $RUNE or $BNT as they make up 50% of each pool

Buying $BNT/$RUNE increases the price meaning the pools get deeper & more liquid attracting more traders

But in order to LM these pools, LPs need to own/stake $RUNE or $BNT as they make up 50% of each pool

Buying $BNT/$RUNE increases the price meaning the pools get deeper & more liquid attracting more traders

What I just described is the liquidity feedback loop ON STEROIDS

Get what else increases with liquidity mining as price increases? LM YIELD

A virtuous cycle of increasing price and deeper liquidity and higher yield resulting in a black hole sucking in all crypto assets https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌀" title="Zyklon" aria-label="Emoji: Zyklon">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌀" title="Zyklon" aria-label="Emoji: Zyklon"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌀" title="Zyklon" aria-label="Emoji: Zyklon">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌀" title="Zyklon" aria-label="Emoji: Zyklon"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌀" title="Zyklon" aria-label="Emoji: Zyklon">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌀" title="Zyklon" aria-label="Emoji: Zyklon">

Get what else increases with liquidity mining as price increases? LM YIELD

A virtuous cycle of increasing price and deeper liquidity and higher yield resulting in a black hole sucking in all crypto assets

Now sprinkle in a bit of meth by considering the concept of REFLEXIVITY

If people anticipate large $BNT or $RUNE LP yield, they will buy more increasing the price creating a self-fulfilling prophecy

This is why $SNX did a mind-blowing 50x pump over 9 months

If people anticipate large $BNT or $RUNE LP yield, they will buy more increasing the price creating a self-fulfilling prophecy

This is why $SNX did a mind-blowing 50x pump over 9 months

Me shilling you this concept right now is actually creating even more reflexivity

But WAIT, there& #39;s more.

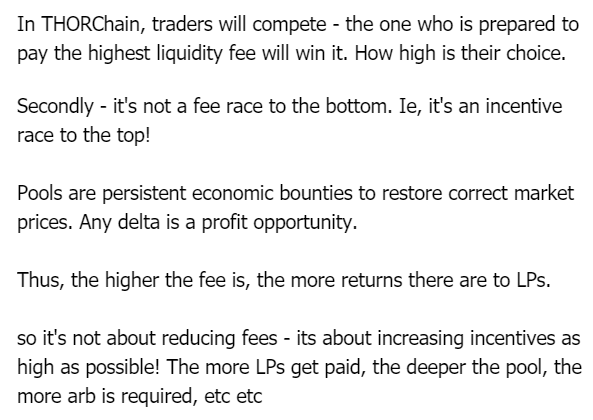

@thorchain_org have liquidity pools that use an alternative fee model described in detail in this thread: https://twitter.com/Rewkang/status/1232414958706520064">https://twitter.com/Rewkang/s...

@thorchain_org have liquidity pools that use an alternative fee model described in detail in this thread: https://twitter.com/Rewkang/status/1232414958706520064">https://twitter.com/Rewkang/s...

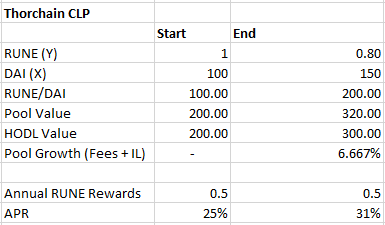

Essentially, instead of a standard 30bp fee, fees are proportional to the slippage created by a trade (scale of 1 to 10000 bps)

Patient traders can split trades to minimize fees

Impatient traders will execute large trades with large fees because they are lazy or can profit

Patient traders can split trades to minimize fees

Impatient traders will execute large trades with large fees because they are lazy or can profit

What most people don& #39;t realize is that most volume in Uniswap and Balancer comes from arbitrage at the expense of LPs

However, arb competition doesn& #39;t benefit LPs, only miners.

Alternatively, CLPs allow LPs to capture more value from arbitrage trades due to higher fees

However, arb competition doesn& #39;t benefit LPs, only miners.

Alternatively, CLPs allow LPs to capture more value from arbitrage trades due to higher fees

You guys know what to do

Footnote*

Now of course, reflexivity could always reverse in the other direction, but the goal is that the liquidity black hole creates pools that act as impenetrable liquidity moats

Now of course, reflexivity could always reverse in the other direction, but the goal is that the liquidity black hole creates pools that act as impenetrable liquidity moats

Read on Twitter

Read on Twitter Trading Volume > https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck"> MM Profits > https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck"> Capital Dedicated to MM > https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck">Liquidity > https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck"> Tighter spreads > https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔁" title="Nach rechts und links zeigende Pfeile in offenem Kreis im Uhrzeigersinn" aria-label="Emoji: Nach rechts und links zeigende Pfeile in offenem Kreis im Uhrzeigersinn">Liquidity begets LiquidityThis is true for any market, and for both CLOB exchanges & Pooled Liquidity models" title="First, understand that liquidity can create feedback loops:https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck"> Trading Volume > https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck"> MM Profits > https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck"> Capital Dedicated to MM > https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck">Liquidity > https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck"> Tighter spreads > https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔁" title="Nach rechts und links zeigende Pfeile in offenem Kreis im Uhrzeigersinn" aria-label="Emoji: Nach rechts und links zeigende Pfeile in offenem Kreis im Uhrzeigersinn">Liquidity begets LiquidityThis is true for any market, and for both CLOB exchanges & Pooled Liquidity models" class="img-responsive" style="max-width:100%;"/>

Trading Volume > https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck"> MM Profits > https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck"> Capital Dedicated to MM > https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck">Liquidity > https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck"> Tighter spreads > https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔁" title="Nach rechts und links zeigende Pfeile in offenem Kreis im Uhrzeigersinn" aria-label="Emoji: Nach rechts und links zeigende Pfeile in offenem Kreis im Uhrzeigersinn">Liquidity begets LiquidityThis is true for any market, and for both CLOB exchanges & Pooled Liquidity models" title="First, understand that liquidity can create feedback loops:https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck"> Trading Volume > https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck"> MM Profits > https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck"> Capital Dedicated to MM > https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck">Liquidity > https://abs.twimg.com/emoji/v2/... draggable="false" alt="⏫" title="Nach oben zeigendes doppeltes Dreieck" aria-label="Emoji: Nach oben zeigendes doppeltes Dreieck"> Tighter spreads > https://abs.twimg.com/emoji/v2/... draggable="false" alt="🔁" title="Nach rechts und links zeigende Pfeile in offenem Kreis im Uhrzeigersinn" aria-label="Emoji: Nach rechts und links zeigende Pfeile in offenem Kreis im Uhrzeigersinn">Liquidity begets LiquidityThis is true for any market, and for both CLOB exchanges & Pooled Liquidity models" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌀" title="Zyklon" aria-label="Emoji: Zyklon">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌀" title="Zyklon" aria-label="Emoji: Zyklon">" title="What I just described is the liquidity feedback loop ON STEROIDSGet what else increases with liquidity mining as price increases? LM YIELD A virtuous cycle of increasing price and deeper liquidity and higher yield resulting in a black hole sucking in all crypto assets https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌀" title="Zyklon" aria-label="Emoji: Zyklon">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌀" title="Zyklon" aria-label="Emoji: Zyklon">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌀" title="Zyklon" aria-label="Emoji: Zyklon">" class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌀" title="Zyklon" aria-label="Emoji: Zyklon">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌀" title="Zyklon" aria-label="Emoji: Zyklon">" title="What I just described is the liquidity feedback loop ON STEROIDSGet what else increases with liquidity mining as price increases? LM YIELD A virtuous cycle of increasing price and deeper liquidity and higher yield resulting in a black hole sucking in all crypto assets https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌀" title="Zyklon" aria-label="Emoji: Zyklon">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌀" title="Zyklon" aria-label="Emoji: Zyklon">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🌀" title="Zyklon" aria-label="Emoji: Zyklon">" class="img-responsive" style="max-width:100%;"/>