In @nejmcatalyst, @ALKaplan_MD and I tackle the #Covid shock to hospital & physician practice finances.

As Warren Buffett says, "when the tide goes out, you find out who& #39;s been swimming naked"

Or, in this case, who has bet heavily that prices & volumes will only ever go up. 1/n https://twitter.com/nejmcatalyst/status/1272535351211560960">https://twitter.com/nejmcatal...

As Warren Buffett says, "when the tide goes out, you find out who& #39;s been swimming naked"

Or, in this case, who has bet heavily that prices & volumes will only ever go up. 1/n https://twitter.com/nejmcatalyst/status/1272535351211560960">https://twitter.com/nejmcatal...

We start by noting just how unusual it is for the healthcare industry to face any real financial pressure at all.

Hospital industry revenues, for example, have risen by at least 3% in every year for a half-century. For physicians and clinics, it has always been at least 2%.

Hospital industry revenues, for example, have risen by at least 3% in every year for a half-century. For physicians and clinics, it has always been at least 2%.

That& #39;s remarkable. And, as @bobkocher and others have noted, HC used those ever-rising revenues to add more (and more...and more...) staff.

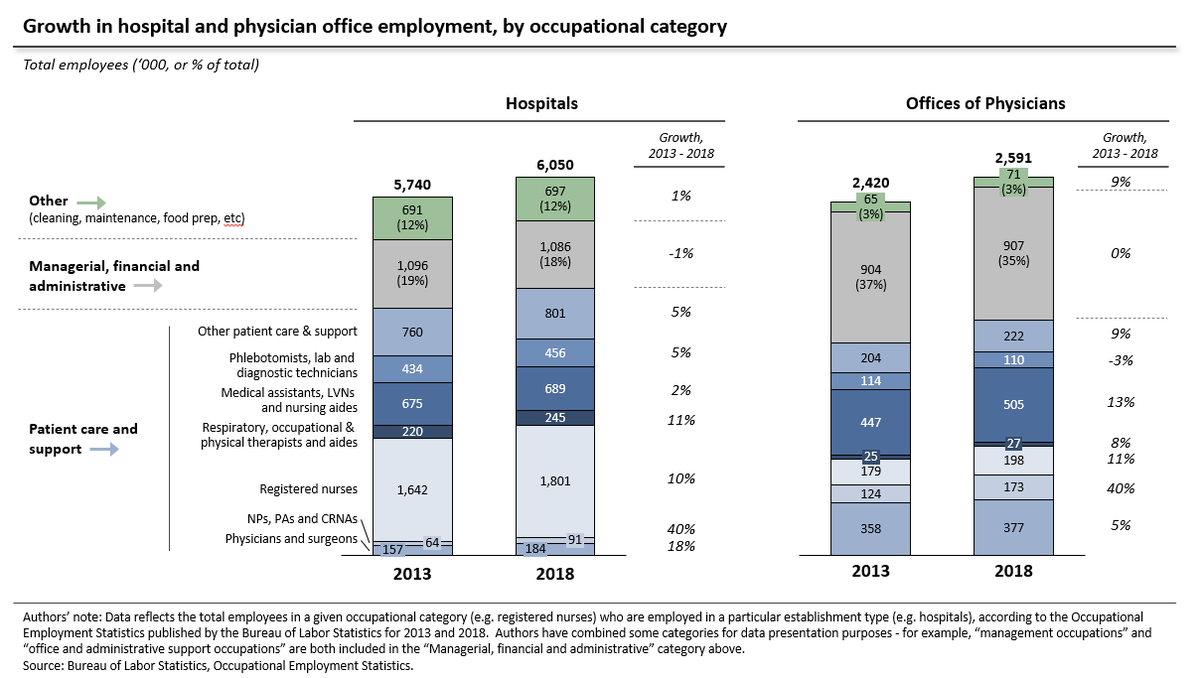

Over the last 20 years, hospitals & physician offices added almost 2 million extra employees. Roughly 1,800 add& #39;l headcount every week.

Over the last 20 years, hospitals & physician offices added almost 2 million extra employees. Roughly 1,800 add& #39;l headcount every week.

In recent years (and contrary to a common perception), that hiring has occurred primarily in patient care and support roles.

From 2013-2018, fully 95% of the incremental headcount in physicians& #39; offices came in patient-facing roles. For hospitals it was 99%.

From 2013-2018, fully 95% of the incremental headcount in physicians& #39; offices came in patient-facing roles. For hospitals it was 99%.

This tracks the fee-for-service incentive to maximize billable encounters, tests and procedures. And, constant price inflation mean ample resources to hire RNs, medical assistants and therapists who can help boost the number of claim lines for a billing provider (MD, NP, PA etc).

Meanwhile, consolidation often means combining back offices, and generates revenue growth via price hikes. Putting a higher number on the same claim doesn& #39;t require extra hands.

Accordingly, the number of admin staff in hospitals is large, but has actually declined slightly.

Accordingly, the number of admin staff in hospitals is large, but has actually declined slightly.

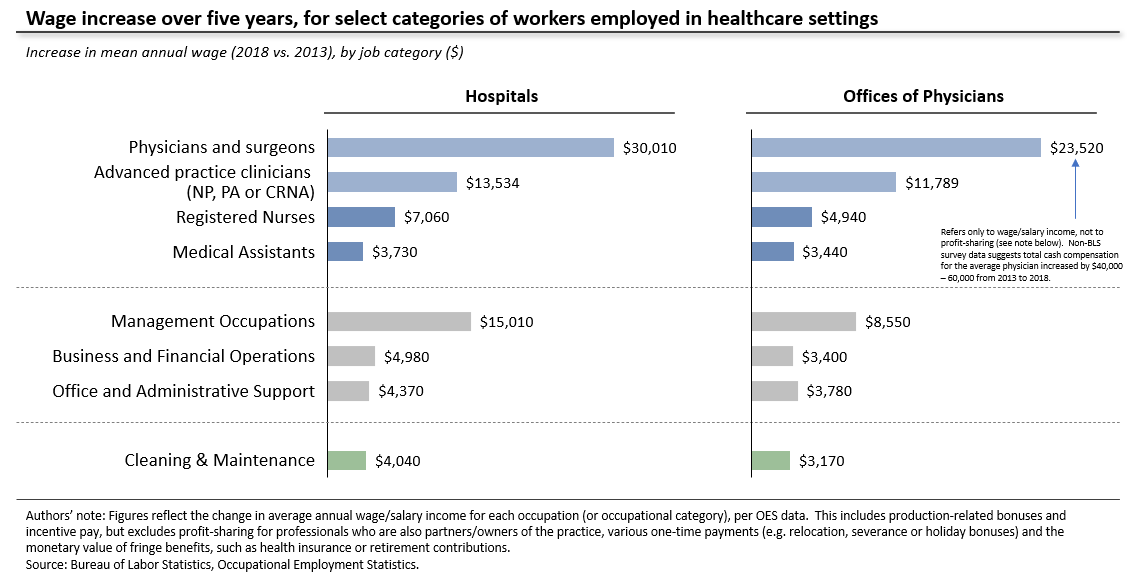

At the same time, pay has risen smartly, particularly in patient-facing roles.

That compensation has flowed disproportionately to higher-income clinicians. MDs, for example, accounted for ~11% of medical practice hiring, but captured almost 40% of incremental wage spending.

That compensation has flowed disproportionately to higher-income clinicians. MDs, for example, accounted for ~11% of medical practice hiring, but captured almost 40% of incremental wage spending.

The result of all this is a set of enterprises which are heavily levered to high and rising revenues, have made few investments to diversify away from volume-driven, transactional revenue, and where any dip in revenues is likely to hit clinical staff compensation or job numbers.

So where to go from here? We suggest a range of options to re-balance revenues and embrace more efficient care delivery models.

That could include, for example, population-based ER contracts, virtual specialist consults, PCP capitation and a shift away from buy-and-bill.

That could include, for example, population-based ER contracts, virtual specialist consults, PCP capitation and a shift away from buy-and-bill.

Finally, I& #39;d also recommend this recent @Health_Affairs post by @emcahan, @bobkocher and @RogerBohn.

/n

https://www.healthaffairs.org/do/10.1377/hblog20200602.168241/full/">https://www.healthaffairs.org/do/10.137...

/n

https://www.healthaffairs.org/do/10.1377/hblog20200602.168241/full/">https://www.healthaffairs.org/do/10.137...

Read on Twitter

Read on Twitter