Grayscale buys way less #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt=""> than many would think.

https://abs.twimg.com/hashflags... draggable="false" alt=""> than many would think.

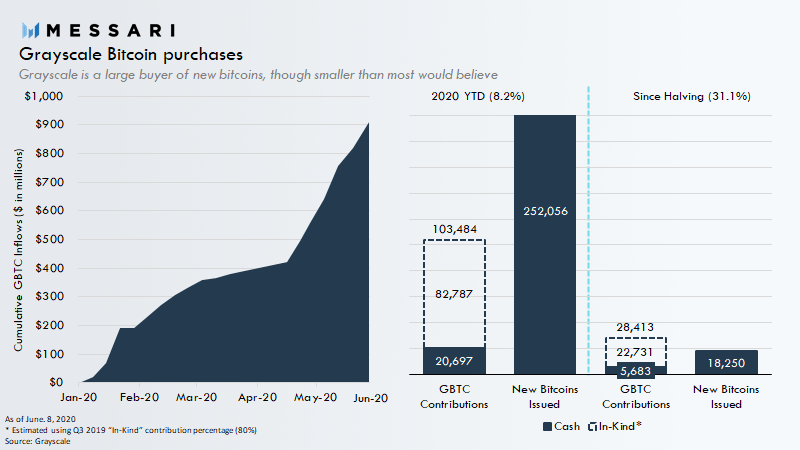

Factoring in "in-kind" purchases, Grayscale has only bought 31% of all new bitcoins mined since the halving, far less than the 150%+ many have reported.

This is just one of many misconceptions about Grayscale& #39;s trusts.

1/

Factoring in "in-kind" purchases, Grayscale has only bought 31% of all new bitcoins mined since the halving, far less than the 150%+ many have reported.

This is just one of many misconceptions about Grayscale& #39;s trusts.

1/

The peculiar structure of Grayscale& #39;s trust products have also likely caused many retail investors to misunderstand how much additional risk they& #39;re exposing themselves to.

Let& #39;s use Grayscale& #39;s Ethereum trust (ETHE) as an example.

Let& #39;s use Grayscale& #39;s Ethereum trust (ETHE) as an example.

Initial ETHE shares are only available to accredited investors and can be created either using cash or cryptocurrency ("in-kind").

A “Rule 144 exemption” allows these initial investors to sell shares to the public on secondary markets after a 12-month holding period.

A “Rule 144 exemption” allows these initial investors to sell shares to the public on secondary markets after a 12-month holding period.

When there are a lot of buyers and few sellers, investors in the secondary market can push the price of the shares well above the value of the underlying cryptocurrencies.

Since no new shares are being created, no new cryptocurrency is actually going into the trust, creating a premium to the underlying.

This can create a significant arbitrage opportunity for accredited investors who can create new shares in the primary market.

This can create a significant arbitrage opportunity for accredited investors who can create new shares in the primary market.

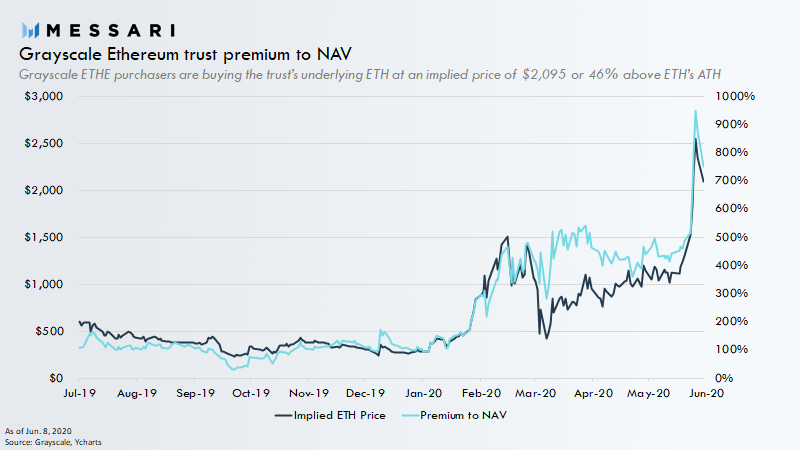

The ETHE premium has gotten so high that investors are now paying a 750%+ premium for exposure to ETH.

What this means is that secondary market investors are buying ETHE& #39;s underlying ETH at an implied price of $2,095.

This is 46% above ETH& #39;s ATH!

What this means is that secondary market investors are buying ETHE& #39;s underlying ETH at an implied price of $2,095.

This is 46% above ETH& #39;s ATH!

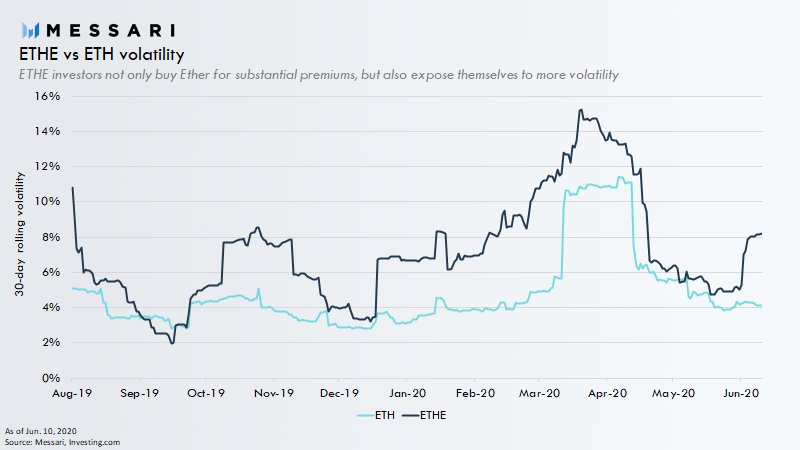

The premiums not only cause secondary market investors to buy ETH exposure at absurd prices, but also exposes them to excess volatility given the fluctuating premiums.

As previously stated these premiums create significant arbitrage opportunities for accredited investors that can create new shares in the primary market.

But why do the premiums remain so high?

But why do the premiums remain so high?

In my latest pro piece I explain how arbitrageurs take advantage of this opportunity, and lay out the path for ETHE premiums to fall.

TL;DR - the ETHE premium will likely fall significantly by end of summer. https://messari.io/article/unpacking-misconceptions-about-grayscale-s-investment-trusts">https://messari.io/article/u...

TL;DR - the ETHE premium will likely fall significantly by end of summer. https://messari.io/article/unpacking-misconceptions-about-grayscale-s-investment-trusts">https://messari.io/article/u...

Read on Twitter

Read on Twitter than many would think.Factoring in "in-kind" purchases, Grayscale has only bought 31% of all new bitcoins mined since the halving, far less than the 150%+ many have reported.This is just one of many misconceptions about Grayscale& #39;s trusts.1/" title="Grayscale buys way less #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> than many would think.Factoring in "in-kind" purchases, Grayscale has only bought 31% of all new bitcoins mined since the halving, far less than the 150%+ many have reported.This is just one of many misconceptions about Grayscale& #39;s trusts.1/" class="img-responsive" style="max-width:100%;"/>

than many would think.Factoring in "in-kind" purchases, Grayscale has only bought 31% of all new bitcoins mined since the halving, far less than the 150%+ many have reported.This is just one of many misconceptions about Grayscale& #39;s trusts.1/" title="Grayscale buys way less #Bitcoin https://abs.twimg.com/hashflags... draggable="false" alt=""> than many would think.Factoring in "in-kind" purchases, Grayscale has only bought 31% of all new bitcoins mined since the halving, far less than the 150%+ many have reported.This is just one of many misconceptions about Grayscale& #39;s trusts.1/" class="img-responsive" style="max-width:100%;"/>