The Decade of Discontent, Destruction and Debt Deflation: 2020-2030

Next 10 yrs will be a telling & trying time. We’re entering the next phase of a crisis brewing since 2008. The root cause & solution lie in reforming & reversing the state’s role in money and markets.

A thread.

Next 10 yrs will be a telling & trying time. We’re entering the next phase of a crisis brewing since 2008. The root cause & solution lie in reforming & reversing the state’s role in money and markets.

A thread.

1/Recent dramatic financial & social events point to a grand crisis that will climax around 2030. The economy going forward will be a distorted version of itself growing/contracting in violent ways dislocating, disrupting and destroying traditional businesses.

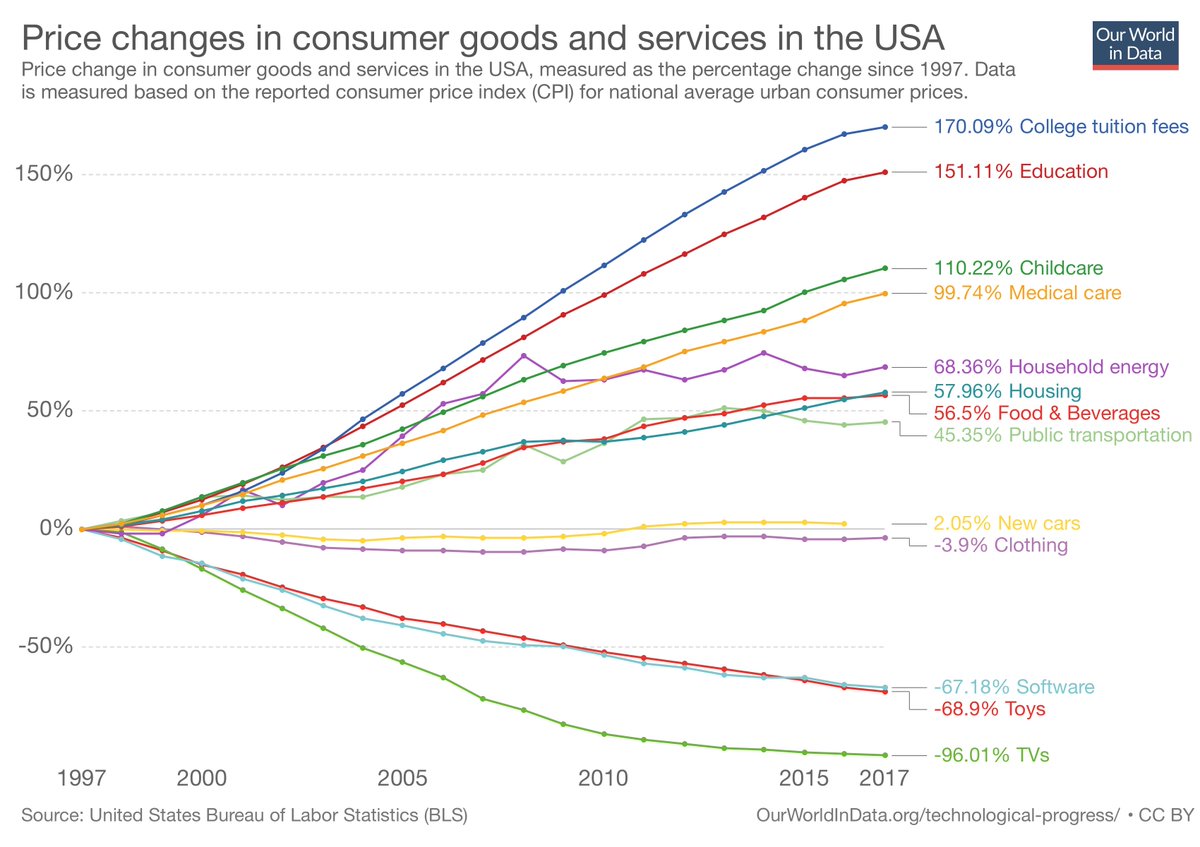

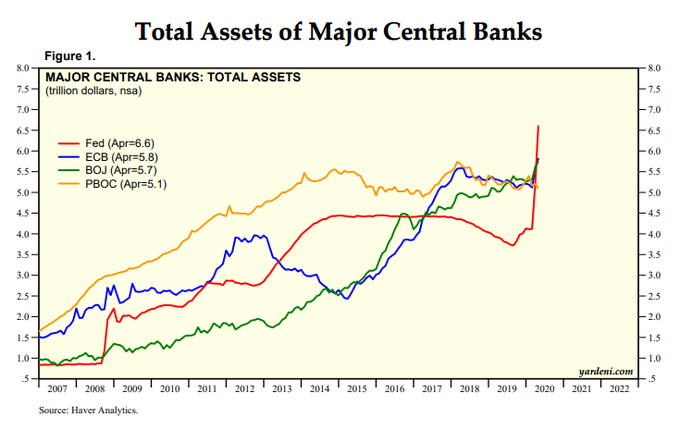

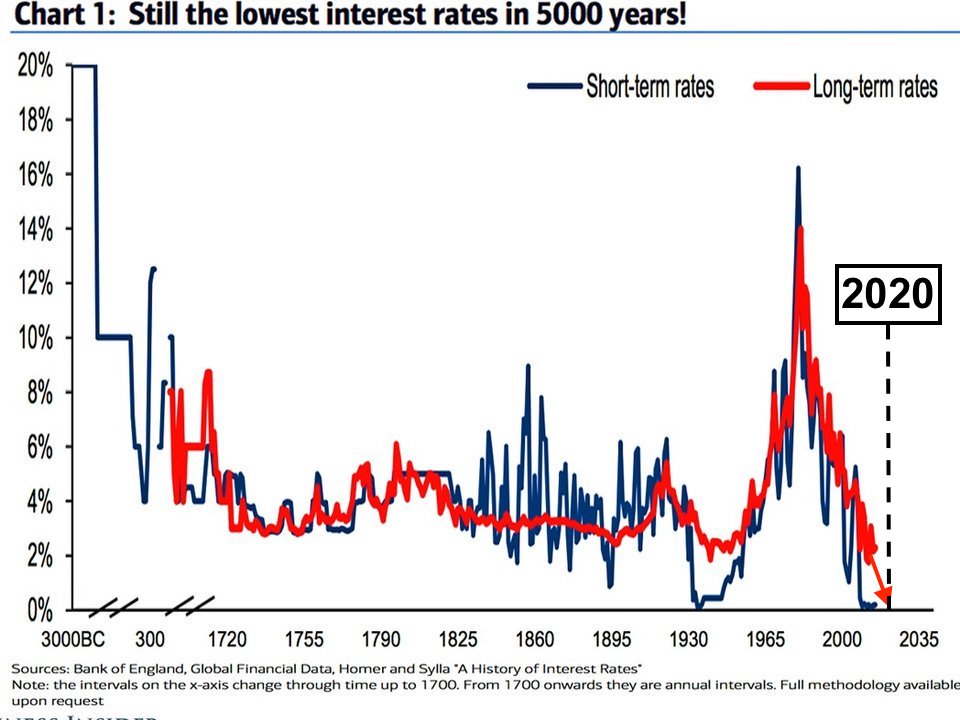

2/Families will suffer and continue to struggle under the dark shadow of central bank policies which punish savers through inflation, wage stagnation and negative interest rates. The average working family will struggle with both implicit and explicit inflation. A familiar chart:

3/Healthcare, housing & education will be further out of reach of most families. Inflation and money printing will deprive opportunities for savings. The state and its cronies will be primary benefactors of central bank policies. The only thing trickling down will be debt.

4/CB debt will be unleashed like never before in order to combat economic deflation in part driven by deleveraging but also by macro trends as @JeffBooth describes in his book "The Price of Tomorrow." These trends act as a gravity well pulling prices down.

5/A deep seated fear of deflation spurs CBs to do whatever it takes to stoke the fires of inflation. They confuse fiat debt deleveraging with sound money price deflation.

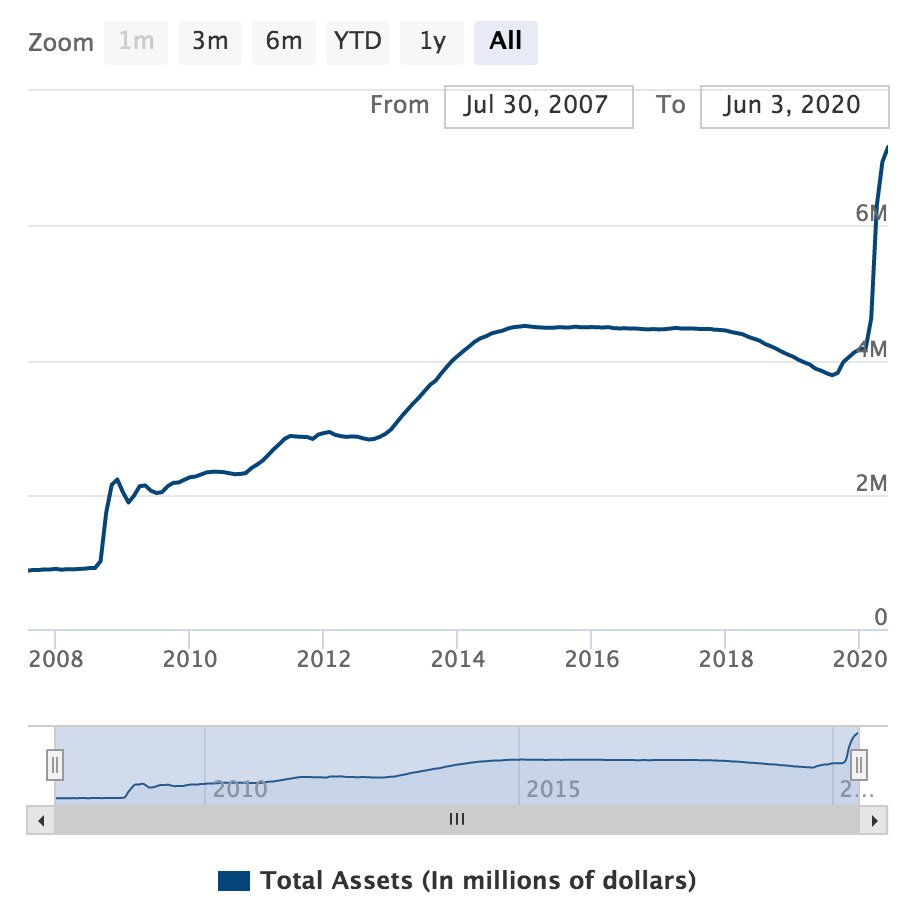

6/CB liquidity is a liquidity trap. Moral hazard drives undue systemic risk which has and will vaporize trillions more of the public’s wealth. They’re heating the house by setting it on fire. Fed’s balance sheet:

7/Yet CBs will overshoot their targets as printed money will not be diverted into productive and capital intensive businesses. The result: parallel economies where a few benefit from the money spigot. Equities are the obvious first tranche.

8/These deeper economic divides create social divides manifesting as political turmoil and social unrest. The parallel fiat fueled “have” economy acts as a visible accelerant.

9/Sparks will vary. State/social oppression, joblessness, food shortages, etc. "Eat the rich" will be a common refrain. Widespread protests let off steam. Yet the pressure will not let up. The state will clamp down harder.

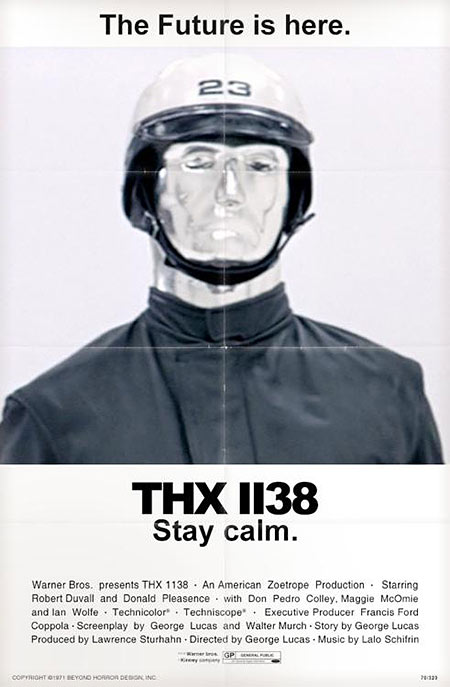

10/Those closest to the government’s largesse continue to accrue power tightening control over capital markets, investment, & growth opportunities. Widespread surveillance and control seeps into every facet of our lives.

11/We have become dependent on authoritarian figures and our ability to self-govern and engage in self-determination has atrophied. We will increasingly look like a policed people.

12/There’s much to look forward to.

Liquidity crises

Equity/bond market dysfunction

USD duress

Globalisation muted

Supply chain stress

Liquidity crises

Equity/bond market dysfunction

USD duress

Globalisation muted

Supply chain stress

13/And there’s more.

Credit limited to HNWI

Political divides deepen

Social unrest/riots

Local inflation/deflation

Food & personal insecurity

Wealth hatred

Credit limited to HNWI

Political divides deepen

Social unrest/riots

Local inflation/deflation

Food & personal insecurity

Wealth hatred

14/Trust in institutions will finally collapse and evolve into expressions of outright revolt. Much of the anger (initially) will be misdirected. The old calcified systems of course fight back in a desperate act of self-preservation. These are signs of a grand restructuring.

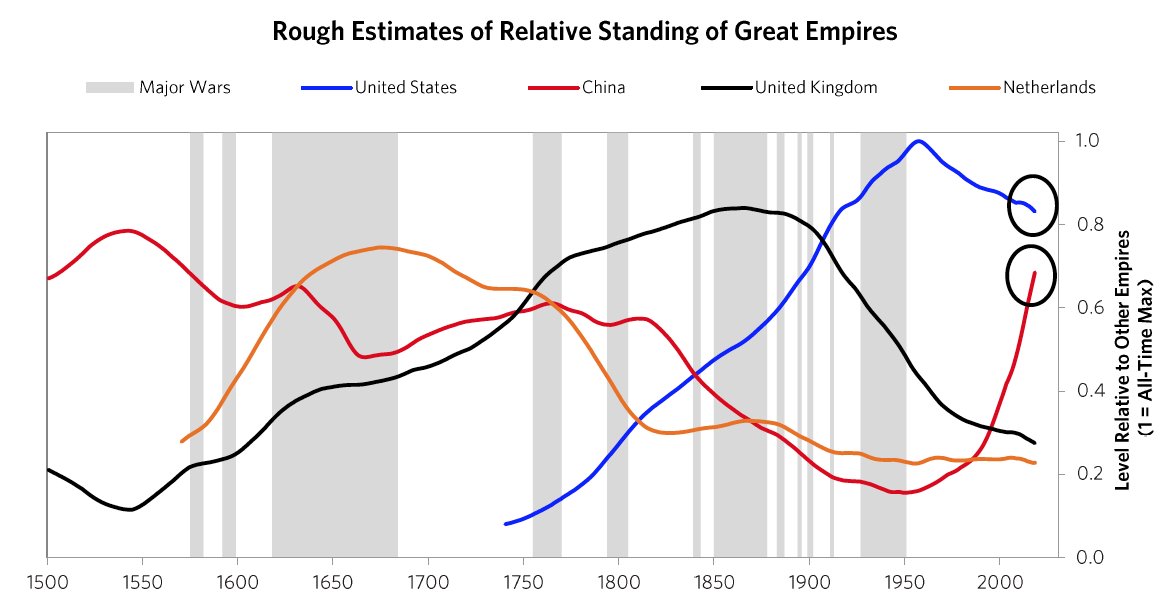

15/The decade will confirm the end of a global macro cycle. It threatens the USD’s status as the world’s reserve currency and the US’s role as the sole superpower as @raydalio describes in recent posts.

https://www.linkedin.com/pulse/big-cycles-over-last-500-years-ray-dalio/">https://www.linkedin.com/pulse/big...

https://www.linkedin.com/pulse/big-cycles-over-last-500-years-ray-dalio/">https://www.linkedin.com/pulse/big...

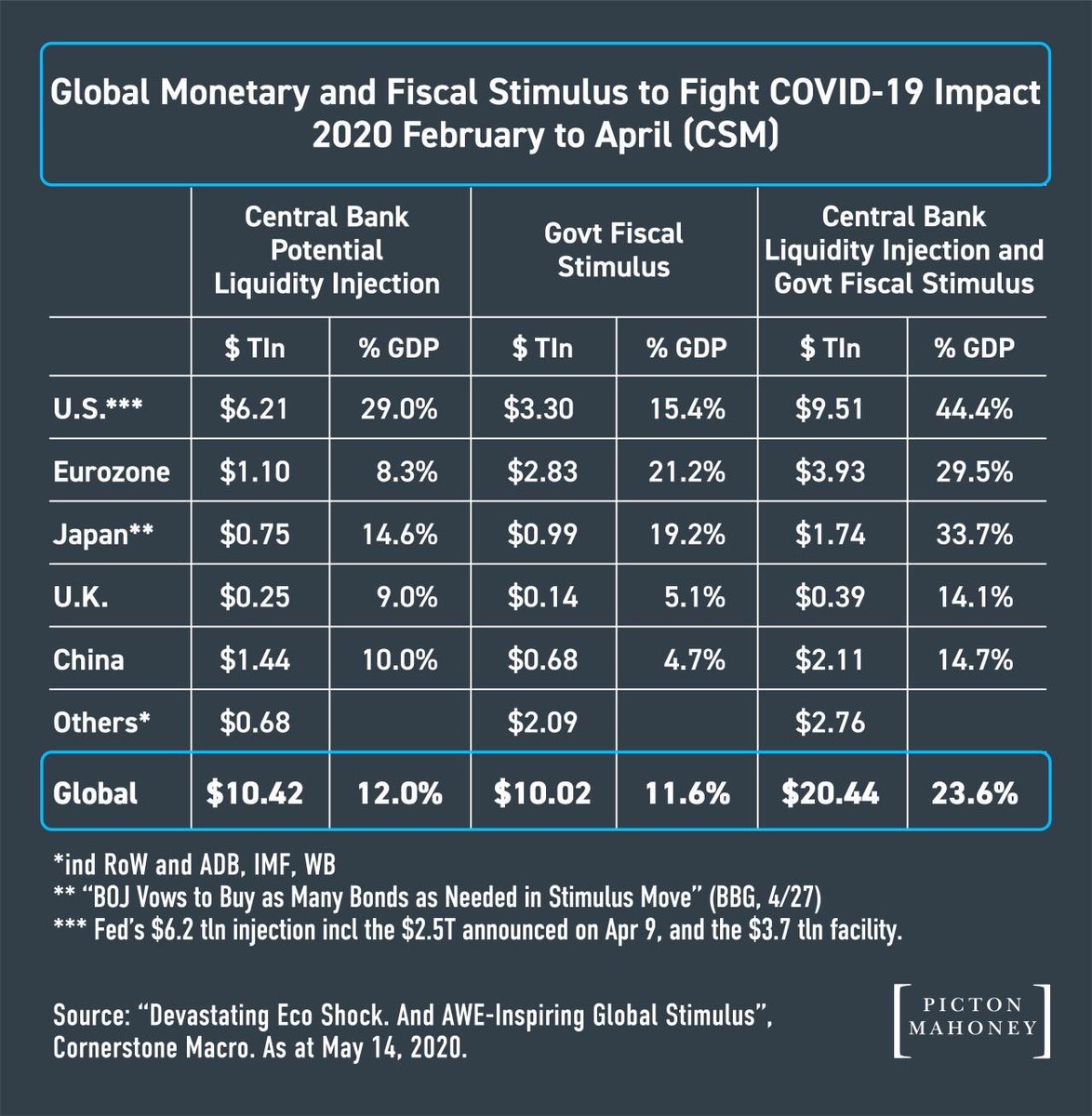

16/During the next 10 years a series of deflationary events will force central banks & the state to fill price voids with endless reams of money in the form of QE, UBI, debt jubilees, public works and negative interest rates.

18/Fiat money will be under attack. Dysfunction in the dollar market will express itself in volatility and loss of trust. A threatened USD opens the door for a myriad of pretenders to the throne. Yet they suffer from the same set of centralized ills.

19/In a post USD world, counter party trust will be challenging. Goods and services continue to flow across virtual and real borders yet the exchange medium will be suspect and subjected to controls.

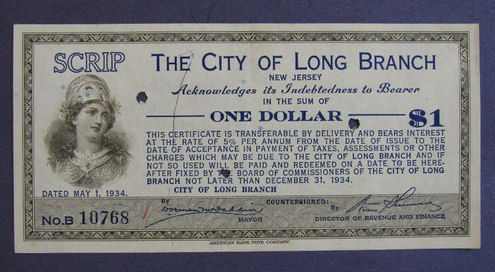

20/We should not be surprised by a smorgasbord of national and even local currencies (esp. during the depths of the crisis) acting as temporary MOE akin to the local monies that developed in the US during the Great Depression.

21/As the crisis unfolds central banks fighting devaluation events ultimately feed a rebound hyperinflationary economy. Already fractured state institutions break and in their place new forms of order take root.

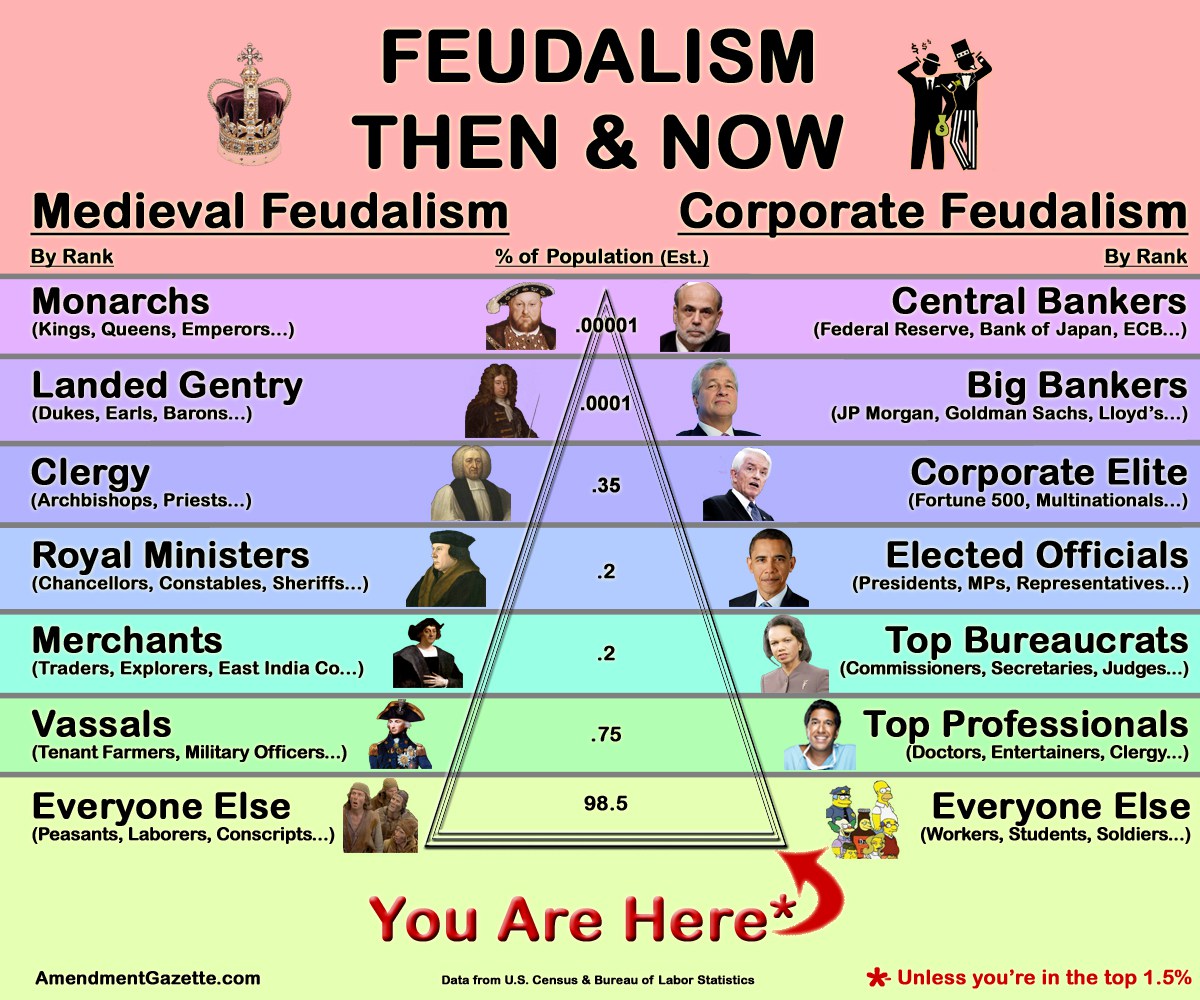

22/The defining subtext of the decade lies in the struggle to reform our money. We& #39;ll learn we do not live in a capitalist society but within a fiat feudal system. The walls of the lords will be breached.

23/A global conflict will end the decade. Physical/cyber/bio- war. But one thing must be considered: the enemy may not be another nation but citizens everywhere resisting fiat funded state oppression.

24/What does 2030 look like? The outcome is far from certain. Will we establish a new governance model or simply collapse under the weight of the old unable to save ourselves and capitulate to even stronger authoritarian regimes?

25/Perhaps a post crisis world where new institutions grow out of the old? A reordering that supersedes national interests conforming to what society demands in an increasingly interconnected and interdependent civilization.

26/If we reject authoritarian systems and financial suppression, human imagination can be freed to work without intrusive regulations. CBs and state apparatuses are weakened. The inflation mandate is broken and interest rates can return to their natural levels.

27/Monetary reform will be part of the restructuring effort and the fiat experiment, on its last legs, finally comes to an end. The rupture can only be repaired by sound money. Enter #Bitcoin  https://abs.twimg.com/hashflags... draggable="false" alt="">.

https://abs.twimg.com/hashflags... draggable="false" alt="">.

28/Bitcoin will increasingly be seen not just a safe haven but as the engine for a new age of prosperity. Bitcoin defunds the state’s ability to fund needless war, obtrusive surveillance, overbearing taxation and the insidious effects of inflation.

29/Markets repaired, the individual’s needs are accounted for. Hyper-partisanship will be muted and people begin coordinate their social and economic activity free from state interference.

30/Economic stability begets familial stability. And stable families give rise to self-interested parties which leads to working governance and the power to change that governance without the threat of state violence.

31/The core of the state will be removed and replaced by nimble, ad hoc “municipalities” which form not only locally but globally through virtual cooperation based on shared needs and goals.

32/Post 2030, Bitcoin will play a dominant role in global trade, large scale settlement and form the foundation of a new monetary system once and for all out of the hands of the state.

33/In time Bitcoin will become part of our daily lives. You will be paid and pay others in sats. But more importantly, money will finally be available for examination & verification by anyone, anywhere, anytime.

Fin/The decade will end and transform our world. It will be unrecognizable to us. Yet hopefully we will be on the path to reforming and reorganizing our world around sound money and economic law codified in Bitcoin’s principles.

Read on Twitter

Read on Twitter