"The best business is a royalty on the growth of others." -- Buffett

If you are looking at the unprecedented monetary base expansions around the world but are wary of investing directly in gold, read on.

$FNV

If you are looking at the unprecedented monetary base expansions around the world but are wary of investing directly in gold, read on.

$FNV

Disclaimers: I& #39;ve followed Franco-Nevada for about a decade now and added to my position in early/mid 2013, late 2015 and late 2019. None of this is investment advice. Do you own work before committing capital including seeking professional advice if necessary.

I believe $FNV has a very high quality business model in the gold/precious metals (and some oil/gas) space which allows asymmetric upside capture with limited downside on the key underlying commodity - gold.

I will not go into the basics of the model which you can read for yourself here on $FNV& #39;s website (and filings)

https://www.franco-nevada.com/about-us/our-business-model/default.aspx

Also">https://www.franco-nevada.com/about-us/... read their asset handbook which has high quality disclosure on their assets and is the basis of my valuation https://s21.q4cdn.com/700333554/files/flipping_book/asset_handbook/index.html">https://s21.q4cdn.com/700333554...

https://www.franco-nevada.com/about-us/our-business-model/default.aspx

Also">https://www.franco-nevada.com/about-us/... read their asset handbook which has high quality disclosure on their assets and is the basis of my valuation https://s21.q4cdn.com/700333554/files/flipping_book/asset_handbook/index.html">https://s21.q4cdn.com/700333554...

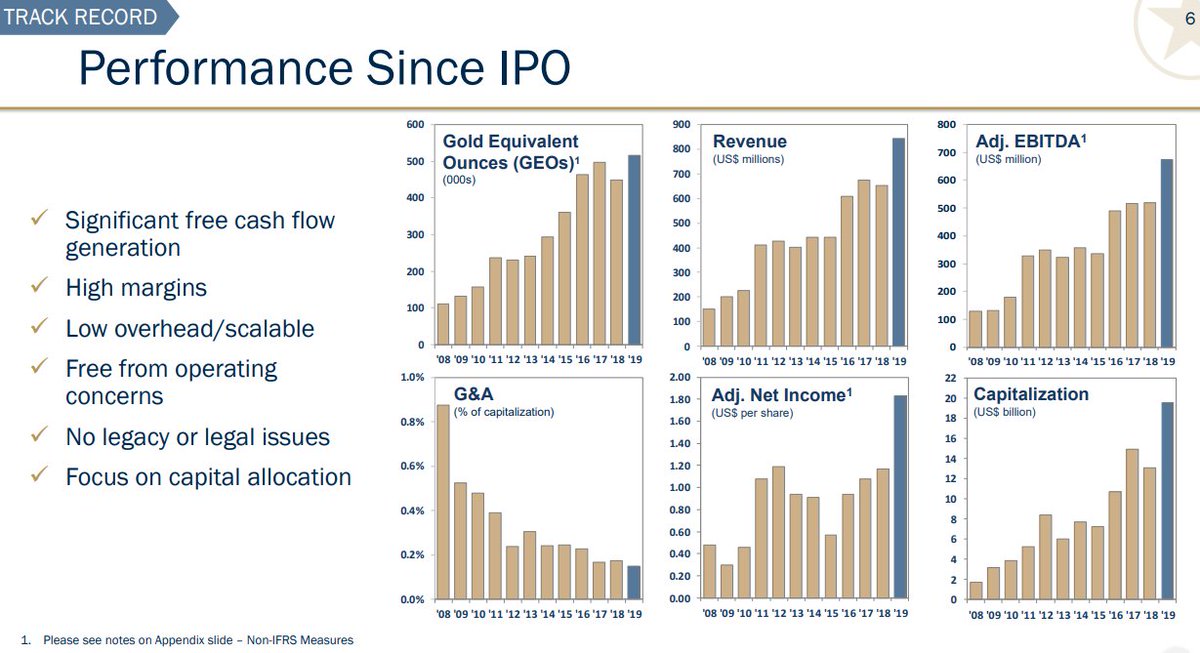

The key is to understand that $FNV is almost a pure royalty/stream on gold assets with absolutely no committed capital expenditures with *perpetual* exploration optionality on land area greater than the size of Switzerland (or thereabouts).

To drive this point home, $FNV has higher free cash flow margins than Facebook and also has higher revenue per employee than Facebook. It also sports returns on tangible capital which are in the triple digits (in fact, it is so high that it is not a meaningful measure)!

Management are true owner-operators and the company was co-founded by investing legend Pierre Lassonde and run by David Harquail until recently handing over the reins to Paul Brink. Management are counter-cyclical capital allocators with skin in the game.

In fact, insiders own so much stock that the value of the stock they own is more than the value of the stock the rest of the industry owns *combined*. They have behaved with integrity and have treated shareholder capital wisely during the infrequent times they have raised equity

What are the barriers to entry? Most important is the balance sheet as well as the skill to do due diligence (knowledge of geology, ore grades as well as risk assessment and royalty structuring). You also need a pristine zero-debt balance sheet to be able to strike deals quickly.

Reputational entry barriers: like credit rating agencies, $FNV partnership is a seal of approval of the quality of the mine and the operational capability of the miner due to the amount of due diligence done on the miner (eg see commentary from miners when they announce deals)

The industry structure is reasonably stable. There are only a handful of royalty companies (and basically an oligopoly when you get into larger deals $100m+). $FNV are financiers (but not leveraged like a bank) so competition is from equity/debt markets, banks etc.

$FNV are also low risk beneficiaries of a rising gold price. Due to the very low cost model and no physical assets, cash flows grow in proportion with (1) production growth of existing portfolio (2) commodity price and (3) new deal sourcing in new assets.

However, this is asymmetric - if gold prices fall over a multi-year period, miners will find that their cost of equity capital is higher and hence demand for $FNV& #39;s financing grows in a counter-cyclical way. This is an antifragile business.

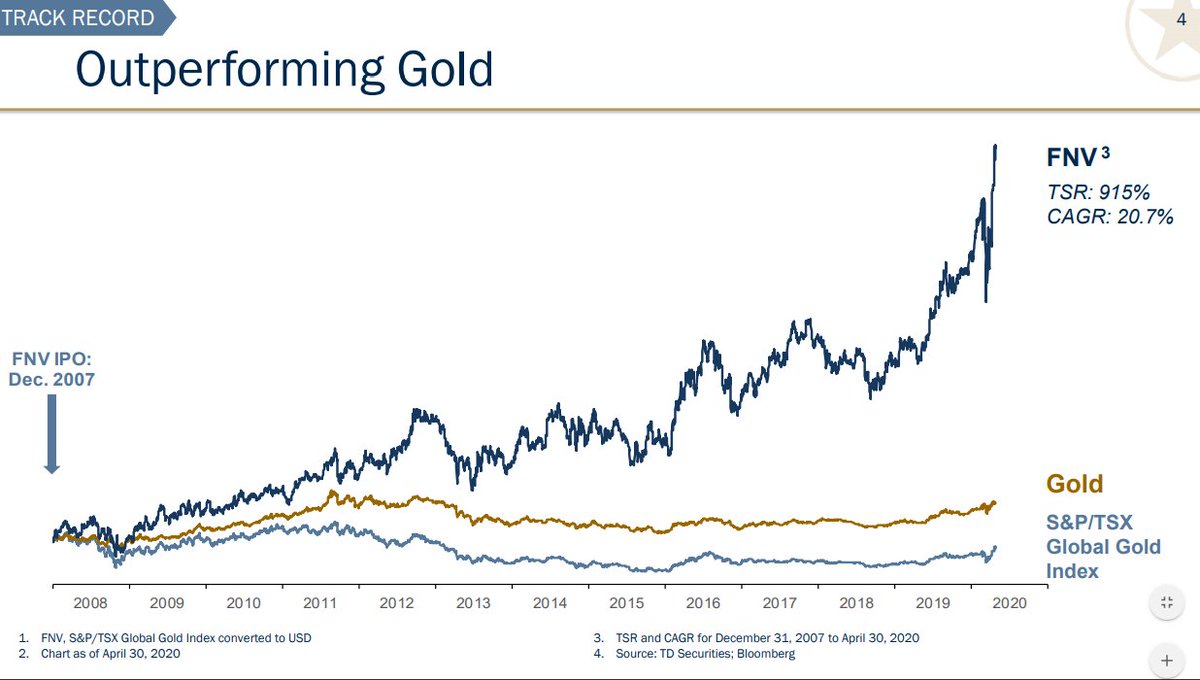

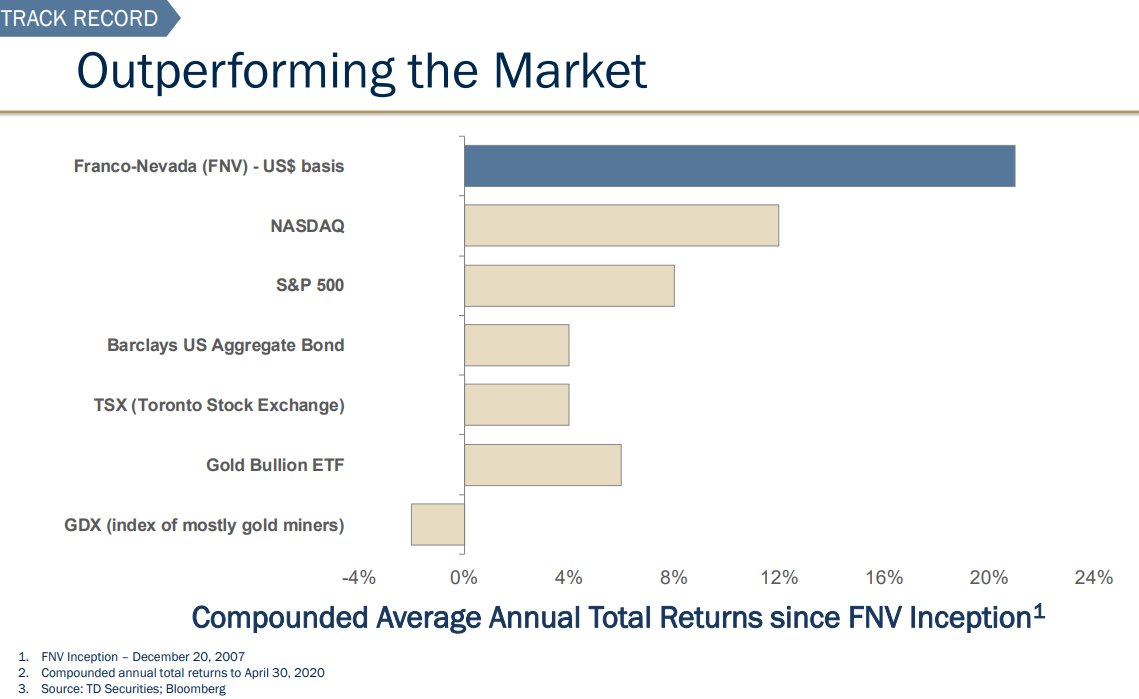

Evidence for this for example during 2013-2018 where the gold price was basically flat within a tight range but $FNV were able to grow FCF per share in the teens and the share price roughly kept pace while the miners didn& #39;t even come close to achieving this.

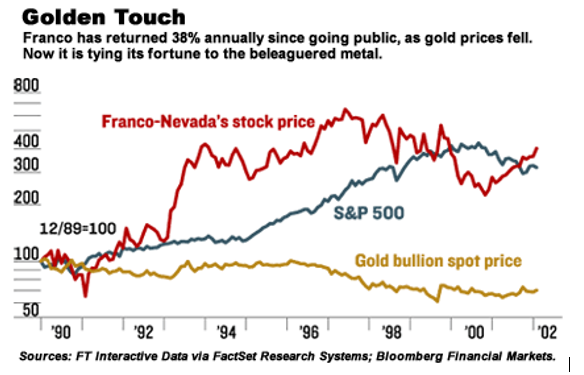

More evidence can be found if you go back in history. $FNV (in it& #39;s older incarnation before being sold to Newmont in 2002) compounded cash flows per share and the stock price at a very healthy clip - during a gold *bear* market (!)

The result is that you get an excellent hedge (via gold) but unlike other hedges, you do not suffer a cost of carry - $FNV has beaten the underlying commodity, the gold mining index as well as wider equity markets driven by true underlying clean FCF growth (per share)

A very important nuance that most gold analysts never pay much attention to is also that $FNV& #39;s royalty deals rank higher than operating debt. This is important to grasp as it materially de-risks the equity (and helps frame the optically high valuation/rating).

I believe both fundamental and monetary conditions are very supportive for gold over the next 5-10 years. Fundamentally, on the supply side, the peak discovery period for gold was in the mid-90s and peak production was in the mid-2010s and has been falling since.

However I would caveat this by saying that the conventional long run marginal cost analysis has its flaws when applied to gold as unlike say, copper or oil, gold demand is not met out of current production but out of inventory (non perishable/consumable unlike copper/oil).

The monetary conditions for the price of gold to rise higher has been put in motion given the government balance sheet expansions we are seeing *globally*. Gold follows money supply - or more accurately, other assets including currencies depreciate relative to gold!

Valuation is a tricky subject when it comes to gold (and by extension $FNV). I believe using traditional cost of equity metrics can be overly punitive for gold royalty companies and the true discount rate is closer to 0-5% that the industry uses (yes, that was zero to five!).

This is because gold is non-deteriorating currency and its purchasing power against a basket of essential assets and cost of living has remained unchanged over hundreds of years. This, combined with unique deal structure (senior to debt) is important to consider.

Some evidence for this: $FNV in its earlier incarnation (Old Franco), it traded at an average P/FCF of 35x and average EV/EBITDA of 25x between 1982-2002 during a gold *bear* market! Also remember revenues are senior to debt (as above).

There are many ways to consider valuation. I will not profess an opinion here as value is in the eye of the beholder and is for you to consider/act on. But some ways to frame valuation below. I find 25x FCF (above the long-run long bond rate) an interesting level for me.

Read on Twitter

Read on Twitter