1/

Get a cup of coffee.

In this thread, I& #39;m going to walk you through the concept of "owner earnings".

Get a cup of coffee.

In this thread, I& #39;m going to walk you through the concept of "owner earnings".

2/

Imagine that you& #39;re opening a coffee shop.

You find a nice corner location with lots of foot traffic. And you sign a lease. Your monthly rent, including all utilities, will be $5K.

Imagine that you& #39;re opening a coffee shop.

You find a nice corner location with lots of foot traffic. And you sign a lease. Your monthly rent, including all utilities, will be $5K.

3/

Then you spend $100K on swanky furniture, fancy lights and other fixtures, etc.

Now the place looks really inviting. And you don& #39;t have to touch it for the next 10 years.

Then you spend $100K on swanky furniture, fancy lights and other fixtures, etc.

Now the place looks really inviting. And you don& #39;t have to touch it for the next 10 years.

4/

Next, you buy some high-end coffee making equipment: coffee roasters, espresso machines, etc. This sets you back about $60K.

This equipment will last you 3 years.

Next, you buy some high-end coffee making equipment: coffee roasters, espresso machines, etc. This sets you back about $60K.

This equipment will last you 3 years.

5/

Then you buy supplies for $30K: coffee beans, milk, water, napkins, paper cups, etc.

These supplies will maybe last you a month before you have to replenish them.

The next day, you open for business. This happens to be Jan 1, 2019.

Then you buy supplies for $30K: coffee beans, milk, water, napkins, paper cups, etc.

These supplies will maybe last you a month before you have to replenish them.

The next day, you open for business. This happens to be Jan 1, 2019.

6/

Fast forward 1 year.

We& #39;re now at Dec 31, 2019.

Your coffee shop was a huge success.

You sold $1M of coffee in the very first year.

Fast forward 1 year.

We& #39;re now at Dec 31, 2019.

Your coffee shop was a huge success.

You sold $1M of coffee in the very first year.

7/

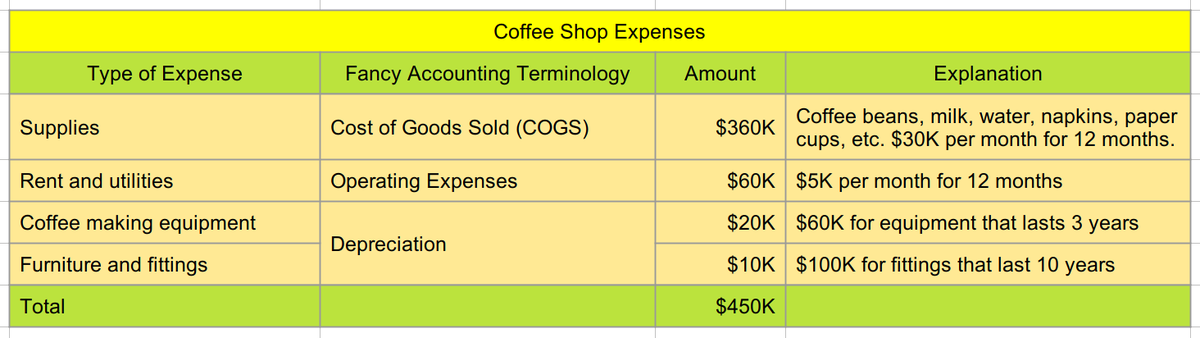

Let& #39;s calculate how much money you made in 2019.

Your revenues were $1M. That& #39;s how much coffee you sold.

And your expenses? They come to around $450K:

Let& #39;s calculate how much money you made in 2019.

Your revenues were $1M. That& #39;s how much coffee you sold.

And your expenses? They come to around $450K:

8/

So, your pre-tax income for 2019 was about $550K ($1M revenue minus $450K expenses).

Say you make a $110K immediate payment to the IRS to cover your taxes for 2019.

That leaves you with a respectable $440K in "net income" for 2019.

So, your pre-tax income for 2019 was about $550K ($1M revenue minus $450K expenses).

Say you make a $110K immediate payment to the IRS to cover your taxes for 2019.

That leaves you with a respectable $440K in "net income" for 2019.

9/

Let& #39;s say your coffee shop has a checking account where all cash is kept.

On Jan 1 2019, let& #39;s say this checking account had enough to cover about 3 months worth of expenses. That& #39;s ($5K rent/mo + $30K supplies/mo)*3 = $105K.

Let& #39;s say your coffee shop has a checking account where all cash is kept.

On Jan 1 2019, let& #39;s say this checking account had enough to cover about 3 months worth of expenses. That& #39;s ($5K rent/mo + $30K supplies/mo)*3 = $105K.

10/

Here& #39;s a simple question:

Net income for 2019 was $440K.

Does that mean the checking account will have grown to $545K (initial $105K plus $440K net income) by Dec 31 2019?

Here& #39;s a simple question:

Net income for 2019 was $440K.

Does that mean the checking account will have grown to $545K (initial $105K plus $440K net income) by Dec 31 2019?

10/

No.

Why? Let& #39;s think about all the deposits and withdrawals that would have affected the account in 2019.

Deposits would have totaled $1M (all the cash collected from customers).

Withdrawals would have totaled $530K (the cash used to pay for rent, supplies, and taxes).

No.

Why? Let& #39;s think about all the deposits and withdrawals that would have affected the account in 2019.

Deposits would have totaled $1M (all the cash collected from customers).

Withdrawals would have totaled $530K (the cash used to pay for rent, supplies, and taxes).

11/

So, the checking account& #39;s balance will have increased by $470K (not $440K) during 2019.

So, the account& #39;s balance on Dec 31 2019 will be $575K (initial $105K plus this $470K).

So, the checking account& #39;s balance will have increased by $470K (not $440K) during 2019.

So, the account& #39;s balance on Dec 31 2019 will be $575K (initial $105K plus this $470K).

12/

But net income was only $440K. How did the checking account grow by $470K?

The $30K difference is because net income included a $30K "non-cash" charge (depreciation).

This is to account for wear and tear on furniture, coffee making equipment, etc.

But net income was only $440K. How did the checking account grow by $470K?

The $30K difference is because net income included a $30K "non-cash" charge (depreciation).

This is to account for wear and tear on furniture, coffee making equipment, etc.

13/

This $30K depreciation is a very real cost to you.

It just didn& #39;t affect your checking account in 2019.

But you can be sure your checking account will be hit when you need to buy new coffee making equipment in 2 years.

This $30K depreciation is a very real cost to you.

It just didn& #39;t affect your checking account in 2019.

But you can be sure your checking account will be hit when you need to buy new coffee making equipment in 2 years.

14/

Key lesson 1: Learn the difference between "net income" and "operating cash flow".

In 2019, your coffee shop& #39;s net income was only $440K.

But operating cash flow (the amount your checking account increased by) was $470K.

Key lesson 1: Learn the difference between "net income" and "operating cash flow".

In 2019, your coffee shop& #39;s net income was only $440K.

But operating cash flow (the amount your checking account increased by) was $470K.

15/

Here& #39;s another question:

How much of this $470K can you actually withdraw from your coffee shop& #39;s checking account to your personal checking account, without hurting the business?

Here& #39;s another question:

How much of this $470K can you actually withdraw from your coffee shop& #39;s checking account to your personal checking account, without hurting the business?

16/

Well, let& #39;s see.

As before, you want to keep 3 months worth of operating expenses in cash.

There& #39;s always inflation. In 2019, 3 months of expenses was $105K. But in 2020, it may be more like $110K.

Well, let& #39;s see.

As before, you want to keep 3 months worth of operating expenses in cash.

There& #39;s always inflation. In 2019, 3 months of expenses was $105K. But in 2020, it may be more like $110K.

17/

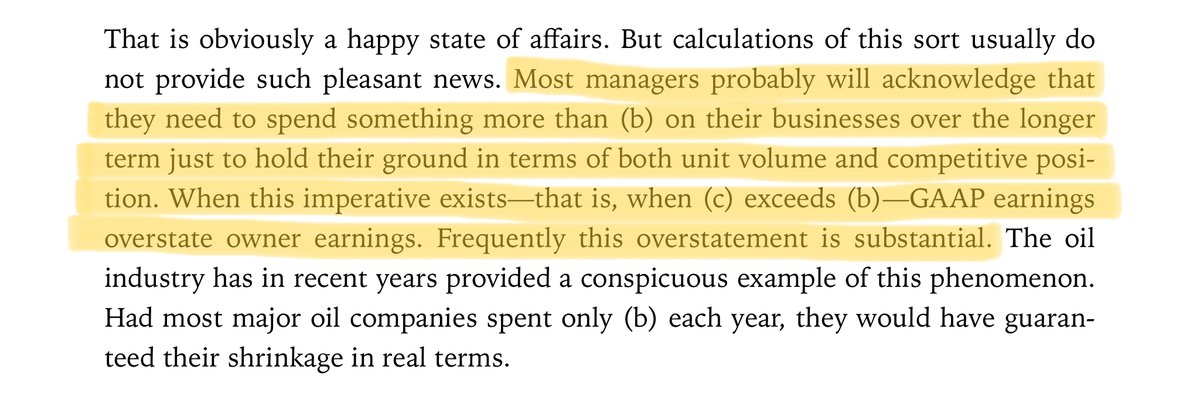

But that& #39;s not all.

In 2 years& #39; time, you& #39;ll need new coffee making equipment. That costed $60K a year ago, but may cost $70K in 2 years.

Better sock away a third of that $70K (~$23K) right now, so there& #39;s no cash crunch later.

But that& #39;s not all.

In 2 years& #39; time, you& #39;ll need new coffee making equipment. That costed $60K a year ago, but may cost $70K in 2 years.

Better sock away a third of that $70K (~$23K) right now, so there& #39;s no cash crunch later.

18/

Oh, and you& #39;ll need new furniture and fittings in 9 years time.

That costed $100K a year ago. It may cost $200K in 9 years. Better put away $20K this year (and each of the next 9 years) to cover that.

Oh, and you& #39;ll need new furniture and fittings in 9 years time.

That costed $100K a year ago. It may cost $200K in 9 years. Better put away $20K this year (and each of the next 9 years) to cover that.

19/

So you& #39;ll need to set aside $110K for operating expenses and $43K for future capital expenses (coffee making equipment, furniture, etc.). That& #39;s $153K.

Your coffee shop checking account has $575K.

So you can safely withdraw about $422K without hurting the business.

So you& #39;ll need to set aside $110K for operating expenses and $43K for future capital expenses (coffee making equipment, furniture, etc.). That& #39;s $153K.

Your coffee shop checking account has $575K.

So you can safely withdraw about $422K without hurting the business.

20/

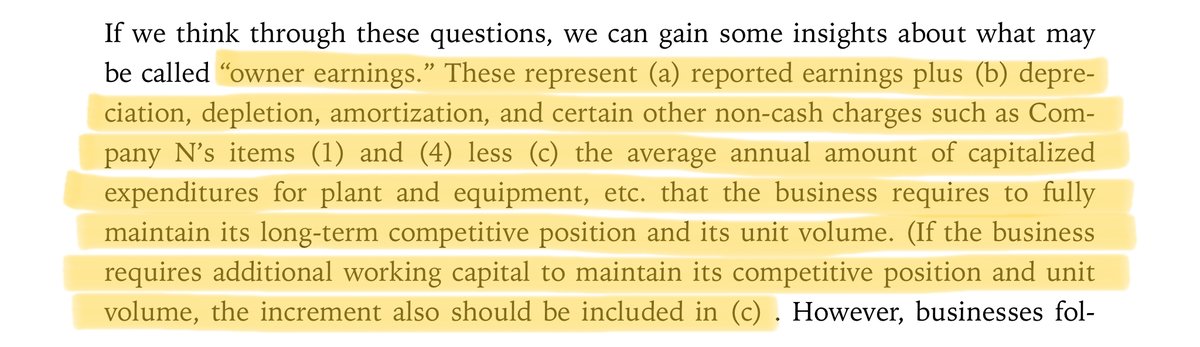

This $422K is called "owner earnings".

It& #39;s not how much cash the business has. It& #39;s how much cash the owner of the business can safely withdraw each year *without* hurting the business& #39;s current earning power or long-term prospects.

This $422K is called "owner earnings".

It& #39;s not how much cash the business has. It& #39;s how much cash the owner of the business can safely withdraw each year *without* hurting the business& #39;s current earning power or long-term prospects.

21/

Key lesson 2: When you buy a stock, think like an owner.

How much cash can the company distribute to you each year *without* hurting its business? And how much are you paying for those future cash flows? Do the numbers make sense?

Key lesson 2: When you buy a stock, think like an owner.

How much cash can the company distribute to you each year *without* hurting its business? And how much are you paying for those future cash flows? Do the numbers make sense?

22/

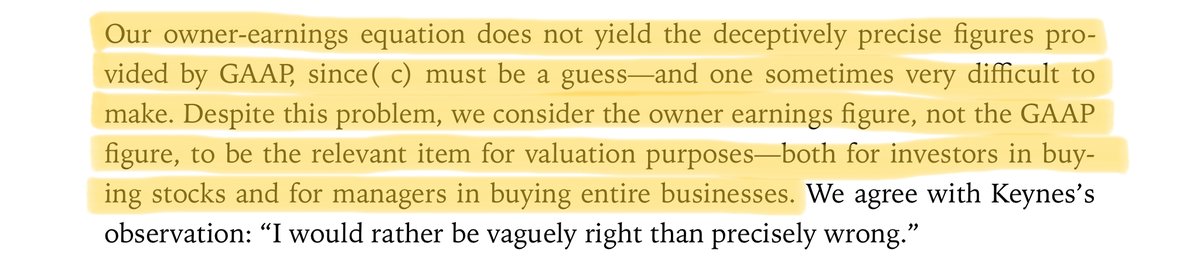

Owner earnings is not net income. It& #39;s not operating cash flow. It& #39;s not free cash flow.

It& #39;s an estimate based on how much cash it takes to maintain a business& #39;s earning power.

It& #39;s imprecise. But it& #39;s a concept that will help you think about businesses the right way.

Owner earnings is not net income. It& #39;s not operating cash flow. It& #39;s not free cash flow.

It& #39;s an estimate based on how much cash it takes to maintain a business& #39;s earning power.

It& #39;s imprecise. But it& #39;s a concept that will help you think about businesses the right way.

23/

I& #39;ll leave you with a couple of references to learn more about owner earnings.

Buffett& #39;s 1986 letter explains the concept beautifully: https://www.berkshirehathaway.com/letters/1986.html">https://www.berkshirehathaway.com/letters/1...

I& #39;ll leave you with a couple of references to learn more about owner earnings.

Buffett& #39;s 1986 letter explains the concept beautifully: https://www.berkshirehathaway.com/letters/1986.html">https://www.berkshirehathaway.com/letters/1...

24/

This @FocusedCompound episode on cash flow statements also has many nuggets on owner earnings.

For example, if a growing business ties up a lot of money in working capital, then that money is not really available to be distributed to owners. https://www.youtube.com/watch?v=z0sQA_EhxP0">https://www.youtube.com/watch...

This @FocusedCompound episode on cash flow statements also has many nuggets on owner earnings.

For example, if a growing business ties up a lot of money in working capital, then that money is not really available to be distributed to owners. https://www.youtube.com/watch?v=z0sQA_EhxP0">https://www.youtube.com/watch...

25/

Thanks for reading! Enjoy your weekend. Stay safe. Think like an owner. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😀" title="Grinsendes Gesicht" aria-label="Emoji: Grinsendes Gesicht">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😀" title="Grinsendes Gesicht" aria-label="Emoji: Grinsendes Gesicht">

/End

Thanks for reading! Enjoy your weekend. Stay safe. Think like an owner.

/End

Read on Twitter

Read on Twitter