I can& #39;t take the misuse of this terminology any more.

Inflation....Deflation....

Here& #39;s my point of view.

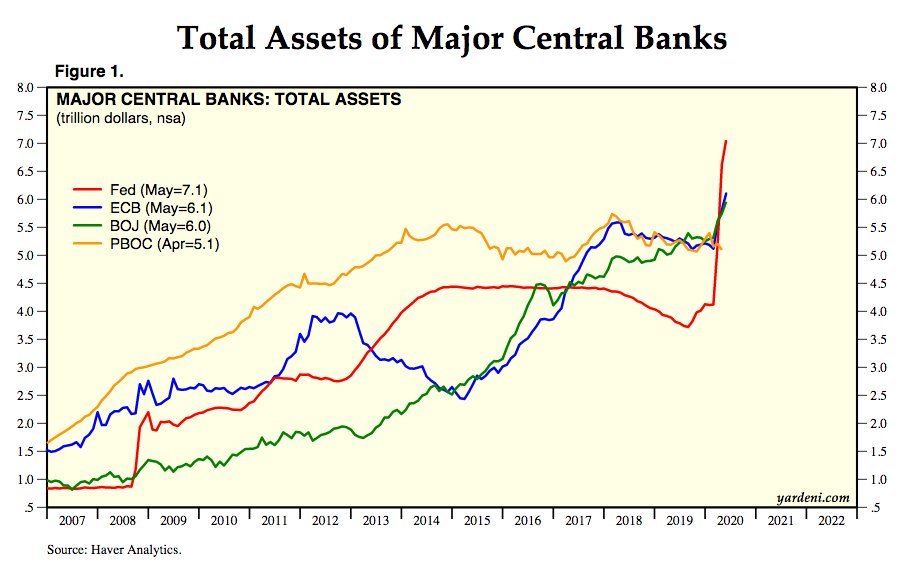

Central banks are aggressively "inflating" the fiat monetary base. Since 2008, the US federal reserve has expanded their balance sheet from .8T to 7.1T. Post 1

Inflation....Deflation....

Here& #39;s my point of view.

Central banks are aggressively "inflating" the fiat monetary base. Since 2008, the US federal reserve has expanded their balance sheet from .8T to 7.1T. Post 1

That means they have "inflated" that fiat monetary base supply of currency by 21.9% ANNUALLY over that 11 year period of time. Well, then why haven& #39;t we seen CPI "inflation"? Easy, because they are buy financial assets with that freshly printed money. Bonds are purchased .. /2

off the open market and freshly printed cash is supplied into the "free and open economy". The problem - the money goes straight into the hands of the people holding assets & only a trickle comes down into the lower income sections of the economy where a majority.. Post 3

of the population (percentage-wise) exists. As the wealthy portion of the population continues to benefit from this process of inserting freshly printed cash into the system, their net worth continues to grow & they get first access to allocate the capital to even ...Post 4

more advantageous assets that make more money. This is NOT free and open. This is manipulated. You won& #39;t find CPI inflation because the freshly printed money is nesting itself into financial assets by bidding the market capitalization higher and higher. Now for deflation.

When an economy& #39;s money supply becomes manipulated in an inflationary manner, it incentivizes aggressive investment (see above). This is because if the cash is simply held, it& #39;s value will continue to debase over time. But if the fiat is invested, it can potentially outpace

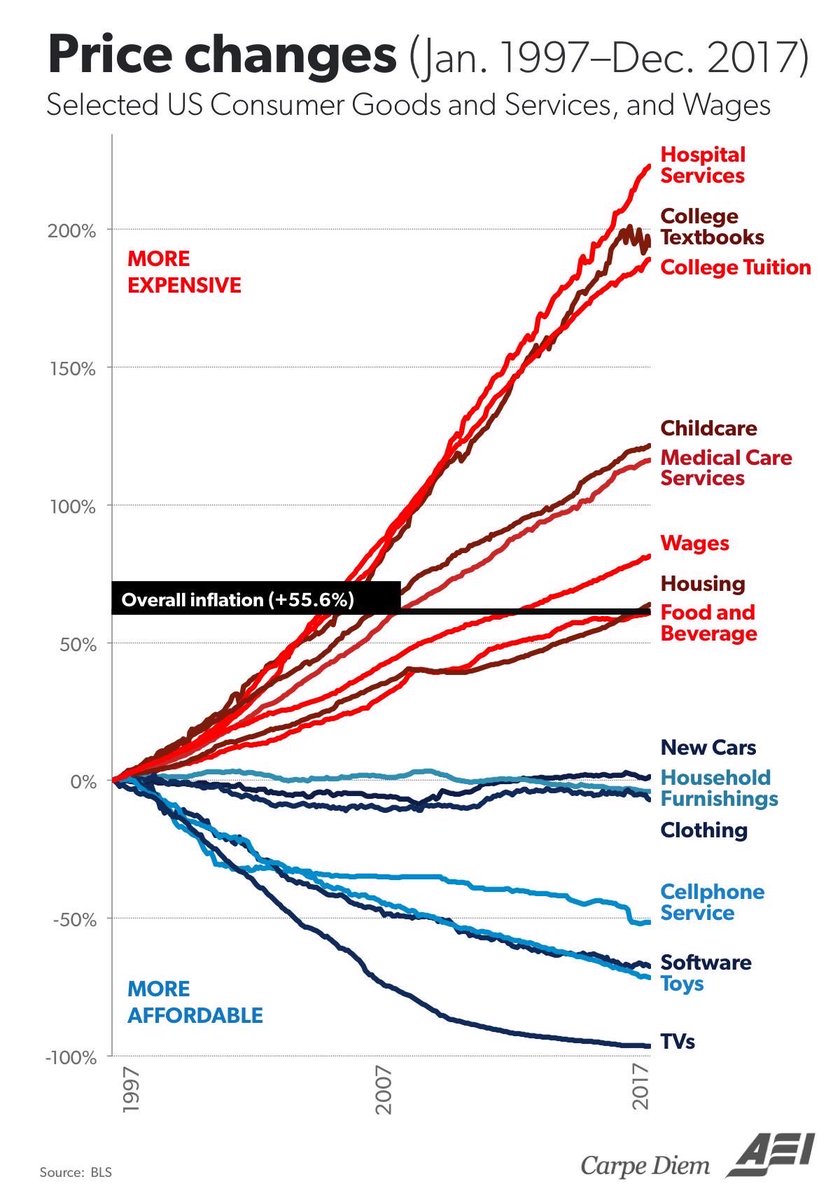

the debasement. When years and decades of a deeply manipulated inflationary fiat money expansion has occurred, it actually creates deflationary prices for some goods and services. Remember, the newly printed money is bidding asset prices, this means the gap between wealthy and

poor will expand. If a majority of the population can& #39;t afford goods and services (because the percentage of poor are becoming larger each day), then the demand for goods and services go down. If demand for goods and services go down, the price must follow it.

Now, the opposite is true for good and services that are absolute essentials to life. I.e. Healthcare, Food, Education. Look at this chart - it graphically explains everything.

So, we are seeing price deflation of non-essential goods and services. We are seeing price inflation of essential goods and services. We are seeing hyperish inflation of bonds and stocks due to the government unapologetically manipulating those markets.

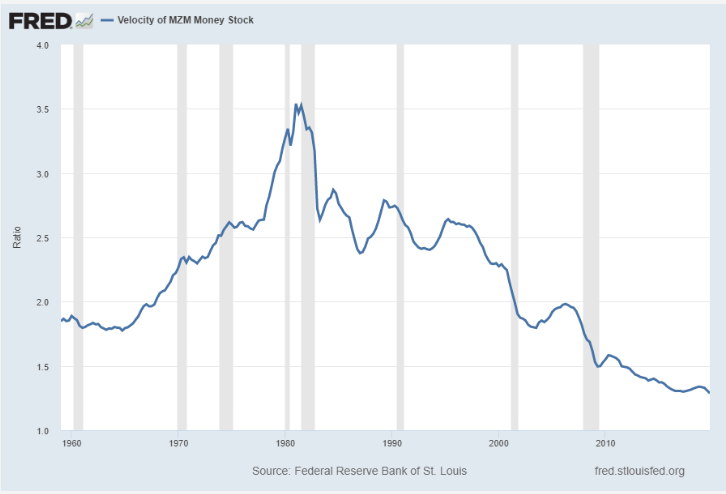

Why is the FED doing this? They have to. Right now, the money they are printing and inserting into the system (non-homogeneously) is not getting to the masses. This is why the velocity of money continues to decline in the system.

That& #39;s why the gov. is now doing direct deposits to citizens. It& #39;s got the fancy name, universal basic income (UBI). But don& #39;t let the name fool you - they are out of options. They MUST get cash into the hands of the citizens or else further civil unrest will continue

to spiral out of control. A majority of people don& #39;t have enough money to even pay for their basic needs any more. Long term, UBI has it& #39;s problems just like QE (asset purchases) has. But make no mistake about it, the engine is out of oil. They have to print, and they have

get the money into the general population where it& #39;s needed most. All of this is why I own Bitcoin. Everything that& #39;s being done is a short term fix to an unstoppable spiral of fiat printing doom. The people peacefully protesting on the streets have every right to be disgusted

by the 1st degree murder of George Floyd. But I think it& #39;s even bigger and deeper than that. I think the African America community (which I love dearly) are outraged because the financial system also feels rigged. And based on everything I wrote above, it is!

So here& #39;s my recommendation. Read these books:

Bitcoin and Black America - By @bitcoinzay

The Bitcoin Standard - By @saifedean

The Price of Tomorrow - By @JeffBooth

Everyone, take peaceful command of your future through the only sword which can supply it - pure knowledge.

Bitcoin and Black America - By @bitcoinzay

The Bitcoin Standard - By @saifedean

The Price of Tomorrow - By @JeffBooth

Everyone, take peaceful command of your future through the only sword which can supply it - pure knowledge.

If you’re wanting to understand my opinions on Bitcoin more, this podcast interview covers a lot of important ideas. Please give it a listen and let me know your questions. https://twitter.com/princey1976/status/1268651537754177544?s=21">https://twitter.com/princey19... https://twitter.com/princey1976/status/1268651537754177544">https://twitter.com/princey19...

Some folks that really need to read this thread about Inflation Vs Deflation: @andrewrsorkin @BeckyQuick @JoeSquawk @ThisIsSethsBlog @garyvee @guykawasaki @XSalaimartin @KellyCNBC @carlquintanilla @jimcramer @ScottWapnerCNBC @SaraEisen @kaylatausche @joerogan

Read on Twitter

Read on Twitter