I have not been one to take risk and tbh, I wish I did. I still have time but heeh,

I would honestly like to get in on some Pharmaceutical companies. But you can never have enough practice... so https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷🏾♀️" title="Achselzuckende Frau (durchschnittlich dunkler Hautton)" aria-label="Emoji: Achselzuckende Frau (durchschnittlich dunkler Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷🏾♀️" title="Achselzuckende Frau (durchschnittlich dunkler Hautton)" aria-label="Emoji: Achselzuckende Frau (durchschnittlich dunkler Hautton)"> https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷🏾♀️" title="Achselzuckende Frau (durchschnittlich dunkler Hautton)" aria-label="Emoji: Achselzuckende Frau (durchschnittlich dunkler Hautton)">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷🏾♀️" title="Achselzuckende Frau (durchschnittlich dunkler Hautton)" aria-label="Emoji: Achselzuckende Frau (durchschnittlich dunkler Hautton)">

Anyway in the meantime, please check @ScopeMarketsKE tutadiscuss CFDs. https://twitter.com/Wincie_/status/1254322707640061953">https://twitter.com/Wincie_/s...

I would honestly like to get in on some Pharmaceutical companies. But you can never have enough practice... so

Anyway in the meantime, please check @ScopeMarketsKE tutadiscuss CFDs. https://twitter.com/Wincie_/status/1254322707640061953">https://twitter.com/Wincie_/s...

When you talk about getting into shares, please make sure you know if you are dealing with contract for difference (CFD) or share investment. Very similar yet very different. Scope Market products fall on the former. (CFD). So what is CFD. What is share investment.

CFD- Derivative Financial Instrument. For these, it& #39;s about speculation. FYI, you don& #39;t buy the actual item (can be commodity ie gold, currency, shares). You DO NOT own the item. Share investment however, you own the actual shares.

With CFDs, it& #39;s a contract between you and a CFD provider, in this case Scope Markets

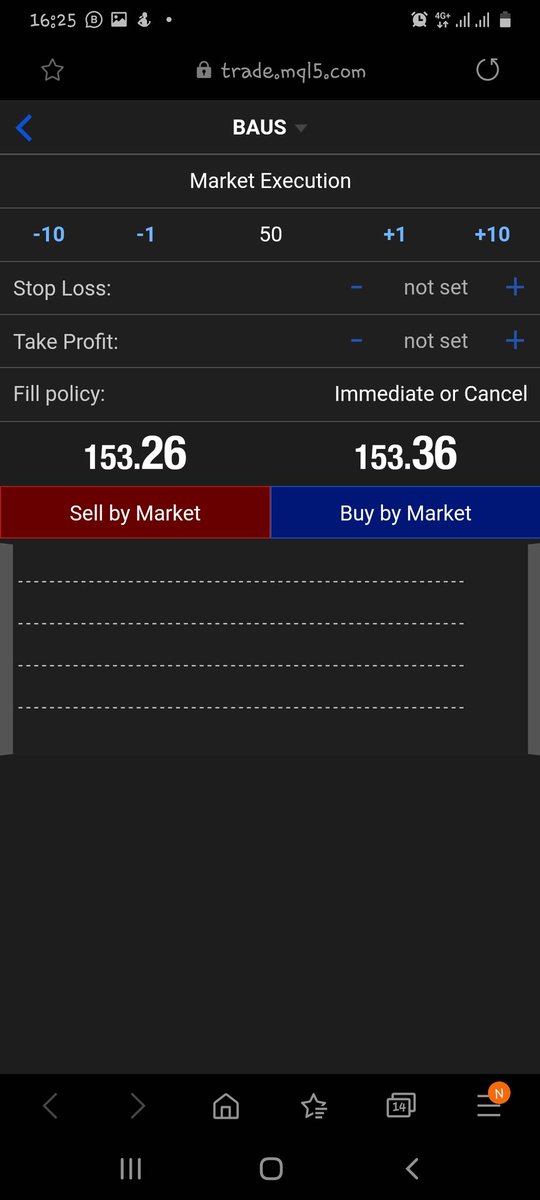

In this pic, are the buying and sale of Boeing shares (CFD). So if I were to buy, I& #39;d buy at 153.36, and sell at 153.26. End goal is to make as much from 1 CFD. So I would wait for price>153.36

In this pic, are the buying and sale of Boeing shares (CFD). So if I were to buy, I& #39;d buy at 153.36, and sell at 153.26. End goal is to make as much from 1 CFD. So I would wait for price>153.36

PS: You need to know when to let a CFD go. As said before, it& #39;s all about speculation.

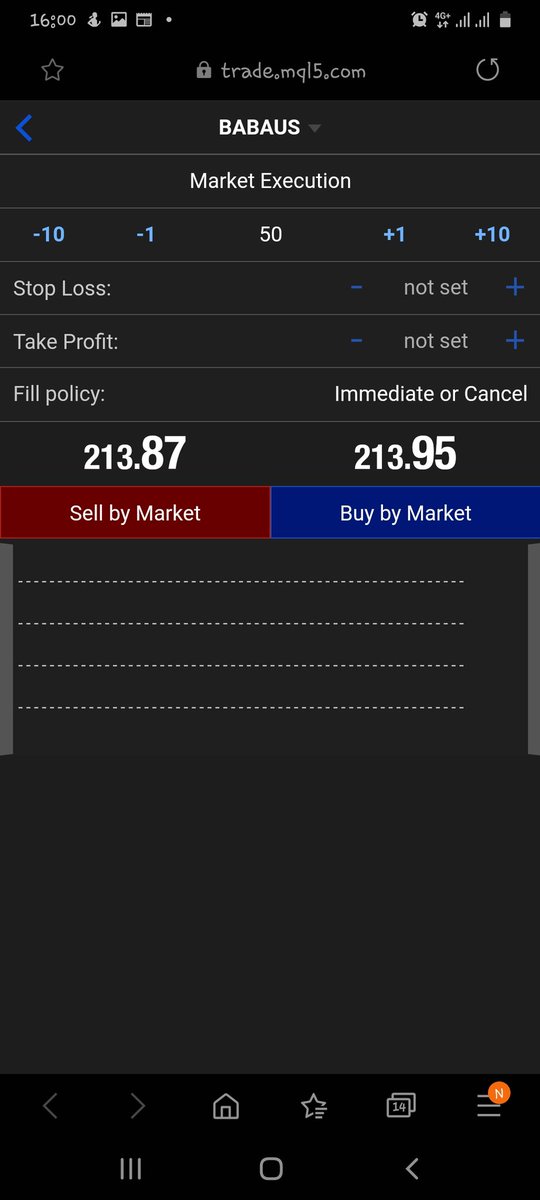

Based on this Covid situation, a lot of pharmaceutical companies stand to gain in their share price, reflective on the CFD. So that would be a good buy now.

IMO, hold out stocks not CFDs.

Based on this Covid situation, a lot of pharmaceutical companies stand to gain in their share price, reflective on the CFD. So that would be a good buy now.

IMO, hold out stocks not CFDs.

We however learn everyday, so all this info shouldn& #39;t stop you from trading.

Register with Scope Markets; https://scp.ke/register ">https://scp.ke/register&... (Customer Care: +254 20764 0115)

You& #39;ll also get access to some webinars zikupee an idea on how to navigate the platform https://abs.twimg.com/emoji/v2/... draggable="false" alt="😊" title="Lächelndes Gesicht mit lächelnden Augen" aria-label="Emoji: Lächelndes Gesicht mit lächelnden Augen">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😊" title="Lächelndes Gesicht mit lächelnden Augen" aria-label="Emoji: Lächelndes Gesicht mit lächelnden Augen">

Register with Scope Markets; https://scp.ke/register ">https://scp.ke/register&... (Customer Care: +254 20764 0115)

You& #39;ll also get access to some webinars zikupee an idea on how to navigate the platform

Read on Twitter

Read on Twitter https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷🏾♀️" title="Achselzuckende Frau (durchschnittlich dunkler Hautton)" aria-label="Emoji: Achselzuckende Frau (durchschnittlich dunkler Hautton)">Anyway in the meantime, please check @ScopeMarketsKE tutadiscuss CFDs. https://twitter.com/Wincie_/s..." title="I have not been one to take risk and tbh, I wish I did. I still have time but heeh,I would honestly like to get in on some Pharmaceutical companies. But you can never have enough practice... so https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷🏾♀️" title="Achselzuckende Frau (durchschnittlich dunkler Hautton)" aria-label="Emoji: Achselzuckende Frau (durchschnittlich dunkler Hautton)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷🏾♀️" title="Achselzuckende Frau (durchschnittlich dunkler Hautton)" aria-label="Emoji: Achselzuckende Frau (durchschnittlich dunkler Hautton)">Anyway in the meantime, please check @ScopeMarketsKE tutadiscuss CFDs. https://twitter.com/Wincie_/s..." class="img-responsive" style="max-width:100%;"/>

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷🏾♀️" title="Achselzuckende Frau (durchschnittlich dunkler Hautton)" aria-label="Emoji: Achselzuckende Frau (durchschnittlich dunkler Hautton)">Anyway in the meantime, please check @ScopeMarketsKE tutadiscuss CFDs. https://twitter.com/Wincie_/s..." title="I have not been one to take risk and tbh, I wish I did. I still have time but heeh,I would honestly like to get in on some Pharmaceutical companies. But you can never have enough practice... so https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷🏾♀️" title="Achselzuckende Frau (durchschnittlich dunkler Hautton)" aria-label="Emoji: Achselzuckende Frau (durchschnittlich dunkler Hautton)">https://abs.twimg.com/emoji/v2/... draggable="false" alt="🤷🏾♀️" title="Achselzuckende Frau (durchschnittlich dunkler Hautton)" aria-label="Emoji: Achselzuckende Frau (durchschnittlich dunkler Hautton)">Anyway in the meantime, please check @ScopeMarketsKE tutadiscuss CFDs. https://twitter.com/Wincie_/s..." class="img-responsive" style="max-width:100%;"/>