1/

Get a cup of coffee.

In this thread, I& #39;ll show you why "geometric thinking" is superior to "arithmetic thinking" while making investment decisions.

Get a cup of coffee.

In this thread, I& #39;ll show you why "geometric thinking" is superior to "arithmetic thinking" while making investment decisions.

2/

Let& #39;s start with an example.

There are 2 stocks, A and B.

A goes up 10% every year. Like clockwork.

B is more volatile. Half the years, it goes down 10%. But the other half, it compensates by going up 33%.

Let& #39;s start with an example.

There are 2 stocks, A and B.

A goes up 10% every year. Like clockwork.

B is more volatile. Half the years, it goes down 10%. But the other half, it compensates by going up 33%.

3/

You have $10,000.

You have to pick a stock (A or B), put your entire $10K in it, and not touch it for 20 years.

Do you pick A or B?

You have $10,000.

You have to pick a stock (A or B), put your entire $10K in it, and not touch it for 20 years.

Do you pick A or B?

4/

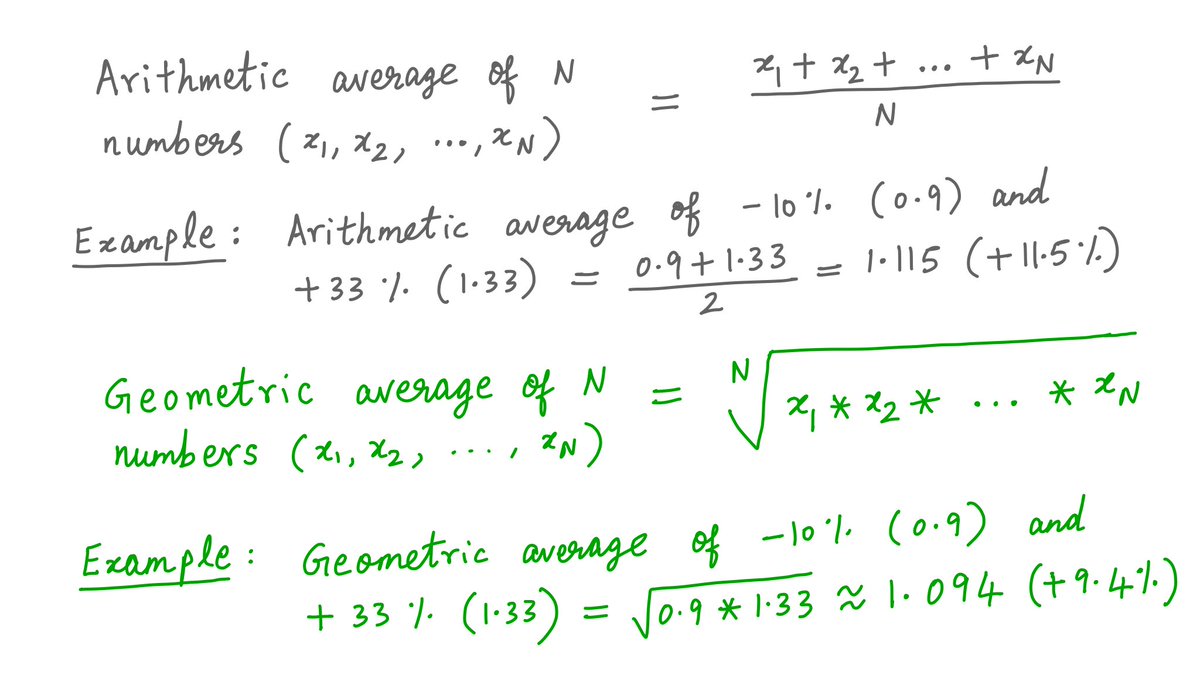

Some mental math for Option B: half the years, B is down 10%. The other half, it& #39;s up 33%. On average, that& #39;s a 11.5% return, right? After all, (-10% + 33%)/2 = 11.5%.

That seems better than Option A& #39;s steady 10%.

So you should pick B over A, right?

Read on.

Some mental math for Option B: half the years, B is down 10%. The other half, it& #39;s up 33%. On average, that& #39;s a 11.5% return, right? After all, (-10% + 33%)/2 = 11.5%.

That seems better than Option A& #39;s steady 10%.

So you should pick B over A, right?

Read on.

5/

Say you choose Option B. You put your $10K in stock B. You hold for 20 years.

As advertised, B goes up 33% during 10 of those years, and down 10% during the other 10.

How much are you left with?

That& #39;s easy. You& #39;d have $10K*(0.9^10)*(1.33^10) = $60,387.

Not bad.

Say you choose Option B. You put your $10K in stock B. You hold for 20 years.

As advertised, B goes up 33% during 10 of those years, and down 10% during the other 10.

How much are you left with?

That& #39;s easy. You& #39;d have $10K*(0.9^10)*(1.33^10) = $60,387.

Not bad.

6/

If instead, you& #39;d been a sucker and taken Option A& #39;s steady 10%, how much would you have?

Even easier. $10K*(1.1^20) = $67,275.

Wait, Option A gets you $6,888 *more* than Option B?

How& #39;s that possible?

If instead, you& #39;d been a sucker and taken Option A& #39;s steady 10%, how much would you have?

Even easier. $10K*(1.1^20) = $67,275.

Wait, Option A gets you $6,888 *more* than Option B?

How& #39;s that possible?

7/

The reason is: "arithmetic thinking" vs "geometric thinking".

Let me explain. How did we calculate the average 11.5% return for Option B?

We just took the average of -10% and +33%. (-10% + 33%)/2 = +11.5%. That& #39;s "arithmetic".

The reason is: "arithmetic thinking" vs "geometric thinking".

Let me explain. How did we calculate the average 11.5% return for Option B?

We just took the average of -10% and +33%. (-10% + 33%)/2 = +11.5%. That& #39;s "arithmetic".

8/

But how did the $10K invested in B actually behave?

Half the years (-10%), it got multiplied by 0.9. And the other half (+33%), it got multiplied by 1.33.

That& #39;s a growth rate of ((0.9^10)*(1.33^10))^(1/20), or 9.4%. Not 11.5%.

But how did the $10K invested in B actually behave?

Half the years (-10%), it got multiplied by 0.9. And the other half (+33%), it got multiplied by 1.33.

That& #39;s a growth rate of ((0.9^10)*(1.33^10))^(1/20), or 9.4%. Not 11.5%.

9/

This 9.4% is the *geometric* average of -10% and +33%. The 11.5% was their *arithmetic* average.

To many people, average just means arithmetic average.

But if you make investment decisions all day long, you probably encounter geometric averages far more often.

This 9.4% is the *geometric* average of -10% and +33%. The 11.5% was their *arithmetic* average.

To many people, average just means arithmetic average.

But if you make investment decisions all day long, you probably encounter geometric averages far more often.

10/

Key lesson: Money does not grow arithmetically. It compounds geometrically.

So, when you make investment decisions, "geometric thinking" is superior to "arithmetic thinking".

Key lesson: Money does not grow arithmetically. It compounds geometrically.

So, when you make investment decisions, "geometric thinking" is superior to "arithmetic thinking".

12/

Here& #39;s an interesting mathematical fact:

The geometric average of any N positive numbers *never* exceeds their arithmetic average.

This is called the "Arithmetic Mean/Geometric Mean theorem", or the "AM/GM theorem" for short.

https://en.wikipedia.org/wiki/Inequality_of_arithmetic_and_geometric_means">https://en.wikipedia.org/wiki/Ineq...

Here& #39;s an interesting mathematical fact:

The geometric average of any N positive numbers *never* exceeds their arithmetic average.

This is called the "Arithmetic Mean/Geometric Mean theorem", or the "AM/GM theorem" for short.

https://en.wikipedia.org/wiki/Inequality_of_arithmetic_and_geometric_means">https://en.wikipedia.org/wiki/Ineq...

13/

You may have noticed that I said "positive numbers" in the theorem above.

But don& #39;t worry. When we work with money, our numbers are always positive. Even a negative 10% return is just multiplication by 0.9, a positive number.

So the theorem always applies.

You may have noticed that I said "positive numbers" in the theorem above.

But don& #39;t worry. When we work with money, our numbers are always positive. Even a negative 10% return is just multiplication by 0.9, a positive number.

So the theorem always applies.

14/

The AM/GM theorem means:

If you approximate annual returns by taking their arithmetic average, you will always *overestimate* your actual return.

So, arithmetic thinking is not just wrong. It& #39;s dangerous. It makes you think you& #39;ll have more money than you& #39;ll actually do.

The AM/GM theorem means:

If you approximate annual returns by taking their arithmetic average, you will always *overestimate* your actual return.

So, arithmetic thinking is not just wrong. It& #39;s dangerous. It makes you think you& #39;ll have more money than you& #39;ll actually do.

15/

Think about what this means for pension funds and 401-Ks that assume a steady 7% return.

If the fund loses money some years and makes it up in others, it may do worse than 7% long term.

And AM/GM *guarantees* it, if the average arithmetic annual return is 7%.

Think about what this means for pension funds and 401-Ks that assume a steady 7% return.

If the fund loses money some years and makes it up in others, it may do worse than 7% long term.

And AM/GM *guarantees* it, if the average arithmetic annual return is 7%.

16/

Humans are wired so that geometric thinking is much harder for most people than arithmetic thinking.

If you cultivate geometric thinking, you& #39;ll have an edge over most people.

Humans are wired so that geometric thinking is much harder for most people than arithmetic thinking.

If you cultivate geometric thinking, you& #39;ll have an edge over most people.

17/

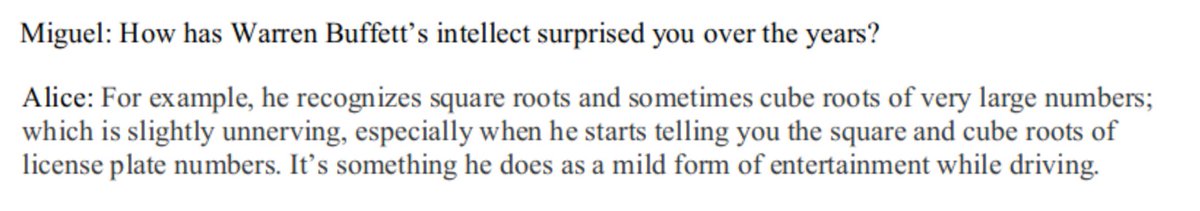

Warren Buffett can do geometric calculations (square roots, cube roots, CAGRs) in his head.

To him, thinking geometrically is as effortless as thinking arithmetically is to us.

This is a huge edge.

https://twitter.com/BrentBeshore/status/1004444368680439808?s=20">https://twitter.com/BrentBesh...

Warren Buffett can do geometric calculations (square roots, cube roots, CAGRs) in his head.

To him, thinking geometrically is as effortless as thinking arithmetically is to us.

This is a huge edge.

https://twitter.com/BrentBeshore/status/1004444368680439808?s=20">https://twitter.com/BrentBesh...

18/

Yes, geometric calculations are hard.

And we& #39;re not Buffett. Most of us can& #39;t do geometric averages in our heads.

But we& #39;re surrounded by calculating machines. Smartphones. Tablets. Laptops. Excel. Python.

No excuse for not using them while taking important decisions.

Yes, geometric calculations are hard.

And we& #39;re not Buffett. Most of us can& #39;t do geometric averages in our heads.

But we& #39;re surrounded by calculating machines. Smartphones. Tablets. Laptops. Excel. Python.

No excuse for not using them while taking important decisions.

19/

Thanks for reading. Enjoy your weekend. Be safe. Think geometric. https://abs.twimg.com/emoji/v2/... draggable="false" alt="😀" title="Grinning face" aria-label="Emoji: Grinning face">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😀" title="Grinning face" aria-label="Emoji: Grinning face">

/End

Thanks for reading. Enjoy your weekend. Be safe. Think geometric.

/End

Read on Twitter

Read on Twitter