Yesterday, we broke the news that Moderna has begun phase two of its human trials for a coronavirus vaccine.

But two other topics have swirled around the company in recent days:

Let& #39;s chat about adverse reactions and stock sales by Moderna& #39;s execs... https://www.nationalgeographic.com/science/2020/05/coronavirus-vaccine-passes-first-human-trial-but-is-it-frontrunner-cvd/">https://www.nationalgeographic.com/science/2...

But two other topics have swirled around the company in recent days:

Let& #39;s chat about adverse reactions and stock sales by Moderna& #39;s execs... https://www.nationalgeographic.com/science/2020/05/coronavirus-vaccine-passes-first-human-trial-but-is-it-frontrunner-cvd/">https://www.nationalgeographic.com/science/2...

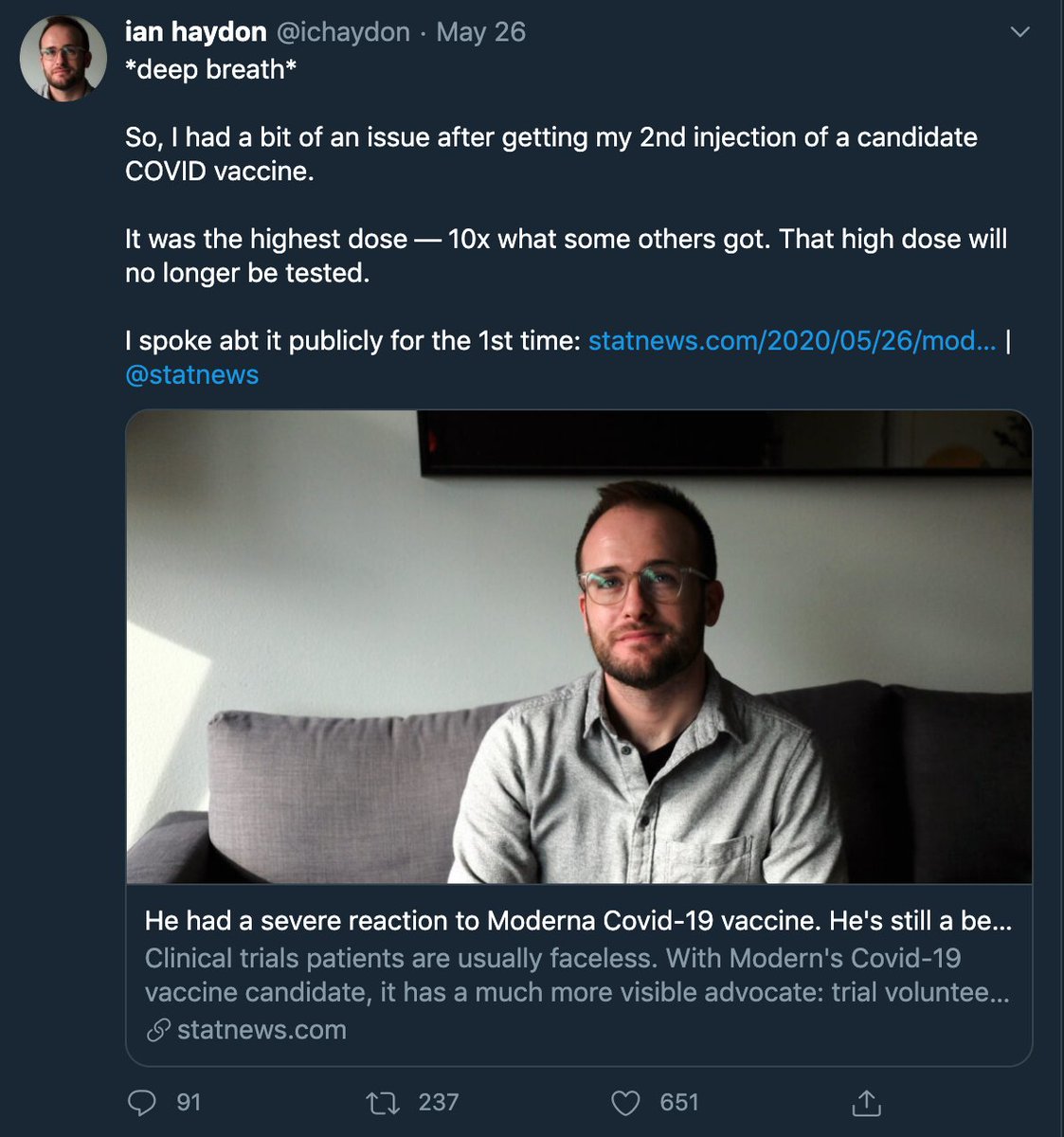

This week, @matthewherper wrote a great story about how a subject in Moderna’s phase one trial developed a fever and fainted.

While this reaction may seem worrying, it isn’t surprising, appears to be rare, isn’t life-threatening, and is key to finding a drug’s safest dosage.

While this reaction may seem worrying, it isn’t surprising, appears to be rare, isn’t life-threatening, and is key to finding a drug’s safest dosage.

As our story explains, scientists have known that taking too much mRNA can overstimulate an immune system.

That’s why Moderna’s first phase had 3 groups taking different dosages: 25-, 100-, or (a quite high) 250 micrograms.

https://www.nationalgeographic.com/science/2020/05/coronavirus-vaccine-passes-first-human-trial-but-is-it-frontrunner-cvd/">https://www.nationalgeographic.com/science/2...

That’s why Moderna’s first phase had 3 groups taking different dosages: 25-, 100-, or (a quite high) 250 micrograms.

https://www.nationalgeographic.com/science/2020/05/coronavirus-vaccine-passes-first-human-trial-but-is-it-frontrunner-cvd/">https://www.nationalgeographic.com/science/2...

Of 30 people on the lower doses, only 1 person experienced a mild side effect (soreness in the arm)

3 of 15 folks on the high dose had “grade 3” adverse reactions, which can be serious but aren’t life-threatening

This is how safety profiles are made

https://investors.modernatx.com/news-releases/news-release-details/moderna-announces-positive-interim-phase-1-data-its-mrna-vaccine">https://investors.modernatx.com/news-rele...

3 of 15 folks on the high dose had “grade 3” adverse reactions, which can be serious but aren’t life-threatening

This is how safety profiles are made

https://investors.modernatx.com/news-releases/news-release-details/moderna-announces-positive-interim-phase-1-data-its-mrna-vaccine">https://investors.modernatx.com/news-rele...

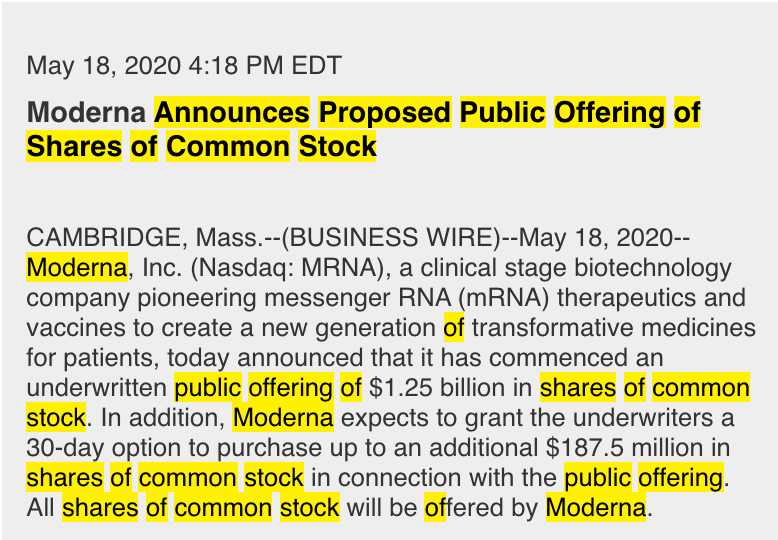

Ok, let& #39;s talk stocks.

Hours after its big news on May 18, Moderna began to offer up $1.2 billion of shares to new investors.

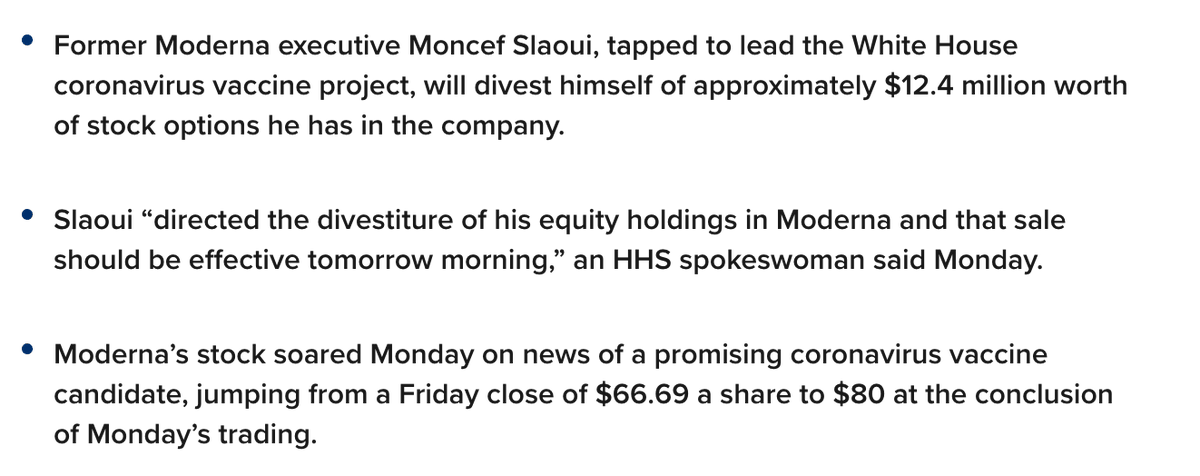

Moderna’s executives have also reportedly sold off $89 million of shares this year.

While it might make many uneasy, both moves could be expected...

Hours after its big news on May 18, Moderna began to offer up $1.2 billion of shares to new investors.

Moderna’s executives have also reportedly sold off $89 million of shares this year.

While it might make many uneasy, both moves could be expected...

Re the $1.2B offering: A Harvard biz prof told me it is a sign that Moderna expects to produce its vaccine on a large scale, which will be costly:

“If Moderna had not gone out to raise more capital, I would have thought that it means the trial results aren& #39;t all that great.”

“If Moderna had not gone out to raise more capital, I would have thought that it means the trial results aren& #39;t all that great.”

Ok, what about the “stock dumping”...?

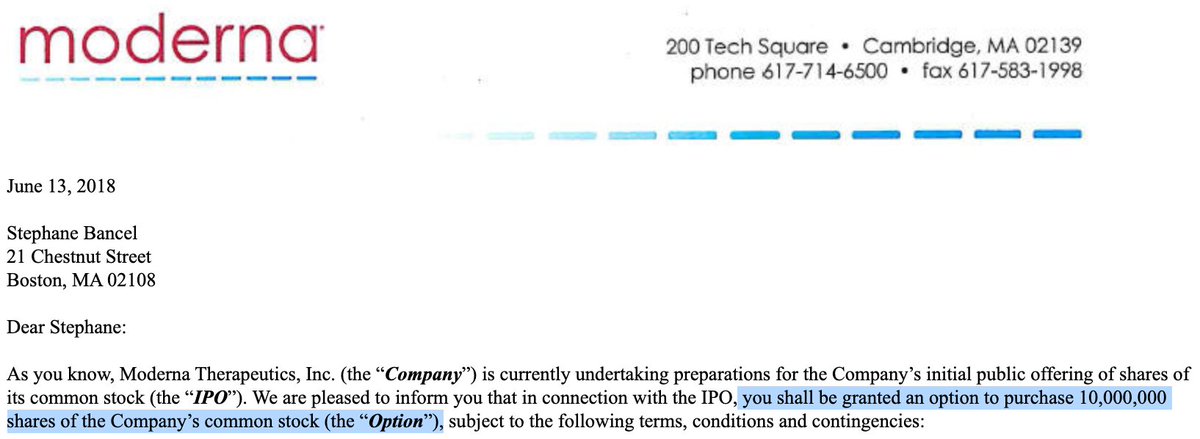

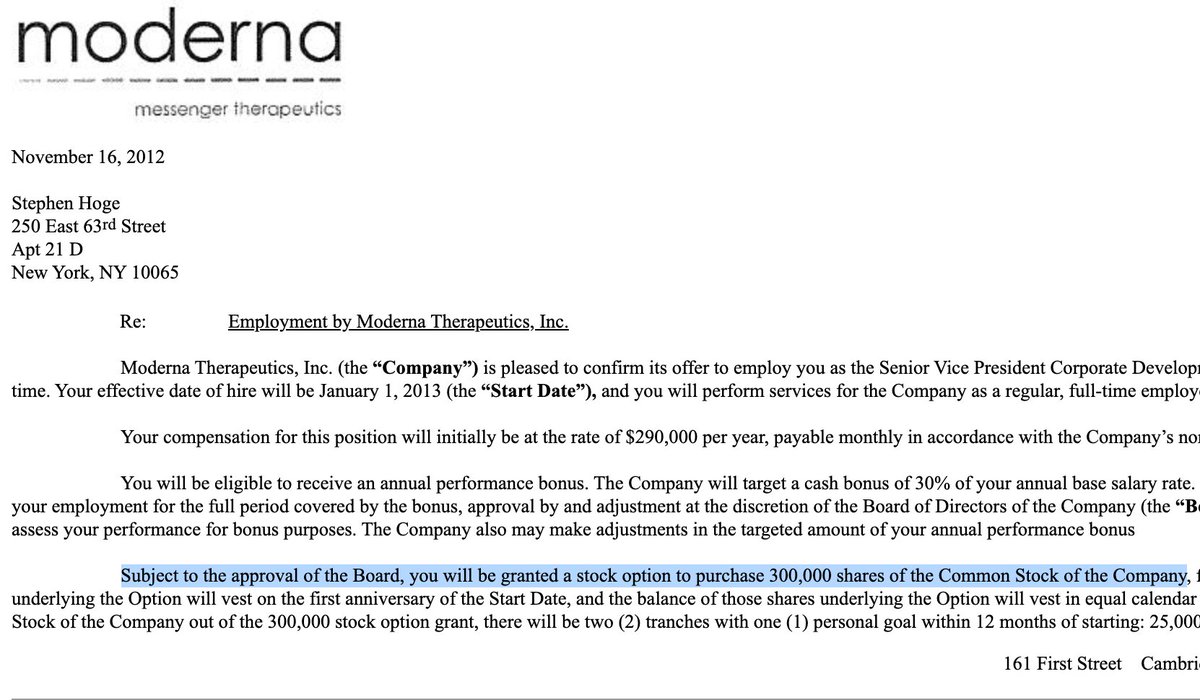

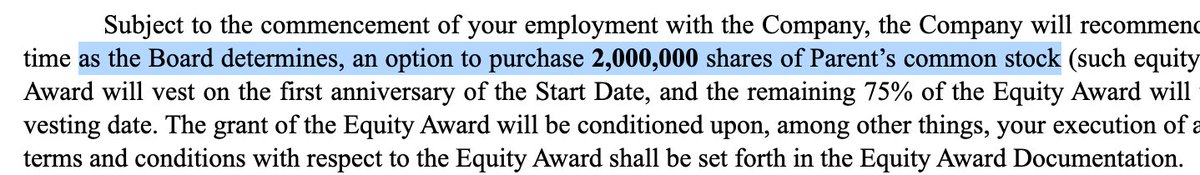

Many biotechs, including Moderna https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">, compensate their executives by giving the option to buy stock in their own company.

https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">, compensate their executives by giving the option to buy stock in their own company.

Yet owning too much stock of any single company, including one’s own, is risky. What happens if the company goes bust?

Many biotechs, including Moderna

Yet owning too much stock of any single company, including one’s own, is risky. What happens if the company goes bust?

On the flip side, how do policymakers prevent/dissuade execs from waiting until the most opportune moments to trade their own stock based on insider info (which would be illegal)?

For an answer, I spoke with a Georgetown Law professor who specializes in securities…

For an answer, I spoke with a Georgetown Law professor who specializes in securities…

Under federal law, executives can give *predetermined* instructions *in advance* to their *stock brokers* to make transactions.

Ostensibly speaking, the execs are not making these trades when they actually happen.

Ostensibly speaking, the execs are not making these trades when they actually happen.

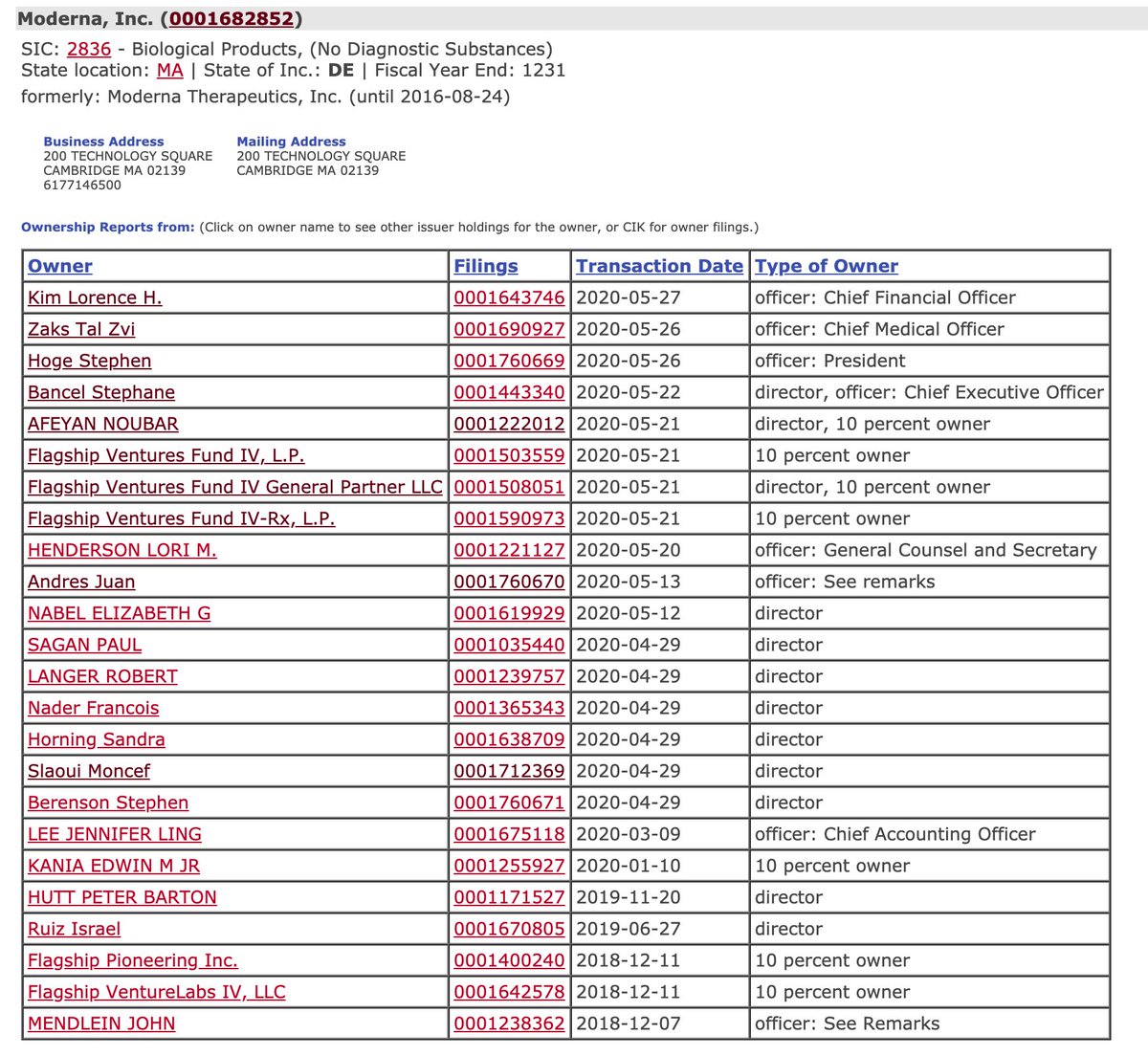

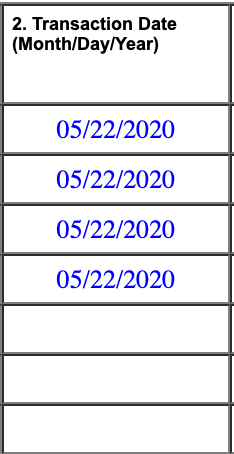

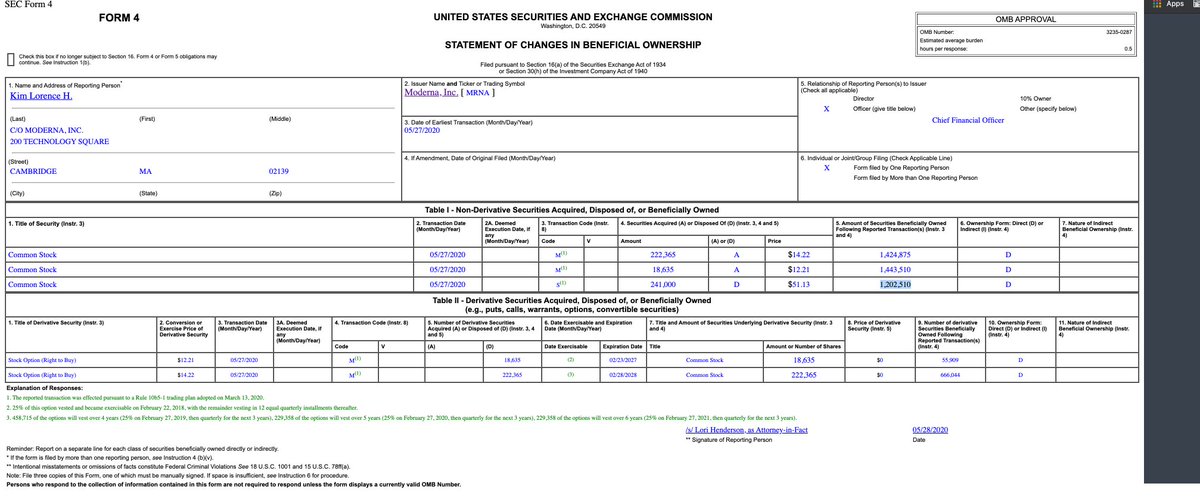

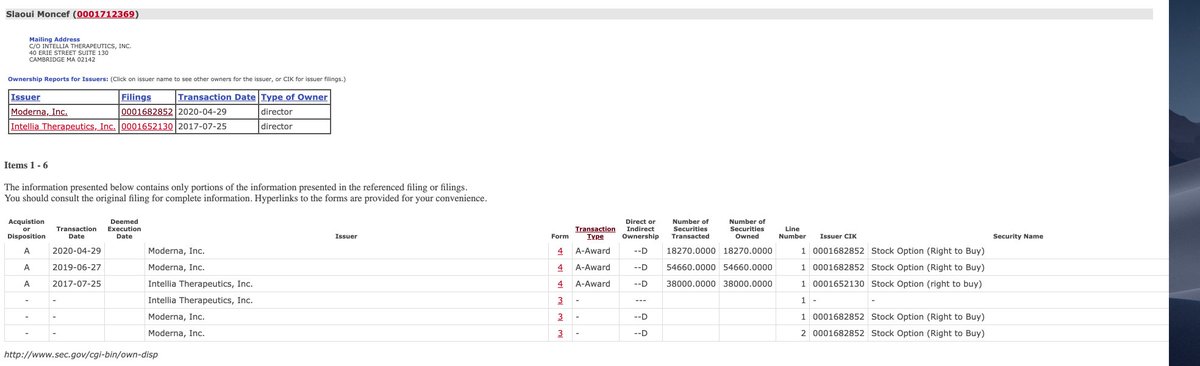

Based on Moderna’s SEC filings, its execs’ recent trades have followed these legal terms.

https://www.sec.gov/cgi-bin/own-disp?action=getissuer&CIK=0001682852

Also,">https://www.sec.gov/cgi-bin/o... many of the trades were instructed BEFORE Moderna’s stock took off this year. CEO Stéphane Bancel has been consistently selling/acquiring shares since November

https://www.sec.gov/cgi-bin/own-disp?action=getissuer&CIK=0001682852

Also,">https://www.sec.gov/cgi-bin/o... many of the trades were instructed BEFORE Moderna’s stock took off this year. CEO Stéphane Bancel has been consistently selling/acquiring shares since November

Plus, Moderna’s top execs have kept most of their potential stock options.

Based on their contract terms, Moderna’s CEO, president and CTO have this year sold less than a fifth of their potential shares.

Its CFO still owns 1.2 million shares after his latest selloff.

Based on their contract terms, Moderna’s CEO, president and CTO have this year sold less than a fifth of their potential shares.

Its CFO still owns 1.2 million shares after his latest selloff.

Sure $89 million sounds big, but it pales against what the execs could have dumped.

Moreover, society has abdicated the costliest/riskiest parts of R&D to private hands.

I’m not saying that’s the best system, but can we be surprised when execs/investors profit from it?

Moreover, society has abdicated the costliest/riskiest parts of R&D to private hands.

I’m not saying that’s the best system, but can we be surprised when execs/investors profit from it?

Read on Twitter

Read on Twitter

, compensate their executives by giving the option to buy stock in their own company.Yet owning too much stock of any single company, including one’s own, is risky. What happens if the company goes bust?" title="Ok, what about the “stock dumping”...?Many biotechs, including Moderna https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">, compensate their executives by giving the option to buy stock in their own company.Yet owning too much stock of any single company, including one’s own, is risky. What happens if the company goes bust?" class="img-responsive" style="max-width:100%;"/>

, compensate their executives by giving the option to buy stock in their own company.Yet owning too much stock of any single company, including one’s own, is risky. What happens if the company goes bust?" title="Ok, what about the “stock dumping”...?Many biotechs, including Moderna https://abs.twimg.com/emoji/v2/... draggable="false" alt="👇" title="Down pointing backhand index" aria-label="Emoji: Down pointing backhand index">, compensate their executives by giving the option to buy stock in their own company.Yet owning too much stock of any single company, including one’s own, is risky. What happens if the company goes bust?" class="img-responsive" style="max-width:100%;"/>