(1/N) *Updated*: Corporate Bond Market Liquidity During the COVID-19 Crisis with co-authors @poweill, @mahyar_k, David Lindsay, Shuo Liu, and Diego Zuniga. http://www.econ.ucla.edu/cbml/corporate-bond-liquidity.html">https://www.econ.ucla.edu/cbml/corp...

2/N Investors rushed to sell bonds (and other assets) as the sky was falling in mid March. Dealers didn’t want to lean against the wind and absorb inventory onto their balance sheets. So what happened?

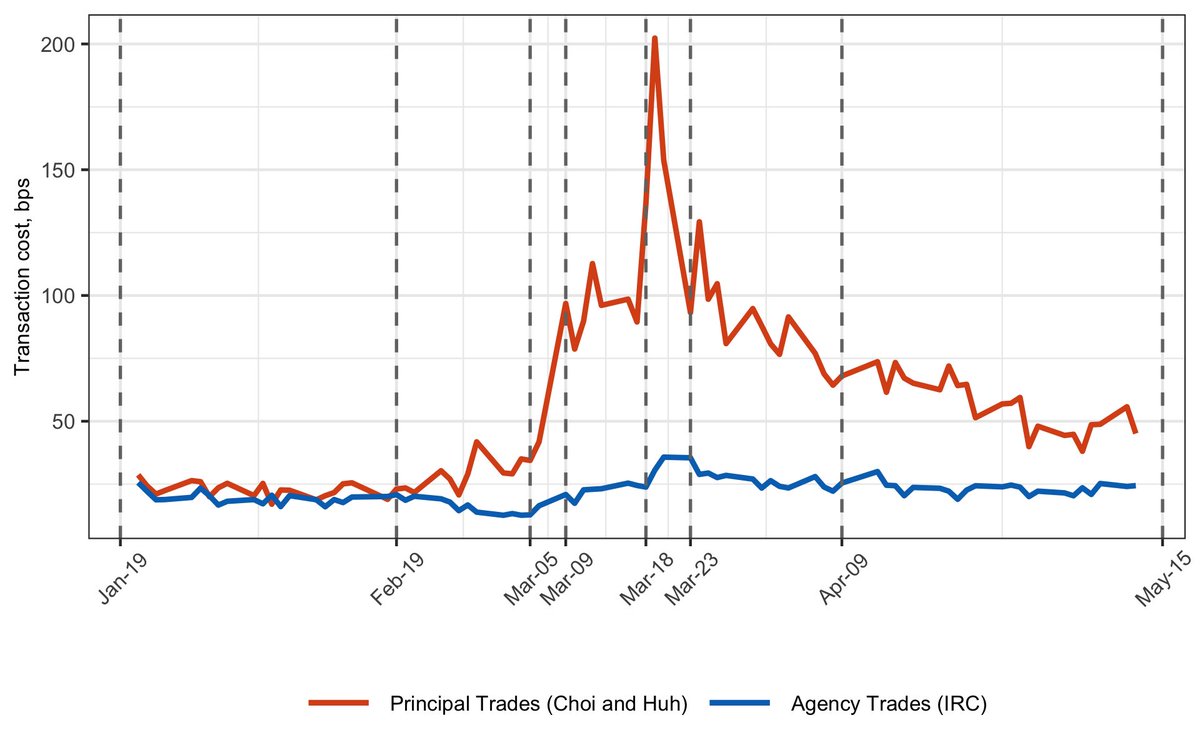

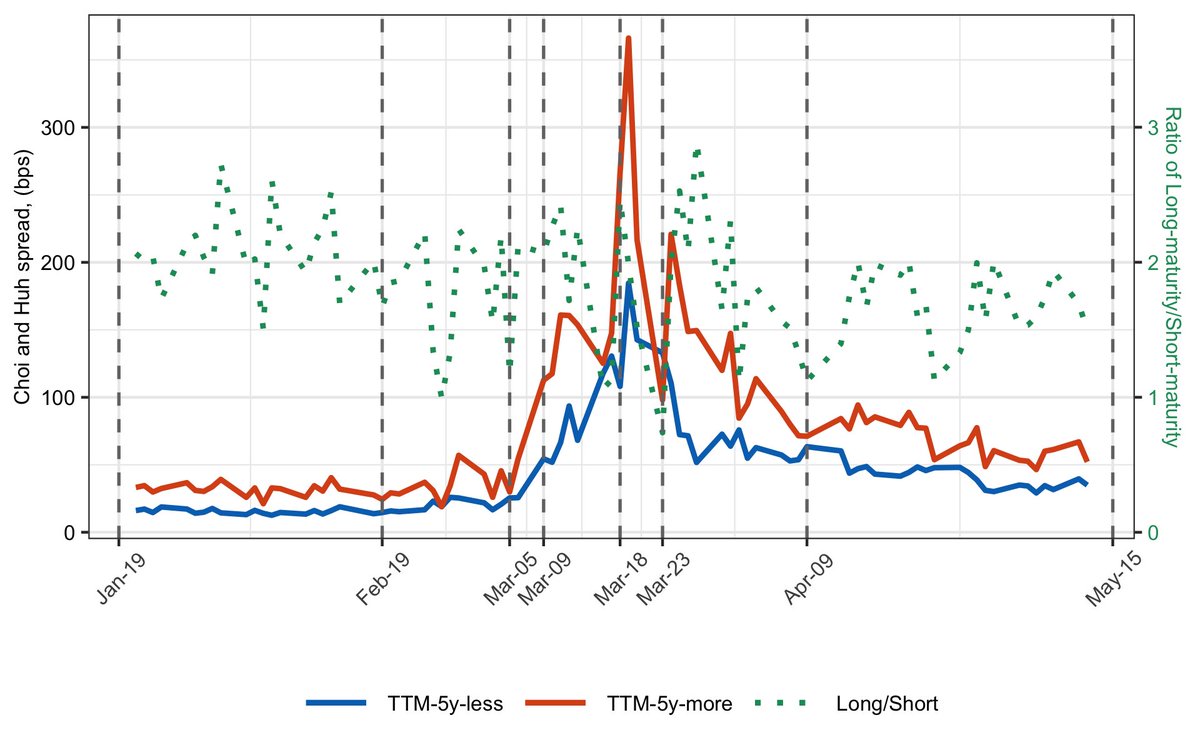

3/N Price of immediate, principal trades (measured using Choi and Huh spreads) goes up a lot. Price of slower, agency trades (measured using modified IRC) more muted. The latter is what @JohnHCochrane picked up on in his blog post about our earlier work

4/N Here& #39;s the ratio of the two, just to make the point

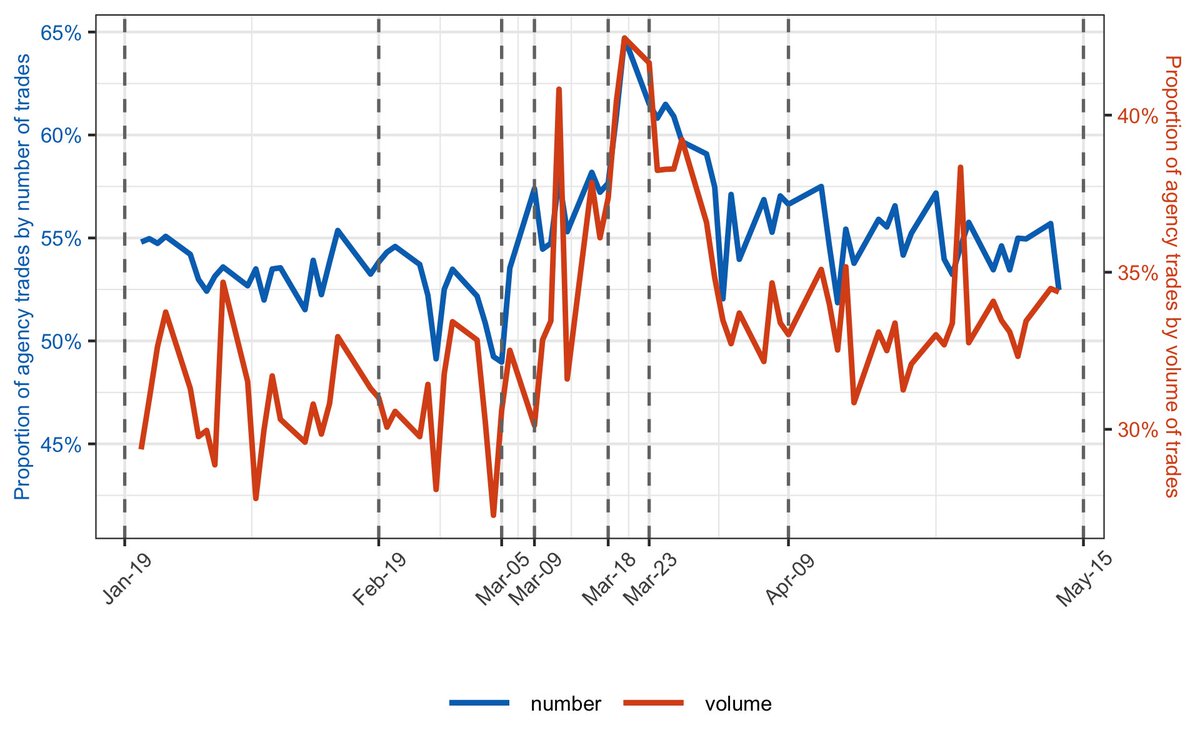

5/N So what happens when relative price of principal trades goes up? You got it. Traders substitute towards agency trades. This is where you& #39;d miss something if you treated all spreads the same

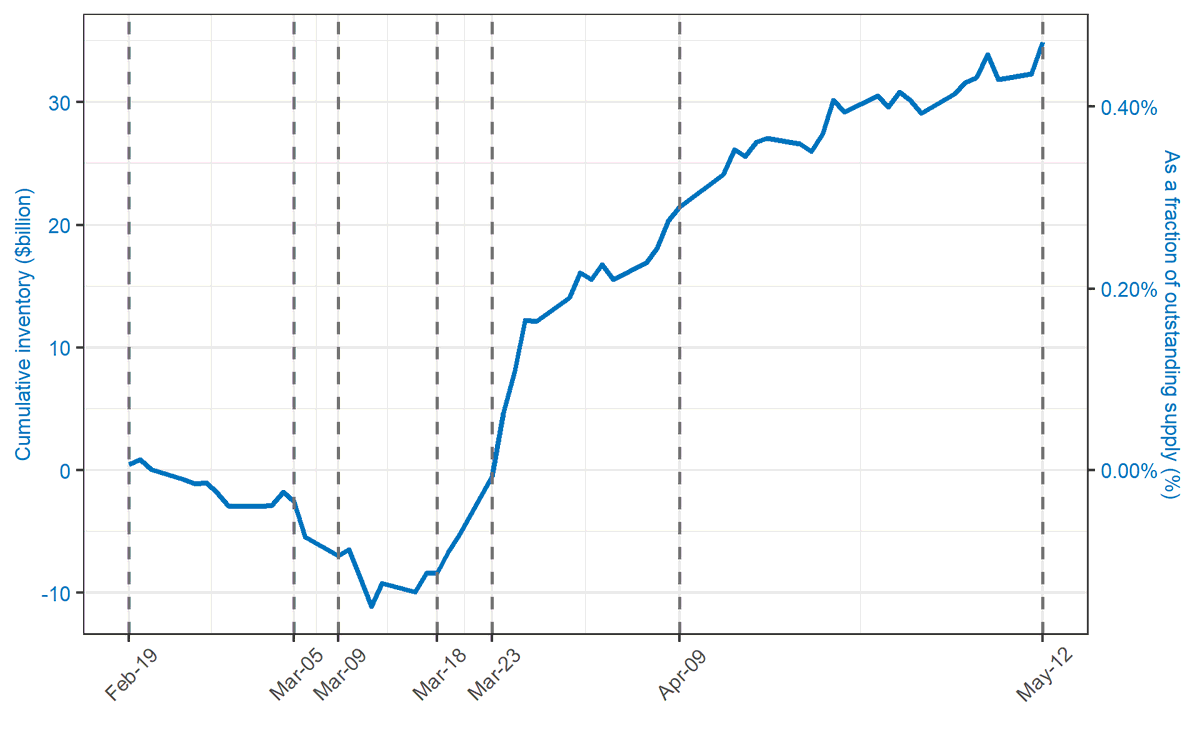

6/N Here is cumulative inventory absorbed by dealers. What& #39;s striking is that dealers absorbed ZERO net inventory during the worst of the selling pressure (March 16-18). Customers were providing liquidity.

7/N Dealers start to lean against the wind on 3/18 (after PDCF announced), and inventory accumulation accelerates after corporate credit facilities announced on 3/23. From the trough, dealers have basically doubled previous holdings of bonds.

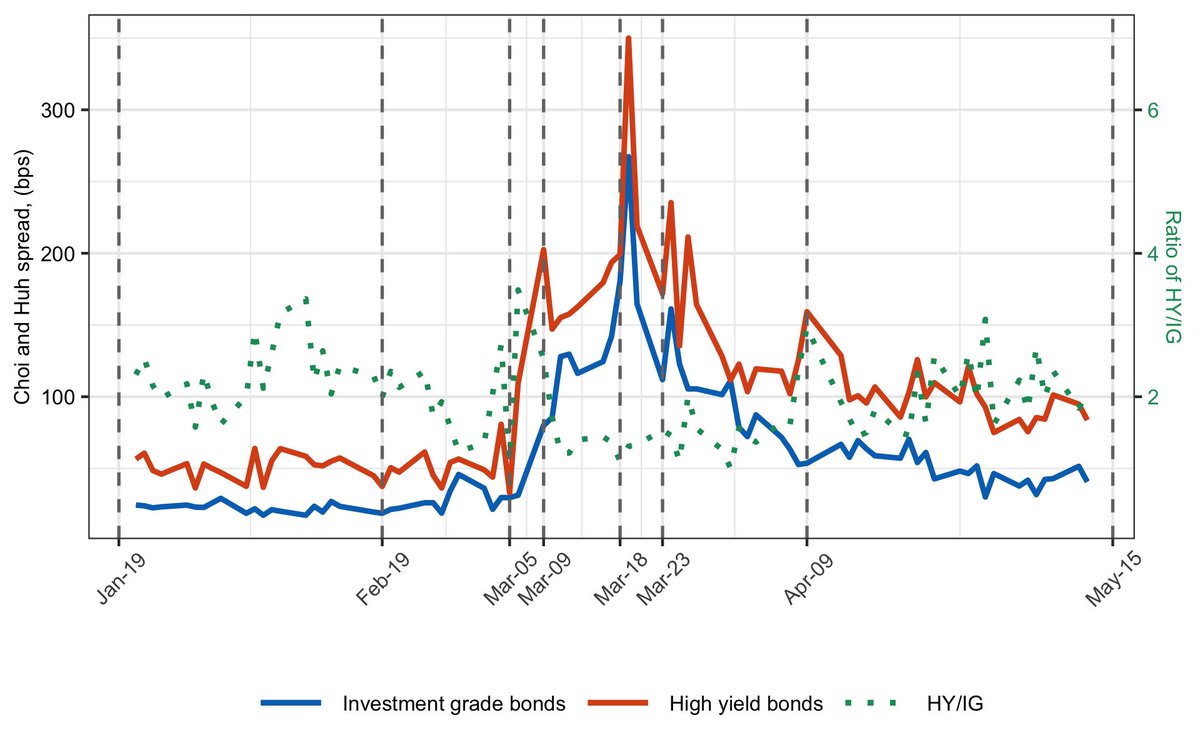

8/N Interestingly, liquidity improves for bonds that were eligible for Fed facilities, and those that weren& #39;t. Here is bid-ask spread for principal trades of investment grade and high yield bonds (HY weren& #39;t initially eligible, later they were)

10/N Lots more to do. But one takeaway for me, from this research and others& #39; work on related topics (like @mfariacastro and @kozjuli): we need a better understanding of dealers& #39; inventory management and balance sheet constraints. More comments after FOMC blackout period...

Read on Twitter

Read on Twitter