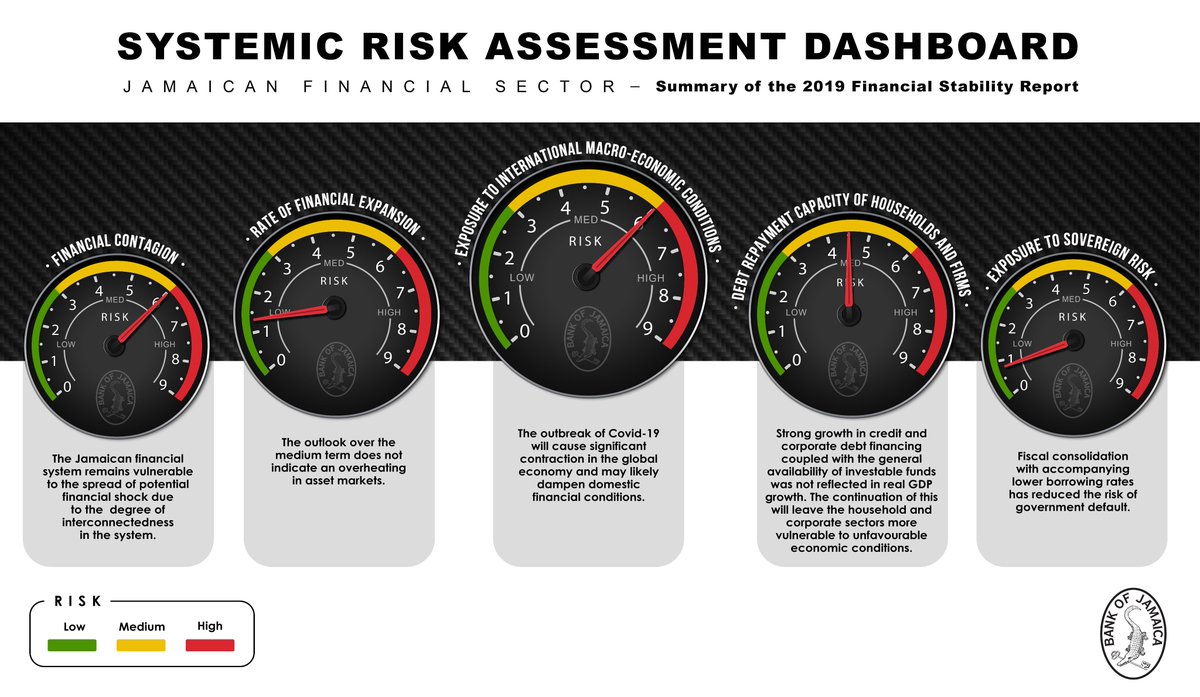

This is a highlighted graphical summary (zoom, zoom! https://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Smiling face with sunglasses" aria-label="Emoji: Smiling face with sunglasses">) of the recently published 2019 BOJ Financial Stability Report. For the full, albeit slightly less sexy report itself, click here: https://bit.ly/3bTwQvp ">https://bit.ly/3bTwQvp&q...

https://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Smiling face with sunglasses" aria-label="Emoji: Smiling face with sunglasses">) of the recently published 2019 BOJ Financial Stability Report. For the full, albeit slightly less sexy report itself, click here: https://bit.ly/3bTwQvp ">https://bit.ly/3bTwQvp&q...

#BOJSpeaks #FinanceTwitterJa #FinancialStability #Macroprudential https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">

#BOJSpeaks #FinanceTwitterJa #FinancialStability #Macroprudential

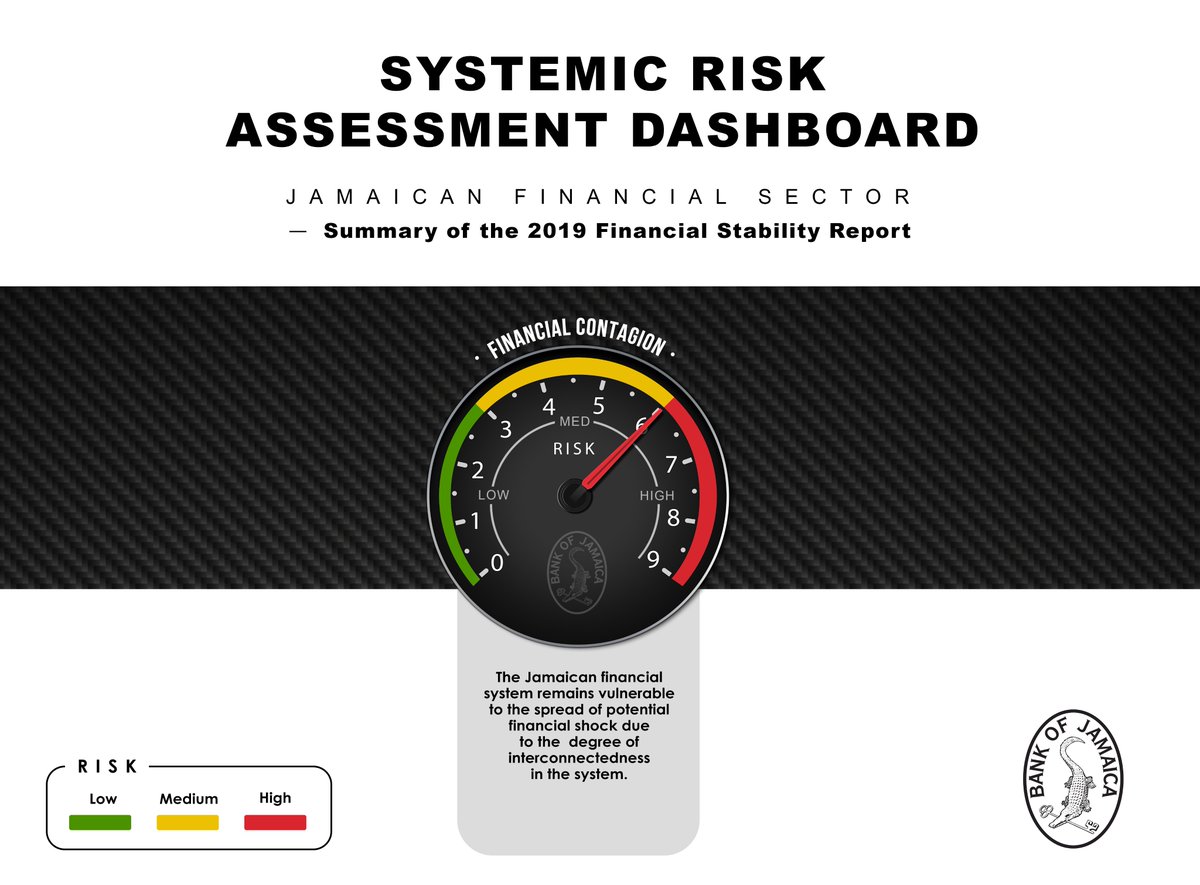

2. The extent to which financial institutions are financially exposed to other financial institutions determines how easily shocks can spread to the system. Bilateral balance sheet exposures are assessed by BOJ to monitor interconnectedness within the financial system.

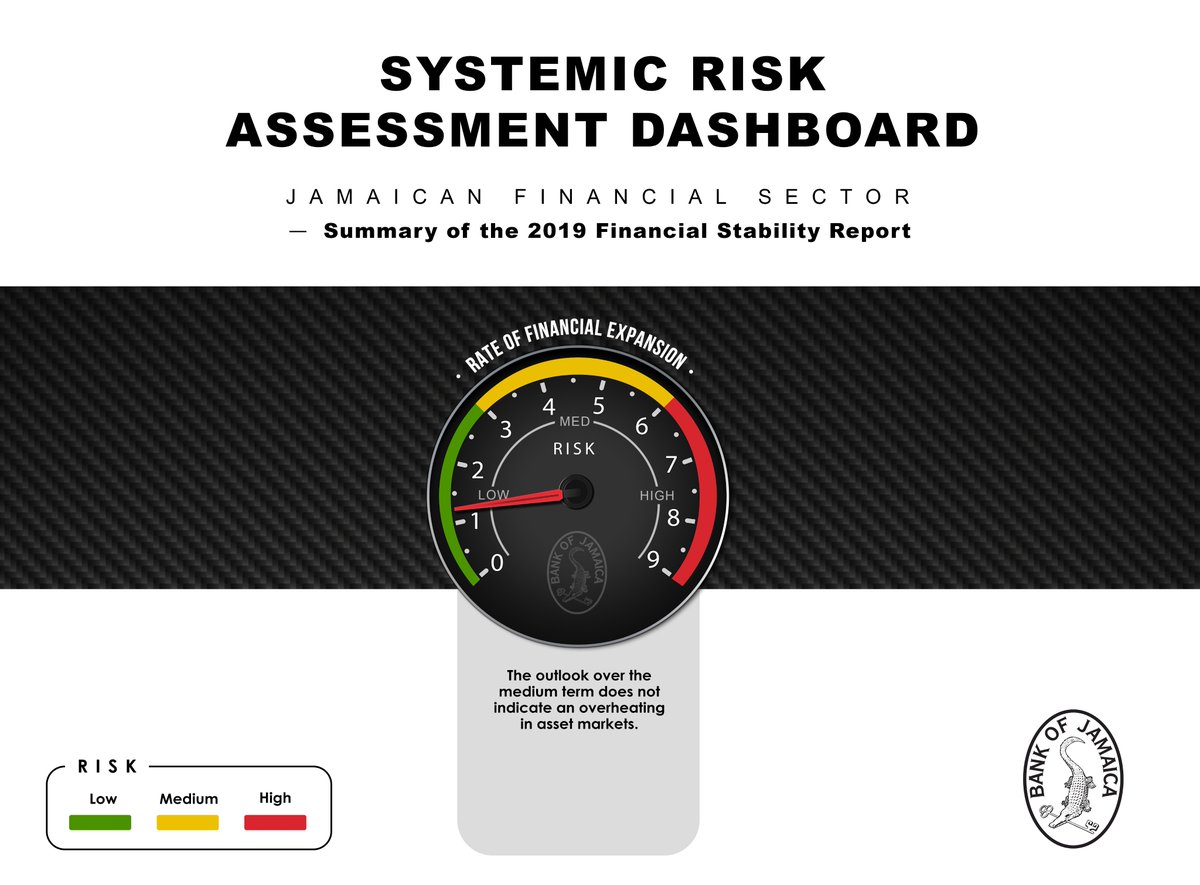

3. The financial system is more vulnerable to asset price and credit boom/bust cycles if overleveraged and expanding at a faster rate than fundamentally manageable. BOJ& #39;s Stability Department monitors asset prices and credit markets and leverage of financial institutions.

4. Weak financial performance, or soft resilience to stress testing, reveals fragility in the sector. Stress testing is important in determining the degree of systemic resilience to changes in both macroeconomic and microeconomic factors by measuring the impact on capital.

5. It should be noted that stress-testing usually involves very extreme hypothetical scenarios that are highly unlikely to ever happen. Merely passing a stress test, therefore, let alone doing well at one, is a good sign, but such are our standards that passes are expected.

6. Composite indices are used to support financial stability analysis - including stress testing - and are used to monitor the degree of build-up of risks and the level of vulnerability within the financial system.

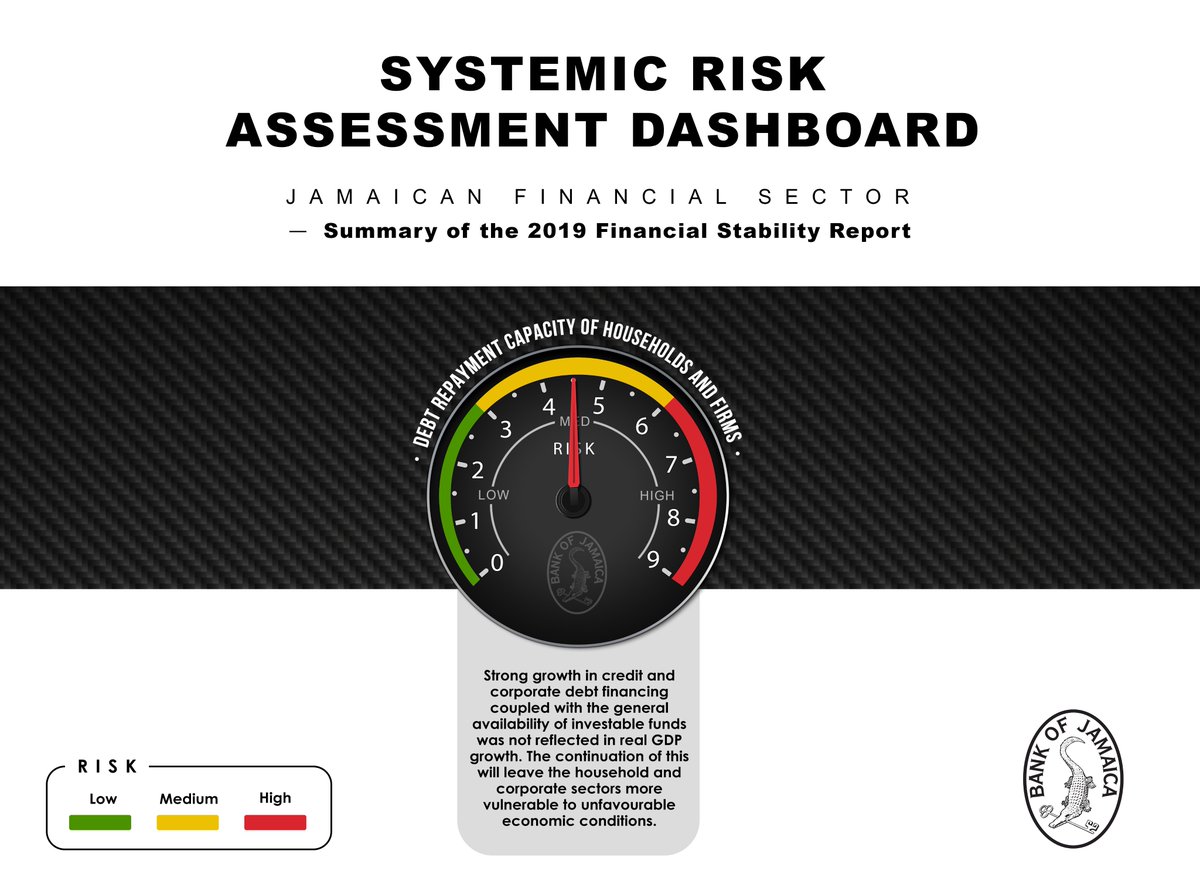

7. If borrowers have, overall, received more credit without an accompanying increase in the ability to repay, this may create a weakness in the system.

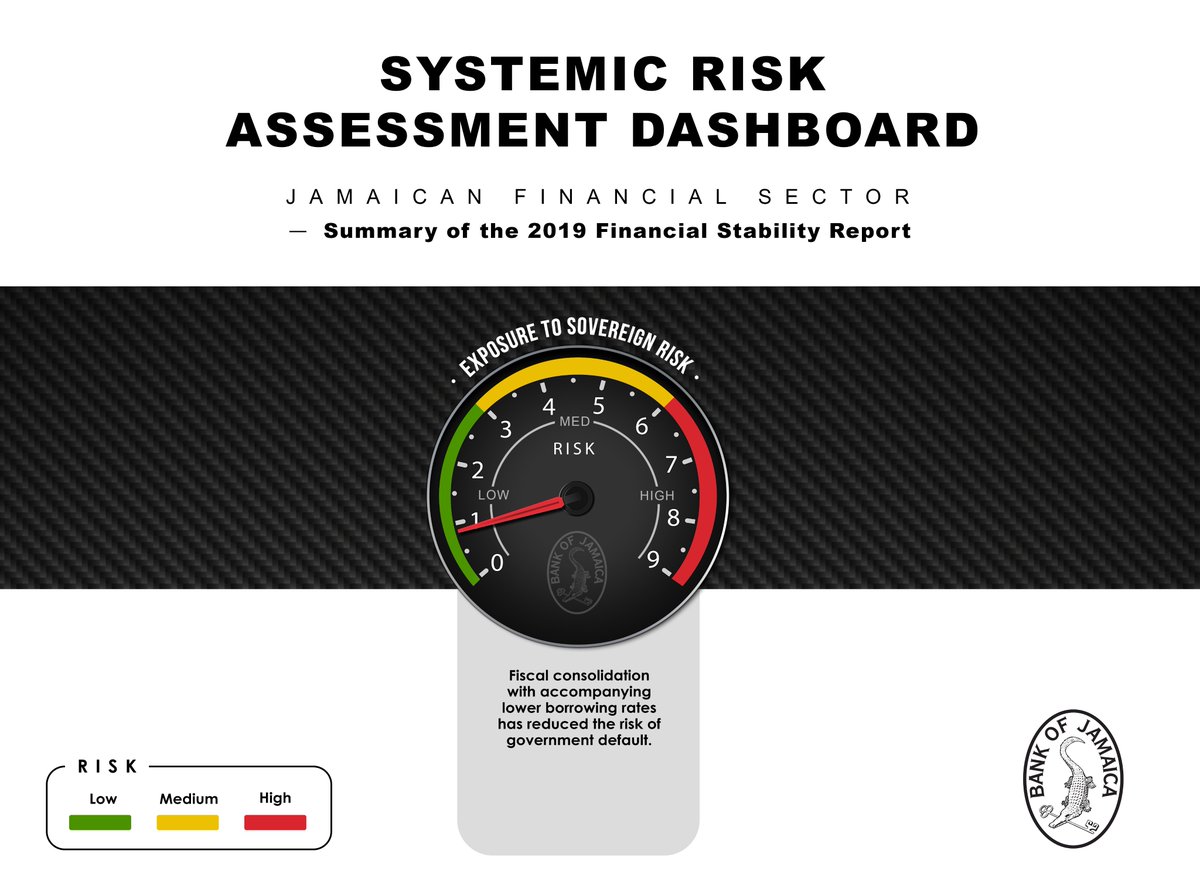

8. Systemic risks could stem from a lack of diversification due to financial concentration in a particular sector or asset type. Concentrated exposures to sovereigns, as well as financial markets and institutions, sectoral loans, and the real estate market, are all assessed.

9.

Read on Twitter

Read on Twitter ) of the recently published 2019 BOJ Financial Stability Report. For the full, albeit slightly less sexy report itself, click here: https://bit.ly/3bTwQvp&q... #BOJSpeaks #FinanceTwitterJa #FinancialStability #Macroprudential https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">" title="This is a highlighted graphical summary (zoom, zoom!https://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Smiling face with sunglasses" aria-label="Emoji: Smiling face with sunglasses">) of the recently published 2019 BOJ Financial Stability Report. For the full, albeit slightly less sexy report itself, click here: https://bit.ly/3bTwQvp&q... #BOJSpeaks #FinanceTwitterJa #FinancialStability #Macroprudential https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">" class="img-responsive" style="max-width:100%;"/>

) of the recently published 2019 BOJ Financial Stability Report. For the full, albeit slightly less sexy report itself, click here: https://bit.ly/3bTwQvp&q... #BOJSpeaks #FinanceTwitterJa #FinancialStability #Macroprudential https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">" title="This is a highlighted graphical summary (zoom, zoom!https://abs.twimg.com/emoji/v2/... draggable="false" alt="😎" title="Smiling face with sunglasses" aria-label="Emoji: Smiling face with sunglasses">) of the recently published 2019 BOJ Financial Stability Report. For the full, albeit slightly less sexy report itself, click here: https://bit.ly/3bTwQvp&q... #BOJSpeaks #FinanceTwitterJa #FinancialStability #Macroprudential https://abs.twimg.com/emoji/v2/... draggable="false" alt="🧵" title="Thread" aria-label="Emoji: Thread">" class="img-responsive" style="max-width:100%;"/>