THREAD:

1/ I& #39;ve been thinking a lot about population growth in Canada. Scary thought, but there& #39;s a non-trivial chance that we see outright population declines in coming quarters, something we& #39;ve never seen before. Here& #39;s the math...

1/ I& #39;ve been thinking a lot about population growth in Canada. Scary thought, but there& #39;s a non-trivial chance that we see outright population declines in coming quarters, something we& #39;ve never seen before. Here& #39;s the math...

2/ Q4 nominal population y/y was ~560k, of which ~96k was natural increase, 196k was net non-permanent residents (NPRs), and ~268k was net international migration.

Natural increase is relatively stable regardless of pandemic, so pencil that in at ~95-100k y/y.

Natural increase is relatively stable regardless of pandemic, so pencil that in at ~95-100k y/y.

3/ Net international migration will almost certainly slow sharply in coming quarters. We currently welcome ~340k new immigrants each year, which nets out to ~270k after emigration is accounted for.

This may well be cut in half over the next few quarters.

This may well be cut in half over the next few quarters.

4/ So it& #39;s likely that before changes in net-NPRs we may be looking at 230k-270k y/y as base.

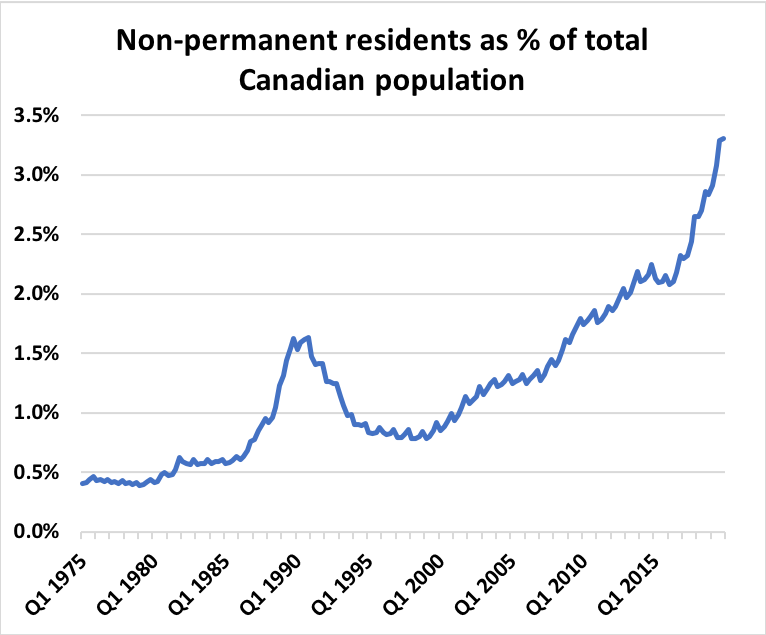

Big unknown is NPR component, which normally sees strong outflows during recessions. I& #39;ve written about this before. This cohort is 1.25MM strong (a record 3.3% of total Cdn popltn)

Big unknown is NPR component, which normally sees strong outflows during recessions. I& #39;ve written about this before. This cohort is 1.25MM strong (a record 3.3% of total Cdn popltn)

5/ So who makes up the NPR segment? Somewhere between 500-600k international students, a comparable level of work permit holders, and a relatively small group of refugees.

Consider foreign students: We know must colleges and universities are moving to online in the fall

Consider foreign students: We know must colleges and universities are moving to online in the fall

6/ How many will continue to pay rent and living expenses to take Zoom classes they could be taking from home?

And among work permit holders (programs that are generally procyclical by design) how many will see permits extended with unemployment at double digits?

And among work permit holders (programs that are generally procyclical by design) how many will see permits extended with unemployment at double digits?

7/ There will be substantial outflows from this cohort. It& #39;s not outside of the realm of possibility that outflows exceed net international migration + natural increase, which would mean outright population declines. Not necessarily a base case, but far from zero probability.

8/ On top of that, the politics of immigration change during recessions. A record share of Canadians were already in favor of reducing immigration targets in mid-2019 based on several surveys. And that was with unemployment near record lows.

9/ There& #39;s also the issue of slowing household formations, which tend to fall sharply during recessions. Already Im hearing that some tenants are vacating and moving back in with parents/other roomies.

And how many kids are moving out of their parents& #39; place right now? Very few

And how many kids are moving out of their parents& #39; place right now? Very few

10/ Put it all together and net rental demand will be very weak over next few q& #39;s and could literally be zero, something that was unfathomable just a few months ago.

Compounding the problem is the construction pipeline...over 200k apartments under construction across the country

Compounding the problem is the construction pipeline...over 200k apartments under construction across the country

11/ This breaks down to ~70k rental apartments and ~130k condo apartments. CMHC data suggests that the share of new units that enter the rental market in major metros is as high as 50%. So we& #39;re talking about de facto 135k rental units in the pipeline (~65k condo + 70k rental).

12/ Never before have we seen this sort of supply come online against (potentially) such a weak demand backdrop.

Lots of moving parts here, and certainly hard to have high confidence in anything at the moment, but to me, this is the most underappreciated risk right now.

Lots of moving parts here, and certainly hard to have high confidence in anything at the moment, but to me, this is the most underappreciated risk right now.

Read on Twitter

Read on Twitter