1530 multinationals have their regional headquarters in Hong Kong according to the Hong Kong government (InvestHK, 2019). This is an increase of two-thirds since 1997.

In 2018, United States- based companies had the largest number of regional headquarters (290) and regional offices (434) in Hong Kong, followed by Japanese and Mainland Chinese firms (Census and Statistics Department, 2018b).

137 UK companies had their regional headquarters in Hong Kong, and Hong Kong was the top destination for Foreign Direct Investment in Asia from the United Kingdom.

Hong Kong is the United Kingdom’s second largest trading partner in Asia, second only to Mainland China with exports in 2018 totalling $10.3 billion.

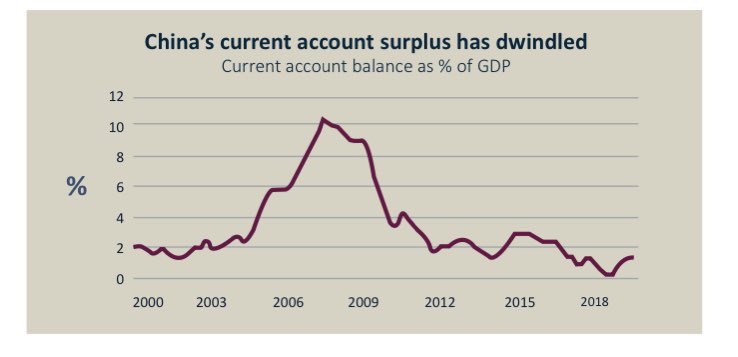

China’s current account surplus reached over 10% of GDP in 2007 but it has since declined to only about 1-2%. Some analysts think China might go into deficit in future years as the ageing population brings a lower savings ratio (Weizen, 2019).

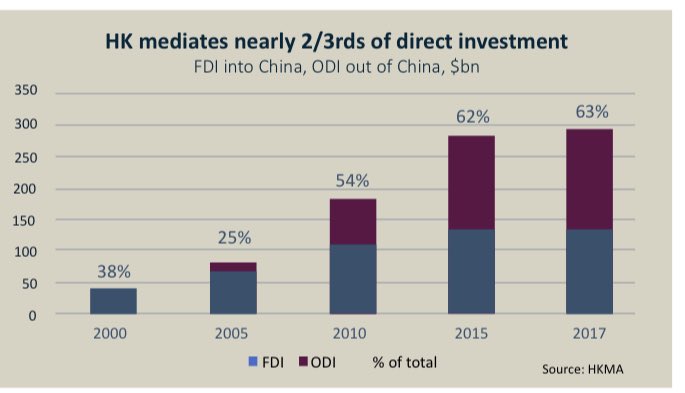

But even with a small surplus, China is more reliant on attracting capital inflows from foreigners than in the past because it tends to have a net outflow from residents, despite strict capital controls.

Chinese firms want to buy overseas companies for access to technology while individuals want portfolio diversification as well as to safeguard wealth from the unpredictable behaviour of the Chinese Communist Party (CCP).

Hong Kong plays a key role as a private wealth management centre for high-net worth individuals from China, including many members of the Chinese Community Party. CCP has built an empire of Real Estate in Hong Kong, ring of Front Companies exploiting HK’s access to world.

CCP uses HK’s access to Global Capital, Enterprise & Technology as source point. All that access, privelleges will be gone. Hong Kong will no more be golden goose for CCP it will be like any other Chinese city.

Shanghai cant replace Hong Kong due to various factors like

#TAX HK has 15% flat Tax & Shanghai 45%. HK has no capital gains tax, VAT & lower corporate income Tax at 16.5%.

#Controls Shanghai has Prohibitive Regulations & Capital Controls and need more political connections

#TAX HK has 15% flat Tax & Shanghai 45%. HK has no capital gains tax, VAT & lower corporate income Tax at 16.5%.

#Controls Shanghai has Prohibitive Regulations & Capital Controls and need more political connections

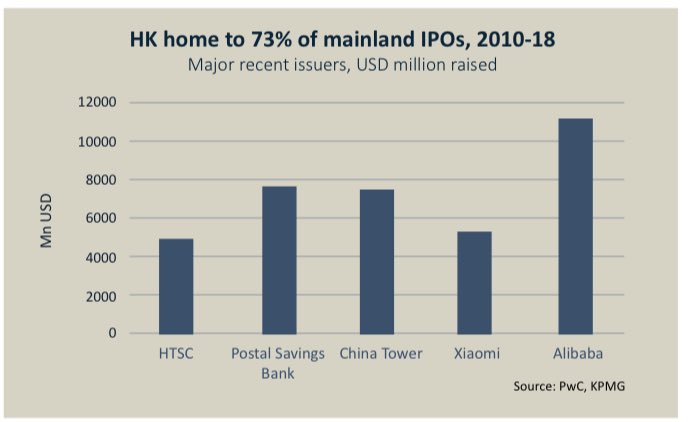

#StockMarket - The strength of the stock markets in Shanghai and Hong Kong also sharply diverge. Mainland companies with CCP connection dominate Shanghai Stock Exchange & HK is more easy to raise international cash & corporations.

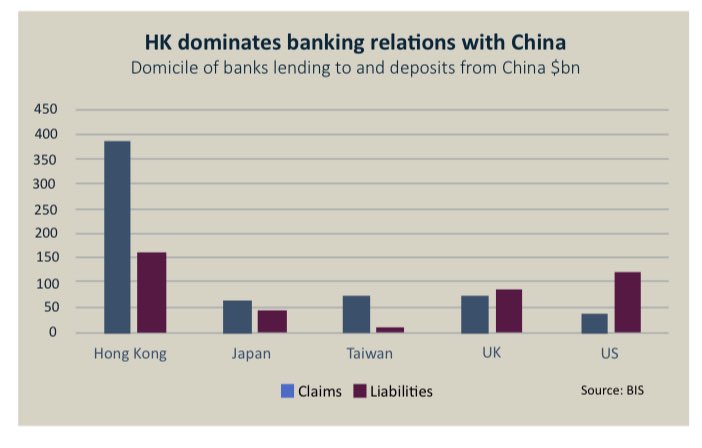

#WellConnected - Shanghai also does not have the same connections as Hong Kong. Hong Kong has more networks with the rest of the world than any other place in China, ranking: ‘top worldwide in linkages to both London and New York’.

#CommonLaw - The common law system is also shared with other key financial hubs and offshore centres, notably London and Singapore, which helps facilitate contracts across jurisdictions and gives Hong Kong a comparative advantage as a gateway to the world for foreign firms.

#CustomStatus - Finally, HK independent trading status means that it is treated as a separate entity by foreign governments.

This has direct benefits, notably those laid out in the US-Hong Kong Policy Act such as freer trade of goods and services including dual-use technology, as well as other preferential treatment in trade.

So this is in Nutshell how important Hong Kong is for China, killing HK economy & trading status is a big blow to CCP & its oligarchs. Once the detail measures follow by US, you will see Beijing retaliate coz it know what is coming from Washington DC.

#Currency -

Hong Kong’s easy access to both dollars and renminbi (RMB) means that it is able to serve as a hub for RMB internationalisation, as well as be the best place for Chinese businesses to raise US-dollar funding and establish a platform for international expansion.

Hong Kong’s easy access to both dollars and renminbi (RMB) means that it is able to serve as a hub for RMB internationalisation, as well as be the best place for Chinese businesses to raise US-dollar funding and establish a platform for international expansion.

@threadreaderapp unroll

Read on Twitter

Read on Twitter