Some big industry news breaking today: the @FPAssociation CEO Lauren Schadle is leaving immediately (terminated?), and FPA will be beginning a search for new leadership to get the organization growing again.

This. Was. Long. Overdue. (1/?)

This. Was. Long. Overdue. (1/?)

Having worked alongside Lauren in various volunteer capacities for more than 15 years, I& #39;ve always found her very pleasant to work with, and believe she had a genuine desire to see FPA and its mission succeed.

However, as I wrote back in 2018: "If six years of flat membership and declining revenue under the current leadership, despite their 20+ years of history with the organization, still isn’t long enough to be held accountable for their results, then how long does it take?"

And sadly, in the barely 18 months since THAT article, FPA membership is down yet ANOTHER 10%, from what was reported as ~24,000 in 2018, to barely 21,000 in the Membership Dashboard that FPA is now (finally!) sharing for the first time ever. https://www.financialplanningassociation.org/sites/default/files/2020-05/FPA%20Membership%20Dashboard%20-%20May%202020.pdf">https://www.financialplanningassociation.org/sites/def...

Notably, it appears that most of this decline was NOT pandemic related (as FPA was reporting a drop to 22,000 already by last fall in https://www.investmentnews.com/fpa-selects-11-chapters-to-participate-in-trial-run-170522).">https://www.investmentnews.com/fpa-selec... Instead, it appears National& #39;s badly botched OneFPA Network rollout severely damaged them.

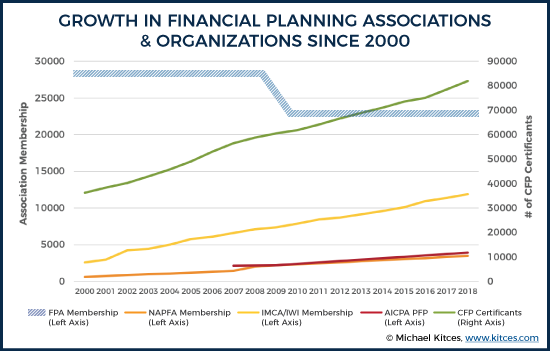

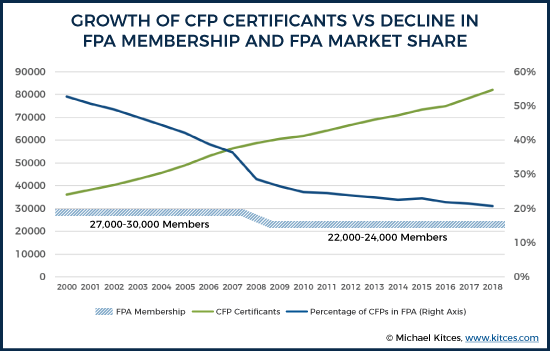

And as we& #39;ve documented repeatedly, EVERY other financial-planning-related organization, from @iw_inst to @NAPFA, AICPA& #39;s PFP section and of course @CFPBoard itself, have all been growing steadily, through 08-09 crisis, to new highs. Only FPA is down - nearly 25% now - since 08.

And as the organization FOR CFP professionals (according to its own Bylaws at https://www.financialplanningassociation.org/sites/default/files/2020-05/FPA%20Bylaws%20as%20of%20November%202019.pdf),">https://www.financialplanningassociation.org/sites/def... FPA& #39;s market share of CFP certificants has crashed from nearly 50% to well under 20% in the past 20 years while Shadle was COO and then CEO since 2012.

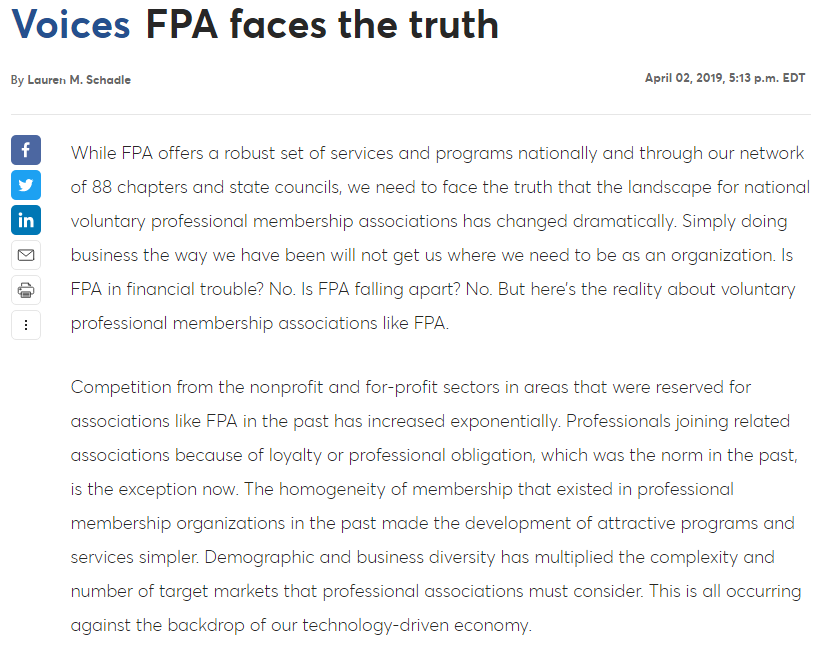

In other words, while genuinely well-intentioned for FPA, in the end Schadle simply didn& #39;t execute effectively. And instead of taking constructive feedback, she ostracized anyone who disagreed w/ FPA& #39;s declining path, & blamed her environment (notwithstanding all others growing).

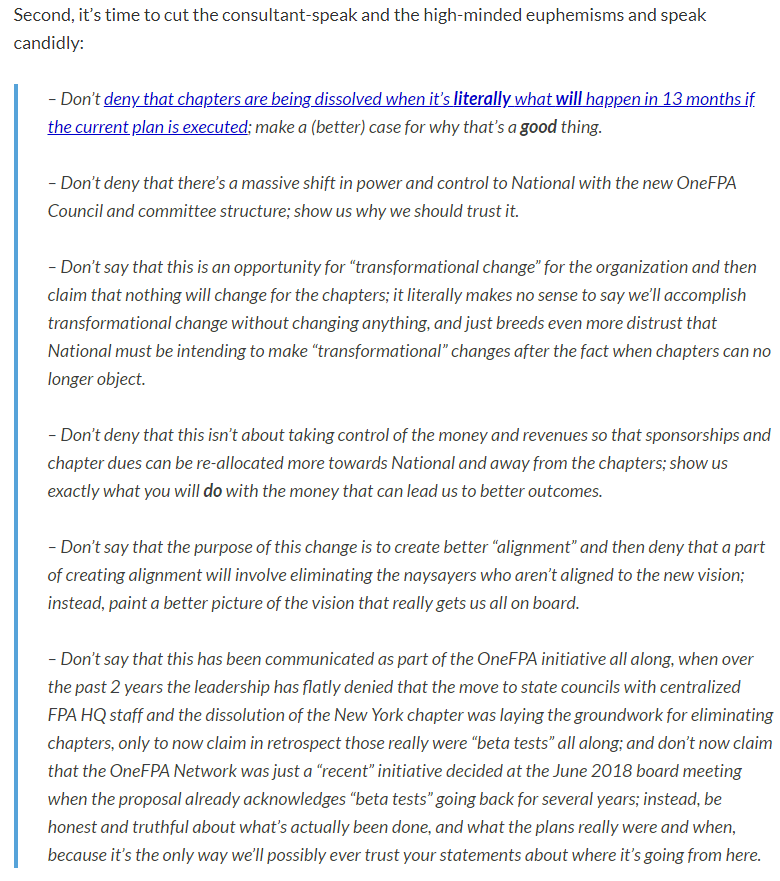

That& #39;s not to say that FPA doesn& #39;t have some structural challenges, or even that it was a bad idea to consider the OneFPA Network. As I noted throughout, & #39;on paper& #39; consolidating FPA made sense; the problem was horrific execution that failed to get any buy-in from stakeholders.

And even worse, the misguided focus from FPA& #39;s Executive Leadership on the OneFPA Network sucked all the oxygen out of the Board room to talk about real impact opportunities, distracting focus from important chapter initiatives & dropping the ball on a Reg BI challenge.

The question now will become: what& #39;s next for the FPA, and can it recover from the lax fiduciary oversight of its own Board of Directors that allowed the same CEO to preside over 8 years of negative growth and a potentially-catastrophic failed rollout of a crucial reorg?

Especially given that FPA National - and ESPECIALLY the FPA chapters - are critically dependent on running events to generate the sponsorship dollars necessary to pay staff to execute, and it& #39;s not clear whether large-scale advisor events will even be back this fall.

And not even members know where the FPA stands financially, as the organization hasn& #39;t shared an Annual Report including financials to the membership since FY2016(!), in violation of its own Information & Transparency Policy. And it still hasn& #39;t fixed. https://www.financialplanningassociation.org/sites/default/files/2020-04/Transparency%20Policy%20updated%20June%202016.pdf">https://www.financialplanningassociation.org/sites/def...

In fact, the FPA was even refusing to share Audited Financials with members - despite being required to do so in its Bylaws - until we pointed out last year that FPA was making extensive undisclosed alterations to its numbers to make itself look better. https://www.kitces.com/blog/fpa-national-audited-financials-mismatch-overview-national-finances-membership-transparency/">https://www.kitces.com/blog/fpa-...

Which means the FPA leadership will not only need to answer the question "what is the new vision for FPA under new leadership" but "does FPA even still have the resources TO recover, or did the Board& #39;s failure to exercise timely fiduciary oversight deal itself a fatal blow?"

Ultimately, I believe @fpassociation is a critical infrastructure organization of the financial planning profession, & that it& #39;s incredibly important for the FPA to recover. Other organizations like @NAPFA play important roles, but CFP professionals need a membership association.

As if FPA doesn& #39;t step up, the community of CFP certificants is too large to remain 85% unserved. Nature abhors a vacuum. Some organization - most likely @CFPBoard itself - will step in. But I believe it& #39;s better to have an FPA to counterbalance CFP Board. https://www.kitces.com/blog/could-the-fpas-waning-power-given-its-declining-market-share-of-cfp-certificants-lead-to-its-untimely-demise/">https://www.kitces.com/blog/coul...

As while I& #39;m often painted as an FPA naysayer, the reality is that I& #39;m a 15-yr member who& #39;s been an FPA chapter President, chaired National conferences for FPA, served on countless volunteer committees, and spoken at almost 90% of our chapters nationwide. https://www.kitces.com/blog/why-im-so-critical-of-the-fpa-that-i-support-and-the-fpa-leadership-responds-in-writing/">https://www.kitces.com/blog/why-...

Simply put, I have and continue to believe that @fpassociation was/is too important to sit idly by and watch the organization slowly destroy itself with staff leadership failing to execute & a Board that refused to take responsibility & hold its CEO accountable for 8 years.

So now the moment has come. It& #39;s FPA& #39;s opportunity to reinvent w/ new leadership. As @CFPBoard showed by hiring Kevin Keller, & @NAPFA with Geof Brown, you CAN hire an effective CEO - even one from outside our community - who learns and takes up the mission & really EXECUTES it.

Whereas Schadle was hired without the due diligence of an external CEO search process as Tuttle& #39;s heir apparent, & Tuttle himself was hired w/o an external CEO search after McCallan was dismissed. The FPA hasn& #39;t looked outside its four walls for new leadership since the 1990s!

The silver lining at least is that the pandemic environment and associated recession has put a lot of high quality talent in play. Improving the odds(?) that the FPA can find a strong CEO capable of getting growth going again in the 2020s.

Read on Twitter

Read on Twitter