@Bayer4Crops and @agrostar_in jointly announced that they would be partnering to deliver seeds and crop protection products directly to farmer’s doorsteps.

I had been waiting for this partnership.

It had all ingredients to make perfect rom-com in #agriinputs #ecommerce

I had been waiting for this partnership.

It had all ingredients to make perfect rom-com in #agriinputs #ecommerce

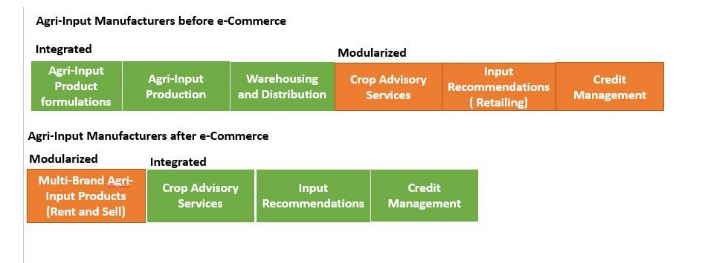

In 2018, when I wrote an article in @AgroPages_Info "Should agri-input manufacturers outsource e-commerce to startups?",I drew this to apply @claychristensen& #39;s theory of disruption in #agriinputs context.

With @agrostar_in filling in the green blocks, playing to their strengths of getting agri-input products to the last mile, @Bayer4Crops has found its perfect companion to flex its powerful channel distribution muscles.

Now wait. The story doesn& #39;t end here.

Now wait. The story doesn& #39;t end here.

This isn& #39;t a regular rom-com fare, bleeding with cloying romantic gooeyness that makes you wonder: What is really happening beneath the surface? Did you pay attention to one statement which Simon had made in the press release?

#agritech #agriinputs

#agritech #agriinputs

Which brings us to this question: Why have the Go-to-Market approaches in the Indian #agriinputs industry been static over the last five decades?

Sometime back @PranArora9 had made similar statement to this effect.

#agritech #agrochemicals

Sometime back @PranArora9 had made similar statement to this effect.

#agritech #agrochemicals

If you scratch the surface, the real question is this.

What influences the #agriinputs buying behaviour of Indian farmers? Is it the power of the channel or last-mile activity led field marketing?

Sure, trade channel and the field marketing play a synchronous role.

#Agritech

What influences the #agriinputs buying behaviour of Indian farmers? Is it the power of the channel or last-mile activity led field marketing?

Sure, trade channel and the field marketing play a synchronous role.

#Agritech

But, if one were to pit one against the other, the answer is obvious.

Channel wins hands down.

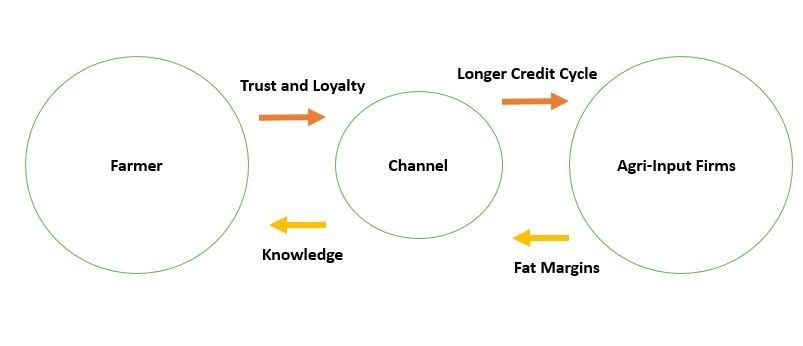

After all, channel provides credit to farmers, underwritten by the margins provided by the agri-Input manufacturer and the credit agri-input manufacturers get from their supplier.

Channel wins hands down.

After all, channel provides credit to farmers, underwritten by the margins provided by the agri-Input manufacturer and the credit agri-input manufacturers get from their supplier.

Here is the how the game of traditional channel was played in the world of #agriinputs retail

If you look at @agrostar_in origin Story, they entered this game, seeing a massive untapped opportunity in disrupting the agri-input channel& #39;s massive, yet, unspoken influence.

If you look at @agrostar_in origin Story, they entered this game, seeing a massive untapped opportunity in disrupting the agri-input channel& #39;s massive, yet, unspoken influence.

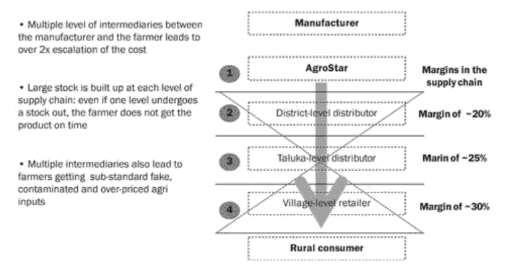

In their book, "Principles and Practice of Impact Investing: A Catalytic Revolution", the authors include a nice graphic which illustrated the real problem statement @agrostar_in was aiming at.

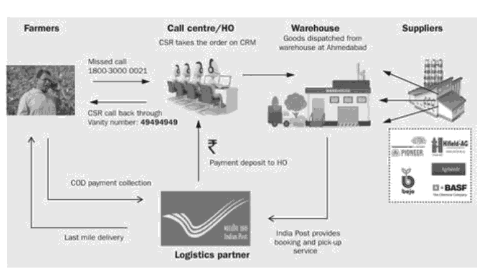

Before building their own fulfillment network for delivery tracking, their original transaction cycle looked like this.

If you look at this image, one thing becomes clear.

How do you disrupt an existing two-tier channel network?

It& #39;s simple.

You become another channel.

If you look at this image, one thing becomes clear.

How do you disrupt an existing two-tier channel network?

It& #39;s simple.

You become another channel.

Think about it. What is the difference between Agrostar (or any agri-input e-commerce player offering free agronomy advice) and traditional agri-input retailers?

Both the old and the new give agronomy advice to farmers in order to sell #agriinputs

Both the old and the new give agronomy advice to farmers in order to sell #agriinputs

It& #39;s a separate story for some other day whether this lack of skin in the game helps farmers or not.

Think about it.

How can you sell agronomy advice and sell agri-inputs?

You either do the former or the latter. It& #39;s unethical to do both

#agriinputs #agritech

Think about it.

How can you sell agronomy advice and sell agri-inputs?

You either do the former or the latter. It& #39;s unethical to do both

#agriinputs #agritech

Being a channel to serve farmers in the last mile comes with its own baggage.

You manage your

inventory and warehouse costs.

Distributor and sales commission

In other words, expect your gross profit margins to go down south until you fully optimize your fulfillment network.

You manage your

inventory and warehouse costs.

Distributor and sales commission

In other words, expect your gross profit margins to go down south until you fully optimize your fulfillment network.

You make further investments in logistics networks.

As spelled out by @benthompson in the case of @amazon, "this fixed cost investment has to be borne by customers at some point, which means the more customers the aggregator acquires, the less any one customer is responsible"

As spelled out by @benthompson in the case of @amazon, "this fixed cost investment has to be borne by customers at some point, which means the more customers the aggregator acquires, the less any one customer is responsible"

But, there is a even bigger risk that is waiting in store for agri-input manufacturers.

Picture Quiz: Do you see something unusual in this image I picked up from @agrostar_in website?

#agritech

Picture Quiz: Do you see something unusual in this image I picked up from @agrostar_in website?

#agritech

The brand packaging of Agrostar supersedes the brand of the agri-input product that is actually being served to the farmer.

This is where a channel like Agrostar differentiates itself from traditional two-tier channels which have been serving farmers by providing agri-inputs

This is where a channel like Agrostar differentiates itself from traditional two-tier channels which have been serving farmers by providing agri-inputs

A traditional channel sells on the basis of agri-input manufacturer& #39;s brand value, while a channel like @agrostar_in sells its brand first, before selling the product of the agri-input manufacturer, based on agronomy advice.

This @amazon styleaggregator play partnership with @agrostar_in works for @Bayer4Crops in the interim period as the latter contends with the massive shift required in their go-to-market strategies to deal with the rising share of off-patent products.

But what about the future?

But what about the future?

Would this partnership go the way of @Amazon where massive CPG brands like @ProcterGamble are realizing the hard way that in the online retail world, there is no bigger brand than @Amazon itself?

Long story short, there are two responses that I see emerging to the question:

Long story short, there are two responses that I see emerging to the question:

Should agri-input manufacturers outsource e-commerce?

Response-1: Yes, you do. You outsource it to an Amazonian aggregator who is more likely to commoditize the suppliers and build a captive relationship with end customers, paving the way to disrupt the traditional credit flows.

Response-1: Yes, you do. You outsource it to an Amazonian aggregator who is more likely to commoditize the suppliers and build a captive relationship with end customers, paving the way to disrupt the traditional credit flows.

Response-2: No, you don& #39;t. You build your own platform in which the traditional channel pay a subscription fee to the agri-input manufacturer to digitize their existing captive relationships with farmers.

There are plenty of lessons to be derived from the ongoing tennis match happening in the world of platform vs aggregators, beautifully chronicled by @stratechery

I will be writing more about this. Do share your thoughts

I will be writing more about this. Do share your thoughts

Incase you wish to read the longform article version of this thread, you can do so here in @LinkedIn https://www.linkedin.com/pulse/when-bayer-met-agrostar-venky-ramachandran/?trackingId=YEkbkPK%2BSr%2BBYVy3ipnWlQ%3D%3D">https://www.linkedin.com/pulse/whe...

Read on Twitter

Read on Twitter